Press release

Crypto Lending Platform Market Is Going to Boom | Major Giants BlockFi, Nexo, Celsius Network, Aave, Compound, Binance

HTF MI just released the Global Crypto Lending Platform Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.Major Giants in Crypto Lending Platform Market are:

BlockFi, Nexo, Celsius Network, Aave, Compound, YouHodler, Binance, Crypto.com, SALT Lending, MakerDAO, Bitfinex, DeFiChain, Yearn Finance, CoinLoan, Ledn, Genesis, Lendroid, Dharma, Polkadot, Curve Finance

Request PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

👉 https://www.htfmarketintelligence.com/sample-report/global-crypto-lending-platform-market?utm_source=Nilesh_OpenPR&utm_id=Nilesh

HTF Market Intelligence projects that the global Crypto Lending Platform market will expand at a CAGR of 20.7% from 2025 to 2032, from USD 2.1 Billion in 2025 to USD 9.6 Billion by 2032.

Our Report Covers the Following Important Topics:

By Type:

Centralized Platforms, Decentralized Protocols, Stablecoin Loans, Flash Loans, NFT-backed Lending

By Application:

Retail Lending, Institutional Loans, Liquidity Mining, Staking Collateral, Margin Trading

Crypto lending platforms enable users to borrow or lend cryptocurrencies by locking digital assets as collateral. Centralized and decentralized protocols offer interest-bearing services, often without traditional credit checks. Users can access funds while retaining crypto exposure. Rapid DeFi innovation, yield farming, and stablecoin use are driving growth. Despite security and regulatory concerns, the market is attracting users seeking liquidity and passive income.

Dominating Region:

North America

Fastest-Growing Region:

Asia-Pacific

Market Trends:

• DeFi expansion, NFT-collateral lending, Cross-chain lending innovations

Market Drivers:

• Demand for yield on crypto assets. Growth in DeFi ecosystem. Access to borderless credit.

Market Challenges:

• Regulatory uncertainty. Smart contract risks. Market volatility.

Market Opportunities:

• Tokenization of assets. Emerging markets adoption. Institutional entry into DeFi.

Have a query? Ask Our Expert 👉 👉 https://www.htfmarketintelligence.com/enquiry-before-buy/global-crypto-lending-platform-market?utm_source=Nilesh_OpenPR&utm_id=Nilesh

The titled segments and sub-section of the market are illuminated below:

In-depth analysis of Crypto Lending Platform market segments by Types: Centralized Platforms, Decentralized Protocols, Stablecoin Loans, Flash Loans, NFT-backed Lending

Detailed analysis of Crypto Lending Platform market segments by Applications: Retail Lending, Institutional Loans, Liquidity Mining, Staking Collateral, Margin Trading

Global Crypto Lending Platform Market -Regional Analysis

• North America: United States of America (US), Canada, and Mexico.

• South & Central America: Argentina, Chile, Colombia, and Brazil.

• Middle East & Africa: Kingdom of Saudi Arabia, United Arab Emirates, Turkey, Israel, Egypt, and South Africa.

• Europe: the UK, France, Italy, Germany, Spain, Nordics, BALTIC Countries, Russia, Austria, and the Rest of Europe.

• Asia: India, China, Japan, South Korea, Taiwan, Southeast Asia (Singapore, Thailand, Malaysia, Indonesia, Philippines & Vietnam, etc.) & Rest

• Oceania: Australia & New Zealand

Read More About Crypto Lending Platform Market Report 👉 https://htfmarketintelligence.com/report/global-crypto-lending-platform-market?utm_source=Nilesh_OpenPR&utm_id=Nilesh

Crypto Lending Platform Market Research Objectives:

- Focuses on the key manufacturers, to define, pronounce and examine the value, sales volume, market share, market competition landscape, SWOT analysis, and development plans in the next few years.

- To share comprehensive information about the key factors influencing the growth of the market (opportunities, drivers, growth potential, industry-specific challenges and risks).

- To analyze the with respect to individual future prospects, growth trends and their involvement to the total market.

- To analyze reasonable developments such as agreements, expansions new product launches, and acquisitions in the market.

- To deliberately profile the key players and systematically examine their growth strategies.

FIVE FORCES & PESTLE ANALYSIS:

Five forces analysis-the threat of new entrants, the threat of substitutes, the threat of competition, and the bargaining power of suppliers and buyers-are carried out to better understand market circumstances.

• Political (Political policy and stability as well as trade, fiscal, and taxation policies)

• Economical (Interest rates, employment or unemployment rates, raw material costs, and foreign exchange rates)

• Social (Changing family demographics, education levels, cultural trends, attitude changes, and changes in lifestyles)

• Technological (Changes in digital or mobile technology, automation, research, and development)

• Legal (Employment legislation, consumer law, health, and safety, international as well as trade regulation and restrictions)

• Environmental (Climate, recycling procedures, carbon footprint, waste disposal, and sustainability)

Get 10-25% Discount on Immediate purchase 👉 https://www.htfmarketintelligence.com/request-discount/global-crypto-lending-platform-market?utm_source=Nilesh_OpenPR&utm_id=Nilesh

Points Covered in Table of Content of Global Crypto Lending Platform Market:

Chapter 01 - Crypto Lending Platform Executive Summary

Chapter 02 - Market Overview

Chapter 03 - Key Success Factors

Chapter 04 - Global Crypto Lending Platform Market - Pricing Analysis

Chapter 05 - Global Crypto Lending Platform Market Background or History

Chapter 06 - Global Crypto Lending Platform Market Segmentation (e.g. Type, Application)

Chapter 07 - Key and Emerging Countries Analysis Worldwide Crypto Lending Platform Market

Chapter 08 - Global Crypto Lending Platform Market Structure & worth Analysis

Chapter 09 - Global Crypto Lending Platform Market Competitive Analysis & Challenges

Chapter 10 - Assumptions and Acronyms

Chapter 11 - Crypto Lending Platform Market Research Method Crypto Lending Platform

Thank you for reading this post. You may also obtain report versions by area, such as North America, LATAM, Europe, Japan, Australia, or Southeast Asia, or by chapter.

Nidhi Bhawsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketintelligence.com

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Crypto Lending Platform Market Is Going to Boom | Major Giants BlockFi, Nexo, Celsius Network, Aave, Compound, Binance here

News-ID: 4133246 • Views: …

More Releases from HTF Market Intelligence Consulting Private Limited

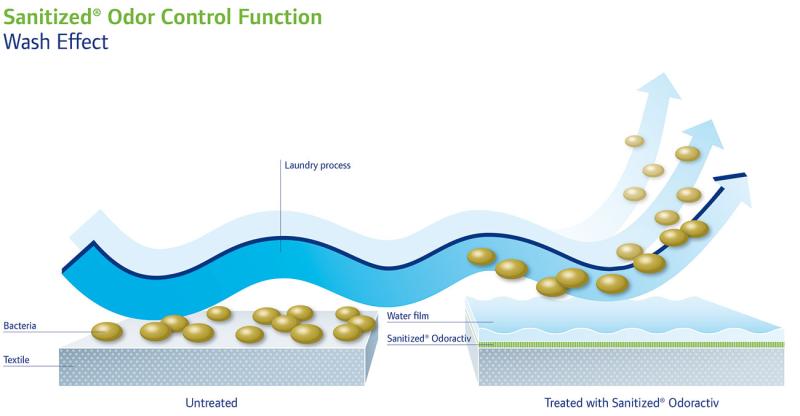

Odour Control Textiles Market Growth Outlook: Trends, Opportunities & Competitiv …

The Odour Control Textiles Market is entering a high-growth phase as global consumer and industrial sectors increasingly demand freshness-enhancing, hygiene-focused, and performance-driven textile solutions. From sportswear and athleisure to healthcare fabrics, military gear, and home furnishings, odour-neutralizing technologies are transforming product design and functionality. As brands move toward sustainability, antimicrobial performance, and premium comfort, odour control textiles have become a core component in next-generation material engineering.

Get a Sample Copy of…

Pet Shampoo Market Overview & Growth Rate Forecast for the Next 5 Years

The latest study released on the Global Pet Shampoo Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Pet Shampoo study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

E-Passport and E-Visa Market: Pioneering Secure, Digital Travel Authentication

The E-Passport and E-Visa Market is at the intersection of travel security, digital identity management, and global mobility. As international travel continues to rebound and migrate toward contactless experiences, governments and border authorities are embracing electronic solutions that streamline entry processes, enhance security, and reduce fraud. E-passports and e-visas have emerged as cornerstones of modern travel infrastructure, enabling faster processing, greater convenience, and stronger identity assurance for travelers and authorities…

Vegan Footwear Market Rewriting Long Term Growth Story | Adidas, Nike, Native Sh …

The latest study released on the Global Vegan Footwear Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Vegan Footwear study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…