Press release

2006 - was a very good year for Hübner Schlösser & Cie

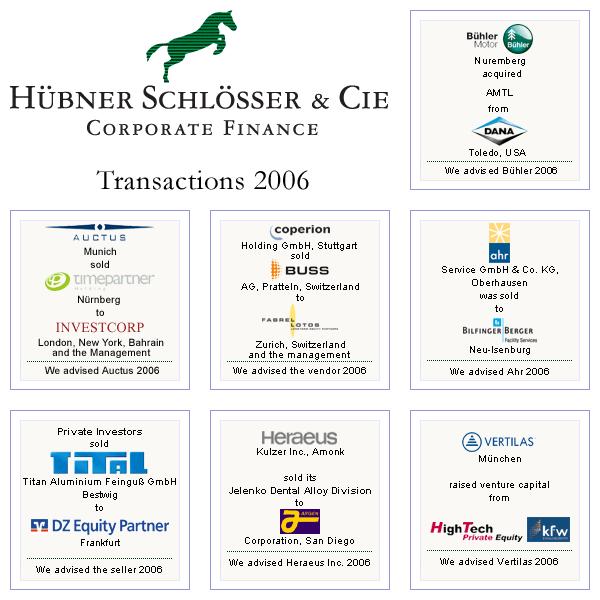

In 2006 Hübner Schlösser & Cie (HSCie, hscie.com) successfully advised on eight transactions whereof one was not published at customers request. Five transactions were structured sales processes of mid-sized companies to financial and strategic investors. The remaining transactions dealt with corporate acquisition, capital raising, and corporate restructuring.HSCie claims to handle mid-sized transactions with highest professionalism and competence while providing their service cost efficiently. HSCie's track-record proves the team's profound experience and ability to effectively take transactions to closings. Typically HSCie achieves results that far exceed their customers expectations.

The year 2007 marks the 10th anniversary of Hübner Schlösser & Cie.

Acquisition of drivetrain technology of Automotive Motion Technology Limited (AMTL):

Bühler Motor Group, Nuremberg, Germany is a worldwide operating developer a manufacturer of electromotive and mechatronical drives (drivetrains, all-wheel, and other automotive applications).

Dana Corporation, Toledo, OH, USA, is a leading tier one supplier of drivetrain, chassis, structural, and engine technologies for the automotive sector.

Dana sold different divisions during the reorganization under Chapter 11. Bühler Motor Group acquired the electronic actuator division of AMTL in this process.

HSCie advised Bühler.

AUCTUS sells temporary employment company Time Partner Group to Investcorp:

With more than 5.000 employees at 50 locations Time Partner Group ranks among the top tentemporary employment companies in Germany and is market leader in some market segments such as aerospace or logistics industry. Through organic growth of more than 30% per year andimplementation of a successful buy-and-build strategy Time Partner has increased its turnovertenfold to nearly € 200 m at double-digit Ebit margins within 24 months.

Auctus Management GmbH, a private equity firm based in Munich, Germany, invests in mid-sized companies.

HSCie advised the vendor.

Sale of Buss AG Group to Fabrel Lotos and the management:

Coperion is world market leader for machinery and complete conveyor and production systems for plastics, chemical, and food industries. In 2006, the Group expects a turnover of € 440 m, up 20% from the previous year.

Buss AG is a worldwide leading manufacturer of compounding and processing plants. The globally active Buss AG, with annual sales of approx. CHF 60 m, currently employs 200 people.

HSCie advised the vendor.

Sale of Ahr Group to Bilfinger Berger:

With the acquisition of the Ahr Group, Bilfinger Berger gains wide access to the dynamically growing market for services in the health care sector. Ahr Group is specialized in integrated services in health care and oversees about 200 hospitals and nursing homes in Germany. It had an output volume of more than € 60 m in 2005.

HSCie advised the vendor.

Sale of Titan Aluminium Feinguss GmbH to DZ Equity Partner:

TITAL, founded in 1974, is a leading manufacturer and provider of premium aluminium and titanium investment casting parts and solutions primarily for the aerospace industry. TITAL has ongoing supply relationships with all major OEMs and Tier 1 suppliers in the European aerospace industry for large and complex aluminium and titanium components.

DZ Equity Partner GmbH and the management acquires 100% of Titan Aluminium Feinguss GmbH, Bestwick, Germany, effective from April 1, 2006, within a management buy-out.

HSCie advised the vendor.

Sale of the Jelenko Dental Alloy Division of Heraeus Kulzer Inc. to Argen Inc.:

Heraeus Kulzer is a leading company for dental materials and dentistry needs, as well as bio-materials used in cementing and coating implants and prostheses.

Heraeus Kulzer is part of the Heraeus company, one of Germany’s largest family enterprises active in the field of precious metal trading, precious metal products, dental products, sensorics, laboratory equipment, medical technology, special lamps and quartz glass, which all together yields € 8 bn in sales.

The US subsidiary Heraeus Kulzer Inc., based in Armonk, New York, sold its Dental Alloy Division to Argen Inc., based in San Diego.

HSCie advised the vendor.

Capital increase of VERTILAS GmbH:

VERTILAS carried out a capital increase from High Tech Private Equity and kfw.

VERTILAS GmbH develops, produces and markets innovative laser diodes for optical communications technology, sensing engineering (gas spectroscopy, tunable diode laser spectroscopy TDLS) and measuring methods.

High Tech Private Equity GmbH is a in Düsseldorf based bank-independent and entrepreneurial Venture-Capital- / Private-Equity-firm.

HSCie advised VERTILAS.

Hübner Schlösser & Cie (www.hscie.com) is a corporate finance advisory firm, which specializes in acquisitions and divestitures of mid-sized firms. With nearly 100 published transactions with a total volume in excess of € 17 bn and 80% of our mandates successfully executed, we are one of the leading M&A advisors for medium-sized transactions in Germany. According to Thomson Financial, we are the number 6 for German based medium-sized transactions in Germany. This year as we have successfully advised in 7 transactions, last year we were able to close 9 deals for our mandates.

Hübner Schlösser & Cie

Luise-Ullrich-Strasse 8

82031 Grünwald

Germany

Phone: +49 (89) 998997-0

Fax: +49 (89) 998997-33

info@hscie.com

www.hscie.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release 2006 - was a very good year for Hübner Schlösser & Cie here

News-ID: 16892 • Views: …

More Releases from Hübner Schlösser & Cie

Hübner Schlösser & Cie advised Wellington fund and private shareholders in the …

As of March 31st, the shareholders of Truck24 AG, including a fund of Wellington Partners, sold 100% of the company to Cybit Holding Plc, a UK-based supplier of telematics solutions.

Truck24 AG, based in Oberhaching near Munich, is a leading Central European telematics service provider (TSP), specialising in the HGV and logistics sectors across Germany, Switzerland and Austria. The company has more than 200 customers with 3,300 installed units. The Truck24…

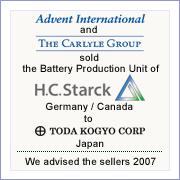

Hübner Schlösser & Cie advised in the sale of the Battery Products Business of …

Effective as of August 1, 2007, Toda Kogyo, Japan, has acquired the Battery Products Busi-ness of H.C. Starck, including its main production facilities located in Sarnia, Canada. The parties have agreed not to disclose the transaction value. With this acquisition Toda not only avails itself of the only industrial scale production facility for spherical Nickelhydroxide (SNH) in the western world but also secures its ability to supply next generation Li-Ion…

Hübner Schlösser & Cie advised GEA Group AG, Germany, in the sale of its large …

As of May 2, 2007, GEA Group sold its plant engineering subsidiary Lentjes GmbH, Rat-ingen, to a subsidiary of A-Tec Industries AG, a globally active industrial group based in Vienna that specializes in drive systems, plant engineering and mechanical engineering. In addition to the nominal purchase price of EUR 1, the buyer has agreed to inject a double digit million Euro amount to strengthen Lentjes GmbH\'s equity base. Chances and…

AUCTUS sells Time Partner Group, temporary employment company, to Investcorp - H …

Germany, Grünwald, July 27, 2006. Investcorp acquires a majority share of Time Partner Group, a temporary employment company based in Nuernberg, Germany. Investcorp, the internationally renowned private equity firm, has invested in transactions totalling more than $30 billion and is based in London, New York, Bahrain.

Sellers are Auctus Management GmbH, Munich and the management of Time Partner Group. Auctus is an independent private equity firm for majority investments in profitable,…

More Releases for HSCie

Calcium Aluminum Borosilicate Market Size, Share and Forecast By Key Players-Pre …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to the MRI Team's Market Research Intellect, the global Calcium Aluminum Borosilicate market is anticipated to grow at a compound annual growth rate (CAGR) of 16.77% between 2024 and 2031. The market is expected to grow to USD 23.82 Billion by 2024. The valuation is expected to reach USD 70.51 Billion by 2031.

The calcium aluminum borosilicate market is expected to experience substantial growth due to its…