Press release

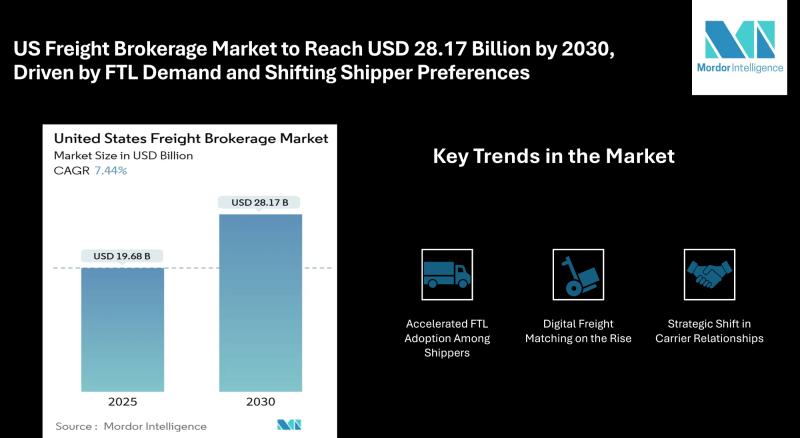

US Freight Brokerage Market to Reach USD 28.17 Billion by 2030, Driven by FTL Demand, Digitalization, and Shifting Shipper Preferences

Mordor Intelligence has published a new report on the "US Freight Brokerage Market" offering a comprehensive analysis of trends, growth drivers, and future projectionsIntroduction

Mordor Intelligence, in its latest United States Freight Brokerage Market report, forecasts strong growth through 2030. The market is witnessing increasing traction due to the rising demand for full-truckload (FTL) services, the proliferation of digital freight matching platforms, and evolving shipper expectations centered around flexibility, visibility, and operational reliability.

The U.S. freight brokerage market serves as a vital link between shippers and carriers, ensuring freight movement across a highly fragmented logistics network. From large manufacturers to small retailers, businesses rely on freight brokers to navigate rate fluctuations, equipment shortages, and complex multi-modal shipping needs. The market is experiencing a dynamic shift, particularly in the way brokers operate-driven by data analytics, customer-centric tools, and tighter integration with carrier networks.

Report Overview: https://www.mordorintelligence.com/industry-reports/united-states-freight-brokerage-market?utm_source=openpr

Key Trends

Accelerated FTL Adoption Among Shippers

The full-truckload (FTL) segment has become a primary growth area within freight brokerage. As more shippers seek direct, faster, and less-handled transport solutions, demand for FTL services has significantly expanded. Brokers are responding by building deeper relationships with carriers, securing capacity in advance, and offering better rate consistency. This is particularly relevant in time-sensitive or high-volume sectors such as retail and automotive.

Digital Freight Matching on the Rise

Digitalization is redefining freight brokerage operations. The rise of app-based load boards, API-integrated carrier tracking, and AI-driven pricing tools is making freight transactions faster and more transparent. Brokers are integrating these technologies to improve shipment visibility, reduce manual processes, and offer more flexible booking options for shippers and carriers alike. As digital adoption increases, traditional freight brokers are being challenged to modernize their systems or risk losing market share to digital-native competitors.

Strategic Shift in Carrier Relationships

Freight brokers are moving beyond transactional relationships and forming long-term strategic partnerships with carriers. These partnerships are built on consistent volume commitments, predictive pricing models, and real-time performance metrics. This allows brokers to secure capacity during market fluctuations and deliver reliability to shippers even during peak periods or driver shortages.

Shifting Shipper Expectations

Shippers are placing growing importance on end-to-end visibility, predictable delivery schedules, and customer service responsiveness. Brokers are increasingly expected to serve not just as intermediaries but as logistics consultants who can navigate disruptions, optimize costs, and tailor solutions based on client-specific constraints. These evolving expectations are reshaping how brokers build their service models and tech infrastructure.

Increased Complexity in Cross-Border Freight

While domestic freight forms the backbone of the market, cross-border flows, particularly with Canada and Mexico, are also seeing growth. Regulatory requirements, customs compliance, and infrastructure variability make these lanes more complex. Brokers with expertise in managing international documentation and multi-lane coordination are well-positioned to capture this demand.

Driver Availability and Capacity Constraints

The ongoing challenge of driver availability continues to affect how freight brokers secure capacity. As carriers face driver recruitment and retention issues, brokers must balance spot and contract freight strategically. Building a diversified carrier portfolio and investing in automated carrier onboarding processes has become a core strategy to mitigate capacity risks.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/united-states-freight-brokerage-market?utm_source=openpr

Market Segmentation

The United States freight brokerage market is segmented based on a range of parameters that reflect the operational complexity and service diversity across the industry:

By Service

Full-Truckload (FTL) - Demand is rising for direct routes and faster transit, making FTL the leading service type.

Other Services - Includes LTL, intermodal, and specialized freight solutions tailored for industry-specific needs.

By Equipment / Trailer Type

Dry Van - Commonly used for general freight, providing cost-effective capacity.

Other Equipment - Includes flatbed, refrigerated, and specialized trailers serving construction, agriculture, and perishables.

By Haul Length

Long-Haul - Dominant in national freight lanes, serving coast-to-coast and regional networks.

Other Haul Lengths - Includes short-haul and regional movements focused on metro-area or state-level delivery needs.

By Business Model

Traditional Freight Brokerage - Relies on established relationships and manual coordination.

Other Models - Digital-first platforms and hybrid models using automation, predictive analytics, and real-time dashboards.

By End User

Manufacturing - A core sector for freight movement, requiring dependable scheduling and material flow.

Other End Users - Includes retail, agriculture, energy, and healthcare, each with distinct freight requirements.

By Customer Size

Large Enterprises - Typically have consistent volume and prefer long-term agreements with brokers.

Other Customers - SMEs looking for flexible rates and seasonal capacity.

By Geography

Northeast - High-density freight corridors with urban logistics challenges.

Other Regions - Midwest, South, West, and cross-border routes with varying infrastructure and freight volumes.

Explore Our Full Library of Logistics Research Industry Reports: https://www.mordorintelligence.com/market-analysis/logistics?utm_source=openpr

Key Players

Several major freight brokerage companies continue to shape the competitive landscape in the United States. These players combine national networks with advanced tech platforms and strong carrier relationships:

C.H. Robinson Worldwide Inc. - One of the largest third-party logistics providers, offering end-to-end supply chain solutions with strong brokerage capabilities.

Total Quality Logistics (TQL) - Known for its extensive carrier network and real-time freight tracking capabilities.

XPO Logistics Inc. - A major logistics provider with a growing brokerage segment focused on technology-enabled freight management.

Echo Global Logistics - Specializes in multimodal solutions and tailored shipping services for a wide range of industries.

Worldwide Express - Offers domestic and international freight brokerage with a focus on mid-market customers and small businesses.

These firms are enhancing their platforms to offer predictive freight insights, automated load matching, and personalized dashboards for shippers and carriers. Their investments in scalability and customer service help set benchmarks for emerging brokers in the space.

Conclusion

The US freight brokerage market is undergoing notable transformation as digital tools, FTL growth, and evolving shipper expectations reshape the way freight is booked, priced, and delivered. With increasing pressure to secure reliable capacity and ensure shipment visibility, brokers are adapting rapidly leveraging both technology and carrier partnerships to remain competitive. As the landscape continues to shift, companies that prioritize operational flexibility, client alignment, and process efficiency will be best positioned to lead the next phase of market expansion.

For complete market analysis, visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/united-states-freight-brokerage-market?utm_source=openpr

Industry Related Reports

US FTL Freight Brokerage Market: US FTL Freight Brokerage Market is Segmented by End User (manufacturing and Automotive; Oil and Gas, Mining and Quarrying; Agriculture, Fishing and Forestry; Construction; Distributive Trade; and Other End-Users).

Get more insights: https://www.mordorintelligence.com/industry-reports/united-states-ftl-freight-brokerage-market?utm_source=openpr

Mexico Customs Brokerage Market: The Mexico Customs Brokerage Market Report is Segmented by Mode of Transport (Sea, Air, and Cross-Border Land Transport).

Get more insights: https://www.mordorintelligence.com/industry-reports/mexico-customs-brokerage-market?utm_source=openpr

Europe Customs Brokerage Market: Europe Customs Brokerage Market is Segmented by Mode of Transport (Sea, Air and Cross-Border Land Transport) and by Geography (Germany, United Kingdom, France, Netherlands, Italy and the Rest of Europe)

Get more insights: https://www.mordorintelligence.com/industry-reports/europe-customs-brokerage-market?utm_source=openpr

Asia-Pacific Customs Brokerage Market: Asia-Pacific Customs Brokerage Market is Segmented by Mode of Transport (Sea, Air, and Cross-Border Land Transport) and by Geography (China, Japan, India, Australia, Malaysia, South Korea and Rest of Asia-Pacific)

Get more insights: https://www.mordorintelligence.com/industry-reports/asia-pacific-customs-brokerage-market?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release US Freight Brokerage Market to Reach USD 28.17 Billion by 2030, Driven by FTL Demand, Digitalization, and Shifting Shipper Preferences here

News-ID: 4111584 • Views: …

More Releases from Mordor Intelligence

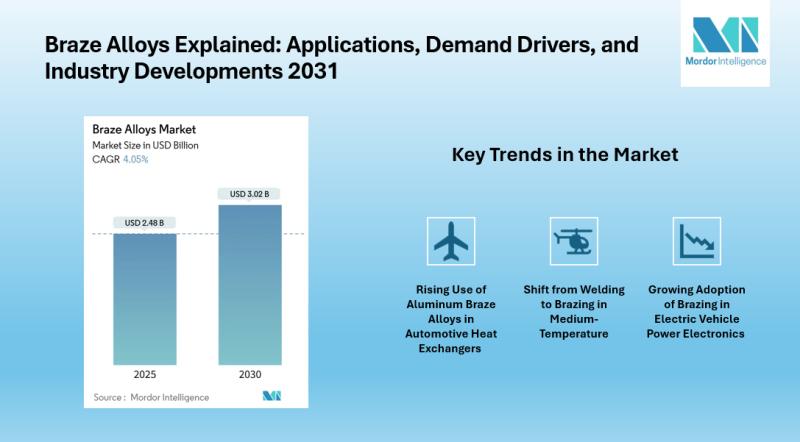

Braze Alloys Market Trends Point to USD 3.02 Billion Opportunity by 2030 Across …

Mordor Intelligence has published a new report on the Braze Alloys Market, offering a comprehensive analysis of trends, growth of drivers, and future projections.

According to Mordor Intelligence, the Braze Alloys Market size is estimated at USD 2.48 billion in 2025 and is projected to reach USD 3.02 billion by 2030, growing at a CAGR of 4.05%. The Braze Alloys Industry benefits from increasing use of aluminum-based fillers in automotive heat…

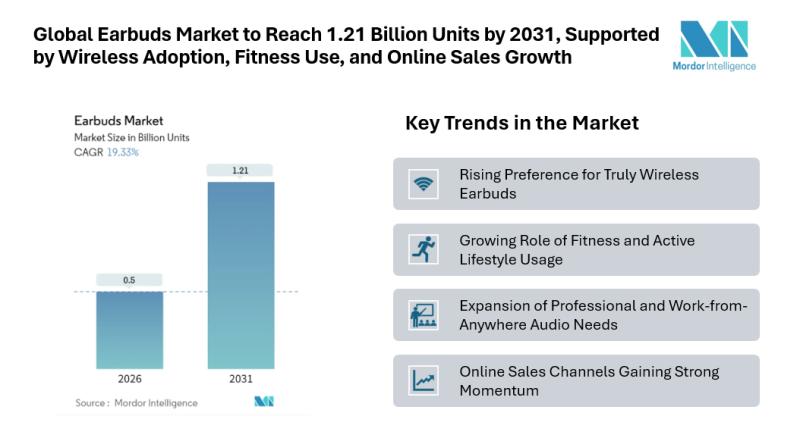

Global Earbuds Market to Reach 1.21 Billion Units by 2031, Supported by Wireless …

Mordor Intelligence has published a new report on the Earbuds Market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Earbuds Market Overview

The Earbuds Market continues to gain strong momentum as compact audio devices become a daily companion across entertainment, work, and fitness use cases. According to the latest analysis, the market is expected to expand from 0.42 billion units in 2025 to 0.5 billion units…

Functional Mushroom Market Size to Reach USD 20.74 Billion by 2031 as Supplement …

Functional Mushroom Market Outlook

The global Functional Mushroom Market has transitioned from a niche wellness category into a mainstream segment spanning nutrition, functional foods, and personal care. According to Mordor Intelligence, the market was valued at USD 13.20 billion in 2026 and is projected to reach USD 20.74 billion by 2031, supported by a strong compound annual growth rate during the forecast period.

This growth reflects rising consumer confidence in mushroom-based ingredients…

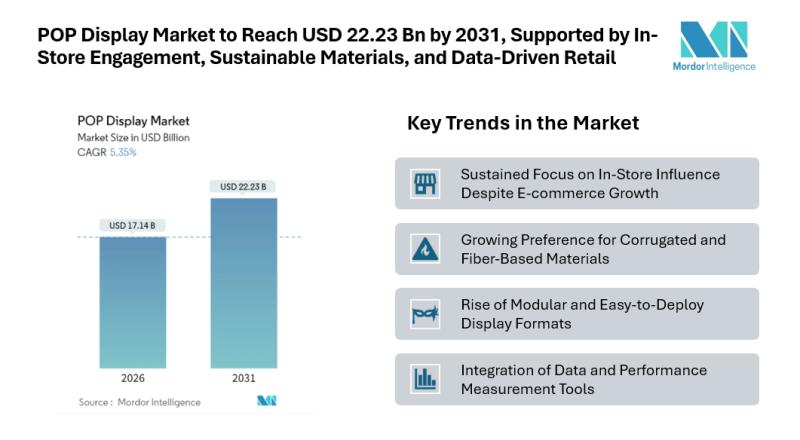

POP Display Market to Reach USD 22.23 Billion by 2031, Supported by In-Store Eng …

Mordor Intelligence has published a new report on the POP Display Market, offering a comprehensive analysis of trends, growth drivers, and future projections.

POP Display Market Overview

The POP Display Market plays a vital role in physical retail by helping brands attract shopper attention and influence buying decisions at the point of purchase. According to Mordor Intelligence, the POP Display Market size is estimated at USD 17.14 billion in 2026,…

More Releases for Brokerage

Prominent Mortgage Brokerage Services Market Trend for 2025: Technological Advan …

How Are the key drivers contributing to the expansion of the mortgage brokerage services market?

The increasing need for personalized financial guidance is likely to fuel the growth of the mortgage brokerage services market in the coming years. Personalized financial guidance involves creating financial strategies based on an individual's financial needs and goals. This demand is growing due to factors such as inflation, economic growth, interest rates, and technological progress. Mortgage…

Prediction market Kalshi launches brokerage integrations

Image: https://www.globalnewslines.com/uploads/2025/01/1738333447.jpg

New York, NY - Feb 3, 2025 - Kalshi, America's largest regulated prediction market, today announced the capability to integrate prediction markets with traditional financial brokerages.

The ability to integrate event contracts with brokerages significantly increases the number of Americans who will have access to prediction markets, signifying that further growth for the industry is imminent.

"A few years ago, prediction markets were a niche corner of the internet. We built…

Insurance Brokerage Market Size and Forecast

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- The global Insurance Brokerage Market is expected to record a CAGR of XX.X% from 2024 to 2031 In 2024, the market size is projected to reach a valuation of USD XX.X Billion. By 2031 the valuation is anticipated to reach USD XX.X Billion.

Insurance Brokerage Market Size and Scope

The insurance brokerage market is substantial and continues to expand, driven by the increasing demand for insurance solutions across various…

Online Financial Brokerage Market Next Big Thing | Major Giants- Financial Broke …

Advance Market Analytics published a new research publication on "Online Financial Brokerage Market Insights, to 2028" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Online Financial Brokerage market was mainly driven by the increasing R&D spending across the world.

Some of the key players…

Online Financial Brokerage Market, Online Discount Brokerage Market: Ken Researc …

Financial Brokerage Market –during the recent trend the financial market across the Philippines is one of the most fortunate financial markets in the South-Asia region with the very few financial products recommended for trading at recent but will enhance during a few years. In addition, the Trading activities across the Philippines region is exceedingly delimited owing to very low trading capacity and reasonably fewer trading accounts, most of the brokerage…

Cloud Services Brokerage Market Report 2018: Segmentation by Service Type (Catal …

Global Cloud Services Brokerage market research report provides company profile for Accenture (Ireland), DoubleHorn (US), Jamcracker (US), IBM (US), HPE (US), RightScale (US), Dell (US), Wipro (India), Arrow Electronics (US), ActivePlatform (Belarus), Cloudmore (Sweden) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate,…