Press release

Green Hydrogen Production Plant Cost Report 2025: Setup Details, Capital Investments and Business Plan

Green hydrogen is a clean fuel produced by splitting water into hydrogen and oxygen using renewable energy sources like solar or wind power through a process called electrolysis. Unlike grey or blue hydrogen, green hydrogen generates no carbon emissions during production, making it a key component in the global shift toward sustainable energy. It is increasingly being used in transportation, industry, and power generation as a clean alternative to fossil fuels.Setting up a green hydrogen production plant requires access to renewable electricity, electrolyzers, water purification systems, storage infrastructure, and safety controls. Strategic location, water availability, and grid connectivity are essential for efficiency and scalability.

IMARC Group's report, titled "Green Hydrogen Production Cost Analysis Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," provides a complete roadmap for setting up a green hydrogen production plant. It covers a comprehensive market overview to micro-level information such as unit operations involved, raw material requirements, utility requirements, infrastructure requirements, machinery and technology requirements, manpower requirements, packaging requirements, transportation requirements, etc.

Request for a Sample Report: https://www.imarcgroup.com/green-hydrogen-manufacturing-plant-project-report/requestsample

Green Hydrogen Industry Outlook 2025

The green hydrogen industry is poised for significant growth in 2025, driven by accelerating global decarbonization efforts, supportive government policies, and increasing investment in renewable energy infrastructure. As nations strive to meet their net-zero emission targets, green hydrogen is emerging as a critical energy vector across sectors such as transportation, heavy industry, and power generation. Technological advancements are improving the efficiency and cost-effectiveness of electrolyzers, while large-scale projects and international collaborations are gaining momentum, especially in regions like the EU, Middle East, Australia, and India. By 2025, global green hydrogen production capacity is expected to reach several million tons per year, with dozens of commercial-scale plants coming online. Major energy companies and industrial players are investing heavily in green hydrogen hubs, supported by falling costs of solar and wind energy. Despite challenges such as infrastructure development, high initial costs, and water usage concerns, the market outlook remains strong, with green hydrogen expected to play a pivotal role in shaping the future of clean energy.

Key Insights for setting up a Green Hydrogen Production Plant

Detailed Process Flow

• Product Overview

• Unit Operations Involved

• Mass Balance and Raw Material Requirements

• Quality Assurance Criteria

• Technical Tests

Project Details, Requirements and Costs Involved:

• Land, Location and Site Development

• Plant Layout

• Machinery Requirements and Costs

• Raw Material Requirements and Costs

• Packaging Requirements and Costs

• Transportation Requirements and Costs

• Utility Requirements and Costs

• Human Resource Requirements and Costs

Buy now: https://www.imarcgroup.com/checkout?id=20566&method=1911

Capital Expenditure (CapEx) and Operational Expenditure (OpEx) Analysis:

Project Economics:

• Capital Investments

• Operating Costs

• Expenditure Projections

• Revenue Projections

• Taxation and Depreciation

• Profit Projections

• Financial Analysis

Profitability Analysis:

• Total Income

• Total Expenditure

• Gross Profit

• Gross Margin

• Net Profit

• Net Margin

Key Cost Components

• Electrolyzer System (30-50%)

• The electrolyzer (PEM, Alkaline, or SOEC) is the core technology used to split water into hydrogen and oxygen.

• Includes stack, balance of plant (BoP), and power electronics.

• Renewable Energy Supply (20-30%)

• Electricity from solar, wind, or hydro sources is the primary input; cost depends on location and energy contract terms.

• Includes grid connection or on-site generation.

• Water Purification System (5-10%)

• Purified water is essential for electrolysis; includes reverse osmosis or deionization units.

• Water intake, treatment, and circulation systems are part of this cost.

• Hydrogen Compression & Storage (10-15%)

• Hydrogen must be compressed or liquefied for storage or transport.

• Includes compressors, storage tanks (gaseous/liquid), and safety systems.

• Civil & Infrastructure Costs (5-10%)

• Land, site preparation, buildings, and structural installations.

• Includes roads, drainage, and fencing.

• Control & Safety Systems (3-7%)

• Automation, SCADA, sensors, emergency shutdown systems, and compliance with hydrogen safety standards.

• Operation & Maintenance (O&M) (5-10%)

• Includes labor, periodic maintenance, spare parts, and consumables.

• Ongoing energy and water costs also fall here.

• Engineering, Procurement & Construction (EPC) Services (5-10%)

• Costs for project design, equipment procurement, installation, and commissioning.

• Permitting & Regulatory Compliance (1-3%)

• Environmental impact assessments, local regulatory approvals, and hydrogen-specific safety certifications.

• Contingency & Financing (5-10%)

• Includes insurance, interest during construction, and unexpected cost overruns.

Economic Trends Influencing Green Hydrogen Plant Setup Costs 2025

• Declining Renewable Energy Costs

The continued fall in solar and wind power prices is reducing the cost of electricity - the largest operating expense in green hydrogen production. This trend improves plant economics and makes large-scale projects more viable.

• Electrolyzer Cost Reduction

Mass production, technological improvements, and increased competition are driving down electrolyzer costs. Government-supported innovation and economies of scale are expected to further reduce capital expenditure (CAPEX).

• Government Incentives and Subsidies

Many countries are offering grants, tax breaks, and production-linked incentives for green hydrogen projects. These financial supports significantly offset setup and operational costs.

• Carbon Pricing and Emissions Regulations

Stricter carbon pricing mechanisms (e.g., EU ETS, India's proposed carbon market) increase the cost of fossil-based hydrogen, improving the competitiveness and attractiveness of green hydrogen.

• Global Supply Chain Pressures

Ongoing challenges in global logistics, raw material sourcing (e.g., rare metals for electrolyzers), and inflation can temporarily elevate equipment and construction costs.

• Strategic Partnerships and Investments

Growing public-private partnerships and cross-border hydrogen trade agreements (e.g., EU-North Africa, India-Japan) are accelerating project development while sharing costs and risks.

• Interest Rates and Financing Environment

Fluctuating global interest rates affect financing costs for capital-intensive hydrogen projects. A stable, low-interest environment encourages investment; higher rates raise overall project costs.

• Water Resource Valuation

As water becomes a more critical and regulated resource, especially in arid regions, costs for water procurement, treatment, and sustainability compliance are increasingly influencing project location and design.

Speak to an Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=20566&flag=C

Challenges and Considerations for Investors

• High Capital Expenditure (CAPEX)

Green hydrogen plants require significant upfront investment, particularly for electrolyzers, renewable energy infrastructure, and hydrogen storage systems. Long payback periods can deter risk-averse investors.

• Dependence on Low-Cost Renewable Energy

The viability of green hydrogen hinges on access to cheap, abundant renewable electricity. Site selection must consider solar/wind resource quality, grid access, and energy tariffs.

• Technology Maturity and Standardization

While electrolysis technology is advancing, large-scale commercial deployment is still evolving. Lack of standardized designs and proven long-term performance can increase perceived technical risk.

• Water Availability and Quality

Electrolysis requires significant volumes of purified water. In water-scarce regions, sourcing and treating water can be costly and contentious, impacting both feasibility and ESG ratings.

• Regulatory and Policy Uncertainty

Hydrogen policies vary widely across countries. Investors must navigate evolving frameworks, subsidy regimes, and international trade rules, which may affect returns and timelines.

• Infrastructure Gaps

Limited hydrogen transport, storage, and distribution infrastructure can constrain market access. Co-location with off-takers or industrial clusters may be necessary to ensure demand.

• Market Demand and Offtake Agreements

Securing long-term offtake agreements with industrial users, transportation sectors, or governments is essential for project bankability. Demand uncertainty can delay financing decisions.

• Competition from Other Hydrogen Types

Grey and blue hydrogen (from natural gas) still dominate the market due to lower production costs. Green hydrogen must compete on price and policy support to gain share.

Conclusion

Green hydrogen is emerging as a vital clean energy solution, enabling significant carbon emission reductions across industries by leveraging renewable electricity for hydrogen production. Despite high initial capital costs, advances in electrolyzer technology, declining renewable energy prices, and supportive government policies are making green hydrogen increasingly viable. However, investors must carefully consider challenges such as capital intensity, market uncertainty, regulatory variability, and supply chain constraints. With continued innovation and strong policy backing, green hydrogen is poised to play a central role in the global transition to a sustainable, net-zero future.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excel in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Green Hydrogen Production Plant Cost Report 2025: Setup Details, Capital Investments and Business Plan here

News-ID: 4136443 • Views: …

More Releases from IMARC Group

United States Air Freight Market Size, Share, Industry Trends, Growth and Foreca …

IMARC Group has recently released a new research study titled "United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Air Freight Market Overview

The United States air freight market size was valued at USD 64.06 Billion in 2025.…

Mexico Medical Tourism Market 2026 : Industry Size to Reach USD 10.6 Billion by …

IMARC Group has recently released a new research study titled "Mexico Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Medical Tourism Market Overview

The Mexico medical tourism market size reached USD 2.1 Billion in 2025. Looking forward, the market is projected…

Saudi Arabia Pilates & Yoga Studios Market Size to Surpass USD 3.6 Billion by 20 …

Saudi Arabia Pilates & Yoga Studios Market Overview

Market Size in 2024: USD 1.6 Billion

Market Forecast in 2033: USD 3.6 Billion

Market Growth Rate 2025-2033: 8.20%

According to IMARC Group's latest research publication, "Saudi Arabia Pilates & Yoga Studios Market Size, Share, Trends and Forecast by Activity Type, Application, and Region, 2025-2033", the Saudi Arabia pilates & yoga studios market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the…

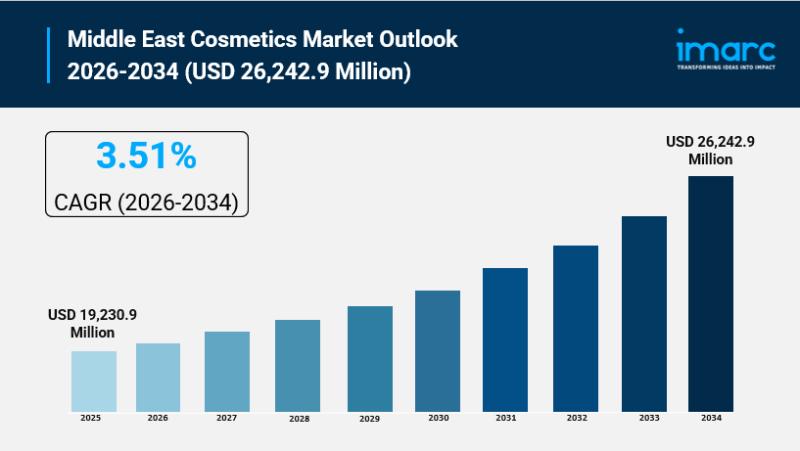

Middle East Cosmetics Market Size to Surpass USD 26,242.9 Million by 2034, at a …

Middle East Cosmetics Market Overview

Market Size in 2025: USD 19,230.9 Million

Market Size in 2034: USD 26,242.9 Million

Market Growth Rate 2026-2034: 3.51%

According to IMARC Group's latest research publication, "Middle East Cosmetics Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", the Middle East cosmetics market size reached USD 19,230.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 26,242.9 Million by 2034, exhibiting a growth rate…

More Releases for Cost

Steel Production Cost - Process Economics, Raw Materials, and Cost Drivers

Steel is the backbone of modern industry, and its production cost is one of the most closely tracked indicators across construction, infrastructure, automotive, and manufacturing sectors. Unlike niche chemicals or APIs, steel economics are driven by scale, energy intensity, and raw material volatility.

Here's the thing: steel production cost isn't just about iron ore prices. It's a layered equation involving coking coal, electricity, labor, emissions compliance, logistics, and technology choice. A…

Egg Powder Manufacturing Plant Setup Cost | Cost Involved, Machinery Cost and In …

IMARC Group's report titled "Egg Powder Manufacturing Plant Project Report 2024: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" provides a comprehensive guide for establishing an egg powder manufacturing plant. The report covers various aspects, ranging from a broad market overview to intricate details like unit operations, raw material and utility requirements, infrastructure necessities, machinery requirements, manpower needs, packaging and transportation requirements, and more.

In addition to…

Glucose Manufacturing Plant Cost Report 2024: Requirements and Cost Involved

IMARC Group's report titled "Glucose Manufacturing Plant Project Report 2024: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" provides a comprehensive guide for establishing a glucose manufacturing plant. The report covers various aspects, ranging from a broad market overview to intricate details like unit operations, raw material and utility requirements, infrastructure necessities, machinery requirements, manpower needs, packaging and transportation requirements, and more.

In addition to the operational…

Fatty Alcohol Production Cost Analysis: Plant Cost, Price Trends, Raw Materials …

Syndicated Analytics' latest report titled "Fatty Alcohol Production Cost Analysis 2023-2028: Capital Investment, Manufacturing Process, Operating Cost, Raw Materials, Industry Trends and Revenue Statistics" includes all the essential aspects that are required to understand and venture into the fatty alcohol industry. This report is based on the latest economic data, and it presents comprehensive and detailed insights regarding the primary process flow, raw material requirements, reactions involved, utility costs, operating costs, capital…

Corn Production Cost Analysis Report: Manufacturing Process, Raw Materials Requi …

The latest report titled "Corn Production Cost Report" by Procurement Resource, a global procurement research and consulting firm, provides an in-depth cost analysis of the production process of the Corn. Read More: https://www.procurementresource.com/production-cost-report-store/corn

Report Features - Details

Product Name - Corn Production

Segments Covered

Manufacturing Process: Process Flow, Material Flow, Material Balance

Raw Material and Product/s Specifications: Raw Material Consumption, Product and Co-Product Generation, Capital Investment

Land and Site Cost: Offsites/Civil Works, Equipment Cost, Auxiliary Equipment…

Crude Oil Production Cost Analysis Report: Manufacturing Process, Raw Materials …

The latest report titled "Crude Oil Production Cost Report" by Procurement Resource, a global procurement research and consulting firm, provides an in-depth cost analysis of the production process of the Crude Oil. Read More: https://www.procurementresource.com/production-cost-report-store/crude-oil

Report Features - Details

Product Name - Crude Oil

Segments Covered

Manufacturing Process: Process Flow, Material Flow, Material Balance

Raw Material and Product/s Specifications: Raw Material Consumption, Product and Co-Product Generation, Capital Investment

Land and Site Cost: Offsites/Civil Works, Equipment Cost,…