Press release

Salmon Market Growth Insights: Share & Forecast 2025-2033

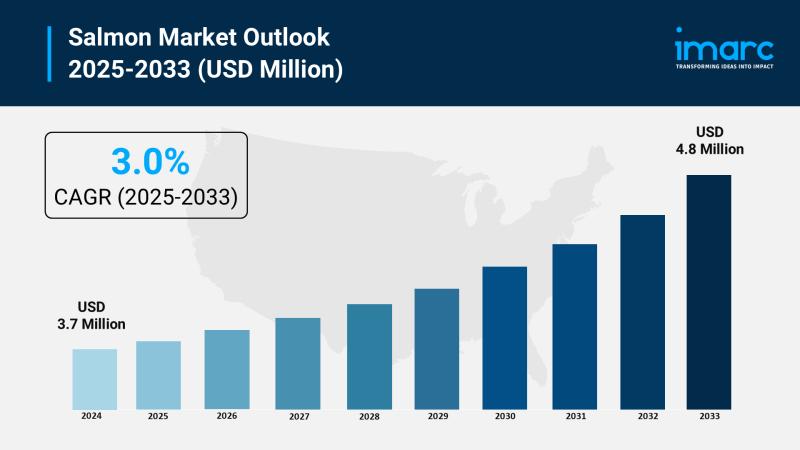

The global Salmon Market is experiencing robust growth, driven by increasing health consciousness, rising disposable incomes, and a growing preference for nutritious seafood options. In 2024, the market reached a volume of 3.7 million tons, and it is projected to attain 4.8 million tons by 2033, expanding at a CAGR of 3.0% during 2025-2033. Key factors propelling this growth include advancements in aquaculture technologies, favourable government policies supporting sustainable fisheries, and the escalating demand for value-added salmon products. Notably, the European Union currently dominates global consumption, accounting for over 46.3% of the market share in 2024.Request for a sample copy of this report:

https://www.imarcgroup.com/salmon-market/requestsample

STUDY ASSUMPTION YEARS

• Base Year: 2024

• Historical Years: 2019-2024

• Forecast Years: 2025-2033

SALMON MARKET KEY TAKEAWAYS

• Market Size and Growth: The global salmon market reached 3.7 million tons in 2024 and is expected to grow to 4.8 million tons by 2033, exhibiting a CAGR of 3.0% during 2025-2033.

• Dominant Consumption Region: The European Union leads global consumption, holding over 46.3% market share in 2024.

• Type Segment: Farmed salmon accounts for most of the market share, ensuring year-round availability and predictable supply.

• Species Preference: Atlantic salmon holds the largest share in the salmon industry, attributed to its high protein and omega-3 content.

• Product Form: Frozen salmon remains a dominant segment due to its cost-effectiveness and extended shelf life, appealing to both consumers and businesses.

• Distribution Channel: Foodservice represents the leading distribution channel segment, driven by the increasing demand for ready-to-eat and convenience seafood products.

MARKET GROWTH FACTORS

1. Rising Consumer Awareness of Salmon's Nutritional Benefits

Consumers worldwide are increasingly aware of the health benefits of salmon, particularly its high omega-3 fatty acid content, protein, vitamins, and minerals. These nutrients support heart health, brain function, and overall immunity, making salmon a preferred choice for health-conscious individuals. Campaigns by health organizations and dietary experts continue to highlight salmon as a superfood, driving stronger demand across retail and foodservice channels. Moreover, with rising lifestyle diseases such as obesity, diabetes, and cardiovascular conditions, consumers are actively seeking nutrient-rich and low-calorie foods. The growing emphasis on balanced diets, fitness routines, and clean eating trends is pushing salmon consumption upward. This ongoing health-driven demand positions salmon as a central product in the global seafood market, accelerating consistent market expansion in the forecast period.

2. Role of Recirculating Aquaculture Systems (RAS) in Salmon Farming

Recirculating Aquaculture Systems (RAS) are revolutionizing salmon farming by improving sustainability, efficiency, and production capacity. Unlike traditional open-water farming, RAS allows farmers to raise salmon in controlled, land-based environments with minimal impact on oceans. This reduces disease risk, environmental pollution, and mortality rates while ensuring year-round production. As consumer preferences shift toward eco-friendly and responsibly farmed seafood, RAS is gaining significant traction among producers and investors. Governments and private players are funding aquaculture innovations, making RAS adoption more widespread. The system also supports scalability, enabling companies to meet growing salmon demand without overfishing. With sustainability becoming a crucial buying factor, RAS technology is set to drive salmon market growth by combining environmental responsibility with high-quality, traceable, and safe seafood production.

3. Rising Role of Seafood-Specialized Retail Chains in Salmon Market Growth

The increasing interest in healthy, protein-rich foods is driving up the demand for salmon, largely due to its high levels of omega-3 fatty acids, which are vital for heart and brain health. As people become more health-conscious, salmon has become a favored option. Moreover, the hectic pace of modern life is creating a need for convenient meal solutions. Ready-to-eat salmon options, including smoked, canned, and frozen forms, are becoming more popular for their quick preparation and nutritional benefits. The rise of e-commerce and subscription delivery services is also enhancing accessibility, allowing consumers to order their preferred salmon products from home. Together, these trends are supporting consistent growth in the global salmon market.

MARKET SEGMENTATION

By Type:

• Farmed: Accounts for most shares due to its ability to meet the growing global demand for salmon at a more consistent and affordable price.

• Wild Captured: Preferred for its natural diet and flavor profile, catering to niche markets and traditional consumption patterns.

By Species:

• Atlantic: Holds the largest share in the salmon industry, attributed to its high protein and omega-3 content.

• Pink: Known for its mild flavour and affordability, making it popular among consumers seeking value options.

• Chum/Dog: Valued for its firm texture and suitability for smoking and canning processes.

• Coho: Appreciated for its rich taste and vibrant colour, often used in premium culinary applications.

• Sockeye: Recognized for its deep red flesh and robust flavour, favoured in gourmet dishes.

• Others: Includes lesser-known species catering to specific regional preferences and culinary uses.

By End Product Type:

• Frozen: Remains a dominant segment due to its cost-effectiveness and extended shelf life, appealing to both consumers and businesses.

• Fresh: Preferred for its taste and texture, often consumed in regions with access to local fisheries.

• Canned: Offers convenience and affordability, widely accepted in North America and Europe.

• Others: Includes smoked, cured, and ready-to-eat products catering to diverse consumer preferences.

By Distribution Channel:

• Foodservice: Represents the leading distribution channel segment, driven by the increasing demand for ready-to-eat and convenience seafood products.

• Retail: Encompasses supermarkets, hypermarkets, and online platforms, offering a wide range of salmon products to consumers.

Breakup by Region:

o North America (United States, Canada)

o Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

o Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

o Latin America (Brazil, Mexico, Others)

o Middle East and Africa

REGIONAL INSIGHTS

In 2024, the European Union dominated the global salmon market, accounting for more than 46.3% of total consumption. This robust standing is attributed to the high demand for both farmed and wild salmon across various EU nations. Favorable government regulations and a strong emphasis on sustainable fishing practices have contributed to increasing salmon supply and aligning with the rising consumer desire for healthy, environmentally friendly seafood.

RECENT DEVELOPMENTS & NEWS

Recent improvements in fish farming technology are helping the salmon market grow faster. New methods like recirculating aquaculture systems (RAS) and eco-friendly fish feed are making salmon farming more efficient and better for the environment. At the same time, more people are buying salmon online thanks to subscription services and bulk order discounts. These changes show how the industry is working to meet rising global demand while staying sustainable and accessible.

KEY PLAYERS

Cermaq Group, Lerøy Seafood Group ASA, Mowi ASA, and SalMar ASA, etc.

Ask Analyst for Customization:

https://www.imarcgroup.com/request?type=report&id=974&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as part of the customization.

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Salmon Market Growth Insights: Share & Forecast 2025-2033 here

News-ID: 4149680 • Views: …

More Releases from IMARC Group

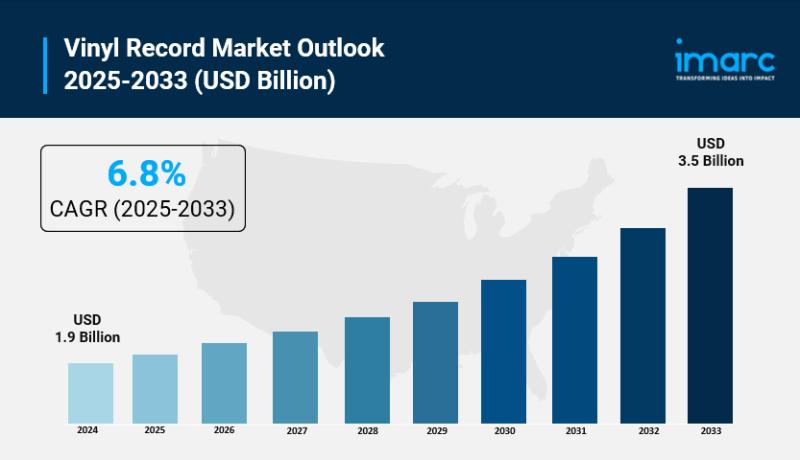

Vinyl Record Market Size to Reach USD 3.5 Billion by 2033 | With a 6.8% CAGR

Market Overview:

According to IMARC Group's latest research publication, "Vinyl Record Market Report by Product (LP/EP Vinyl Records, Single Vinyl Records), Feature (Colored, Gatefold, Picture), Gender (Men, Women), Age Group (13-17, 18-25, 26-35, 36-50, Above 50), Application (Private, Commercial), Distribution Channel (Supermarkets and Hypermarkets, Independent Retailers, Online Stores, and Others), and Region 2025-2033", The global vinyl record market size reached USD 1.9 Billion in 2024. Looking forward, IMARC Group expects the…

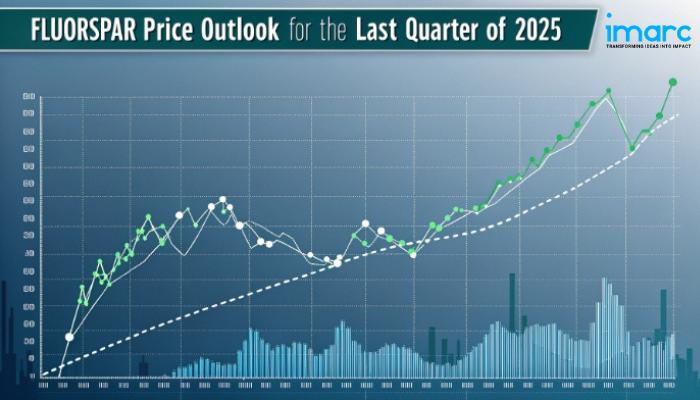

North America Fluorspar Prices Rise in Q4 2025: USA at USD 484/MT, Canada Peaks …

North America Fluorspar Prices Movement Q4 2025:

Fluorspar Prices in USA:

In Q4 2025, fluorspar prices in the USA averaged USD 484 per metric ton. Stable demand from aluminum production and chemical manufacturing supported price levels. Domestic mining operations maintained consistent output, while transportation and energy costs influenced overall supply. Moderate industrial activity and inventory management helped prevent significant price fluctuations across the regional market.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/fluorspar-pricing-report/requestsample

Note: The analysis…

Brazil Hybrid Electric Vehicle Market: Growth Dynamics, Consumer Shifts, and Com …

The Brazil hybrid electric vehicle market size was 348.75 Thousand Units in 2025 and is forecasted to reach 2,551.74 Thousand Units by 2034, reflecting a CAGR of 24.75% during 2026-2034. This robust expansion is fueled by increasing environmental awareness, rising fuel costs, and government policies aimed at emission reduction. Advances in battery technology and flex-fuel hybrid variants leveraging Brazil's ethanol resources also contribute to market growth.

Sample Request Link: https://www.imarcgroup.com/brazil-hybrid-electric-vehicle-market/requestsample

Study Assumption…

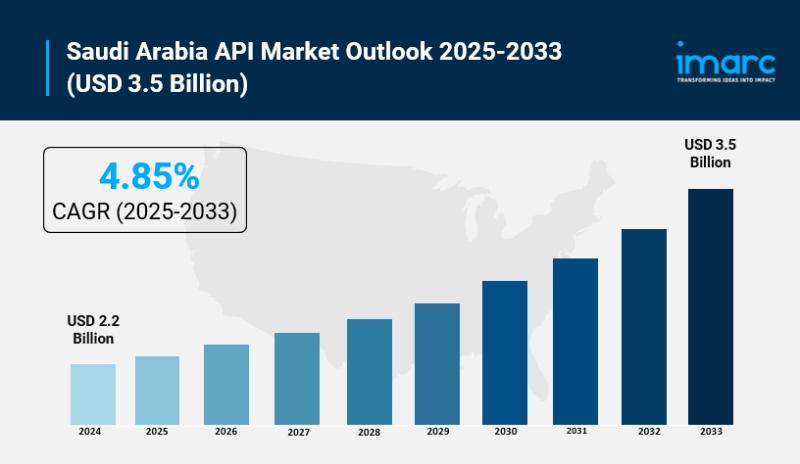

Saudi Arabia API Market Size to Expand USD 3.5 Billion by 2033 at a CAGR of 4.85 …

Saudi Arabia API Market Overview

Market Size in 2024: USD 2.2 Billion

Market Forecast in 2033: USD 3.5 Billion

Market Growth Rate 2025-2033: 4.85%

According to IMARC Group's latest research publication, "Saudi Arabia API Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia API market size reached USD 2.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.5 Billion by 2033, exhibiting a growth rate…

More Releases for Salmon

Land Based Salmon Market Size, Outlook 2031 by Key Companies- Atlantic Sapphire, …

USA, New Jersey: According to Verified Market Research analysis, the global Land Based Salmon Market size was valued at USD 4.28 Billion in 2024 and is projected to reach USD 6.18 Billion by 2031, growing at a CAGR of 5.20% from 2026 to 2032.

What is the current market outlook for land-based salmon farming?

The land-based salmon farming market is experiencing significant growth, driven by increasing demand for sustainable seafood and advancements…

Smoked Salmon Market to See Massive Growth by 2028 | Salmar, Mowi, Norway Royal …

Latest published market study on Smoked Salmon Market provides an overview of the current market dynamics in the Smoked Salmon space, as well as what our survey respondents—all outsourcing decision-makers—predict the market will look like in 2027. The study breaks market by revenue and volume (wherever applicable) and price history to estimates size and trend analysis and identifying gaps and opportunities. Some of the players that are in coverage of…

Land-Based Salmon Market Survey Report 2022 Along With Statistics, Forecasts Til …

The Latest report about the Land-Based Salmon market provides a detailed evaluation of the business vertical in question, alongside a brief overview of the industry segments. An exceptionally workable estimation of the present industry scenario has been delivered in the study, and the Land-Based Salmon market size with regards to the revenue and volume have also been mentioned. In general, the research report is a compilation of key data with…

Land-Based Salmon Market Huge Growth Opportunity between 2020-2028 | Top Players …

A recent report published by QMI on land-based salmon market is a detailed assessment of the most important market dynamics. After carrying out thorough research of land-based salmon market historical as well as current growth parameters, business expectations for growth are obtained with utmost precision. The study identifies specific and important factors affecting the market for land-based salmon during the forecast period. It can enable companies investing in land-based salmon…

Canned Salmon Market 2019 analysis with Top Key Players and Major Types Farmed C …

Canned Salmon Market

Salmon is the common name for fishes belonging to the family of Salmonidae. It is available from both wild and farmed sources. It is estimated that nearly 60% of the world's salmon production is farmed. Salmon farming started in the beginning of 1960s. Atlantic salmon is the most common type of salmon that is farmed. Major part of Atlantic salmon available around the globe are farmed commercially.

To Access…

Global Alaskan Salmon Market Analysis Covers Cost Structure, Demand Rate, Growth …

Commercial fishing is one of the major industries contributing to the economy of Alaska. Natives of Alaska have been harvesting salmons and various other fishes for centuries. Salmon are ray-finned fish in the family of salmonidae. The term salmon comes from Latin word salmo, emerged from salire, meaning "to leap". Alaskan salmon are highly preferred around the world owing to its better taste and high nutritional values. Alaskan salmon is…