Press release

Wearable Payment Devices Market is Expanding USD 133.09 Billion by 2034 | Fact.MR Report

The global wearable payment devices market is valued at USD 33.47 billion in 2024 and is projected to expand to USD 133.09 billion by 2034, growing at a compound annual growth rate (CAGR) of 14.8%. This impressive growth is driven by the increasing adoption of contactless payment technologies, advancements in wearable devices, and rising consumer preference for convenient, secure transaction methods.For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=5795

Wearable payment devices, integrating NFC, RFID, and biometric features, are transforming everyday transactions in sectors like retail and transportation, supported by the global shift toward cashless economies and digital wallets.

Market Segmentation and Trends:

The wearable payment devices market is segmented by product type, application, and region, providing a detailed view of its dynamics. Product types include fitness trackers, payment wristbands, and smartwatches, with fitness trackers holding a 42% market share in 2024 due to their multifunctionality and health-focused appeal. Smartwatches account for 24%, valued for their seamless integration with mobile ecosystems. Applications encompass festivals & life events, fitness, healthcare, retail, and transportation, with retail leading at 28% market share, driven by quick, hygienic payments at point-of-sale terminals.

Trends include the rise of biometric authentication for enhanced security, blockchain integration for transaction transparency, and the development of hybrid devices combining payment with health monitoring, aligning with consumer demands for versatility and convenience.

Driving Factors Behind Market Growth:

Several factors are fueling the wearable payment devices market's expansion. The surge in contactless payments, accelerated by health concerns post-COVID-19, has boosted demand for hygienic, touch-free solutions. Technological advancements in NFC, HCE, and RFID enable faster, more secure transactions, with biometrics like fingerprint and voice recognition adding layers of protection.

Growing smartphone penetration and digital wallet adoption, such as Apple Pay and Google Wallet, facilitate seamless integration with wearables. Government initiatives promoting cashless economies, particularly in Asia Pacific, and collaborations between tech firms and financial institutions are driving innovation. Additionally, the increasing use of wearables in events and transportation for quick access enhances user experience, further propelling market growth.

Browse Full Report: https://www.factmr.com/report/wearable-payment-devices-market

Recent Developments and Key Players:

The wearable payment devices market is highly competitive, with key players focusing on innovation, partnerships, and product launches to capture market share. In August 2024, Airtel Payments Bank partnered with Noise and NPCI to launch an NCMC-enabled smartwatch with RuPay chip, targeting India's growing digital payments ecosystem. In October 2024, Tappy Technologies introduced an integrated payment and fitness ring at Hong Kong Fintech Week, collaborating with Thales for secure element chips.

Mastercard and Tappy also partnered with Premier Bank in Somalia for 'Tap2Pay' tokenized wearables. In July 2024, Samsung unveiled the Galaxy Ring, Watch7, and Watch Ultra with enhanced AI and payment features. Other notable developments include Mastercard's August 2024 tie-up with boAt for tap-and-pay smartwatches and Apple's January 2024 Apple Pay enhancements.

Key players include Apple Inc., Samsung Electronics, Fitbit Inc., Garmin Ltd., Xiaomi Corporation, Visa Inc., Mastercard, Google LLC, Barclays PLC, Tappy Technologies, Gemalto NV (Thales), PayPal Holdings Inc., and Nymi. Competitor analysis reveals a focus on ecosystem integration and security. Apple and Samsung dominate with comprehensive platforms like Apple Pay and Samsung Pay, while Garmin and Fitbit emphasize fitness-oriented payments. Strategic partnerships, such as Visa's collaborations for tokenized solutions, enhance global reach. Emerging players like Tappy are innovating with form factors like rings, while established firms invest in biometrics and AI to address security concerns and differentiate offerings.

Regional Insights and Opportunities:

North America holds a 33% market share in 2024, led by the United States at USD 4.91 billion, projected to reach USD 19.12 billion by 2034 at a 14.5% CAGR, driven by tech-savvy consumers and major players like Apple and Visa. East Asia accounts for 23.5%, growing to 26% by 2034, with China at USD 3.85 billion in 2024, expected to hit USD 16.44 billion at 15.6% CAGR, fueled by cashless trends and digital adoption. Europe benefits from PSD2 regulations promoting innovation, while Asia Pacific shows high potential due to population growth and e-commerce expansion. Emerging markets in Latin America and the Middle East & Africa offer opportunities through urbanization and mobile penetration. Partnerships with local banks and investments in infrastructure are key to market penetration.

Challenges and Future Outlook:

The wearable payment devices market faces challenges, including short battery life limiting usability, high device costs restricting accessibility in emerging markets, and security concerns like data breaches deterring adoption. Regulatory variations and interoperability issues between devices and payment systems also pose hurdles. However, the market's future is promising, with opportunities in biometric advancements, expanded form factors like rings and implants, and integration with IoT for smart ecosystems.

As 5G and AI evolve, enhancing transaction speed and personalization, the market is well-positioned for sustained growth. By 2034, wearable payments are expected to become ubiquitous, reshaping transactions through innovative, secure, and convenient solutions.

Check out More Related Studies Published by Fact.MR:

Biometric Payment Market https://www.factmr.com/report/1850/biometric-payment-market

Real-Time Payment Market https://www.factmr.com/report/real-time-payments-market

Mobile Payment Market https://www.factmr.com/report/mobile-payment-market

Payment Gateway Market https://www.factmr.com/report/payment-gateway-market

Payment Gateway Market https://www.factmr.com/report/payment-gateway-market

Contact:

US Sales Office

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583, +353-1-4434-232

Email: sales@factmr.com

About Fact.MR

We are a trusted research partner of 80% of fortune 1000 companies across the globe. We are consistently growing in the field of market research with more than 1000 reports published every year. The dedicated team of 400-plus analysts and consultants is committed to achieving the utmost level of our client's satisfaction.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Wearable Payment Devices Market is Expanding USD 133.09 Billion by 2034 | Fact.MR Report here

News-ID: 4160080 • Views: …

More Releases from Fact.MR

Organic Rice Syrup Market is forecasted to increase at a CAGR of 5.1% and US$ 1. …

The global Organic Rice Syrup Market is projected to expand steadily over the coming decade, driven by rising consumer demand for natural, clean-label sweeteners and growing awareness of health and wellness trends. Industry analysts estimate that the organic rice syrup market, valued at approximately USD 450 million in 2025, is expected to reach nearly USD 880 million by 2035, registering a compound annual growth rate (CAGR) of about 7.1% during…

Compound Horse Feedstuff Market is Estimated to Grow at a CAGR of 4.6%, Reaching …

The global compound horse feedstuff market is galloping toward steady growth, projected to expand from a valuation of USD 3.8 billion in 2026 to approximately USD 5.4 billion by 2036. This represents a compound annual growth rate (CAGR) of 3.6% over the ten-year forecast period.

The market is being driven by the "humanization" of equine companions, the professionalization of equestrian sports, and a significant shift toward specialized performance nutrition that…

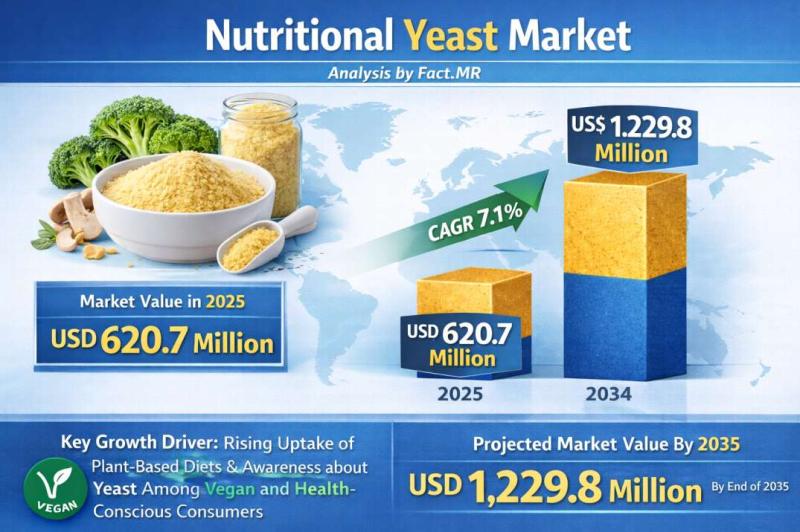

Nutritional Yeast Market Forecasted CAGR is 7.1% by 2035 | Fact.MR Report

The global nutritional yeast market is experiencing a significant surge in demand, projected to grow from a valuation of USD 515.2 million in 2026 to approximately USD 1.2 billion by 2036. This represents a robust compound annual growth rate (CAGR) of 8.8% over the ten-year forecast period.

The market is being propelled by the global explosion of plant-based diets and the "clean-label" movement, with nutritional yeast emerging as the primary…

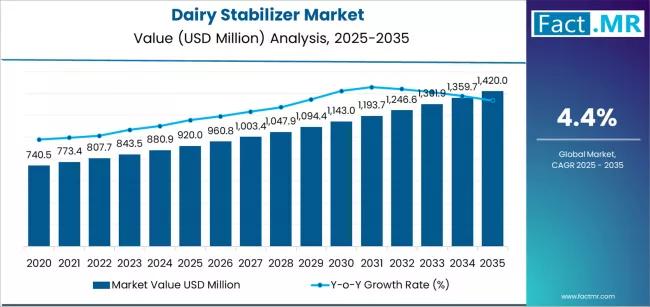

Dairy Stabilizer Market is Expected to Reach USD 1,420.0 million by 2035 | Resea …

The global Dairy Stabilizers Market is projected to sustain solid growth over the next decade as consumer demand for high-quality dairy and dairy-based products continues to expand across foodservice and retail sectors. Industry analysts estimate that the dairy stabilizers market, valued at approximately USD 2.4 billion in 2025, is expected to reach around USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of about 6.5% during the…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…