Press release

Australia Private Equity Market Projected to Reach USD 48.5 Billion by 2033

The latest report by IMARC Group, titled "Australia Private Equity Market Size, Share, Trends and Forecast by Fund Type and Region, 2025-2033," offers a comprehensive analysis of the Australia private equity market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia private equity market size reached USD 22.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 48.5 Billion by 2033, exhibiting a growth rate (CAGR) of 8.20% during 2025-2033.Report Attributes:

· Base Year: 2024

· Forecast Years: 2025-2033

· Historical Years: 2019-2024

· Market Size in 2024: USD 22.0 Billion

· Market Forecast in 2033: USD 48.5 Billion

· Market Growth Rate 2025-2033: 8.20%

For an in-depth analysis, you can refer to a sample copy of the report:

https://www.imarcgroup.com/australia-private-equity-market/requestsample

How Is AI Transforming the Private Equity Market in Australia?

• AI is streamlining deal sourcing, automating due diligence, and supporting data-driven valuations.

• Predictive analytics are being used for risk assessment and portfolio optimization.

• Machine learning tools are identifying trends and probability of returns in emerging sectors.

• Digital platforms are enhancing deal collaboration and transparency for stakeholders.

• AI is helping PE firms screen investments for ESG compliance and regulatory risk.

Australia Private Equity Market Overview

• More people are looking to invest in buyout funds, venture capital, and infrastructure funds, and this trend is growing quickly in every industry.

• Big investment groups, especially pension funds, are putting more money into private equity.

• Government programs that support innovation and new rules are making more deals happen.

• Companies in areas like finance technology, healthcare, and clean energy are changing a lot with digital tools, and this is drawing more interest from private equity.

• Businesses that have private equity backing are usually doing better than those in regular stock markets.

Key Features and Trends of Australia Private Equity Market

• Smaller and medium-sized company deals are increasing because they offer more flexibility and chances for growth in an uncertain economy.

• ESG factors are affecting how companies are valued, how due diligence is done, and what plans are made after an investment.

• Funds focusing on infrastructure and real estate are becoming more popular because there's a steady flow of money coming in.

• New ways to exit investments, such as selling part of a company or dealing with another buyer, are becoming more common.

• Mergers and acquisitions are increasing, and there's more government monitoring, especially around taxes and transparency.

Growth Drivers of Australia Private Equity Market

• Managed a record amount of money in retirement funds and large investment pools.

• Interest rates stayed steady and it's easier for people and businesses to get loans.

• More chances to invest in technology, healthcare, and environmentally friendly projects.

• Government made changes that support better business conditions and policies.

• There is strong interest in making operations more efficient and buying smaller companies to grow.

Browse Full Report with TOC & List of Figures:

https://www.imarcgroup.com/australia-private-equity-market

Innovation & Market Demand of Australia Private Equity Market

• ESG-linked private equity products are seeing strong demand from domestic and foreign investors.

• AI-empowered due diligence and sector analysis are boosting efficiency.

• Multisector partnerships are expanding-especially within renewables, healthcare, and infrastructure.

• Digital transformation is fueling innovation across mid-cap and venture-backed companies.

• Record deployment of committed dry powder is supporting buyout and growth deals.

Australia Private Equity Market Opportunities

• Growth of secondary market transactions and sponsor-to-sponsor exits.

• Expansion of venture and buyout investment in renewable energy and technology sectors.

• Increasing momentum in regional and mid-cap private market deals.

• Development of ESG-aligned and impact investing PE strategies.

• Enhanced partnerships between local and global private equity firms.

Australia Private Equity Market Challenges

• Competitive deal environment leading to higher valuations.

• Regulatory scrutiny on tax, mergers, and ESG disclosures.

• Economic uncertainty and global market volatility impacting deal flows.

• Difficulty sourcing large-scale, high-yield investment targets.

• Balancing return expectations with ESG requirements and transparency needs.

Australia Private Equity Market Analysis

• Detailed study of fund structures, benchmarking, and exit valuations.

• Segmentation by buyout, venture capital, real estate, infrastructure, and others.

• Assessment of superannuation and institutional fund flows.

• Analysis of regional opportunities across Australian states and territories.

• Competitive landscape mapping with strategy, structure, and best practices.

Australia Private Equity Market Segmentation:

1. By Fund Type:

• Buyout

• Venture Capital (VCs)

• Real Estate

• Infrastructure

• Others

2. By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Australia Private Equity Market News & Recent Developments:

• March 2025: I Squared Capital partners with Rest Superannuation for USD 300 Million infrastructure fund investment.

• December 2024: IFM Investors merges with ISPT to strengthen leadership in real estate and private markets.

Australia Private Equity Market Key Players:

• I Squared Capital

• IFM Investors

• QIC Private Capital

• Pacific Equity Partners

• BPEA EQT

• Adamantem Capital

• The Carlyle Group

• KKR Australia

• Blackstone Group Australia

• CPE Capital

Key Highlights of the Report:

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter's Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=31707&flag=E

FAQs: Australia Private Equity Market

Q1: What is the projected Australia private equity market size by 2033?

A: USD 48.5 Billion.

Q2: Which sectors and deal types are driving market growth in 2025-2033?

A: Buyouts, venture capital, infrastructure, and ESG-integrated investments.

Q3: How is AI influencing deal sourcing and diligence in Australia's PE market?

A: By automating data discovery, risk analysis, and increasing transparency.

Q4: What are current challenges for PE firms in Australia?

A: Rising competition, regulatory scrutiny, and a tight macroeconomic environment.

Q5: Who are the major investors/players in the Australia private equity market?

A: IFM Investors, I Squared, Pacific Equity Partners, Carlyle, KKR.

Contact Us:

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

About Us:

IMARC Group is a leading market research company that provides management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our solutions include comprehensive market intelligence, custom consulting, and actionable insights to help organizations make informed decisions and achieve sustainable growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Private Equity Market Projected to Reach USD 48.5 Billion by 2033 here

News-ID: 4153073 • Views: …

More Releases from IMARC Services Private Limited

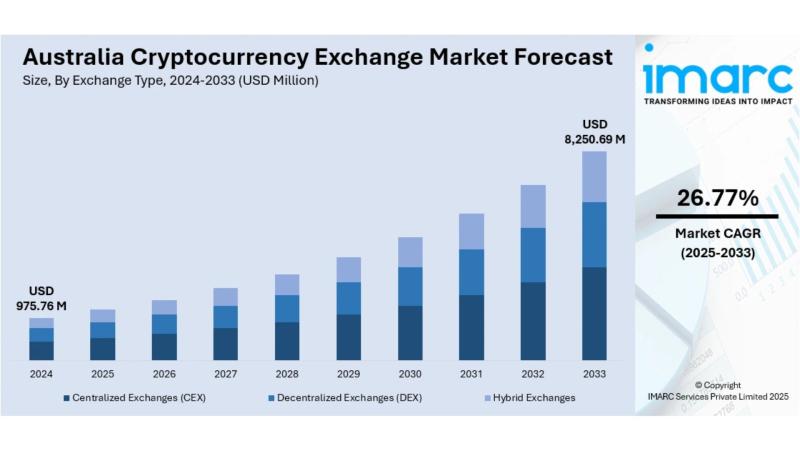

Australia Cryptocurrency Exchange Market Size, Share, Trends 2025-2033

Australia Cryptocurrency Exchange Market Overview

Market Size in 2024: USD 975.76 Million

Market Size in 2033: USD 8,250.69 Million

Market Growth Rate 2025-2033: 26.77%

According to IMARC Group's latest research publication, "Australia Cryptocurrency Exchange Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia cryptocurrency exchange market size was valued at USD 975.76 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 8,250.69 Million by 2033, exhibiting a…

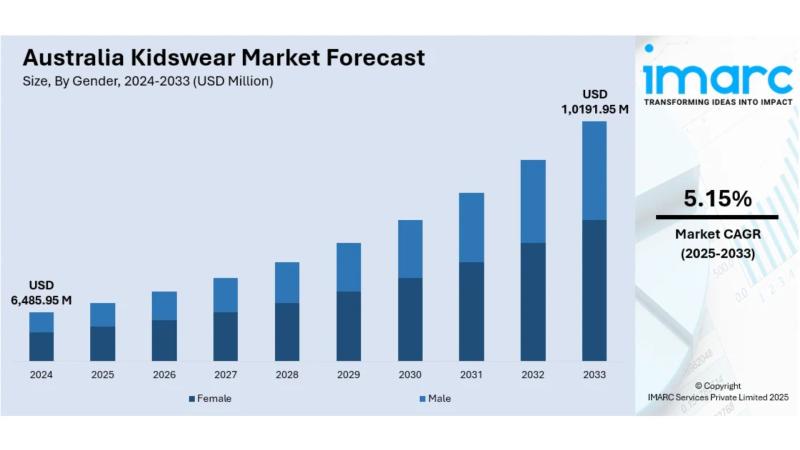

Australia Kidswear Market Size, Share, Trends and Forecast by 2025-2033

Australia Kidswear Market Overview

Market Size in 2024: USD 6,485.95 Million

Market Size in 2033: USD 10,191.95 Million

Market Growth Rate 2025-2033: 5.15%

According to IMARC Group's latest research publication, "Australia Kidswear Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia kidswear market size was valued at USD 6,485.95 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 10,191.95 Million by 2033, exhibiting a CAGR of 5.15%…

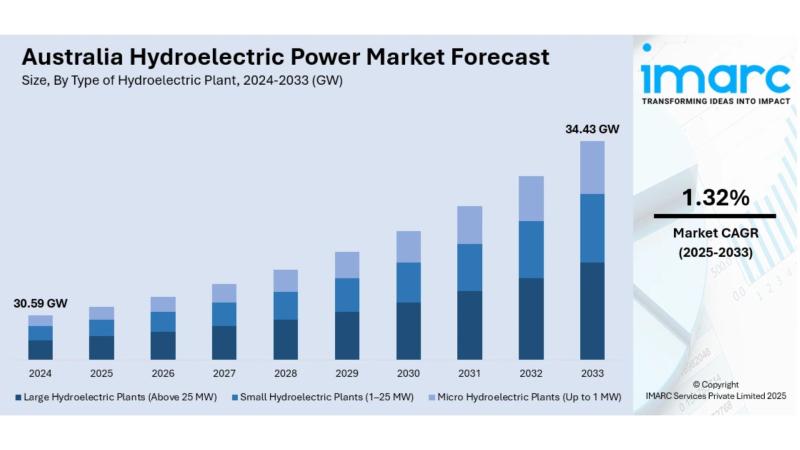

Australia Hydroelectric Power Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Hydroelectric Power Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia hydroelectric power market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia hydroelectric power market size reached 30.59 GW in 2024. Looking forward, IMARC Group expects the market to reach 34.43 GW…

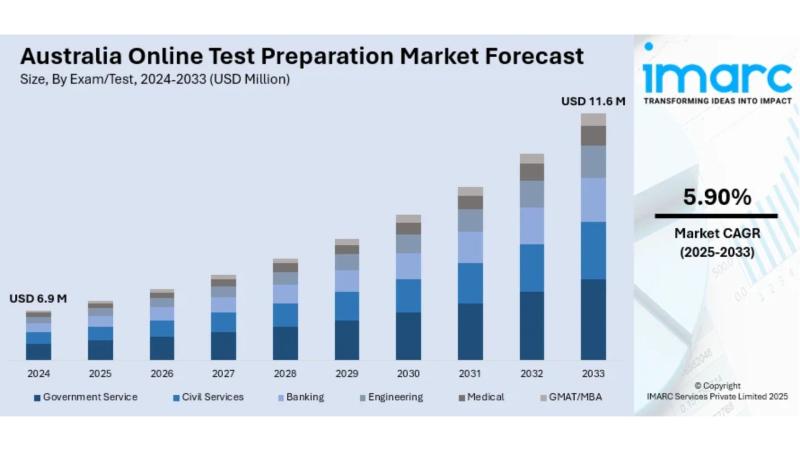

Australia Online Test Preparation Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Online Test Preparation Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia online test preparation market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia online test preparation market size reached USD 6.9 Million in 2024. Looking forward, IMARC Group expects the market…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…