Press release

e-KYC Market Size, Share, Growth & Industry Future Outlook (2025-2033)

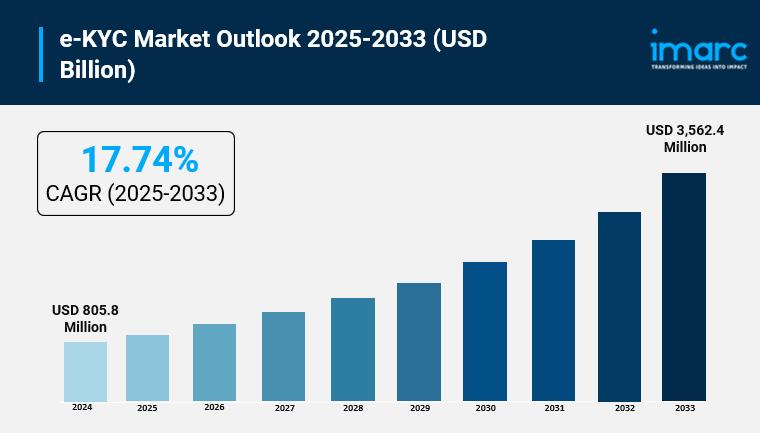

Market Overview:The e-KYC market is growing significantly due to the escalating need for digital, safe identity authentication solutions. In addition, the automation and technological advancements, regulatory adherence requirements, and a surge in fintech and digital banking solutions, upgrading consumer onboarding and minimizing fraud risk is further increasing the e-KYC market share across the region. According to IMARC Group's latest research publication, "e-KYC Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global e-KYC market size was valued at USD 805.8 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 3,562.4 Million by 2033, exhibiting a CAGR of 17.74% during 2025-2033. North America currently dominates the market, holding a significant market share of over 40.0% in 2024.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Get Sample Free Copy of Report at - https://www.imarcgroup.com/e-kyc-market/requestsample

Key Highlights of the Report:

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• COVID-19 Impact on the Market

• Porter's Five Forces Analysis

• Strategic Recommendations

• Historical, Current and Future Market Trends

• Market Drivers and Success Factors

• SWOT Analysis

• Structure of the Market

• Value Chain Analysis

• Comprehensive Mapping of the Competitive Landscape

Growth Factors Driving the e-KYC Industry

• Increasing Regulatory Compliance and Anti-Fraud Measures Driving Adoption

The e-KYC market is witnessing robust growth due to the rising need for regulatory compliance and stringent anti-fraud measures across banking, fintech, and financial services sectors. Financial institutions are increasingly mandated by governments and regulatory authorities to implement secure, streamlined customer verification processes to prevent money laundering, identity theft, and fraudulent transactions. Traditional KYC processes are often manual, time-consuming, and prone to human error, which has led organizations to adopt digital solutions that can automate identity verification while ensuring compliance with legal frameworks. The integration of biometric authentication, artificial intelligence, and machine learning in e-KYC platforms allows institutions to verify customers in real-time with high accuracy and minimal operational overhead. In 2025, the demand for e-KYC solutions is projected to surge as regulators across regions tighten anti-money laundering (AML) and counter-terrorist financing (CTF) guidelines, prompting financial institutions to adopt scalable, secure, and cost-effective verification technologies. This dynamic is further supported by rising digital onboarding requirements, increasing online banking penetration, and the growth of digital financial services globally.

• Digital Transformation and Fintech Expansion Fueling Market Growth

The rapid digitalization of financial services, coupled with the proliferation of fintech startups, is significantly contributing to the expansion of the e-KYC market. As consumers increasingly prefer digital banking, mobile wallets, and online investment platforms, financial institutions are pressured to deliver seamless onboarding experiences that comply with KYC regulations. e-KYC solutions facilitate paperless registration, instant verification, and remote authentication, which enhances customer experience while reducing operational costs. Advanced technologies such as facial recognition, liveness detection, optical character recognition (OCR), and blockchain integration are increasingly being deployed to ensure data integrity and security. In 2025, the growing adoption of digital financial services and mobile banking platforms is expected to accelerate the need for efficient e-KYC processes, as institutions aim to onboard customers faster, minimize fraud risk, and maintain competitive advantage in an increasingly tech-driven financial ecosystem.

• Cross-Industry Applications and Global Expansion Driving Demand

While the financial sector remains the primary adopter of e-KYC solutions, other industries such as telecommunications, insurance, healthcare, and e-commerce are increasingly implementing electronic verification to streamline customer onboarding and enhance security. Telecom providers leverage e-KYC to verify subscriber identities and prevent SIM card fraud, while healthcare and insurance companies use digital verification to ensure accurate patient or policyholder records. The expansion of digital services across emerging markets and the rising number of internet users globally are creating opportunities for cross-border adoption of e-KYC solutions. In 2025, the market is expected to witness increased deployment in Asia-Pacific, Latin America, and Africa due to favorable regulatory frameworks, digital infrastructure growth, and rising awareness of data security and privacy. This cross-industry integration is driving higher investments in AI-based verification technologies, cloud-based solutions, and real-time monitoring platforms, ensuring secure, efficient, and scalable e-KYC processes worldwide.

Get Discount On The Purchase Of This Report: https://www.imarcgroup.com/checkout?id=6112&method=1670

Impact of AI on the e-KYC Market

Artificial intelligence (AI) is revolutionizing the e-KYC (electronic Know Your Customer) market by enhancing accuracy, efficiency, and security across customer verification processes. Traditional KYC methods often involve manual checks, document verification, and in-person authentication, which are time-consuming, prone to errors, and vulnerable to fraud. AI-powered e-KYC solutions, on the other hand, leverage advanced algorithms to automate identity verification, analyze large datasets, and detect anomalies in real-time.

AI technologies such as machine learning, facial recognition, optical character recognition (OCR), and liveness detection enable financial institutions and other service providers to authenticate users quickly and accurately. These tools can instantly validate IDs, passports, and other identity documents while ensuring the person presenting them is genuine. AI also supports risk-based assessments, flagging suspicious activities and reducing potential fraud, which is crucial for compliance with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations.

Moreover, AI enhances the customer onboarding experience by enabling seamless, remote verification. Chatbots and virtual assistants guide users through the e-KYC process, answering queries, and ensuring proper documentation submission. Predictive analytics also helps institutions anticipate fraudulent behaviors and adjust verification protocols proactively.

Leading Companies Operating in the Global e-KYC Industry:

• 63 Moons Technologies Limited

• Acuant Inc.

• Financial Software & Systems Pvt. Ltd.

• GB Group plc

• GIEOM Business Solutions Pvt. Ltd.

• Jumio

• Onfido

• Panamax Inc.

• Tata Consultancy Services Limited

• Trulioo

• Trust Stamp

• Wipro Limited.

e-KYC Market Report Segmentation:

Analysis by Product:

• Identity Authentication and Matching

• Video Verification

• Digital ID Schemes

• Enhanced vs Simplified Due Diligence

Identity authentication and matching remain the largest segment in 2024. According to the e-KYC market forecast, this segment is expected to maintain its leading position, as it plays a crucial role in ensuring the accurate and secure verification of users' identities.

Analysis by Deployment Mode:

• Cloud-based

• On-premises

On-premises solutions lead the market in 2024. According to the e-KYC market research report, this model continues to be prominent, providing organizations with enhanced control over their data and security infrastructure.

Analysis by End User:

• Banks

• Financial Institutions

• E-payment Service Providers

• Telecom Companies

• Government Entities

• Insurance Companies

Banks dominate the market in 2024, propelled by the growing need for secure, efficient customer onboarding and adherence to strict financial regulations.

Regional Insights:

• North America

o United States

o Canada

• Asia-Pacific

o China

o Japan

o India

o South Korea

o Australia

o Indonesia

o Others

• Europe

o Germany

o France

o United Kingdom

o Italy

o Spain

o Russia

o Others

• Latin America

o Brazil

o Mexico

o Others

• Middle East and Africa

In 2024, North America accounted for the largest market share of over 40.0%, majorly due to resilient regulatory protocols, a highly upgraded financial industry, and bolstered adoption of digital technologies.

Do you know more information, Contact to our analyst at- https://www.imarcgroup.com/request?type=report&id=6112&flag=C

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

FAQs

1. What is driving growth in the global e-KYC market?

The e-KYC market is expanding rapidly due to the increasing need for digital, secure identity verification solutions. Factors driving growth include stringent regulatory compliance, the rise of fintech and digital banking, automation of verification processes, and a focus on minimizing fraud risk across industries.

2. Which segment dominates the e-KYC market?

Identity authentication and matching is the largest segment in 2024. This process is critical for ensuring accurate and secure verification of users' identities, making it the cornerstone of e-KYC solutions across banking, fintech, and other sectors.

3. What are the key deployment models in the e-KYC market?

The primary deployment models are on-premises and cloud-based solutions. On-premises solutions lead the market in 2024, offering organizations greater control over data and security infrastructure, while cloud-based deployments provide scalability and cost-efficiency for remote verification needs.

4. Which industries are the major end-users of e-KYC solutions?

Banks are the leading end-users of e-KYC solutions, driven by the need for secure, streamlined customer onboarding and compliance with financial regulations. Other sectors adopting e-KYC include financial institutions, e-payment service providers, telecom companies, insurance companies, and government entities.

5. How is AI impacting the e-KYC market?

AI is transforming e-KYC by enabling automated identity verification, real-time anomaly detection, and enhanced fraud prevention. Technologies like machine learning, facial recognition, OCR, and liveness detection improve verification speed and accuracy, while AI-driven chatbots and predictive analytics enhance the customer onboarding experience.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release e-KYC Market Size, Share, Growth & Industry Future Outlook (2025-2033) here

News-ID: 4143371 • Views: …

More Releases from IMARC Group

Charcoal Production Plant DPR & Unit Setup 2026: Demand Analysis and Project Cos …

Setting up a charcoal production plant involves strategic planning, substantial capital investment, and comprehensive understanding of production technologies. This essential biomass fuel serves cooking, heating, metallurgical, and industrial applications. Success requires careful site selection, efficient carbonization processes, proper kiln systems, reliable wood and biomass sourcing, and compliance with environmental and forestry regulations to ensure profitable and sustainable operations.

IMARC Group's report, "Charcoal Production Plant Project Report 2026: Industry Trends, Plant Setup,…

Grease Manufacturing Plant DPR 2026: CapEx/OpEx Analysis with Profitability Fore …

Setting up a grease manufacturing plant involves strategic planning, substantial capital investment, and comprehensive understanding of production technologies. This essential lubricant serves automotive, industrial machinery, and heavy equipment applications. Success requires careful site selection, efficient blending and mixing processes, quality control systems, reliable raw material sourcing from base oil and thickener suppliers, and compliance with environmental and safety regulations to ensure profitable and sustainable operations.

IMARC Group's report, "Grease Production Plant…

Tequila Manufacturing Plant Cost 2026: CapEx, OpEx & ROI Analysis

Setting up a Tequila Manufacturing Plant positions investors in one of the most stable and essential segments of the premium spirits and alcoholic beverages value chain, backed by sustained global growth driven by rising international demand for authentic agave-based spirits, increasing consumer preference for premium and super-premium heritage-driven beverages, expanding consumption across hospitality, retail, and export channels, and the dual-benefit advantages of strong brand loyalty combined with high-margin product differentiation.…

Prefabricated Building and Structural Steel Manufacturing Plant Cost Analysis Re …

Setting up a prefabricated building and structural steel manufacturing plant positions investors within one of the most dynamic and infrastructure-driven segments of the global construction and industrial manufacturing sector, supported by accelerating urbanization, expanding industrial corridors, and rising demand for fast-track, cost-efficient building solutions across residential, commercial, and industrial projects.

Prefabricated structures and structural steel components play a critical role in modern construction by enabling reduced project timelines, improved quality…

More Releases for KYC

PI Price Prediction: PI Increases KYC Speed Using AI Integration, but Investors …

The latest Pi Network price prediction updates show progress, but also a shift in sentiment. Pi Network's new AI-powered KYC system has reduced verification delays by nearly 50 percent, letting more users complete onboarding faster. However, while this might improve migration to mainnet, investors are still uneasy. A lot of them are attracted to no-KYC services such as Remittix, which focus on privacy, accessibility, and real-time crypto-to-fiat transfers.

The difference is…

Know Your Customer (KYC) Software Market Size Analysis by Application, Type, and …

USA, New Jersey- According to Market Research Intellect, the global Know Your Customer (KYC) Software market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The market for know your customer (KYC) software is expanding quickly as a result of tightening regulations and the increased demand for…

e-KYC Market May See a Big Move | Major Giants | Major Giants Equifax, TransUnio …

HTF Market Intelligence just released the Global e-KYC Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies in e-KYC Market are: IDEMIA (France), Aadhar (India), Onfido…

What Are Non-KYC Exchanges?

What Are Non-KYC Exchanges?

A short Narrative by PayRate42-The Payment Rating Agency

Non-KYC exchanges are cryptocurrency trading platforms that do not require users to verify their identities before participating in trades. Unlike traditional exchanges that enforce Know Your Customer (KYC) regulations, these platforms allow users to maintain anonymity by not requesting personal identification documents such as government-issued IDs, addresses, or financial details. The focus of non-KYC exchanges is on preserving user privacy…

IventiumPro.io Adheres to Strict KYC and AML Regulations

London, United Kingdom - IventiumPro.io [http://iventiumpro.io], a company that provides a reliable financial services, is committed to maintaining high standards of regulatory compliance. The company follows Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations to ensure the integrity and security of its operations. This adherence reflects a strong dedication to preventing illegal activities and protecting the financial system.

KYC regulations are designed to verify the identity of clients. IventiumPro.io collects…

KYC (Know Your Customer) Market is set to Fly High Growth in Years to Come | KYC …

2024-2032 Report on Global KYC (Know Your Customer) Market by Player, Region, Type, Application and Sales Channel is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global KYC (Know Your Customer) Market. Some of the key…