Press release

Navigating the Future: Syndicated Loans Market Trends and Forecast Insights, 2025 Edition

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Syndicated Loans Market Size Growth Forecast: What to Expect by 2025?

The market size of syndicated loans has seen a swift increase in the past few years. The growth is expected to continue from $682.44 billion in 2024 to $782.79 billion in 2025, with a compound annual growth rate (CAGR) of 14.7%. The historic period's growth can be attributed to factors such as economic development, corporate mergers and acquisitions, credit market scenarios, international trade dynamics, bank equity, and liquidity.

How Will the Syndicated Loans Market Size Evolve and Grow by 2029?

The market size of syndicated loans is anticipated to grow rapidly in the upcoming years, with an estimated value of $1342.3 billion in 2029 and a compound annual growth rate (CAGR) of 14.4%. Factors contributing to this growth during the forecast period could include trends in interest rates, environmental, social, and governance (ESG) aspects, worldwide trade and investment flows, investor demand for returns, and geopolitical stability. Primary trends during this period are anticipated to be rising demand for infrastructure funding, growth in developing markets, involvement of private equity, sectoral growth, and improved risk management techniques.

View the full report here:

https://www.thebusinessresearchcompany.com/report/syndicated-loans-global-market-report

What Drivers Are Propelling the Growth of Syndicated Loans Market Forward?

The uptick in demand for substantial capital loans is anticipated to fuel the expansion of the syndicated loan market in future. Major loans typically involve massive funds borrowed by an organization or individual, usually for appreciable investments or initiatives. The requirement for significant loans is escalating owing to burgeoning business growth and increased investments in infrastructure and property. Syndicated loans aid in providing such substantial loans by aggregating funds from several lenders, redistributing the risk, and offering large-scale capital to borrowers. For example, as per the British Business Bank plc, a financing company based in the UK, the gross inflow of new business loans escalated from $75.01 billion (£57.7 billion) in 2021 to $75.776 billion (£59.2 billion) in 2023. This signifies a rise of $1.92 billion (£1.5 billion) in two years. Consequently, the increasing demand for major loans is propelling the growth of the syndicated loan market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18751&type=smp

Which Emerging Trends Are Transforming the Syndicated Loans Market in 2025?

Leading firms in the syndicated loan market are placing an emphasis on creating sophisticated systems, including syndicated loan trading platforms, that seamlessly deliver trading guidelines, live data, and analysis in one unified platform. A syndicated loan trading solution is a system that enables financial institutions and investors to buy and sell syndicated loans readily. For example, in June 2024, Charles River Development Ltd., a technology systems and services organization from the US for investment firms, collaborated with Octaura LL Trading Co. LLC, an American electronic syndicated loan trading solution provider, to introduce a bi-directional interface that eases the process of syndicated loan trading. This interface promotes smooth merging of loan management systems and trading platforms, fostering live data transfer and improving trading workflows efficiency, thereby enhancing precision and proficiency in syndicated loan trading.

What Are the Key Segments in the Syndicated Loans Market?

The syndicated loans market covered in this report is segmented -

1) By Type: Term Loan, Revolving Loan, Underwritten Transactions, Other Types

2) By Use Of Proceeds: Working Capital, Acquisition Financing, Project Finance, Other Use Of Proceeds

3) By Industry Vertical: Financials Services, Energy And Power, High Technology, Industrials, Consumer Products And Services, Other Industry Verticals

Subsegments:

1) By Term Loan: Senior Term Loan, Subordinated Term Loan, Bridge Loan

2) By Revolving Loan: Multi-Currency Revolving Credit Facility, Single-Currency Revolving Credit Facility, Callable Revolving Loan

3) By Underwritten Transactions: Fully Underwritten, Best Efforts Underwriting

4) By Other Types: Asset-Backed Loan, Securitized Loan, High Yield Loan

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=18751&type=smp

Who Are the Key Players Shaping the Syndicated Loans Market's Competitive Landscape?

Major companies operating in the syndicated loans market are JPMorgan Chase & Co, Banco Santander S.A, Bank of China, BNP Paribas SA, ING Group N.V., Mitsubishi UFJ Financial Group Inc., Barclays PLC, State Bank of India, Sumitomo Mitsui Banking Corporation, Deutsche Bank AG, UniCredit S.p.A., Mizuho Financial Group Inc., Apollo Global Management Inc., Standard Bank Group Limited, Union Bank of India, Macquarie Bank Limited, Stifel Financial Corp., Ares Management Corporation, Toronto Dominion Securities, Houlihan Lokey Inc., Credit Agricole CIB, Brookfield Asset Management Inc., BMO Capital Markets, William Blair & Company, Bank Handlowy w Warszawie S.A., Acuity Knowledge Partners

What Geographic Markets Are Powering Growth in the Syndicated Loans Market?

North America was the largest region in the syndicated loans market in 2024. The regions covered in the syndicated loans market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18751

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Navigating the Future: Syndicated Loans Market Trends and Forecast Insights, 2025 Edition here

News-ID: 4141123 • Views: …

More Releases from The Business Research Company

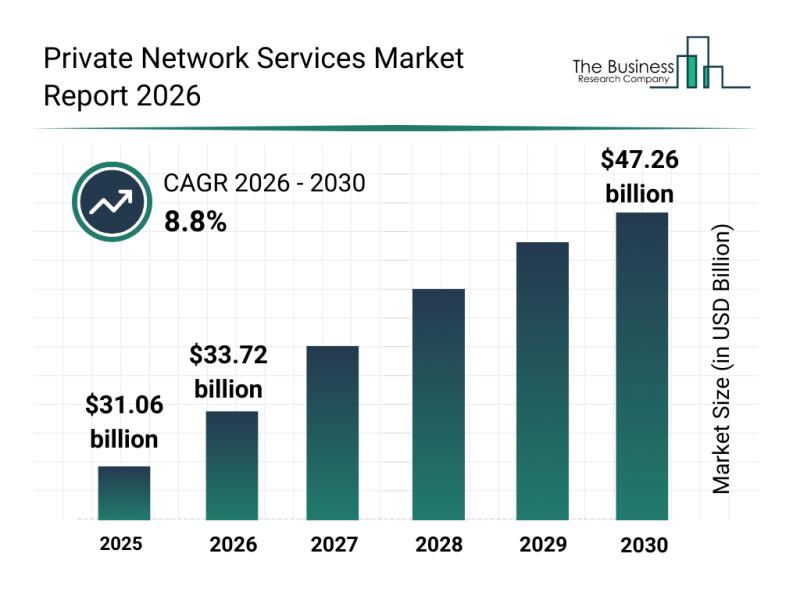

Leading Companies Fueling Innovation and Growth in the Private Network Services …

The private network services sector is set to experience remarkable growth as demand for secure, high-performance connectivity continues to rise across various industries. With advancements in wireless technology and evolving network needs, this market is positioning itself for widespread adoption and innovation over the coming years. Let's explore the market size, key players, driving trends, and segmentation to better understand what lies ahead.

Private Network Services Market Size and Growth Outlook…

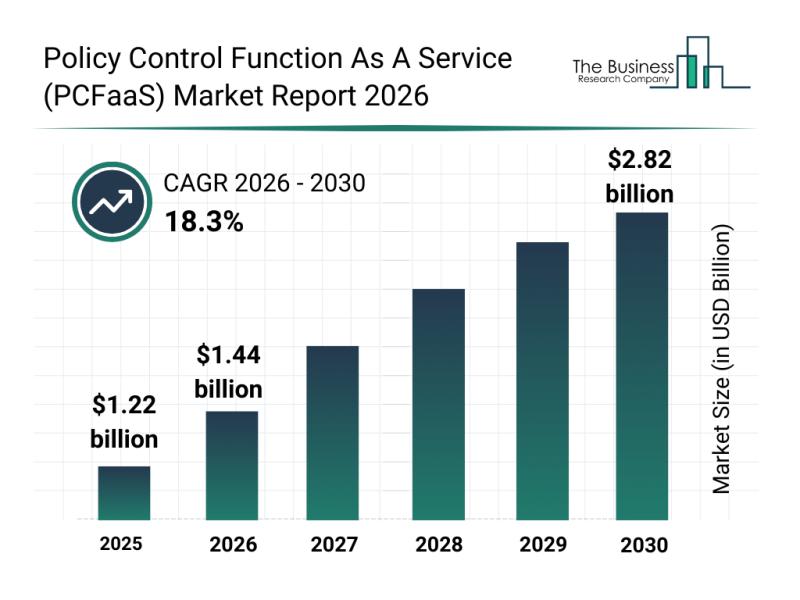

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Po …

The policy control function as a service (PCFaaS) market is on track for substantial expansion over the coming years, driven by technological advancements and increasing demand in telecommunications. This sector is transforming rapidly as operators adapt to next-generation network requirements and cloud-native approaches. Let's delve into the market's expected valuation, key players, emerging trends, and notable segmentations shaping its future.

Significant Growth Forecast for the Policy Control Function As A Service…

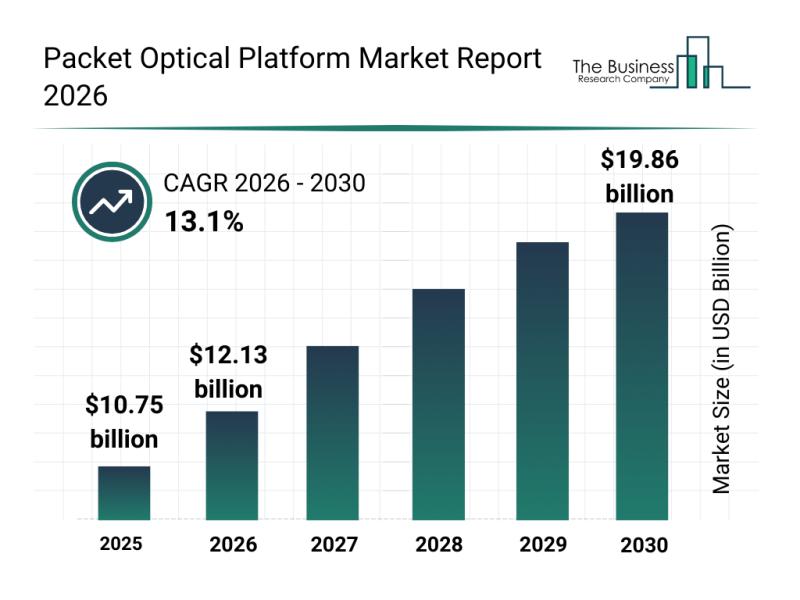

Top Players and Competitive Dynamics in the Packet Optical Platform Market

The packet optical platform market is positioned for significant expansion in the coming years, driven by advances in network technology and increasing demand for high-capacity data transmission. As digital infrastructure evolves, this sector is set to play a crucial role in supporting the growing needs of data centers, telecom providers, and cloud services. Let's explore the market's projected size, key players, emerging trends, and the segments contributing to its growth.

Forecasted…

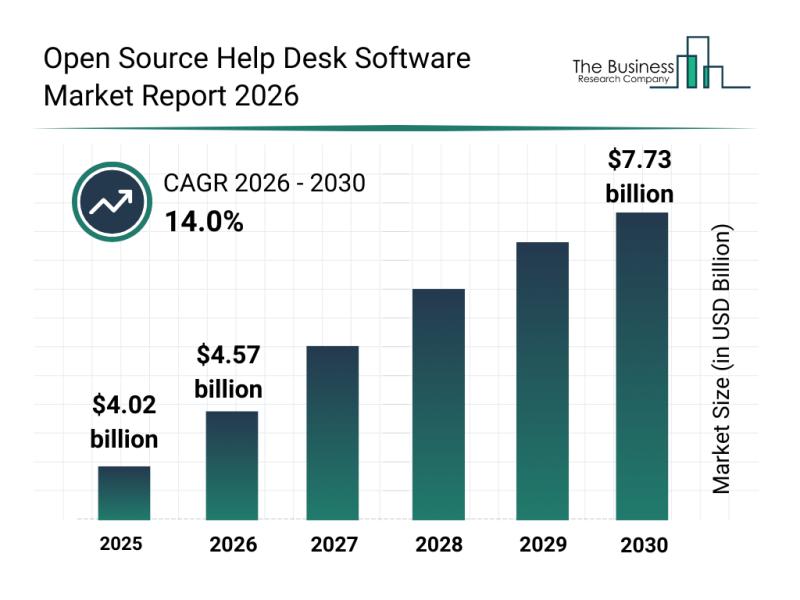

Analysis of Segmentation, Market Trends, and Competitive Landscape in the Open S …

The open source help desk software market is set to experience significant expansion in the coming years, driven by technological advancements and evolving business needs. As organizations increasingly embrace digital customer support, this market is positioned for notable growth through 2030. Below is an in-depth exploration of the market size, leading players, key trends, and segmentation insights.

Projected Market Size and Growth Rate of the Open Source Help Desk Software Market…

More Releases for Loan

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

New Jersey Loan Modification Lawyer Daniel Straffi Releases Insightful Article o …

New Jersey loan modification lawyer Daniel Straffi (https://www.straffilaw.com/loan-modifications) of Straffi & Straffi Attorneys at Law has recently published an informative article addressing the complexities and solutions surrounding loan modifications in New Jersey. The piece, aimed at helping homeowners understand their options to prevent foreclosure, sheds light on the legal avenues available to modify loan terms effectively.

In the article, the New Jersey loan modification lawyer explores various scenarios that may lead…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…