Press release

Inside The Collapse of The IRS Debt Settlement Program (Offer in Compromise)

What Taxpayers Need to Know About the Hijacking of the IRS Offer in Compromise.The IRS Offer in Compromise (OIC) program has really been made a second chance lifeline to help taxpayers who find themselves in dire financial straits. Over the last few years, however, the connection has become very battered.

The once-trusted mechanism for settling an IRS debt, the OIC program, has become a favorite mark for predatory firms and misleading marketing tactics. What was the result? Fewer approvals, wasted resources, and ripped off taxpayers.

As someone who spent decades working both inside the IRS and in private tax resolution practice, I've seen this shift unfold in real time. And it's time we talk about what's really going on.

What Is the Offer in Compromise?

At its core, an Offer in Compromise allows taxpayers to settle their IRS debt for less than the full amount owed, but only if paying in full would create severe financial hardship. It's not a loophole, a giveaway, or a secret backdoor. It's a structured, rule-based process designed to balance the government's interest in collecting revenue with a taxpayer's ability to pay.

When used appropriately, the OIC can be a powerful tool for both the IRS and the individual. But today, that intent is being severely undermined.

A Troubling Trend is Arising as Approval Rates Are Falling

In the last year, the IRS received over 33,000 OIC submissions, but accepted just 7,199 of them. That's a 21% approval rate, far below the historical average of 30-40%. The downward trend is stark and alarming.

So why the drop?

In short: an explosion of frivolous and unqualified OIC filings, driven largely by deceptive advertising and sales tactics from a growing number of tax resolution companies.

How Tax Resolution Companies Are Misleading the Public

We've all seen the ads on TV, online, even on billboards promising to "settle your tax debt for pennies on the dollar." Some claim access to secret IRS programs. Others imply insider connections. Many offer free consultations that quickly turn into high-pressure sales pitches.

The reality? These firms often submit OICs for clients who have no chance of qualifying, wasting IRS resources and leaving the taxpayer in worse shape than before. I personally receive three to four calls each week from taxpayers who spent thousands of dollars on these services, only to be left with a denied offer, no refund, and no clear next steps.

What's the Most Common Deceptive Marketing Tactic

Here are just a few of the misleading claims that you may come across that trick taxpayers into overpaying for false hope:

*

"The IRS Writes Off Millions Every Year!": Technically true, but most of those write-offs come from the expiration of collection statutes, not successful OICs.

*

"Fresh Start Program": It's a real IRS initiative, but not something new, neither a secret. Also, it does not give you a guarantee of settlement.

*

"Settle for Pennies on the Dollar": A catchy phrase, but often misleading. The majority of taxpayers do not qualify for such favorable terms.

*

Claims of Insider Access: There are no secret handshakes. The OIC program operates under publicly available criteria and a free IRS pre-qualifier tool.

The IRS Is Trying to Respond But It's Not Enough

To its credit, the IRS has issued repeated warnings about these scams, even listing OIC fraud on its annual "Dirty Dozen" list of top tax scams. The IRS has also made improvements to accessibility, including:

*

The Offer in Compromise Pre-Qualifier Tool

*

An online portal for submission and tracking

*

Increased public guidance and alerts

Still, last year the IRS had to review and reject over 26,000 OIC submissions, each one diverting time and staff away from legitimate cases.

Recommendations for What Needs to Change in Policy

If we want to restore faith in the OIC program and protect vulnerable taxpayers, stronger enforcement and smarter safeguards are urgently needed. Here are three recommendations:

1. Implement Penalties for Frivolous Filings

Tax resolution firms that knowingly submit invalid offers should face fines similar to those imposed for filing false returns. Because if there are no consequences, abuse will continue.

2. Require a Justification Cover Sheet

Each OIC based on "doubt as to collectability" should be accompanied by a signed form showing the financial basis for the submission, ideally using IRS pre-qualifier data.

3. Track and Sanction Repeat Offenders

The IRS needs to maintain an internal watchlist of firms with high rejection rates. Such firms should be restricted from submitting further offers on behalf of clients.

A Word of Caution for Taxpayers

If you're considering an Offer in Compromise, you have to proceed carefully. The stakes are high, and so are the risks of being misled. Here are a few survival tips from the inside:

*

Only Work with Licensed Professionals: Ask if they are a CPA, attorney, enrolled agent, or better yet, a former IRS agent. If they dodge the question, walk away.

*

Review Your Financials with Your Preparer: The person filing your OIC should fully understand your income, assets, and liabilities, not just send over a questionnaire.

*

Insist on a Zoom or Video Call Before Hiring: You need to see and speak to the person handling your case, not a commissioned sales rep.

Final Thoughts from the People Who've Been There

My co-author Peter Salinger E.A. (former IRS group supervisor of the offer in compromise program) and I wrote Exposing the Secrets for IRS Settlements because we've lived these stories from both sides. Peter and I spent years managing OIC cases inside the IRS and later reviewing them in Appeals. We have seen firsthand how large "box firms" flood the system with repeat filings, knowing most will be rejected.

The victims of this abuse are not just the IRS, they're the everyday taxpayers who deserve real solutions and honest representation.

The Bottom Line

Last year, just 7,200 Americans were able to settle their tax debts through an Offer in Compromise. For them, it was a clean slate: liens lifted, passports restored, peace of mind regained, and debt finally settled.

But tens of thousands more were sold a dream, and left with nothing but disappointment, and still having their IRS tax debt remaining.

The Offer in Compromise is still a powerful solution, but only when it's used the right way, for the right reasons, by the right professionals. Let's protect its integrity, hold bad actors accountable, and give honest taxpayers the chance at real relief.

Learn more at: https://www.sullivan4irsmatters.com/

For more details contact Michael Sullivan from Company name: MD Sullivan Tax Group at mike@irs-matters.com or call 954 328 3501.

Media Contact

Company Name: MD Sullivan Tax Group

Contact Person: Michael Sullivan

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=inside-the-collapse-of-the-irs-debt-settlement-program-offer-in-compromise]

City: Florida

State: Sebring

Country: United States

Website: http://sullivan4irsmatters.com

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Inside The Collapse of The IRS Debt Settlement Program (Offer in Compromise) here

News-ID: 4145933 • Views: …

More Releases from ABNewswire

The Neighbourhood The Wourld Tour 2026: Cheapest Tickets Available Now - Apply C …

The Neighbourhood's The Wourld Tour 2026 brings the alt-rock band's signature sound to arenas worldwide, supporting their new album (((((ultraSOUND))))). Kicking off March 28 in Austin, TX (Moody Center), the tour hits North America, Europe, Australia, Asia, and more through October 2026-including stops at Madison Square Garden (NYC), TD Garden (Boston), Kia Forum (LA), and recent additions like Little Caesars Arena (Detroit, Nov 19).

The Neighbourhood's The Wourld Tour 2026 [https://www.capitalcitytickets.com/The-Neighbourhood-Tickets]…

Andatel Grande Patong Phuket: 40-50M THB Mold Remediation After 6-Year Coastal C …

Andatel Grande Patong Phuket addresses extensive mold damage from unprecedented six-year COVID closure (March 2023-March 2026) through comprehensive remediation program. The 122-room property invested 40-50 million Thai Baht (35% of total 120-140M budget) demolishing and rebuilding affected ceilings and walls. Coastal humidity exceeding 80% without air conditioning created severe mold penetration throughout property.

PATONG, Phuket, Thailand - February 22, 2026 - One of the best Andatel Grande Patong Phuket option in…

Best Deals on MercyMe 2026 Tour Tickets: Get Affordable Seats at CapitalCityTick …

MercyMe's Wonder + Awe Tour 2026 kicks off March 12 in Greensboro, NC, featuring hits like "I Can Only Imagine" and new tracks from their upcoming album. With special guests Big Daddy Weave, Tim Timmons, and Sam Wesley, the 24+ city spring run spans the U.S., from East Coast arenas to West Coast venues, wrapping April 25 in Spokane, WA.

MercyMe's Wonder + Awe Tour 2026 [https://www.capitalcitytickets.com/MercyMe-Tickets] is bringing an uplifting…

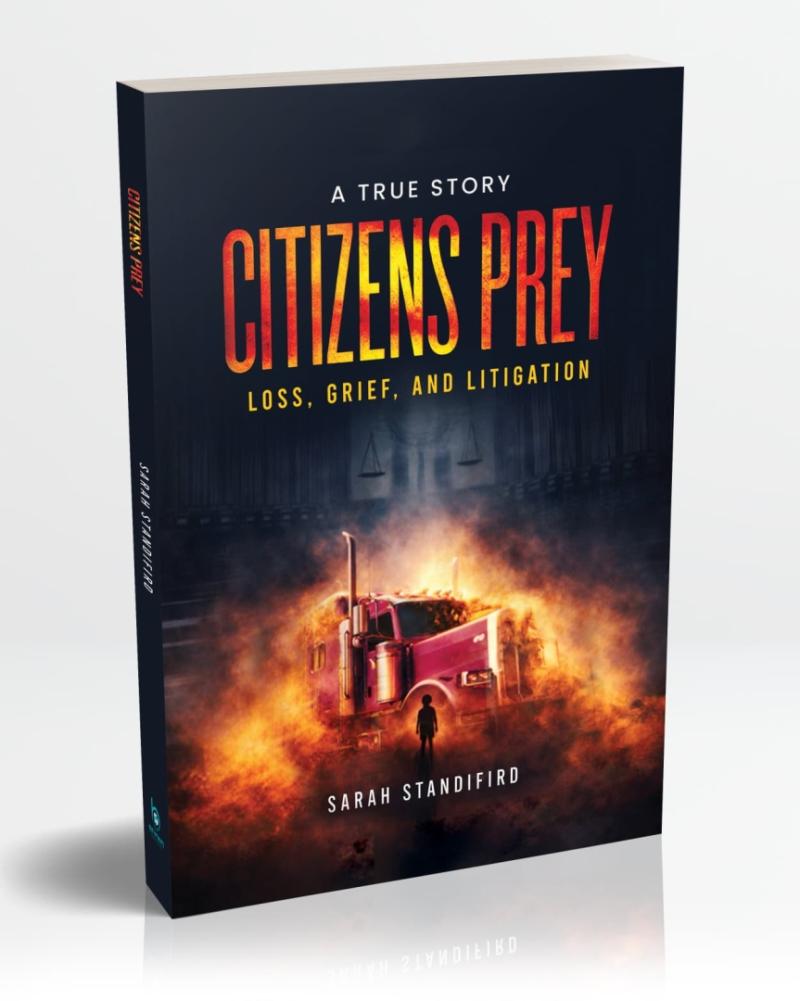

Upcoming Book Offers Readers a Rare Perspective, Taking Them on a Mother's Journ …

Sarah Standifird's upcoming book, Citizen's Prey, will be released on March 28 and offers a rare, unflinching look at what happens when families are forced to navigate the justice system after preventable tragedy.

With years of experience in the legal industry, Sarah Standifird once worked alongside attorneys nationwide. Now, she writes from the other side of the courtroom-as a grieving mother navigating the system as a client-offering a rare and unflinching…

More Releases for IRS

Mobiniti Dedicated Toll-Free Numbers Handle IRS Negotiation Queries

United States, 17th Oct 2025 - Mobiniti's dedicated toll-free numbers are transforming how businesses manage IRS negotiation queries by offering a simple and effective communication tool. Through seamless integration with SMS platforms, businesses can provide clients with immediate access to dedicated lines, ensuring they receive expert assistance on tax-related matters without unnecessary delays. This solution improves customer satisfaction while streamlining the process of handling complex financial inquiries.

How Toll-Free Numbers Enhance…

The REBO Foundation Earns IRS 501(c)(3) Status

BARTLESVILLE, OK - October 15, 2025 - The Bartlesville Education Fund, operating publicly as The REBO Foundation, announced today that it has been officially recognized by the Internal Revenue Service (IRS) as a 501(c)(3) tax-exempt charitable organization, effective July 4, 2025 (EIN 39-2993969).

The REBO Foundation's mission is to build shelters, rehabilitation centers, and mental health programs throughout Oklahoma and beyond. With this IRS determination, the organization can now accept tax-deductible…

Torchlight Tax Offers Free Ebook on Understanding IRS Notices

Torchlight Tax LLC, a full service tax firm, is offering a free ebook entitled Understanding IRS Notices.

Dave Horwedel, CEO of Torchlight Tax, says that many taxpayers are confused and traumatized by receiving an IRS notice.

Mr.Horwedel stated "The IRS sends out a wide variety of notices to taxpayers that often strike fear into the heart of that taxpayer. If you understand what each type of notice is and…

National Tax Debt Offers Help Amidst IRS Collections

Image: https://www.getnews.info/wp-content/uploads/2024/08/1724781499.png

The Internal Revenue Service (IRS) is gearing up to intensify tax collections after a temporary lull during the COVID-19 pandemic. This heightened focus is largely due to increased funding from the Inflation Reduction Act, which has enabled the IRS to expand its workforce and enhance its collection capabilities.

IRS Collections Resuming

Taxpayers who owe back taxes should be aware that the IRS is becoming more aggressive in its collection efforts. This…

Understanding IRS Notices and Navigating Effective Responses

Dealing with the Internal Revenue Service (IRS) can be a daunting task for many taxpayers. Whether it's a simple notification or a more complex issue, understanding the nuances of can significantly impact how one responds and resolves any issues presented.

Identifying Different Types of IRS Notices

The first step in managing Internal Revenue Service [https://sbkass.com/irs-notices-and-effective-responses/] communications effectively is to identify the type of notice you've received. The IRS sends various notices for…

Things you need to know about IRS tax refunds

Tax season is here, and taxpayers across the United States are finalizing their tax filing strategies, as a high tax bill is not desirable at all. Taxpayers intend to obtain as much tax deduction as possible, and several attributes affect the total amount of taxes that are to be paid by a taxpayer. Every taxpayer needs to be aware of the IRS refunds they are entitled to so they can…