Press release

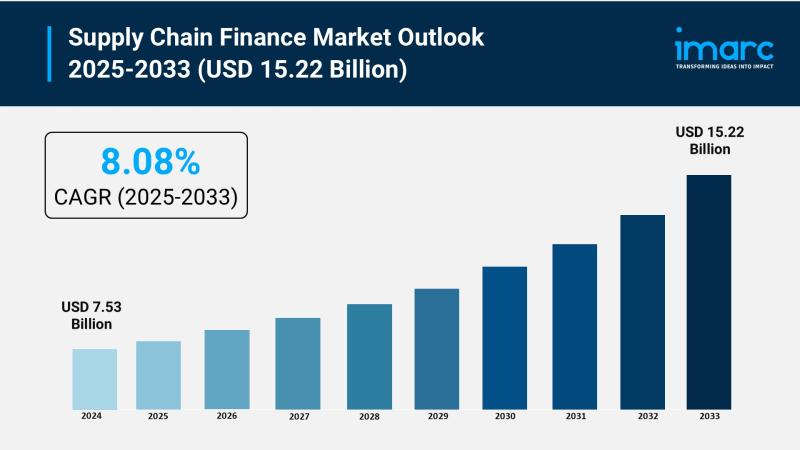

Supply Chain Finance Market Size to Reach USD 15.22 Billion by 2033 | Grow CAGR by 8.08%

Market Overview:The supply chain finance market is experiencing rapid growth, driven by rising demand for working capital optimization, surge in global trade and supply chain complexity, and government initiatives supporting scf adoption. According to IMARC Group's latest research publication, "Supply Chain Finance Market Size, Share, Trends and Forecast by Platform, Betting Type, Sports Type, and Region, 2025-2033", The global supply chain finance market size was valued at USD 7.53 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 15.22 Billion by 2033, exhibiting a CAGR of 8.08% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/supply-chain-finance-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends And Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Growth Factors Driving the Supply Chain Finance Industry

● Rising Demand for Working Capital Optimization:

Businesses today are laser-focused on keeping cash flow smooth and operations humming, which is pushing the demand for supply chain finance (SCF). Companies, especially small and medium-sized enterprises (SMEs), need quick access to funds tied up in invoices to pay suppliers and keep production on track. SCF solutions like invoice discounting and factoring let businesses unlock this cash fast, easing the strain of long payment cycles. For example, platforms like KredX in India are helping SMEs access liquidity through dynamic discounting, boosting their ability to grow without cash flow hiccups. The global SCF market is thriving because it helps businesses manage tight margins and complex supply chains, ensuring they stay financially stable while meeting operational demands.

● Surge in Global Trade and Supply Chain Complexity:

Global trade is booming, and with it, supply chains are getting more intricate, driving the need for SCF solutions. As companies source materials and products across borders, they face longer lead times and payment delays, which SCF helps bridge by offering early payments to suppliers. This is critical in regions like Asia-Pacific, where over 50% of global GDP is expected to originate by 2040. SCF supports this growth by reducing risks and ensuring smoother transactions. For instance, banks like HSBC are rolling out programs to finance cross-border trade, helping suppliers get paid faster while buyers maintain liquidity. This ability to stabilize complex, global supply chains is a key reason SCF is seeing strong demand worldwide.

● Government Initiatives Supporting SCF Adoption:

Governments are stepping up to promote SCF, recognizing its role in boosting economic growth, especially for SMEs. In India, schemes like the Trade Receivables Discounting System (TReDS) make it easier for small businesses to access funds by discounting their invoices, with a 15% year-on-year increase in discounted receivables. Similarly, the UK's Electronic Trade Documents Act, passed in 2023, gives digital trade documents legal weight, cutting costs by an estimated $6.5 billion and enabling $40 billion more in global trade. These initiatives reduce barriers for businesses, streamline financing processes, and encourage wider SCF adoption, helping companies of all sizes stay competitive in fast-moving markets.

Trends in the Global Supply Chain Finance Market

● Integration of AI and Machine Learning:

Artificial intelligence (AI) and machine learning (ML) are shaking up SCF by making financing faster and smarter. These technologies analyze huge datasets to assess credit risks in real time, cutting transaction processing times by nearly 40% on some platforms in India. For example, Standard Chartered's partnership with C2FO uses ML to optimize working capital decisions, helping suppliers get paid quicker with less risk. AI-driven platforms also spot fraud and improve transparency, making SCF more reliable. This trend is gaining traction as businesses demand speed and accuracy, allowing financial institutions to offer tailored solutions that strengthen supplier relationships and boost efficiency across the supply chain.

● Rise of Sustainable Financing:

Sustainability is becoming a big deal in SCF, with companies tying financing to environmental, social, and governance (ESG) goals. In India, 15% of SCF is now linked to sustainability, especially in agriculture and renewable energy. HSBC's green SCF program, for instance, rewards suppliers for meeting eco-friendly targets, like cutting carbon emissions. This not only helps the environment but also attracts ESG-focused investors. Vestas, a Danish wind turbine maker, recently launched a $8.3 million sustainability-linked SCF program with Santander Brazil, a first for the company. This trend shows how SCF is evolving to support greener supply chains while keeping businesses financially healthy.

● Blockchain for Transparency and Efficiency:

Blockchain is transforming SCF by making transactions more transparent and secure. It creates tamper-proof records of invoices and payments, reducing fraud and boosting trust across supply chains. Deep-tier SCF, which extends financing to suppliers' suppliers, is growing thanks to blockchain's ability to track payments across multiple tiers. PrimeRevenue, for example, processes over $300 billion in payment transactions annually across 102 countries, using blockchain to streamline operations. The technology cuts costs and speeds up processes, with McKinsey estimating that digital trade documents could save $6.5 billion globally. As companies embrace blockchain, SCF is becoming a more efficient and reliable tool for managing complex global trade networks.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=19065&flag=E

Leading Companies Operating in the Global Supply Chain Finance Industry:

● Asian Development Bank

● Bank of America Corporation

● BNP Paribas

● DBS Bank India Limited

● HSBC

● JPMorgan Chase & Co.

● Mitsubishi UFJ Financial Group Inc.

● Orbian Corporation

● Royal Bank of Scotland plc (NatWest Group plc)

Supply Chain Finance Market Report Segmentation:

Breakup By Provider:

● Banks

● Trade Finance House

● Others

Banks exhibit a clear dominance in the market due to their established trust, extensive financial networks, and access to capital, which are essential for providing large-scale supply chain finance solutions.

Breakup By Offering:

● Letter of Credit

● Export and Import Bills

● Performance Bonds

● Shipping Guarantees

● Others

Export and import bills represent the largest segment as they are crucial in international trade, providing immediate liquidity for cross-border transactions.

Breakup By Application:

● Domestic

● International

Domestic holds the biggest market share because companies prioritize managing cash flow and reducing risk within local supply chains.

Breakup By End User:

● Large Enterprises

● Small and Medium-sized Enterprises

Large enterprises account for the majority of the market share since they rely heavily on supply chain finance to manage extensive supplier networks and optimize cash flow, giving them a substantial share.

Breakup By Region:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

Asia Pacific dominates the market attributed to its strong trade environment, regulatory support, and financial infrastructure.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Supply Chain Finance Market Size to Reach USD 15.22 Billion by 2033 | Grow CAGR by 8.08% here

News-ID: 4151148 • Views: …

More Releases from IMARC Group

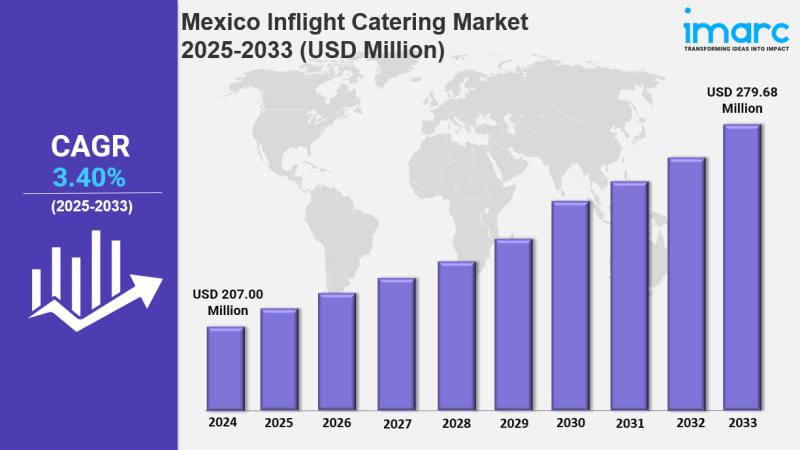

Mexico Inflight Catering Market Size, Trends, Growth and Forecast 2025-2033

IMARC Group has recently released a new research study titled "Mexico Inflight Catering Market Size, Share, Trends and Forecast by Food Type, Flight Service Type, Aircraft Seating Class, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico inflight catering market size reached USD 207.00 Million in 2024. The market is…

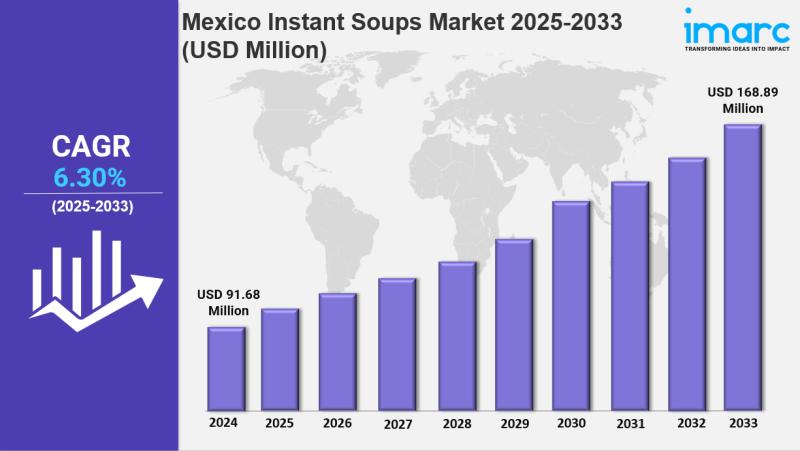

Mexico Instant Soups Market Size, Share, Latest Insights and Forecast 2025-2033

IMARC Group has recently released a new research study titled "Mexico Instant Soups Market Size, Share, Trends and Forecast by Nature, Form, Source, Distribution Channel, End Use, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico instant soups market size reached USD 91.68 Million in 2024 and is projected to…

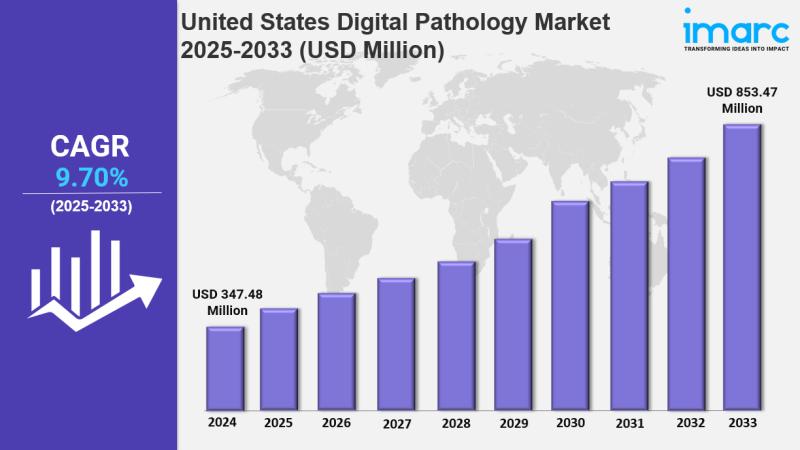

United States Digital Pathology Market : Trends, Drivers, and Growth Opportuniti …

IMARC Group has recently released a new research study titled "United States Digital Pathology Market Size, Share, Trends and Forecast by Product, Type, Delivery Model, Application, End User, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States digital pathology market size was valued at USD 347.48 Million in 2024…

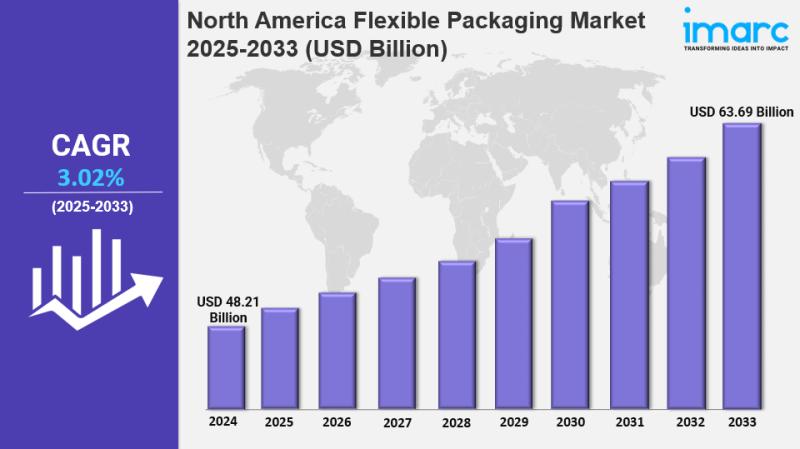

North America Flexible Packaging Market Share, Size, In-Depth Insights, Trends a …

IMARC Group has recently released a new research study titled "North America Flexible Packaging Market Size, Share, Trends and Forecast by Product Type, Raw Material, Printing Technology, Application, and Country, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The North America flexible packaging market was valued at USD 48.21 Billion in 2024 and is…

More Releases for SCF

Digital Supply Chain Finance (SCF) Solution Market Growth Opportunities in the G …

The global market for Digital Supply Chain Finance (SCF) Solution was estimated to be worth US$ 13650 million in 2024 and is forecast to a readjusted size of US$ 28940 million by 2031 with a CAGR of 11.5% during the forecast period 2025-2031.

A 2025 latest Report by QYResearch offers on -"Digital Supply Chain Finance (SCF) Solution - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031" provides…

Stem Cell Factor(SCF) Market Size, Trends, Growth Analysis, and Forecast | Val …

Stem Cell Factor(SCF) Market Size

The global Stem Cell Factor(SCF) market was valued at US$ 12900 million in 2023 and is anticipated to reach US$ million by 2030, witnessing a CAGR of 11.4% during the forecast period 2024-2030.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-10V18247/Global_Stem_Cell_Factor_SCF_Market_Research_Report_2024

The major global manufacturers of Stem Cell Factor(SCF) include PeproTech, Prospec, Proteintech, NeoScientific, STEMCELL Technologies, MP Biomedicals, AJINOMOTO, Enzo, FUJIFILM Irvine Scientific, SigmaAldrich, etc. In 2023, the world's top three vendors…

Dangerous Goods Container Market Size: 2022, Growth Strategic Assessment, Develo …

The Global "Dangerous Goods Container Market" report provides a comprehensive overview of the emerging market trends, drivers, and constraints. This report evaluates historical data on the Dangerous Goods Container market growth and compares it with current market situations. This report provides data to the customers that are of historical & statistical significance and informative. It helps to enable readers to have a detailed analysis of the development of the market.…

Slow Release Fertilizers Market 2018 Global Growth Analysis & Forecast to 2025 | …

UpMarketResearch offers a latest published report on “Global Slow Release Fertilizers Market Analysis and Forecast 2018-2023” delivering key insights and providing a competitive advantage to clients through a detailed report. The report contains pages which highly exhibit on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing and profitability.

Get Free Exclusive PDF Sample Copy of This Report: https://www.upmarketresearch.com/home/requested_sample/5703

Slow Release Fertilizers Industry research report delivers a…

Global Control Release Fertilizers Market Size and Forecast 2025: Hanfeng, Prill …

Qyresearchreports include new market research report Global Control Release Fertilizers Market Professional Survey Report 2018 to its huge collection of research reports.

This report studies Control Release Fertilizers in Global market, especially in North America, China, Europe, Southeast Asia, Japan and India, with production, revenue, consumption, import and export in these regions, from 2013 to 2018, and forecast to 2025.

The global Control Release Fertilizers market is broadly shed light upon in…

Global Slow Release Fertilizers Market Insights, Forecast to 2025 : Hanfeng, Pri …

Researchmoz added Most up-to-date research on "Global Slow Release Fertilizers Market Insights, Forecast to 2025" to its huge collection of research reports.

This report researches the worldwide Slow Release Fertilizers market size (value, capacity, production and consumption) in key regions like North America, Europe, Asia Pacific (China, Japan) and other regions.

This study categorizes the global Slow Release Fertilizers breakdown data by manufacturers, region, type and application, also analyzes the market status,…