Press release

Global VDES Market 2024 to 2031 Reaches 340 Million USD at 18.6% CAGR Led by Kongsberg and Saab

The Very High Frequency Data Exchange System (VDES)-the third-generation maritime communications standard that extends AIS with higher-capacity terrestrial and satellite data channels-is crossing from pilots to production. Global adoption is accelerating as coastal networks upgrade, satellite constellations prove two-way performance, and standards bodies finalize frameworks that let authorities and fleets procure at scale. According to Global Very High Frequency Data Exchange System (VDES) Market Outlook from QYResearch, In-Depth Analysis & Forecast to 2031, the market is projected to expand from US$95.0 million in 2024 to US$340 million by 2031, delivering a CAGR of 18.6% during 2025-2031. Momentum in 2024-2025 centers on secure e-navigation messaging, resilient positioning via VDE-SAT ranging, and integrated coastal-satellite service models that make continuous coverage feasible along blue-water routes.Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) https://www.qyresearch.com/sample/4924129

Latest Data

• Market size: US$95.0 million in 2024, rising to US$340 million by 2031

• CAGR (2025-2031): 18.6%

• Coverage: Global revenue and volume forecasts; company share; competitive landscape; growth drivers and risks

• Regions: North America; Europe; Asia Pacific; South America; Middle East & Africa

• Companies covered: Kongsberg; Saab; CML Microsystems; Aohai Technology; Chiwan Communications Satellite

• Type: Ground-Based VDES System; Space-Based VDES System

• Application: Government; Personal; Enterprise

Leading Companies

Kongsberg

Saab

CML Microsystems

Aohai Technology

Chiwan Communications Satellite

Applications

Government

Personal

Enterprise

Classification

Ground-Based VDES System

Space-Based VDES System

2024-2025 Trend News & Company Milestones

Satellite VDES moves from test to service readiness.

In late 2024, industry partners demonstrated reliable two-way ship-to-satellite VDES, validating the backbone needed for global maritime data exchange beyond coastal coverage. By early 2025, vendors reported sustained performance and coverage footprints that mark the inflection from trials to pre-commercial service, particularly for ocean-going routes and high-latitude operations.

Standardization locks in an interoperable service layer.

In 2025, the Maritime Messaging Service (MMS) architecture was published for AIS/VDES e-navigation, defining a secure, routable framework for digital services such as navigational warnings, port-call messages, maritime safety information, and S-100 data distribution. In parallel, draft SOLAS Chapter V updates advanced at the IMO to enable VDES integration-establishing a pathway for VDES to succeed AIS within carriage requirements as early as the 2028 regulatory cycle.

PNT resilience emerges as a differentiator.

A 2024 satellite ranging proof-of-concept showed VDE-SAT signals can support independent timing/positioning, strengthening maritime resilience against GNSS jamming or spoofing. This positions VDES not only as a data channel but also as an augmentation layer for navigation integrity.

Coastal roll-outs accelerate in Europe and Africa.

National authorities placed multi-site orders for VDES-capable base stations and began integrating VDES services into maritime portals. In West Africa, installations on authority vessels and regional collaborations with satellite VDES providers expanded service coverage and two-way data exchange for surveillance, safety, and fisheries oversight.

Security and authentication reach the VHF layer.

Lighthouse and aids-to-navigation authorities in 2024-2025 unveiled public-key authentication schemes for AIS/VDES that preserve backward compatibility while enabling trusted, signed messages-crucial for safe automation and integration with Maritime Connectivity Platform initiatives.

Five Representative Products

Saab - R60 VDES Base Station

• Function: Coastal base station platform with SDR architecture, supporting AIS, ASM, and VDE channels on marine VHF.

• Standards: Compliant with ITU-R M.2092 VDES framework and relevant AIS base-station and AtoN equipment standards.

• Throughput & channels: AIS at 9.6 kbps; ASM at 19.2 kbps; VDE option enabling wideband terrestrial VDE channels for higher data rates and two-way services.

• RF & reliability: High receiver sensitivity with selectable transmit power classes for dense coastal cells or extended ranges; redundant Ethernet, built-in management, and diagnostics for 24/7 operations.

• 2024-2025 deployment: Adopted in national coastal modernization programs in Northern Europe, including nationwide roll-outs that anchor government e-navigation services.

CML Microsystems - VDES1000 Transceiver Module

• Function: OEM SDR module integrating AIS Class-A, ASM, and VDE capabilities for shipborne, buoy, or coastal terminals.

• Integration: Full developer API, modular RF front-end options, and an enclosure variant to speed certification and time-to-market for device makers.

• Performance: Multi-channel VHF with dynamic channelization across 25/50/100 kHz VDE bandwidths; deterministic latency for MMS e-navigation services.

• Commercial note: Available as a single-board solution with distribution pricing observed at the low-to-mid four-figure USD level per unit, enabling competitive bill-of-materials for terminal OEMs.

• Use case: Shortens development cycles for VDES-ready Class-A replacements, AtoN controllers, and coastal micro-cells.

Kongsberg - Space-Based VDE Transceiver & VDE-SAT Ranging Concept

• Function: Space-qualified VDE payload/transceiver concept enabling two-way VDES messaging with optional ranging for PNT augmentation.

• 2024 milestone: Satellite demos established ranging feasibility over VDE-SAT, opening a path for resilient timing/positioning in parallel with maritime data services.

• Impact: Anchors a space-segment roadmap that complements Kongsberg's coastal and onboard portfolio, supporting integrated services from harbor approach to open ocean.

Aohai Technology - AT-V10 Shipborne VDES Terminal

• Function: Shipboard VDES terminal interoperable with AIS Class-A, providing two-way text/file exchange for routes, forms, and imagery across VDE channels.

• Navigation & I/O: Dual-mode GNSS (e.g., GPS/BeiDou), NMEA/Ethernet interfaces, and integration hooks to ECDIS for S-100 data overlays.

• Performance evidence: Sea trials reported stable image transfer over VDE channels to roughly 35 nautical miles under routine conditions, extending to 45-50 nm in favorable propagation, with controlled-load tests indicating low packet loss at longer ranges.

• Role: Bridges crew workflows and coastal authorities' digital services without exposing bridge systems to public IP networks.

Chiwan Communications Satellite - Integrated VDES Terminals and Base Stations

• Function: Shipborne terminals and coastal base stations designed for both terrestrial VDE and satellite VDE operations, aligned with ITU-R M.2092 channel plans.

• System approach: End-to-end architecture spanning terminal, hub, and system engineering for coastal authorities and fleets; leverages LEO satellite links for global coverage.

• Value: Positions as a price-competitive integrated supplier in an otherwise concentrated market, expanding capacity and diversifying the supply base.

Downstream Customers

Estonian Transport Administration

Norwegian Coastal Administration

Nigerian Maritime Administration and Safety Agency

Ghana Maritime Authority

Danish Maritime Authority

Swedish Maritime Administration

Maritime and Port Authority of Singapore

European Maritime Safety Agency

General Lighthouse Authorities of the United Kingdom and Ireland

Finnish Transport and Communications Agency Traficom

Icelandic Coast Guard

Port of Tallinn

Port of Gothenburg

Port of Esbjerg

Kongsberg Satellite Services

Market Trend

AIS to AIS 2.0/VDES: Capacity and Two-Way by Design

VDES extends AIS with dedicated Application Specific Messages and high-capacity VDE channels in the marine VHF band. Terrestrial VDE supports wider channel bandwidths than legacy AIS, while satellite VDE enables global two-way coverage. The result is a reliable, low-latency pathway for authenticated e-navigation data, remote monitoring, and authority-vessel coordination-even where cellular and broadband VSAT are impractical or cost-prohibitive. This is driving procurement of VDES-ready replacements for legacy Class-A terminals and coastal base stations, alongside upgrades to AtoN and buoy controllers.

Satellite VDES Crosses the Reliability Threshold

LEO-based demonstrations in 2024 validated sustained two-way performance; throughout 2025, vendors and operators have mapped predictable coverage footprints and link budgets that support routine authority messaging, distress coordination supplements, and data-heavy use cases such as route exchange and form-based reporting. As costs per kilobit continue to fall, satellite VDES is becoming an attractive complement to terrestrial VDE in thinly served waters and polar routes.

Regulatory Clarity Accelerates Procurement Cycles

With the MMS architecture published and draft SOLAS amendments advancing through the IMO, maritime administrations now have a clearer path to adopt VDES within statutory frameworks. This regulatory certainty is compressing tender timelines for coastal networks, where authorities increasingly stipulate VDES-capable base stations, VDES-ready shipborne terminals for state craft, and integration with S-100 services. Vendors that align product roadmaps with MMS and future SOLAS carriage provisions are winning multi-year frameworks.

Hybrid Networks and Roaming Models

A defining 2025 theme is the emergence of hybrid terrestrial-satellite VDES networks with roaming-like behavior. Coastal operators are building dense urban cells for high message rates near ports, while satellite layers ensure continuity across blue-water corridors. Equipment now supports seamless handover, consistent addressing, and policy-driven prioritization-so safety-critical messages can preempt lower-priority traffic without manual intervention.

PNT Resilience as a Procurement Criterion

The prospect of VDE-SAT ranging adds a tangible resilience layer against GNSS interference. Administrations evaluating coastal upgrades in 2025 increasingly request roadmaps for timing and ranging support. Expect pilot authorities to specify VDES infrastructure that can participate in multi-sensor fusion for navigation integrity, with performance targets tied to e-navigation risk models.

Security, Authentication, and Trust Services

Public-key authentication schemes for AIS/VDES messages are maturing, enabling digital signatures without breaking interoperability with legacy receivers. Combined with MMS, authorities can now deliver signed navigational warnings, aids-to-navigation status, or traffic organization measures. Port-call and Just-in-Time arrival services-where schedule messages must be trusted-are among the early adopters. This, in turn, is stimulating demand for secure key management, certificate distribution, and device attestation inside terminals and base stations.

Early National Roll-outs De-Risk the Followers

Northern European programs in 2024-2025 are demonstrating nationwide VDES coverage, operational dashboards, and integration with maritime data portals. In West Africa, authority vessels equipped with VDES-capable systems are improving domain awareness and fisheries supervision. These pathfinders are creating implementation playbooks-covering site engineering, spectrum planning, and MMS service orchestration-that shorten deployment cycles for subsequent adopters.

Supply-Side Dynamics: Concentrated, but Broadening

The VDES supply chain remains concentrated, with the top five firms accounting for a substantial share of revenue. Yet 2025 shows healthy diversification:

• Semiconductor and module vendors are compressing development cycles for new terminal entrants.

• Integrated Chinese suppliers are offering end-to-end ship-shore-space portfolios at competitive price points, broadening access for cost-sensitive programs.

• European primes continue to anchor the high end with SDR-rich base stations, satellite payload concepts, and deep standards participation-capabilities that are pivotal for complex national deployments.

Economics: Total Cost, Not Just Capex

Procurements in 2025 weigh the full stack: device capex, coastal backhaul and siting, satellite service fees, integration with existing VTS/VTMIS, and cyber requirements for MMS. Where authorities layer VDES atop AIS infrastructure and share tower/backhaul assets, total program costs fall markedly. On the fleet side, modules that enable drop-in replacements for Class-A reduce installation time and certification overhead, improving payback periods for digital-first shipping companies.

Request for Pre-Order Enquiry On This Report https://www.qyresearch.com/customize/4924129

From Pilots to Services

Authorities are packaging concrete services over VDES-navigational warnings, NoGo areas, e-AtoN status, port-call slots, and structured reporting. Shipping firms are prioritizing functions that save bunkers and port time, such as route exchange aligned with dynamic restrictions or Just-in-Time arrival windows. As these services harden under MMS, they create a virtuous cycle: more terminals justify denser coastal cells and satellite capacity, which support even richer data services.

Editorial Note on Methodology

This release integrates the quantitative outlook, segmentation, and competitive framing from Global Very High Frequency Data Exchange System (VDES) Market Outlook, In-Depth Analysis & Forecast to 2031 with verified 2024-2025 developments reported by industry vendors, national maritime authorities, standards bodies, and program sponsors. Regulatory timelines reflect official committee outcomes and planned milestones; final adoption and in-force dates follow IMO procedures.

Chapter Outline:

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 ; +351 914374211(Tel & Whatsapp); +86-1082945717

Email: qinyue@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About us:

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global VDES Market 2024 to 2031 Reaches 340 Million USD at 18.6% CAGR Led by Kongsberg and Saab here

News-ID: 4154954 • Views: …

More Releases from QYResearch Europe

Global Aerospace Grade Smart Assembly Lines Market 2024 USD 4251 Million to 2031 …

According to recent report from QYResearch, the global market for aerospace-grade smart assembly lines stood at US$4,251 million in 2024 and is projected to reach US$8,712 million by 2031 at a 10.2% CAGR (2025-2031). In 2024, approximately 670 lines were produced globally at an average selling price (ASP) of about US$6.343 million per line. These highly automated systems integrate AI, industrial robotics, advanced sensing, and digital control to deliver repeatable,…

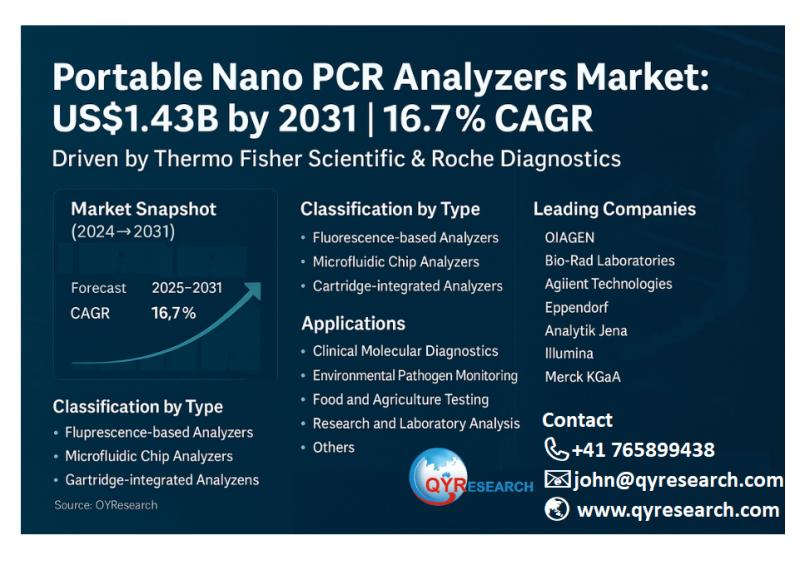

Portable Nano PCR Analyzers Market Growth to US$1.43 Billion by 2031 with 16.7% …

According to the latest QYResearch Report, the global market for Portable Nano PCR Analyzers was valued at US$484 million in 2024 and is expected to reach US$1,427 million by 2031, growing at a CAGR of 16.7% during the forecast period of 2025-2031. Global production in 2024 reached around 96,800 units, with an average price of about US$5,000 per unit. These portable devices utilize nanotechnology-enhanced PCR processes for rapid on-site genetic…

Global Multiphase Flow Conveying Equipment Market to Reach USD 10.88 Billion by …

The global market for Multiphase Flow Conveying Equipment is transitioning from a specialized engineering niche to a core enabler of industrial efficiency across upstream energy, chemicals, mining, and wastewater sectors. According to QYResearch 2025 edition of Multiphase Flow Conveying Equipment - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031, the market was valued at US$7,380 million in 2024 and is projected to reach US$10,879 million by 2031,…

Global Smart Eye-Tracking Medical Devices Market Size Reaches US$3.0 Billion by …

The global Smart Eye-Tracking Medical Devices market has entered a stage of accelerated clinical adoption and product diversification. According to QYResearch 2025 Global Smart Eye-Tracking Medical Devices Market Research Report, the market was valued at US$973 million in 2024 and is projected to reach US$3,009 million by 2031, growing at a CAGR of 17.5% from 2025 to 2031. Global output in 2024 reached approximately 64,900 units, with an average price…

More Releases for VDE

Very High Frequency Data Exchange System (VDES) Industry Analysis: Reach 340 Mil …

The Very High Frequency Data Exchange System (VDES)-the third-generation maritime communications standard that extends AIS with higher-capacity terrestrial and satellite data channels-is crossing from pilots to production. Global adoption is accelerating as coastal networks upgrade, satellite constellations prove two-way performance, and standards bodies finalize frameworks that let authorities and fleets procure at scale. According to Very High Frequency Data Exchange System (VDES) - Global Market Share and Ranking, Overall Sales…

Intelligent Home Device Market to Accelerate Growth with FIBARO, VDE, Control4

The Latest Released Intelligent Home Device market study has evaluated the future growth potential of Global Intelligent Home Device market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision-makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, and emerging trends along with…

Home Automation Market: 3 Bold Projections for 2021 | Emerging Players Honda, VD …

Latest added Global Home Automation Market research study by HTF MI offers detailed product outlook and elaborates market review till 2026. The market Study is segmented by key regions that is accelerating the marketization. At present, the market is sharping its presence and some of the key players in the study are Honda, RWE AG, VDE, Loxone, TP-Link, Savant Pro, FIBARO, Intelligent Home Automated Solutions, Control4, CNET & SmartThings, Inc…

Home Automation Market that require the complete knowledge by: VDE, Loxone, TP-L …

Home Automation Market report has been assessed in accordance with the current market trends and has a detailed description of the essential factors required for a good growth potential. The forecast upto the year 2025 along with an in depth data of the history of the Home Automation market has also been included in the report.

Key Players in the Home Automation Market: VDE, Loxone, TP-Link, Savant Pro, FIBARO, Intelligent…

Wiha slimTECHNOLOGY – The innovation for VDE fastening tools

Schonach – Electricians in particular must face a wide variety of applications with sometimes difficult working conditions. VDE tools used in such environments must not only be rugged and flexible, but must also satisfy the highest demands in terms of quality and safety. A further commonly occurring problem for VDE fastening tools is limited access to low-lying fastening elements, narrow apertures and standard spring clips. The VDE safety insulation of…

Management Board of VDI/VDE-IT visit the HeraSol application centre in Hanau

Dr. Werner Wilke and Peter Dorthans, joint Managing Directors of the VDI/VDE-IT, visited the Heraeus headquarters in Hanau and took the opportunity to have a close look at the new HeraSol applications centre. The VDI/VDE-IT assigns research projects on behalf of the German federal government, and is responsible for the R&D funding, technology policy and innovation management for not only four separate governmental ministries, but for the European Union (EU)…