Press release

Usage-Based Insurance Market: Driving the Future of Personalized Auto Coverage

The usage-based insurance (UBI) market is experiencing significant transformation as it shifts away from traditional fixed-rate policies toward behavior-based, data-driven pricing models. The global demand for UBI accounted for nearly USD 30 billion in 2020 and is projected to reach approximately USD 150 billion by 2031, expanding fivefold over the forecast period from 2021 to 2031. This rapid growth is propelled by advancements in telematics, growing consumer interest in customized premiums, and the global push for smarter, more efficient insurance models.For More Insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=5352

Policy Types: Customizing Premiums Based on Driving Behavior

UBI policies are categorized primarily into three types: Pay-How-You-Drive (PHYD), Pay-As-You-Drive (PAYD), and Manage-How-You-Drive (MHYD). PHYD models charge premiums based on real-time driving behavior such as speed, acceleration, braking, and cornering. These plans incentivize safer driving and help reduce accidents. PAYD policies, on the other hand, base charges solely on the distance driven, making them ideal for infrequent drivers who want to minimize insurance costs. MHYD combines both approaches, tracking not only how much but also how well one drives, offering the most detailed insights for risk assessment and personalized pricing.

Technology Platforms: Enabling Data-Driven Coverage

The UBI market is heavily reliant on technological platforms to gather and analyze driving data. These include black box telematics devices, OBD (On-Board Diagnostics) dongles, and smartphone-based applications. Black box systems, typically installed in vehicles, offer the most comprehensive and tamper-resistant data collection. OBD dongles are cost-effective alternatives that plug directly into a car's diagnostic port, capturing essential driving metrics. Smartphone apps are gaining popularity due to their convenience and lower cost of implementation. Although mobile-based platforms may be less precise than dedicated hardware, they are sufficient for capturing key driving behaviors and are particularly attractive to tech-savvy and younger drivers.

Browse Full Report: https://www.factmr.com/report/5352/usage-insurance-market

Vehicle Types: Broadening Market Reach Across Use Cases

Usage-based insurance is being adopted across various vehicle segments. Private passenger vehicles remain the largest market due to widespread consumer interest in reducing premiums through better driving habits. Commercial fleets are also adopting UBI at a rapid pace, using telematics to monitor driver performance, optimize fuel usage, and reduce liability risks. Ride-sharing companies and shared mobility services benefit from UBI by offering trip-specific pricing and improving operational safety. Additionally, UBI is beginning to penetrate specialty vehicle segments such as rental cars and delivery vans, especially as insurance providers look for more efficient and scalable pricing models.

Regional Trends: North America Leads, Asia-Pacific Surges

Regionally, North America remains the frontrunner in UBI adoption, supported by high connectivity, regulatory flexibility, and insurer investment in telematics infrastructure. Europe follows closely, especially in countries like the UK, Germany, and Italy, where regulatory mandates and environmental initiatives are encouraging more personalized insurance models. Asia-Pacific is witnessing the fastest growth due to increasing urbanization, smartphone penetration, and rapid expansion of vehicle ownership. Emerging markets in Latin America, the Middle East, and Africa are also exploring UBI solutions, though adoption is at an earlier stage and dependent on technology infrastructure development.

Get Your Copy Today: https://www.factmr.com/checkout/5352

Market Drivers and Challenges

Several factors are fueling the growth of the usage-based insurance market. Cost-sensitive consumers are drawn to flexible, performance-based premiums, especially those who drive less or maintain safe driving habits. The proliferation of telematics-enabled vehicles and smartphones has made it easier for insurers to collect and analyze real-time data. Additionally, regulatory bodies are gradually supporting behavior-based pricing as a fairer and more transparent alternative to traditional underwriting.

However, challenges remain. Privacy concerns around data collection and usage continue to be a barrier for some consumers. Ensuring data security and regulatory compliance is essential to building trust. Furthermore, the initial investment in telematics infrastructure can be high for insurers, especially in developing markets. Consumer education is also critical, as many potential users are unaware of the benefits and mechanisms of UBI policies.

Outlook: The Road Ahead for Usage-Based Insurance

The future of the usage-based insurance market is promising, driven by a convergence of technological, regulatory, and consumer trends. As vehicles become more connected and autonomous technologies mature, UBI will likely evolve into a standard offering in auto insurance. Insurers that can innovate with flexible policy types, user-friendly platforms, and robust data analytics will lead the way in redefining auto insurance. With a projected fivefold increase in market size by 2031, usage-based insurance is set to become a cornerstone of the global mobility ecosystem.

Check out More Related Studies Published by Fact.MR:

Fifth Wheel Trailer Market

https://www.factmr.com/report/723/fifth-wheel-trailer-market

Motorcycle Monoshock Suspension Market

https://www.factmr.com/report/885/motorcycle-monoshock-suspension-market

Concrete Sealer Market

https://www.factmr.com/report/936/concrete-sealer-market

Automotive Rocker Panel Market

https://www.factmr.com/report/971/automotive-rocker-panel-market

Contact:

US Sales Office

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583, +353-1-4434-232

Email: sales@factmr.com

About Fact.MR

We are a trusted research partner of 80% of fortune 1000 companies across the globe. We are consistently growing in the field of market research with more than 1000 reports published every year. The dedicated team of 400-plus analysts and consultants is committed to achieving the utmost level of our client's satisfaction.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Usage-Based Insurance Market: Driving the Future of Personalized Auto Coverage here

News-ID: 4111989 • Views: …

More Releases from Fact.MR

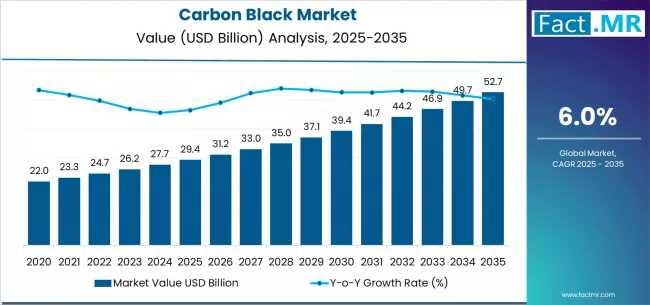

Carbon Black Market Forecast 2026-2036: Market to Reach USD 52.7 Billion by 2036 …

The global carbon black market is valued at USD 29.4 billion in 2025 and is projected to reach USD 52.7 billion by 2035. This robust expansion represents a total growth of 79.1%, progressing at a compound annual growth rate (CAGR) of 6.0% over the ten-year forecast period. As automotive manufacturing scales and tire production capacities rise, the market is expected to grow by approximately 1.8X, driven by the essential role…

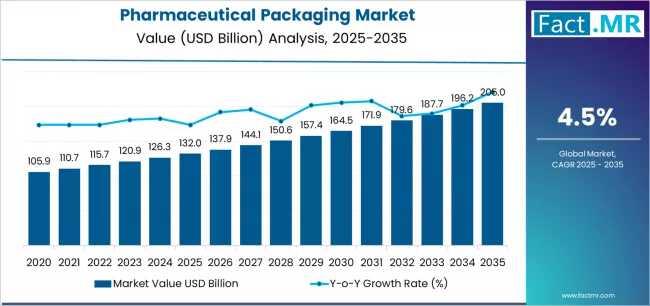

Pharmaceutical Packaging Market Forecast 2026-2036: Market to Reach USD 206.0 Bi …

The global pharmaceutical packaging market is valued at USD 132.0 billion in 2026 and is projected to reach USD 206.0 billion by 2036, expanding at a steady CAGR of 4.5%. This growth reflects a fundamental shift toward advanced sterile packaging, driven by the rapid rise of biologics and the necessity for global regulatory harmonization.

Get Access of Report Sample: https://www.factmr.com/connectus/sample?flag=S&rep_id=4573

pharmaceutical packaging market Quickstat

Market Size 2026: USD 132.0 billion

Market Size…

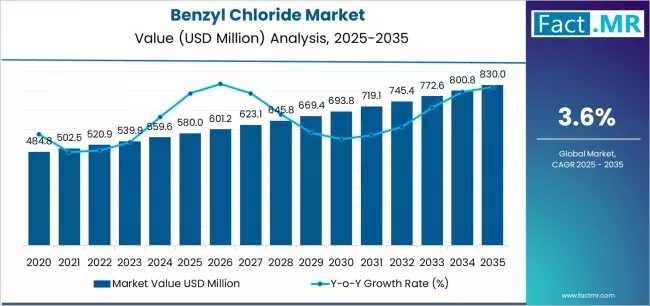

benzyl chloride Market Forecast 2026-2036: Market to Reach USD 830.0 Million by …

The global benzyl chloride market is projected to expand from a valuation of USD 580.0 million in 2025 to approximately USD 830.0 million by 2035. This growth represents an absolute increase of USD 250.0 million, with the market forecast to grow at a compound annual growth rate (CAGR) of 3.6% over the ten-year period. As a critical chemical intermediate, benzyl chloride is seeing heightened utilization in pharmaceutical manufacturing and the…

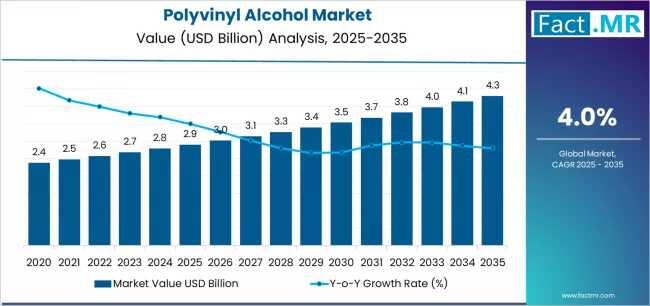

Polyvinyl Alcohol Market Forecast 2026-2036: Market to Reach USD 4,300.0 Million …

The global Polyvinyl Alcohol Market is valued at USD 2,900.0 million in 2025 and is projected to reach USD 4,300.0 million by 2035. This steady expansion represents a CAGR of 4.0% over the ten-year assessment period, marking an absolute increase of USD 1,400.0 million. The market's growth is primarily underpinned by an escalating global demand for water-soluble packaging solutions and advanced film-forming technologies across industrial, textile, and food sectors.

Get Access…

More Releases for UBI

Usage Based Insurance (Ubi) Market: A Comprehensive Overview

The Usage-Based Insurance (UBI) Market was valued at USD 43.38 billion in 2023 and is expected to grow to approximately USD 87.0 billion by 2033, reflecting a CAGR of about 7.2% from 2024 to 2033.

Usage Based Insurance (Ubi) Market Overview

The Usage-Based Insurance (UBI) Market is experiencing significant growth, driven by advancements in telematics and the increasing adoption of connected vehicles. UBI models, such as Pay-As-You-Drive (PAYD) and Pay-How-You-Drive (PHYD), utilize…

Usage Based Insurance (Ubi) Market Size Unlocking New Opportunities for Success

The global Usage-Based Insurance (UBI) Market was valued at approximately USD 33.27 billion in 2023 and is projected to reach around USD 232.94 billion by 2032, growing at a compound annual growth rate (CAGR) of 24.14% from 2024 to 2032.

Usage Based Insurance (Ubi) Market Overview

Usage-Based Insurance (UBI) is an innovative auto insurance model that determines premiums based on individual driving behaviors, such as distance traveled, speed, braking patterns, and time…

Usage-based Insurance (UBI) Market Revenue Sizing Outlook Appears Bright

Global Usage-based Insurance (UBI) Market Report from Market Insights Report highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans and make informed decisions…

Usage-based Insurance (UBI) Market Will Generate Record Revenue by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-based Insurance (UBI) Market to Witness Growth Acceleration by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-Based Insurance (UBI) Market by Policy Type [Pay-As-You-Drive Insurance (P …

UBI Market Size

The global usage-based insurance market size was valued at $28.7 billion in 2019, and is projected to reach $149.2 billion by 2027, growing at a CAGR of 25.1% from 2020 to 2027. Usage-based insurance is expected to grow rapidly in the coming years. Key drivers of the usage-based insurance market include the growing adoption of telematics technology in the automotive insurance space.

Download Free Sample: https://reports.valuates.com/request/sample/ALLI-Auto-0U87/Usage_Based_Insurance

Trends Influencing the Global…