Press release

Buy Now Pay Later Market Projected to Surge from USD 44.7 Billion in 2025 to USD 196.0 Billion by 2032 | Persistence Market Research

Overview of the MarketThe global buy now pay later (BNPL) market is on an impressive growth trajectory, projected to expand from US$ 44.7 billion in 2025 to US$ 196.0 billion by 2032, registering a remarkable CAGR of 23.8% during the forecast period. The market's rapid growth is driven by increasing consumer preference for flexible, interest-free payment solutions, particularly among younger demographics such as millennials and Gen Z. These services allow consumers to spread payments over time without incurring high borrowing costs, making them a preferred alternative to credit cards.

Retail stands out as the leading segment, expected to command around 72.5% market share in 2025, fueled by the integration of BNPL into e-commerce platforms and brick-and-mortar retail checkout systems. North America will likely lead geographically with about 30.6% share in 2025, supported by widespread adoption in the U.S. and evolving regulatory frameworks from bodies like the CFPB. This growth is underpinned by the region's high credit card debt levels and a strong push toward transparent, consumer-friendly financing options.

Elevate your business strategy with comprehensive market data. Request a sample report now: https://www.persistencemarketresearch.com/samples/35349

Key Highlights from the Report

• Online channel expected to hold 66.2% market share in 2025 due to strong mobile-first adoption.

• Retail to capture around 72.5% market share in 2025, driven by fashion, electronics, and beauty.

• North America to account for 30.6% of market share in 2025, led by U.S. adoption.

• Partnerships with virtual payment platforms to boost offline BNPL growth.

• BNPL to be integrated into mobile identity wallets and super apps for wider reach.

• Market to grow at a CAGR of 23.8% between 2025 and 2032.

Market Segmentation

The buy now pay later market is segmented primarily by channel and end-use industry.

By channel, the market is divided into online and Point of Sale (POS). The online segment dominates with an estimated 66.2% share in 2025, supported by seamless integration into e-commerce checkout processes and high adoption among mobile-first shoppers. Retailers using BNPL online often experience significant boosts in cart conversion rates. The POS segment is also growing rapidly as physical retailers adopt BNPL-powered smart cards and in-store payment integrations to replicate the online flexible payment experience.

By end-use, the retail segment takes the lead with 72.5% share in 2025. Growth here is accelerated by strategic partnerships between BNPL providers and leading retail brands, enabling installment payments for a wider range of goods, including high-ticket items. Other emerging segments include automotive, which is seeing BNPL adoption for expensive maintenance and accessory purchases, and healthcare, where rising out-of-pocket expenses are driving patients toward installment-based financing for elective treatments.

Regional Insights

North America:

North America will account for approximately 30.6% of the global BNPL market in 2025, with the U.S. leading adoption due to high consumer demand for interest-free payment options and elevated credit card debt levels. Regulatory oversight from the CFPB is reshaping market practices, ensuring transparency, fair refund policies, and responsible lending.

Europe:

Europe's BNPL growth is driven by strong adoption in the U.K., Sweden, and Germany, with the region holding around 30% of global BNPL transaction value in 2024. Providers like Klarna lead the market, but stricter regulations, such as FCA's affordability checks in the U.K., are shaping a more controlled and sustainable growth path.

Read More: https://www.persistencemarketresearch.com/market-research/buy-now-pay-later-market.asp

Market Drivers

A primary driver for BNPL adoption is the growing demand for debt-light, interest-free payment options. Consumers, particularly younger age groups, are seeking alternatives to traditional credit cards amid rising inflation and stagnant wages. BNPL's instant approval process-often based on alternative data and soft credit checks-further boosts its attractiveness. E-commerce integration has amplified usage, as seen with Klarna's "Pay in 3" product, which recorded significant uptake in the U.K. in 2023.

Market Restraints

The biggest restraint is overspending and missed payments, particularly among younger consumers. Without strict credit limits, users often manage multiple BNPL plans, leading to payment defaults. Complicated refund processes also remain a concern, especially in e-commerce, where BNPL providers act as intermediaries between consumers and merchants, sometimes causing delays in reimbursement.

Market Opportunities

The healthcare sector presents a promising growth avenue for BNPL providers. Rising medical costs and insurance coverage gaps are pushing patients to seek installment-based payment options for elective procedures like dental work, fertility treatments, and dermatology. Collaborations between BNPL companies and healthcare providers, such as Affirm's partnerships in the U.S., are expanding access to care while improving cash flow for clinics.

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/35349

Reasons to Buy the Report

✔ In-depth analysis of market growth trends, drivers, and restraints.

✔ Comprehensive segmentation insights by channel, end-use, and region.

✔ Coverage of key regulatory developments shaping the BNPL industry.

✔ Competitive landscape with profiles of major players and strategies.

✔ Forward-looking forecast data to 2032 for informed decision-making.

Frequently Asked Questions (FAQs)

How Big is the Buy Now Pay Later Market in 2025?

Who are the Key Players in the Global Buy Now Pay Later Market?

What is the Projected Growth Rate of the Buy Now Pay Later Market?

What is the Market Forecast for the Buy Now Pay Later Industry by 2032?

Which Region is Estimated to Dominate the Buy Now Pay Later Industry through the Forecast Period?

Company Insights

Key Players in the Market:

1. Afterpay Limited

2. Affirm, Inc.

3. PayPal Holdings, Inc.

4. Perpay Inc.

5. Klarna Inc.

6. Openpay

7. Splitit Payments, Ltd.

8. HSBC Group

9. LatitudePay Financial Services

10. Zip Co, Ltd.

11. Slice

12. OlaMoney Postpaid

13. Simpl

14. Mobikwik ZIP

15. Amazon Pay Later

16. Others

Recent Developments:

• May 2025: Costco partnered with Affirm to offer long-term BNPL options for purchases over US$ 500 in the U.S.

• September 2024: Zepto launched "Zepto Postpaid" in India, offering interest-free repayments of up to Rs. 5,000.

Related Reports:

AI Governance Market: https://www.persistencemarketresearch.com/market-research/ai-governance-market.asp

Media Gateway Market: https://www.persistencemarketresearch.com/market-research/media-gateway-market.asp

Mobile Biometric Market: https://www.persistencemarketresearch.com/market-research/mobile-biometric-market.asp

Digital Twin Market: https://www.persistencemarketresearch.com/market-research/digital-twin-market.asp

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Buy Now Pay Later Market Projected to Surge from USD 44.7 Billion in 2025 to USD 196.0 Billion by 2032 | Persistence Market Research here

News-ID: 4145362 • Views: …

More Releases from Persistence Market Research

Bicycle Spokes Market Set for Strong Growth at 5.4% CAGR Through 2032 - Persiste …

The global bicycle spokes market is rapidly gaining traction as bicycles continue to be adopted as preferred choices for commuting, fitness, recreation, and eco‐friendly mobility. The global bicycle spokes market size is likely to be valued at US$2.9 billion in 2025 and is expected to reach US$4.2 billion by 2032, registering a steady CAGR of 5.4 % between 2025 and 2032.

➤ Download Your Free Sample & Explore Key Insights: https://www.persistencemarketresearch.com/samples/30615

Bicycle…

Herbal Toothpaste Market Growth Poised at 6.5% CAGR Through 2033 Amid Rising Hea …

The global oral care industry is undergoing a transformational shift as consumers increasingly prioritize natural, chemical free alternatives. Central to this transformation is the herbal toothpaste market, which is rapidly emerging as a mainstream segment driven by rising health consciousness, sustainability trends, and demand for botanical formulations. The global herbal toothpaste market size is likely to be valued at US$ 2.6 billion in 2026 and is projected to reach US$…

Dead Sea Mud Cosmetics Market Set for Steady Expansion Amid Rising Demand for Na …

The global beauty and personal care industry continues to evolve as consumers shift toward natural, mineral-based, and wellness-oriented skincare solutions. Among these, Dead Sea mud cosmetics have gained strong traction for their mineral content and perceived therapeutic benefits. According to industry estimates, the global dead sea mud cosmetics market is likely to be valued at US$1.5 billion in 2026 and is projected to reach US$2.3 billion by 2033, expanding at…

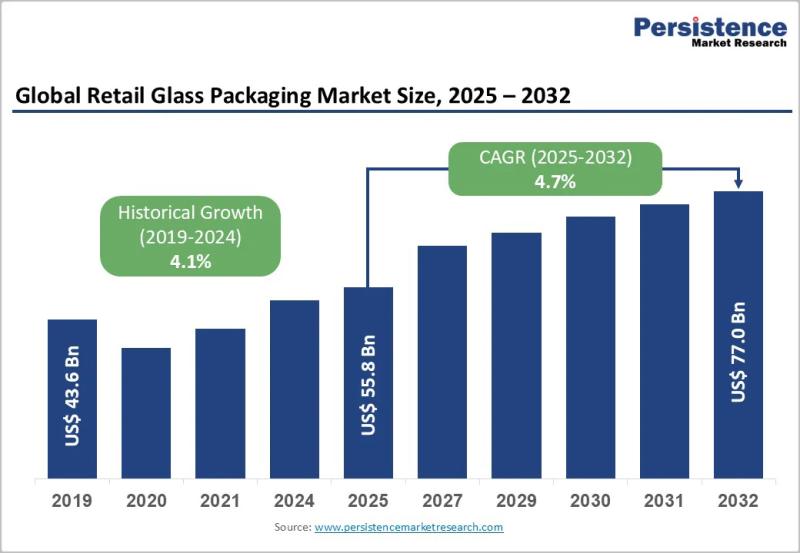

Retail Glass Packaging Market Projected to Reach US$77.0 Billion by 2032 at 5.3% …

The retail glass packaging market continues to play a crucial role in the global packaging ecosystem, particularly across food, beverage, cosmetics, and pharmaceutical retail channels. Glass packaging remains a preferred solution due to its premium appearance, chemical inertness, recyclability, and ability to preserve product integrity. As consumers increasingly prioritize sustainability, safety, and high quality packaging, retail glass packaging has regained strategic importance across both developed and emerging economies. Brands are…

More Releases for BNPL

How New BNPL Regulations Will Transform Ecommerce Technology Infrastructure

The UK government's announcement of comprehensive Buy Now Pay Later regulations represents more than just consumer protection measures-it signals a fundamental shift in how payment technology will operate across ecommerce platforms. As these rules prepare to take effect next year, technology teams, payment processors, and platform developers face the challenge of rebuilding infrastructure that has largely operated in an unregulated environment since BNPL's explosive growth began.

The regulatory framework demands sophisticated…

The Malaysia BNPL Market is growing owing to Digitalization, Rising Tech-Savvy P …

Focus On Shifting Preference Towards BNPL And Adoption of Online Payments Technology Are Major Factor Contributing Towards Development of BNPL Market in Malaysia

Adoption within Retail: With e-commerce growing faster than before the pandemic, it presents a big opportunity due to increased online payments. This coupled with the fact that BNPL giants have witnessed immense adoption within retail and the wider community is a major growth driver for BNPL industry in…

PayNXT360 Expects the BNPL Industry in Netherlands to Grow at a CAGR of 32.8% Du …

BNPL payment industry in the Netherlands has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 74.8% on annual basis to reach US$ 7606.1 million in 2022.

Medium to long term growth story of BNPL industry in the…

PayNXT360 Expects the Norway BNPL Industry to Grow at a CAGR of 17.5% During 202 …

BNPL payment industry in Norway has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 39.8% on annual basis to reach US$ 6358.9 million in 2022.

Medium to long term growth story of BNPL industry in Norway remains…

PayNXT360 Expects the Russian BNPL Industry to Grow at a CAGR of 45.3% During 20 …

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in Russia is expected to grow by 91.9% on annual basis to reach US$ 7361.2 million in 2022.

Medium to long term growth story of BNPL industry in Russia remains strong. The BNPL payment adoption is expected to grow steadily over the forecast period, recording a CAGR of 45.3% during 2022-2028. The BNPL Gross Merchandise Value in the country will increase from…

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL Payment in Switzerland is E …

BNPL payment industry in Switzerland has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL payment in the country is expected to grow by 49.6% on annual basis to reach US$ 1020.4 million in 2021.

Medium to long term growth story of BNPL industry in Switzerland remains…