Press release

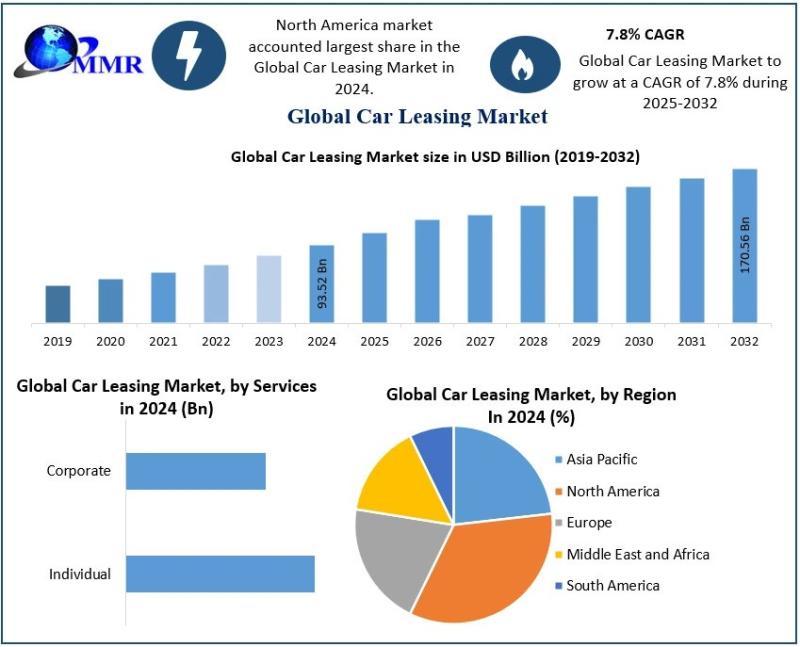

Car Leasing Market Accelerates Toward USD 170.56 Billion by 2032

Car Leasing Market size was valued at USD 93.52 Billion in 2024 and the total Car Leasing revenue is expected to grow at a CAGR of 7.8% from 2025 to 2032, reaching nearly USD 170.56 Billion.Car Leasing Market Overview:

The car leasing market has grown significantly in recent years as consumers and businesses seek more flexible vehicle ownership alternatives. Leasing offers the advantage of lower monthly payments, access to new vehicle models, and minimal long-term maintenance responsibilities. This model has gained particular traction in urban areas where short-term mobility solutions are in demand. Additionally, leasing is increasingly preferred by corporations for managing employee transportation needs through cost-effective and tax-efficient strategies. The market spans a variety of vehicle categories, from compact cars to luxury and commercial vehicles, reflecting broad-based adoption.

Download a Free Sample Report Today: https://www.maximizemarketresearch.com/request-sample/67834/

Car Leasing Market Dynamics:

Several core drivers are shaping the car leasing industry. Rising vehicle prices have encouraged consumers to look for more economical access to cars, with leasing emerging as a viable option. Advancements in digital platforms have streamlined lease applications, making it easier for users to browse, compare, and finalize contracts online. On the corporate side, demand for fleet leasing is increasing due to its operational and financial benefits. However, challenges remain, such as fluctuating interest rates and residual value risks, which can influence leasing affordability and profitability. Environmental concerns are also prompting a shift towards greener fleet leasing practices, especially with the rise of electric and hybrid vehicles.

Car Leasing Market Outlook and Future Trends:

The future of the car leasing market looks promising, with multiple trends set to influence its trajectory. Electrification is expected to play a central role, as environmental regulations and sustainability goals drive demand for electric vehicle leases. Subscription-based leasing models, where services like insurance and maintenance are bundled into a single fee, are also gaining popularity. These models appeal to consumers looking for simplicity and flexibility. Additionally, technological advancements in vehicle connectivity and telematics will enhance fleet management capabilities. As digital transformation continues to reshape consumer behavior, the market is likely to become more personalized, with tailored lease plans based on usage patterns and preferences.

Key Recent Developments:

Recent developments in the car leasing industry reflect its dynamic and adaptive nature. Leasing companies are increasingly incorporating digital verification and remote delivery services to enhance customer convenience. There has also been a surge in short-term and micro-leasing models, particularly for urban dwellers and gig economy workers. New regulations in various regions are influencing lease structures, especially those related to emissions and vehicle types. Furthermore, partnerships between automotive manufacturers and leasing platforms are expanding, aiming to offer customers more comprehensive and flexible mobility solutions. These trends indicate that the market is evolving rapidly in response to technological, economic, and social changes.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report: https://www.maximizemarketresearch.com/request-sample/67834/

Car Leasing Market Segmentation:

by Vehicle Type

Non Commercial Vehicles

Commercial Vehicles

by Type of Mode

Online

Offline

Close Market

by Services

Individual

Corporate

Some of the current players in the Car Leasing Market are:

1.Athlon Car Lease International BV

2.Avis Budget Group Inc.

3.Deutsche Leasing AG

4.Enterprise Holdings Inc.

5.ALD SA

6.Europcar Mobility Group SA

7.Hertz Global Holdings, Inc.

8.LeasePlan Corporation NV

9.Sixt SE

10.Wilmar Inc.

11.Merchants

12.Ewald Automotive Group

13.Arval Service Lease

14.United Leasing & Finance

15.Caldwell Leasing

16.Element Management Corp.

17.Emkay

18.Others

For additional reports on related topics, visit our website:

♦ Global Cat Litter Product Market https://www.linkedin.com/pulse/global-cat-litter-product-market-set-growth-o7c4f

♦ Rugs Market https://www.linkedin.com/pulse/rug-market-set-grow-48-cagr-through-2032-qjsgf

♦ Linux Operating System Market https://www.linkedin.com/pulse/global-linux-os-market-booms-projected-ybyyf

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Car Leasing Market Accelerates Toward USD 170.56 Billion by 2032 here

News-ID: 4098544 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

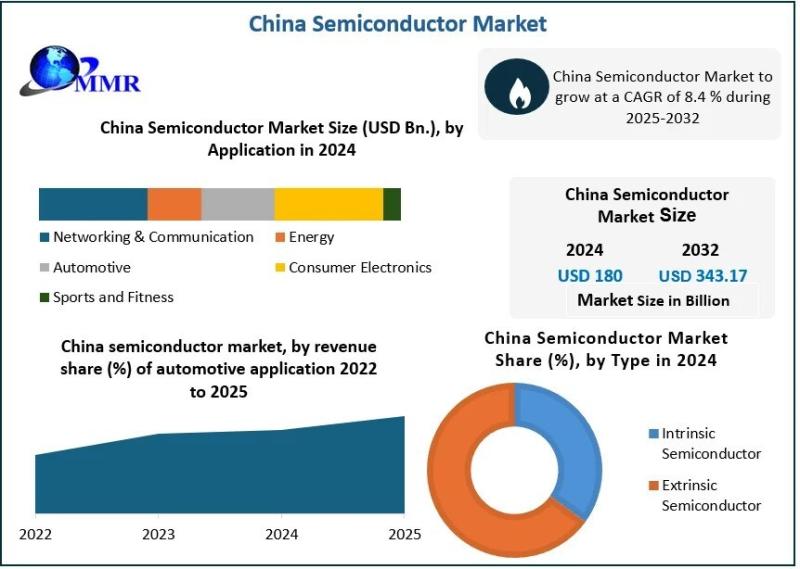

China Semiconductor Market Analysis: Projected to Grow from USD 180 Billion in 2 …

China Semiconductor Market size was valued at USD 180 Bn. in 2024, and the total China Semiconductor revenue is expected to grow by 8.4 % from 2025 to 2032, reaching nearly USD 343.17 Bn.

china-semiconductor-market Overview:

The China semiconductor market is one of the largest and most dynamic in the world, driving significant growth in the global tech industry. As China continues to expand its influence in high-tech manufacturing, the semiconductor market…

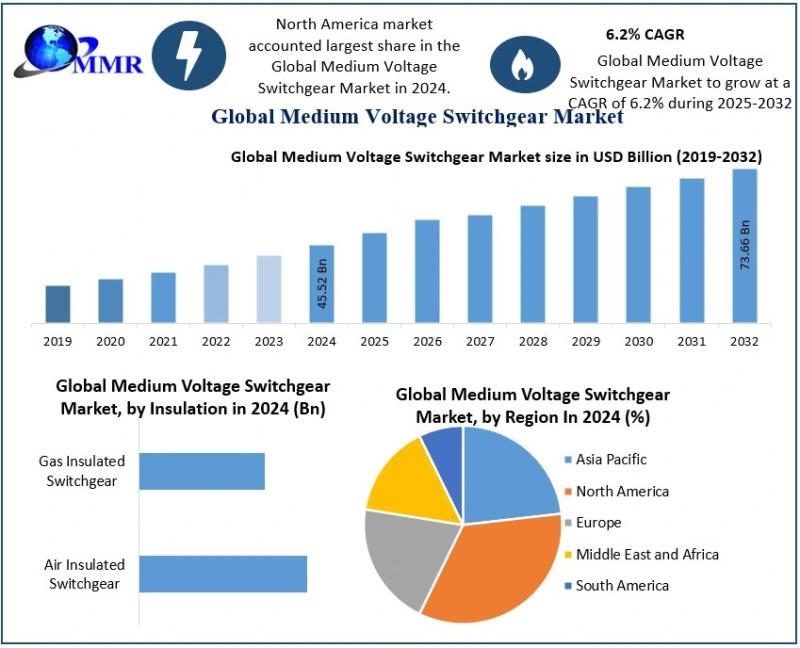

Medium Voltage Switchgear Market Analysis: 6.2% CAGR Driving Growth from USD 48. …

Medium Voltage Switchgear Market size was valued at USD 48.34 Billion in 2025 and the total Medium Voltage Switchgear revenue is expected to grow at a CAGR of 6.2% from 2025 to 2032, reaching nearly USD 73.65 Billion by 2032.

Medium-voltage Switchgear Market Overview:

The medium-voltage switchgear market plays a pivotal role in the global energy distribution landscape. These switchgear devices, typically operating between 1 kV and 72.5 kV, are critical for…

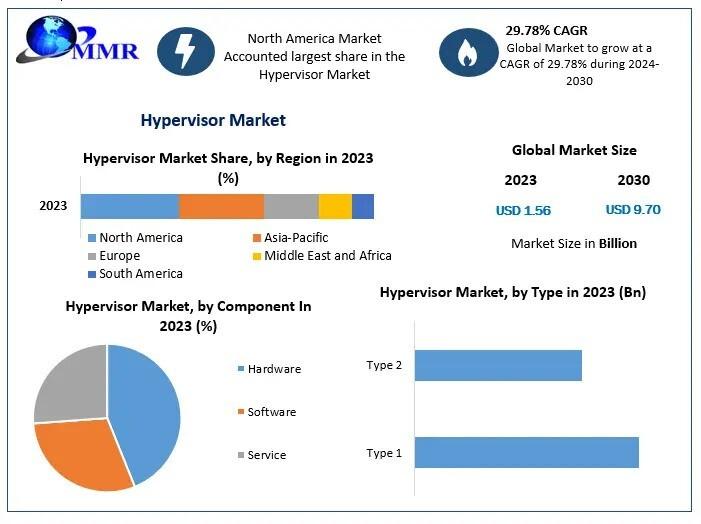

Hypervisor Market Analysis 2025-2030: Growth Rate of 29.78% and Market Value of …

Hypervisor Market size is estimated to grow at a CAGR of 29.78%. The market is expected to reach a value of US $ 9.70 Bn. in 2030.

Hypervisor Market Overview:

The hypervisor market, a critical component of virtualization technology, plays an essential role in the expansion of cloud computing, data centers, and IT infrastructure. By enabling multiple operating systems to run concurrently on a single physical machine, hypervisors streamline resource allocation and…

Cider Market Poised for Steady Growth, Expected to Reach USD 26.90 Billion by 20 …

The global Cider Market is witnessing a significant transformation driven by evolving consumer preferences, premiumization trends, and innovation in flavors and formats. Valued at USD 17.42 Billion in 2025, the market is projected to grow at a compound annual growth rate (CAGR) of 6.4% from 2025 to 2032, reaching nearly USD 26.90 Billion by 2032. This growth reflects cider's rising appeal as a refreshing, gluten-free, and lower-calorie alcoholic beverage alternative…

More Releases for Leasing

Financial Leasing Market: A Compelling Long-Term Growth Story | Minsheng Financi …

The latest 94+ page survey report on Financial Leasing Market is released by HTF MI covering various players of the industry selected from global geographies like North America, US, Canada, Mexico, Europe, Germany, France, U.K., Italy, Russia, Nordic Countries, Benelux, Rest of Europe, Asia, China, Japan, South Korea, Southeast Asia, India, Rest of Asia, South America, Brazil, Argentina, Rest of South America, Middle East & Africa, Turkey, Israel, Saudi Arabia,…

Financial Leasing Market 2019 Global Major Players: CDB Leasing, ICBC Financial …

The Global Financial Leasing Industry, 2019-2024 Market Research Report is a professional and in-depth study on the current state of the Global Financial Leasing industry with a focus on the Global market. The report provides key statistics on the market status of the Financial Leasing manufacturers and is a valuable source of guidance and direction for companies and individuals interested in the industry.

The report displays significant strategies which are…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Outlook to 2023 – CDB Leasing, ICBC Financial Leasing …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Request for Sample of Global Financial Leasing Market 2018 Research Report: https://www.researchreportsinc.com/sample-request?id=177516

Over the next five years, RRI…

Financial Leasing Market Outlook to 2023 – CDB Leasing, ICBC Financial Leasing …

Oct 2018, New York USA (News) - A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Request for Sample of Global Financial Leasing Market 2018 Research Report:…

Financial Leasing Market by Top Key Participant CDB Leasing, ICBC Financial Leas …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Get Sample Copy of this Report @ https://www.researchbeam.com/global-financial-leasing-by-manufacturers-countries-type-and-application-forecast-to-2023-market/request-sample?utm_source=Anil

Scope of the Report:

This report studies the Financial Leasing market…