Press release

Financial Guarantee Market Insights 2025-2034: Growth Forecast and Strategic Priorities

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Financial Guarantee Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

The size of the financial guarantee market has seen rapid expansion recently. The market is forecasted to expand from a valuation of $45.76 billion in 2024 to $51 billion in 2025, reflecting a compound annual growth rate (CAGR) of 11.5%. The historic growth of this market can be attributed to factors such as the surge in import and export activities in developing nations, the proliferation of digital transactions, increasing awareness, a rising need for security and risk mitigation solutions, as well as an escalated demand for financial guarantee products.

Financial Guarantee Market Size Forecast: What's the Projected Valuation by 2029?

The market size of financial guarantees is forecasted to experience significant expansion in the coming years, reaching $78.13 billion by 2029, bolstered by a compound annual growth rate (CAGR) of 11.2%. This predicted surge during the forecast period is due in part to small and medium-sized enterprises (SMEs) increasingly turning to financial guarantees, growing adoption of digital payment platforms, heightened financial risks in business dealings, and increasingly complicated global supply chains. The forecast period will observe various trending aspects, such as technological progression, customized guarantee solutions that cater to the changing demands of the digital economy, a high demand for tools that mitigate risk, and recent advancements and innovative solutions.

View the full report here:

https://www.thebusinessresearchcompany.com/report/financial-guarantee-global-market-report

What Are the Drivers Transforming the Financial Guarantee Market?

The surge in digital payments and transactions is set to spur the advancement of the financial guarantee market in the future. These transactions, which entail the electronic transfer of funds or value between two entities, avoid the conventional physical modes like cash or checks. A surge in demand for digital payments and transactions can be attributed to improved convenience, security, and the universal uptake of online and mobile commerce. Financial guarantees ensure that digital transaction payments will be fulfilled, thereby heightening trust and inspiring more users to embrace digital payment methods. For example, in October 2024, UK finance, an organisation representing the UK banking and financial services industry, reported that UK debit card transactions hit 2.3 billion in July 2024. This represented a 5.1% increase compared to the same month a year earlier, with the total spending reaching £68.8 billion, a 0.9% increase. Similarly, credit card transactions saw expansion, amounting to 403 million in July, an 8.2% uplift, with expenditure reaching £22.5 billion, showing an 8.5% surge. In the meantime, contactless payments continued their growth, constituting 65% of all credit card transactions and 77% of debit card transactions, with 1.63 billion contactless transactions noted, a 2.7% rise from the previous year. Hence, the escalation in digital payments and transactions is fuelling the expansion of the financial guarantee market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18608&type=smp

What Long-Term Trends Will Define the Future of the Financial Guarantee Market?

Major players in the financial guarantee arena are paying attention to the creation of innovative tools, like a digital adaptation of the traditional paper-based bank warranty mechanism, to increase both the effectiveness and safety of guarantee deployment and supervision. A digital variant of the standard paper-based bank warranty process pertains to the virtual creation, oversight, and verification of bank warranties, utilizing digital platforms to simplify, safeguard and obviate the necessity for hard copies. For instance, the Bank of Baroda, a financial institution and services company based in India, in June 2023, initiated an Electronic Bank Guarantee (e-BG) on their BarodaINSTA platform in unison with the National E-Governance Services Limited (NeSL), a financial information-regulated firm also hailing from India. The introduction of the e-BG stands as a significant reform aimed at making banking more simple, safe with enhanced accessibility. This successful launch is seen as a turning point in the financial guarantee space owing to its inventive qualities, technological progression, and substantial effect on banking proficiency and safety.

Which Segments in the Financial Guarantee Market Offer the Most Profit Potential?

The financial guarantee market covered in this report is segmented -

1) By Product Type: Bank Guarantees, Documentary Letter Of Credit, Standby Letter Of Credit (SBLC), Receivables Financing, Other Product Types

2) By Enterprise Size: Small Enterprises, Medium-Sized Enterprises, Large Enterprises

3) By End User: Exporters, Importers

Subsegments:

1) By Bank Guarantees: Performance Guarantees, Payment Guarantees, Bid Bond Guarantees, Advance Payment Guarantees, Customs And Tax Guarantees

2) By Documentary Letter Of Credit: Export Letters Of Credit, Import Letters Of Credit, Revolving Letters Of Credit, Transferable Letters Of Credit, Red Clause Letters Of Credit

3) By Standby Letter Of Credit (Sblc): Performance Sblc, Payment Sblc, Commercial Sblc, Financial Sblc, Trade Finance Sblc

4) By Receivables Financing: Factoring (Accounts Receivable Financing), Invoice Discounting, Supply Chain Finance, Asset-Based Lending, Trade Receivables Securitization

5) By Other Product Types: Surety Bonds, Credit Insurance, Guarantee-Backed Loans, Structured Finance Guarantees, Trade Credit Guarantees

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=18608&type=smp

Which Firms Dominate the Financial Guarantee Market by Market Share and Revenue in 2025?

Major companies operating in the financial guarantee market are The Industrial and Commercial Bank of China, HSBC Holdings plc, Citigroup Inc., AIG (American International Group), Liberty Mutual Insurance Group Inc., BNP Paribas SA, Zurich Insurance Group, Chubb Limited, Bank of Montreal, Barclays plc, Scotiabank, The Hartford, Markel Corporation, S&P Global, Arch Capital Group, Genworth Financial, National Bank of Canada, Moody's Investors Service, Asian Development Bank, Radian Group, Fitch Ratings Inc, SINOSURE, Assured Guaranty, AMBAC Assurance Corporation, United Guaranty Corporation

Which Regions Offer the Highest Growth Potential in the Financial Guarantee Market?

North America was the largest region in the financial guarantee market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the financial guarantee market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18608

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Financial Guarantee Market Insights 2025-2034: Growth Forecast and Strategic Priorities here

News-ID: 4134402 • Views: …

More Releases from The Business Research Company

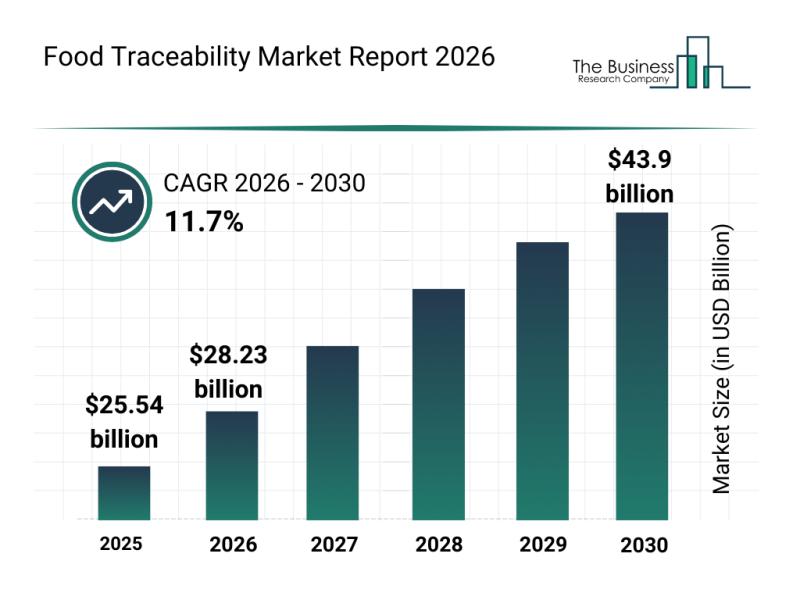

Emerging Growth Trends Driving Expansion in the Food Traceability Market

The food traceability market is gaining significant attention as the global demand for safer and more transparent food supply chains intensifies. With rapid technological advancements and increasing regulatory requirements, this sector is poised for substantial expansion in the coming years. Let's explore the market's expected growth, key players, prevailing trends, and its main segments.

Projected Market Size and Growth of the Food Traceability Market

Forecasts suggest that the food traceability…

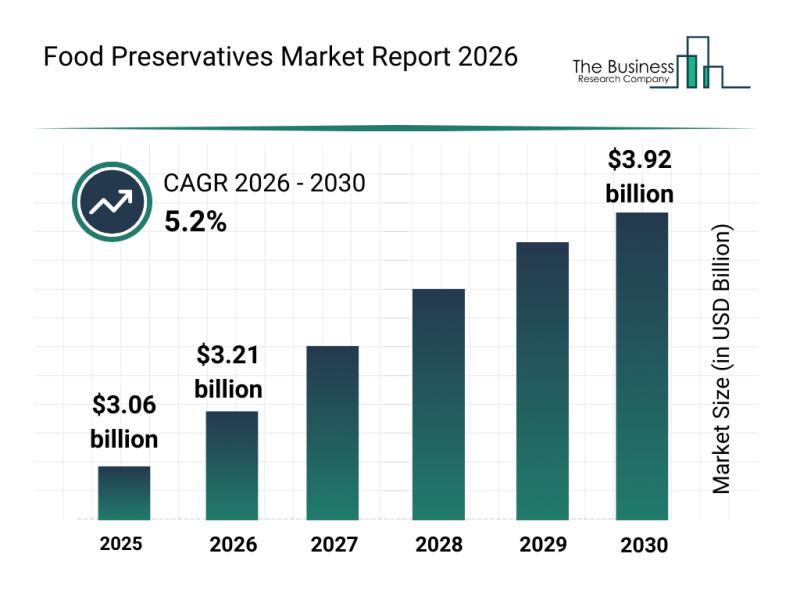

Segment Analysis and Major Growth Areas in the Food Preservatives Market

The food preservatives sector is poised for significant expansion in the near future, driven by evolving consumer preferences and regulatory changes. With a growing emphasis on natural and clean-label products, as well as rising demand for convenient and safe food options, this market is set to experience robust development. Let's explore the current market size, key players, emerging trends, and segmentation details shaping the food preservatives industry.

Projected Market Size Growth…

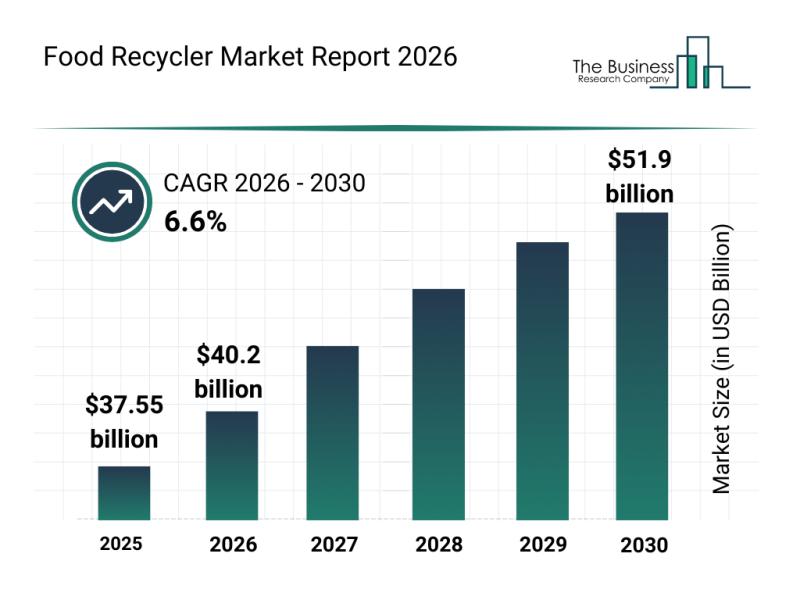

Analysis of Key Market Segments Influencing the Food Recycler Market

The food recycler industry is set to experience substantial growth in the coming years, driven by evolving sustainability practices and technological advancements. As organizations and consumers alike seek smarter and more efficient ways to manage food waste, this market is becoming increasingly important. Let's explore the expected market value, the key players shaping the sector, emerging trends, and the main segments fueling expansion.

Forecasted Market Value and Growth Outlook for the…

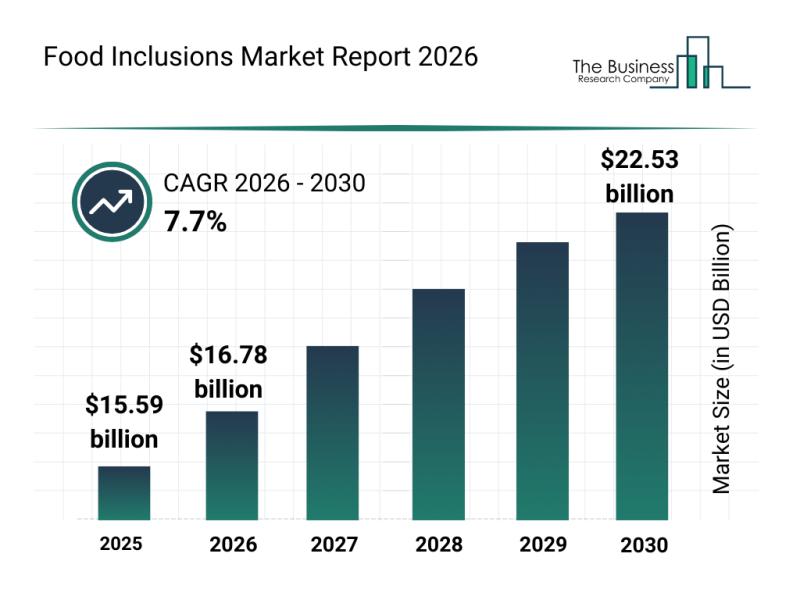

Global Trends Overview: The Rapid Evolution of the Food Inclusions Market

The food inclusions market is gaining significant momentum as consumer preferences shift toward more indulgent and customized food experiences. This sector is evolving rapidly with innovative product developments and a growing emphasis on clean-label ingredients, offering exciting opportunities for manufacturers and retailers alike. Let's explore the current market size, the main players involved, the key trends influencing growth, and how the market segments are expected to evolve through 2030.

Projected Growth…

More Releases for Guarantee

What's Driving the Financial Guarantee Market 2025-2034: The Surge In Digital Pa …

What Are the Projections for the Size and Growth Rate of the Financial Guarantee Market?

The size of the financial guarantee market has been quickly expanding in the past few years. Its projections show a growth from $45.76 billion in 2024 to reach $51 billion in 2025, with a compound annual growth rate (CAGR) of 11.5%. The historical growth in this sector can be credited to factors such as a surge…

What's Driving the Financial Guarantee Market 2025-2034: The Surge In Digital Pa …

What Are the Projections for the Size and Growth Rate of the Financial Guarantee Market?

The size of the financial guarantee market has been quickly expanding in the past few years. Its projections show a growth from $45.76 billion in 2024 to reach $51 billion in 2025, with a compound annual growth rate (CAGR) of 11.5%. The historical growth in this sector can be credited to factors such as a surge…

What's Driving the Financial Guarantee Market 2025-2034: The Surge In Digital Pa …

What Are the Projections for the Size and Growth Rate of the Financial Guarantee Market?

The size of the financial guarantee market has been quickly expanding in the past few years. Its projections show a growth from $45.76 billion in 2024 to reach $51 billion in 2025, with a compound annual growth rate (CAGR) of 11.5%. The historical growth in this sector can be credited to factors such as a surge…

Khaleej Times Introduces Money-Back Guarantee for Advertisers

Khaleej Times, UAE's leading newspaper has announced an initiative designed to enhance advertisers' confidence and deliver measurable results. Under the new Brand Increase Guarantee Program, marketers who invest a minimum of $50,000 in display advertising on khaleejtimes.com over 60 days are assured of achieving an increase in brand lift-or they will receive a complete refund.

To ensure credibility, Khaleej Times has partnered with Readwhere Digital, a third-party research firm, to conduct…

Does Flexibility Guarantee Worklife Balance in 2022?

"We are living at work and working at home, it's all blurred, and it's a huge challenge for everybody. No one's having an easy time with it", says Barbara Corcoran, the founder of The Corcoran Group, a real estate brokerage group in New York City.

Most remote working professionals are in the same pool, just like her. Bacancy's insights on would your organization let you work from home in 2022…

Eye-catching advertising featuring misleading guarantee promises

Advertising featuring a guarantee can be misleading if the guarantee promise is linked to conditions that are not clearly visible to consumers. That was the verdict of the Landgericht (LG) Frankfurt [Regional Court of Frankfurt].

GRP Rainer Lawyers and Tax Advisors in Cologne, Berlin, Bonn, Düsseldorf, Frankfurt, Hamburg, Munich, Stuttgart and London conclude: Clear guidelines relating to what is termed “Blickfangwerbung” (attention-grabbing/eye-catching advertising) had already been set out by the Bundesgerichtshof…