Press release

Hong Kong Debt Restructure Office Launches Comprehensive Financial Relief Services Led by Veteran Banking Professionals

Hong Kong, 1st August 2025, ZEX PR WIRE, Hong Kong Debt Restructure Office (HKDEBTRO), a newly established financial services firm, today announced the launch of its comprehensive debt restructuring services designed to provide relief to individuals and businesses facing financial challenges. The firm, founded by several former senior bankers with over ten years of combined experience and supported by a professional legal team, aims to leverage deep industry knowledge to help clients navigate complex debt situations.The launch comes at a critical time for Hong Kong's financial sector, as the region continues to experience evolving monetary policies and market uncertainties. According to recent financial reports, Hong Kong's financial markets have maintained stability despite global economic pressures, creating opportunities for specialized financial services.

"Our team's extensive background in banking and finance, combined with our legal expertise, positions us uniquely to understand the intricate details of bank terms and financial institution requirements," said a spokesperson for Hong Kong Debt Restructure Office. "We are committed to helping our clients reduce interest burdens and alleviate repayment pressures through strategic debt restructuring solutions."

Comprehensive Service Offering

Hong Kong Debt Restructure Office specializes in providing tailored debt restructuring solutions that address the specific needs of each client. The firm's services include detailed analysis of existing debt obligations, negotiation with financial institutions, and implementation of restructuring plans designed to minimize financial strain while maintaining compliance with legal requirements.

The company's approach leverages the founders' insider knowledge of banking operations and lending practices, enabling them to craft solutions that are both practical and sustainable. This expertise is particularly valuable in Hong Kong's complex financial environment, where understanding regulatory frameworks and institutional procedures is crucial for successful debt restructuring.

Market Context and Industry Expertise

The debt restructuring market has gained significant attention in recent years, with private credit markets experiencing substantial growth globally. Industry reports indicate that the private credit market exceeded US$1.5 trillion in early 2024 and is projected to reach US$2.8 trillion by 2028, highlighting the increasing demand for specialized financial services.

debt restructuring hong kong Office's team brings valuable experience from their previous roles in senior banking positions, providing clients with insights into how financial institutions evaluate and process restructuring requests. This knowledge enables the firm to develop strategies that align with institutional requirements while maximizing benefits for clients.

Professional Standards and Client Focus

The firm operates under strict professional standards, ensuring that all debt restructuring procedures comply with Hong Kong's legal requirements and industry best practices. The combination of banking expertise and legal knowledge allows Hong Kong Debt Restructure Office to provide comprehensive solutions that address both financial and legal aspects of debt restructuring.

"Our goal is to provide clients with clear pathways to financial stability," explained the company representative. "By understanding both the banking perspective and legal requirements, we can create restructuring plans that are acceptable to all parties while providing meaningful relief to our clients."

About Hong Kong Debt Restructure Office

Hong Kong Debt Restructure Office is located at 2214, 22/F, Mira Place Tower A, 132 Nathan Road, Tsim Sha Tsui, Kowloon, Hong Kong. The firm was established by former senior banking professionals with extensive experience in financial services and debt management, supported by a dedicated legal team specializing in debt restructuring procedures.

For more information about Hong Kong Debt Restructure Office and its services, visit https://hkdebtro.com/, call 3480 0223, or email hkdebtro@gmail.com. Follow the company on Facebook at https://www.facebook.com/hkdebtro/ for updates and financial insights.

Contact Information:

Hong Kong Debt Restructure Office

Phone: 3480 0223

Website: https://hkdebtro.com/

Address: 2214, 22/F, Mira Place Tower A, 132 Nathan Road, Tsim Sha Tsui, Kowloon, Hong Kong

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Hong Kong Debt Restructure Office Launches Comprehensive Financial Relief Services Led by Veteran Banking Professionals here

News-ID: 4130084 • Views: …

More Releases from Binary News Network

Church of Scientology Nashville to Celebrate L. Ron Hubbard's 115th Birthday on …

Nashville, TN, 13th February 2026, ZEX PR WIRE, On March 13, 2026, the Church of Scientology Nashville will join Scientologists and communities worldwide in celebrating the 115th birthday of Scientology Founder L. Ron Hubbard, honoring a legacy that continues to benefit communities across Tennessee.

From his groundbreaking work in Dianetics and Scientology to his far-reaching humanitarian initiatives, Mr. Hubbard's influence extends well beyond religious philosophy into education, drug rehabilitation, criminal reform,…

Voshte Gustafson: Inside the Life of a Trade Show Girl

Washington, US, 13th February 2026, ZEX PR WIRE, For Voshte Gustafson, trade shows aren't just part of her job. They're where her energy comes alive. Travel days, booth setups, hotel lobbies, happy hour intros-this is her arena. And she leans all the way in.

"I actually love all of it," she says. "The travel, the setup, the rush of walking into a huge room full of strangers. It's exciting. Every show…

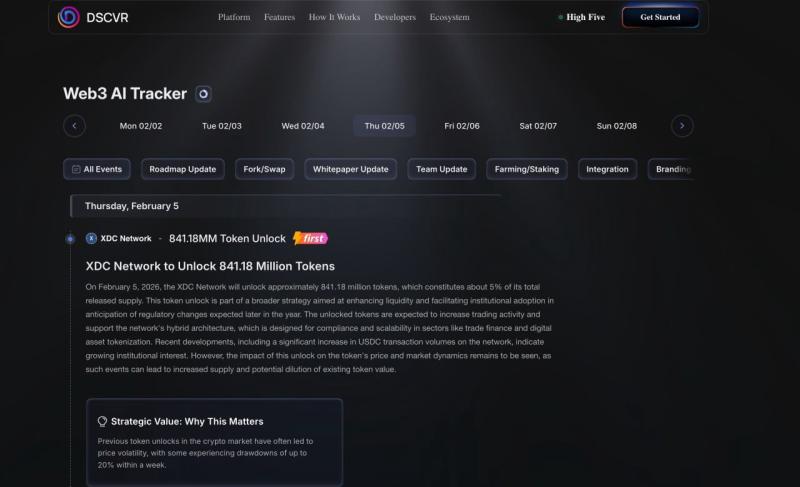

DSCVR Debuts AI-Powered News Feed: A Major Leap Toward Web3 Intelligence

Los Angeles, California, 12th February 2026, ZEX PR WIRE, DSCVR is accelerating its evolution from a social discovery platform into a high-utility intelligence layer for the Web3 ecosystem. As decentralized networks generate a crushing volume of data-from protocol forks and governance shifts to market volatility-the industry's primary challenge has shifted from information access to information clarity.

With its latest product rollout, DSCVR is tackling this "noise" problem head-on through a dual-threat…

Geekvape and Geek Bar Win 14 Global Design Awards in 2025, Marking Milestone in …

Shenzhen, China, 13th February 2026, ZEX PR WIRE, Geekvape and Geek Bar have secured a total of 14 prestigious international design awards in 2025, cementing their leadership in the global design ecosystem. This includes honors from top-tier programs such as the Red Dot, iF Design, MUSE Design, and International Design Awards (IDA), with Geekvape claiming 10 accolades and Geek Bar earning 4.

This achievement is not a coincidence but the result…

More Releases for Hong

Hong Kong Tourism Market Is Going to Boom |• Cathay Pacific • Hong Kong Disn …

Worldwide Market Reports has recently published an in-depth research study titled "Hong Kong Tourism Market Size and Forecast 2026-2033: Analysis by Manufacturers, Key Regions, Product Types, and Applications." The report is developed using a robust blend of primary and secondary research methodologies, ensuring accuracy, reliability, and comprehensive market coverage. Leveraging historical data and forward-looking projections, the study presents a detailed evaluation of the Hong Kong Tourism market growth, analyzing trends…

The Hong Kong Monetary Authority Fines DBS Bank (Hong Kong) Over AML Violations!

On July 5, 2024, the Hong Kong Monetary Authority (HKMA) announced that it had imposed a pecuniary penalty of HK$10,000,000 ($1.3 million) on DBS Bank (Hong Kong) for contraventions of the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO). The fine was issued following an investigation that revealed several control deficiencies at DBS Bank:

Failure to Monitor Business Relationships: DBS failed to continuously monitor business relationships and conduct enhanced due diligence in…

Hong Kong Wealth Management Market Report- Business Review, Technology, Top Comp …

Hong Kong Wealth Management Market research report helps in gathering and analysing useful insights such as global market size, forecast and Compound Annual Growth Rate (CAGR) of a particular industry. It also helps in determining the market status, future prospects, growth opportunity, main challenges about the market for any industry. Hong Kong Wealth Management Market research report also provides complete analysis of the industry, current market trend, overview of the…

Hong Kong National Film Festival

On May 27, 2017 in the Kowloon Walled City (Hong Kong) the annual Hong Kong National Film Festival was held. This event featured 13 films in various genres: drama, documentary, animated film, etc. None of the participants of the Hong Kong National Film Festival were deprived of attention! The winners were awarded certificates, and all those who were a little less lucky this year were awarded memorable prizes and awards.

The…

Country Snapshot: Hong Kong; Overview of the consumer payments market in Hong Ko …

Summary

Hong Kong represents a mature payment card market in Asia, with 25 million payment cards in issue and a population of over 7 million. Despite a high card per customer ratio, Hong Kong is expected to see mild growth in both card numbers and the value of transactions in the coming years.

Key Findings

– Pay-later cards are the fastest growing payment card segment in Hong Kong, mostly driven by the popularity…

Equities First Holdings Hong Kong Limited Receives Reconfirmation of Hong Kong M …

The Hong Kong Money Lenders License was granted by the Hong Kong Eastern Magistrates Courts.

Hong Kong, China -- Equities First Holdings Hong Kong Limited, the Asian subsidiary of Equities First Holdings, LLC (EFH, http://www.equitiesfirst.com) a global securities-based lender and a leader in alternative shareholder financing solutions, has received reconfirmation of its Hong Kong Money Lenders License from the Hong Kong Eastern Magistrates Courts.

This license enables EFH to act as a…