Press release

Smartphone Boom Fuels Soaring Growth In Digital Lending Platforms: Core Growth Enabler in the Digital Lending Platform Market, 2025

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.What Will the Digital Lending Platform Industry Market Size Be by 2025?

The market size of the digital lending platform has seen significant growth recently. It is projected to rise from $15.85 billion in 2024 to $19.37 billion in 2025, with a compound annual growth rate (CAGR) of 22.2%. This substantial growth during the historical period can be accounted for by the emergence of fintech companies, the rise of mobile and internet usage, advancements in data analytics and credit scoring, the demand for speed and convenience, initiatives aimed at economic inclusion, and the escalation of peer-to-peer lending.

What's the Long-Term Growth Forecast for the Digital Lending Platform Market Size Through 2029?

Expectations are set for an impressive expansion in the digital lending platform market in the upcoming years, with predictions estimating that it will reach a value of $45.29 billion by the year 2029, boasting a compound annual growth rate (CAGR) of 23.7%. This anticipated growth during the forecast period can be credited to numerous factors such as open banking strategies, the increasing prominence of decentralized finance, a heightened focus on customer experience, continuing administrative backing, and the worldwide economic restoration. Key emerging trends within the forecast period will include cross-border lending, increased digitization in financial services, mobile-focused methods, the application of blockchain technology for enhanced security, customer-oriented approaches, and collaborations with fintech startups.

View the full report here:

https://www.thebusinessresearchcompany.com/report/digital-lending-platform-global-market-report

What Are the Key Growth Drivers Fueling the Digital Lending Platform Market Expansion?

The growth of the digital lending platform market is anticipated to be driven by an increase in smartphone usage. Smartphones are mobile devices featuring a touchscreen interface and an operating system that allows for the execution of downloaded applications, including internet access. This surge in smartphone usage is resulting in more users and borrowers turning to digital lending platforms to secure instant loans. As noted by Singapore-based online reference library, DataReportal, in 2022, the volume of active smartphones is expanding at a 5.1 percent yearly pace, equating to roughly 1 million new smartphones being activated daily. Consequently, the uptick in smartphone use is fostering the expansion of the digital lending platform market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=7633&type=smp

What Are the Key Trends Driving Digital Lending Platform Market Growth?

Technological innovation is a key trend gaining traction in the digital lending platform market. Major players are focusing their energy on developing cutting-edge technologies to facilitate automation in all business operations. For example, in April 2023, Tavant, a U.S.-based IT services and solutions firm, introduced the touchless lending asset analysis. This technology streamlines the typically labor-intensive process of assessing bank statements and verifying borrower assets in mortgage underwriting. Through the use of sophisticated AI and machine learning algorithms, the product effectively scrutinizes pertinent loan information and gauges document suitability, concurrently identifying any discrepancies or irregularities in financial dealings.

How Is the Digital Lending Platform Market Segmented?

The digital lending platform market covered in this report is segmented -

1) By Type: Loan Origination, Decision Automation, Collections And Recovery, Risk And Compliance Management, Other Types

2) By Component: Software, Service

3) By Deployment Model: On-Premise, Cloud

4) By Industry Vertical: Banks, Insurance Companies, Credit Unions, Savings And Loan Associations, Peer-To-Peer Lending, Other Industry Verticals

Subsegments:

1) By Loan Origination: Application Processing, Credit Scoring, Document Verification

2) By Decision Automation: Automated Underwriting, Risk Assessment Tools

3) By Collections And Recovery: Automated Collections Management, Debt Recovery Solutions

4) By Risk And Compliance Management: Fraud Detection Tools, Regulatory Compliance Solutions

5) By Other Types: Customer Relationship Management (CRM) Tools, Data Analytics Solutions

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=7633&type=smp

Which Companies Are Leading the Charge in Digital Lending Platform Market Innovation?

Major companies operating in the digital lending platform market include Nucleus Software Exports Limited, accenture* plc, Fiserv Inc., Fidelity National Information Services Inc. (FIS), HES FinTech POS, Wipro Limited, DocuSign Inc., Finastra Limited, Pegasystems Inc., Black Knight Inc., LendingTree LLC, Temenos AG, Ellie Mae Inc., ICE Mortgage Technology Inc., Tavant Technologies Inc., EdgeVerve Systems Limited, BlendLabs Inc., Teylor AG, Intellect Design Arena Ltd., Mambu GmbH, Newgen Software Technologies Ltd., Sigma Infosolutions Ltd., Auxmoney GmbH, Roostify Inc., DocuTech Corporation, Built Technologies lnc., Decimal Technologies Pvt Ltd., CU Direct Corporation, Swiss Fintech AG, Upstart Network Inc., ZestFinance Inc.

Which Regions Are Leading the Global Digital Lending Platform Market in Revenue?

North America was the largest growing region in the digital lending platform market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the digital lending platform market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=7633

This Report Supports:

1. Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2. Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3. Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4. Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Smartphone Boom Fuels Soaring Growth In Digital Lending Platforms: Core Growth Enabler in the Digital Lending Platform Market, 2025 here

News-ID: 4111044 • Views: …

More Releases from The Business Research Company

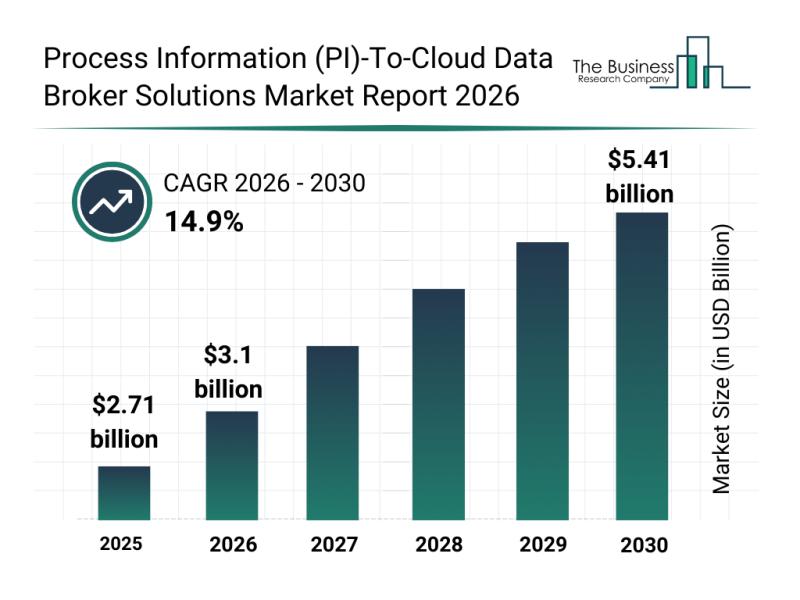

Leading Industry Participants Reinforce Their Presence in the Process Informatio …

The process information (PI)-to-cloud data broker solutions industry is positioned for significant expansion as digital transformation accelerates across industrial sectors. Increasing demand for real-time data access and seamless integration between operational technology (OT) and information technology (IT) systems is driving rapid innovations and investments. Let's explore the market size projections, key players, emerging trends, and segment insights shaping this evolving landscape.

Projected Market Size Growth in the Process Information (PI)-To-Cloud Data…

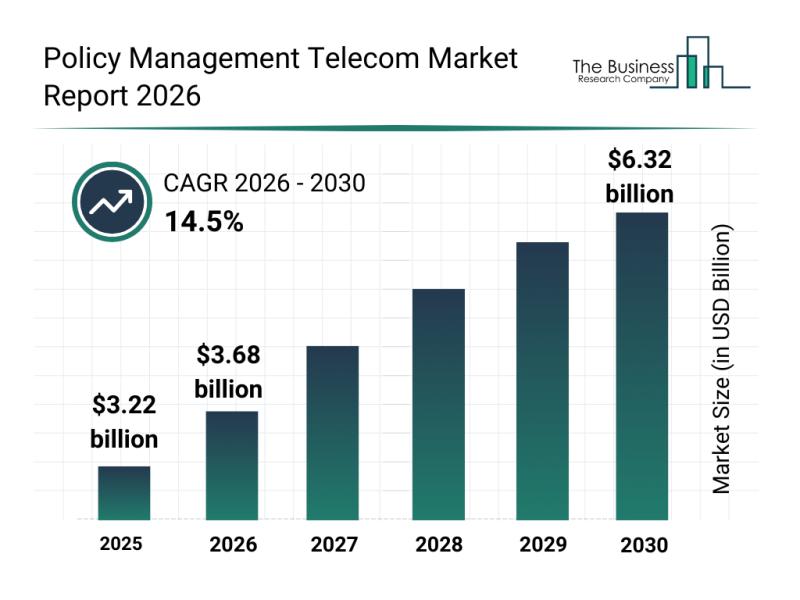

Future Perspective: Key Trends Shaping the Policy Management Telecom Market Up t …

The policy management telecom sector is set to experience significant expansion over the coming years, driven by technological advances and growing network demands. This evolving market is playing a crucial role in supporting the complex needs of modern telecom operators, enabling more efficient management and automation of network policies. Below, we explore the current market size projections, leading companies, key trends, and segmentation details that define this dynamic industry.

Strong Growth…

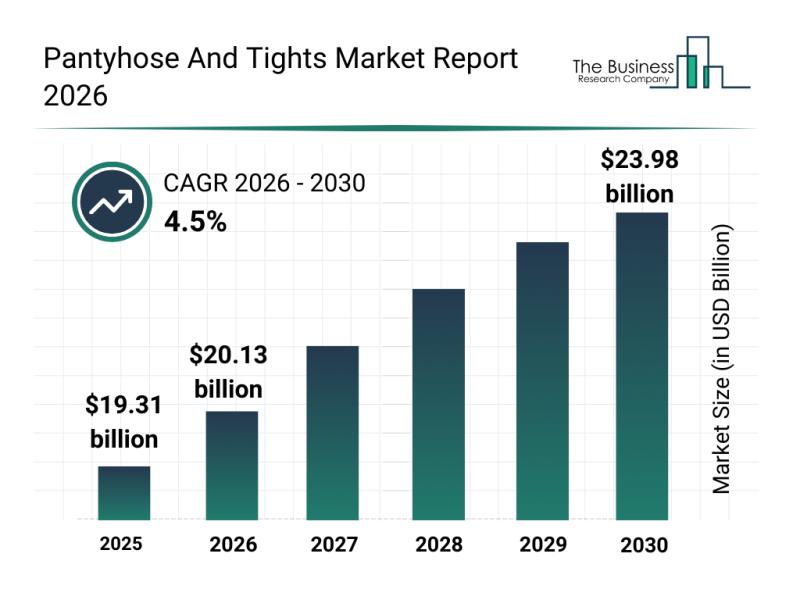

Competitive Analysis: Key Market Leaders and New Entrants in the Pantyhose and T …

The pantyhose and tights market is set to witness consistent growth as consumer preferences evolve and new trends gain traction. With increasing emphasis on sustainability, comfort, and style, this sector is poised for meaningful expansion through 2030. Let's dive into the market's valuation, key players, emerging trends, and segmentation to understand the trajectory of this dynamic industry.

Forecasted Market Value and Growth Rate of the Pantyhose and Tights Market

The…

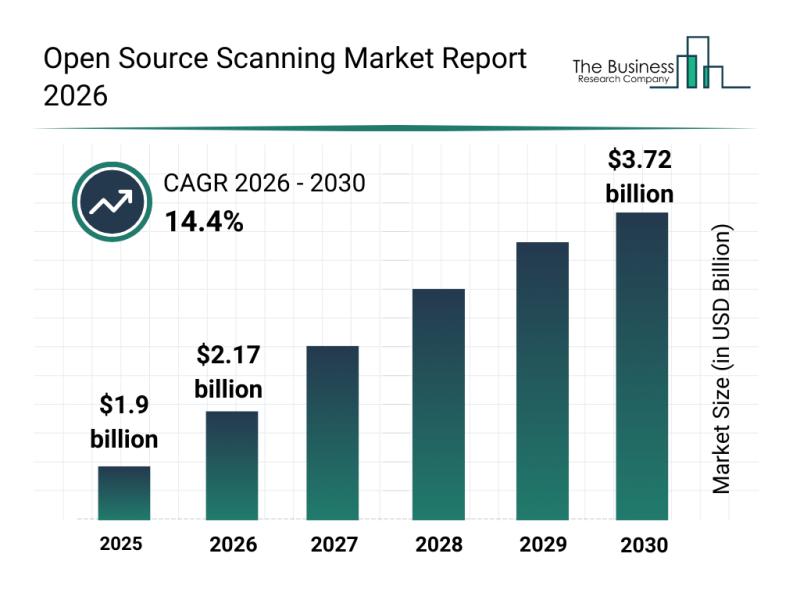

Emerging Growth Patterns, Market Segmentation, and Competitive Approaches Influe …

The open source scanning industry is positioned for remarkable expansion as the reliance on open source software and security intensifies. With growing complexities in software development and increasing regulatory demands, this sector is set to experience significant advancements and adoption in the years ahead. Let's explore the market size projections, key players, emerging trends, and detailed segment breakdowns shaping this vital landscape.

Market Value Forecast and Growth Outlook of the Open…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…