Press release

Hübner Schlösser & Cie advised Wellington fund and private shareholders in the sale of Truck24 AG

Hübner Schlösser & Cie (www.hscie.com) advised Wellington fund and private shareholders in the sale of Truck24 AG, Munich, Germany, to Cybit Holding Plc, Huntingdon, UK

Truck24 AG, based in Oberhaching near Munich, is a leading Central European telematics service provider (TSP), specialising in the HGV and logistics sectors across Germany, Switzerland and Austria. The company has more than 200 customers with 3,300 installed units. The Truck24 product range is touch-screen based for ease of use, and can be fully integrated into end-to-end logistics operations, including planning and scheduling, to reduces costs and increase transparency across the supply chain. All services can be linked with the “FleetExplorer”, a highly scalable web-based platform. With more than five years of extensive experience in the telematics industry, Truck24 has become a strong brand in the fast growing telematics market. All staff will transfer on acquisition, and its CEO will become part of the Cybit international management team. In 2007, Truck24 generated revenues of EUR 5.3 million.

Through this acquisition Cybit Holding Plc gets direct access to Central Europe and strengthens its position as a European leading telematics vendor, creating a customer community of over 1,700 and more than 70,000 mobile assets tracked by Cybit Group hardware and software solutions. It will also help accelerate Cybit’s ability to deliver new initiatives, such as CanBus engine management integration and digital tachograph. CanBus-generated vehicle performance data helps unlock a range of new cost savings and efficiency enhancements within a vehicle fleet.

Cybit Holdings Plc, based in Huntigdon, UK, is a global force in Telematics, operating within three core sectors: Internet-based vehicle Telematics solutions; Economic Exclusion Zone (EEZ) Management; and Private Mobile Radio (PMR) based asset tracking and precise positioning solutions. Cybit Holdings generates revenues of above EUR 20 million and is listed at the London Stock Exchange.

As a corporate finance consultant, Hübner Schlösser & Cie (www.hscie.com) provided Truck24 during all phases of the transaction.

Hübner, Schlösser & Cie

Joachim Schlösser

Dr. Markus Tschernig

Luise-Ullrich-Straße 8

82031 Grünwald

Germany

Phone: +49 (89) 998997-0

Fax. +49 (89) 998997-33

info@hscie.com

www.hscie.com

Hübner Schlösser & Cie, located in Grünwald near Munich, is an independent corporate finance advisory firm, specialised in acquisitions and divestitures of medium-sized and large companies worldwide. In the last years the firm advised in more than 100 transactions with a total transaction value in excess of EUR 17 billion. Hübner Schlösser & Cie is one of the leading advisory firms for medium-sized transactions in Germany.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Hübner Schlösser & Cie advised Wellington fund and private shareholders in the sale of Truck24 AG here

News-ID: 41217 • Views: …

More Releases from Hübner Schlösser & Cie

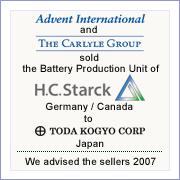

Hübner Schlösser & Cie advised in the sale of the Battery Products Business of …

Effective as of August 1, 2007, Toda Kogyo, Japan, has acquired the Battery Products Busi-ness of H.C. Starck, including its main production facilities located in Sarnia, Canada. The parties have agreed not to disclose the transaction value. With this acquisition Toda not only avails itself of the only industrial scale production facility for spherical Nickelhydroxide (SNH) in the western world but also secures its ability to supply next generation Li-Ion…

Hübner Schlösser & Cie advised GEA Group AG, Germany, in the sale of its large …

As of May 2, 2007, GEA Group sold its plant engineering subsidiary Lentjes GmbH, Rat-ingen, to a subsidiary of A-Tec Industries AG, a globally active industrial group based in Vienna that specializes in drive systems, plant engineering and mechanical engineering. In addition to the nominal purchase price of EUR 1, the buyer has agreed to inject a double digit million Euro amount to strengthen Lentjes GmbH\'s equity base. Chances and…

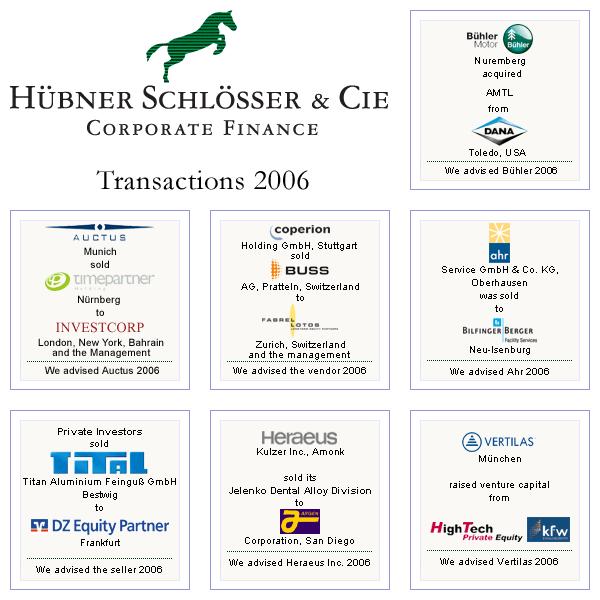

2006 - was a very good year for Hübner Schlösser & Cie

In 2006 Hübner Schlösser & Cie (HSCie, hscie.com) successfully advised on eight transactions whereof one was not published at customers request. Five transactions were structured sales processes of mid-sized companies to financial and strategic investors. The remaining transactions dealt with corporate acquisition, capital raising, and corporate restructuring.

HSCie claims to handle mid-sized transactions with highest professionalism and competence while providing their service cost efficiently. HSCie's track-record proves the team's profound experience…

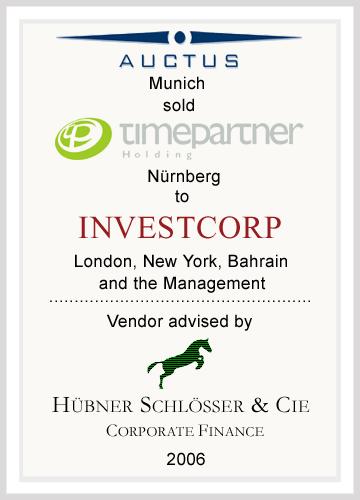

AUCTUS sells Time Partner Group, temporary employment company, to Investcorp - H …

Germany, Grünwald, July 27, 2006. Investcorp acquires a majority share of Time Partner Group, a temporary employment company based in Nuernberg, Germany. Investcorp, the internationally renowned private equity firm, has invested in transactions totalling more than $30 billion and is based in London, New York, Bahrain.

Sellers are Auctus Management GmbH, Munich and the management of Time Partner Group. Auctus is an independent private equity firm for majority investments in profitable,…