Press release

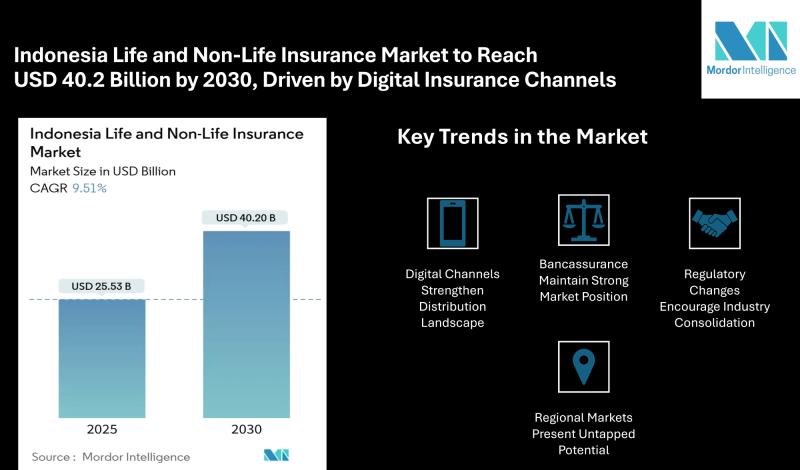

Indonesia Life and Non-Life Insurance Market to Reach USD 40.2 Billion by 2030, Driven by Digital Expansion and Regulatory Reforms

IntroductionMordor Intelligence has published a new report on the "Indonesia Life and Non-Life Insurance Market" offering a comprehensive analysis of trends, growth drivers, and future projections

Indonesia's life and non-life insurance market is forecast to reach USD 40.2 billion by 2030, highlighting steady progress in insurance penetration across the country. The sector's growth is underpinned by expanding digital channels, regulatory updates enhancing market stability, and rising demand for protection and investment-linked products. Life insurance remains the backbone of the market due to consistent consumer interest in financial planning and health protection, while non-life insurance is witnessing strong momentum from motor and health policies.

Report Overview: https://www.mordorintelligence.com/industry-reports/life-non-life-insurance-market-in-indonesia?utm_source=openpr

Key Trends

Life Insurance Retains Dominance but Faces New Challenges

Life insurance continues to account for the largest market share in Indonesia, driven by demand for savings-linked and health-focused products among middle-income consumers. However, insurers face challenges in diversifying portfolios as market maturity increases. Companies are focusing on developing simpler, affordable plans to appeal to younger demographics and first-time policyholders, while simultaneously improving after-sales service to reduce policy lapsation rates.

Non-Life Insurance Shows Accelerated Growth

Non-life insurance, encompassing motor, property, health, and marine segments, is expanding at a faster pace compared to life insurance. Rising vehicle ownership fuels the motor insurance segment, while increasing healthcare costs and awareness are driving demand for health insurance. Property insurance is also gaining traction, especially among commercial property owners seeking protection against operational risks. This diversified growth demonstrates that Indonesian consumers are gradually recognizing the value of insuring assets beyond life and health.

Digital Channels Strengthen Distribution Landscape

The market is witnessing a digital shift, with insurers investing in mobile apps and online platforms to simplify product access, payments, and claims processing. Younger, urban consumers are increasingly using digital channels for insurance purchases, preferring the ease of comparison, transparent information, and quick transactions. This trend also enables insurers to expand their reach to underinsured populations in semi-urban regions.

Bancassurance Maintains Strong Market Position

Bancassurance remains one of the leading distribution channels in Indonesia, accounting for a significant share of total premiums. Banks leverage their large customer base and branch networks to cross-sell insurance products, especially life and investment-linked plans. Insurers are forming strategic partnerships with major banks to co-develop products tailored to customers' savings and protection needs.

Regulatory Changes Encourage Industry Consolidation

Recent capital requirement reforms have prompted smaller insurers to merge or seek acquisition by financially stronger players to meet solvency standards. While this reduces market fragmentation and enhances financial stability, it also intensifies competition among top-tier insurers to maintain market share. Regulatory clarity around digital insurance sales is also expected to strengthen consumer trust and attract new entrants with innovative business models.

Sharia-Compliant Insurance and Micro-Insurance Gain Momentum

Indonesia's predominantly Muslim population drives growing interest in Takaful (Sharia-compliant insurance) products that align with religious beliefs. Micro-insurance is also expanding, targeting low-income groups with affordable premiums and simplified policies covering health, accidents, and life risks. These segments are crucial in deepening financial inclusion and reaching previously uninsured populations.

Regional Markets Present Untapped Potential

While Java remains the largest regional market for insurance due to urban concentration and income levels, growth in outer islands such as Sumatra, Kalimantan, Sulawesi, and eastern provinces is accelerating. Infrastructure development and the rise of digital distribution channels facilitate insurer expansion into these regions, where insurance awareness is gradually improving.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/life-non-life-insurance-market-in-indonesia?utm_source=openpr

Market Segmentation

Indonesia's insurance market is segmented into:

By Insurance Type:

Life Insurance: Term life, whole life, group life, and critical illness policies

Non-Life Insurance: Motor, property, health, marine, and travel insurance

By Distribution Channel:

Bancassurance

Direct sales (agents and brokers)

Online/digital platforms

Other channels including partnerships and community-based marketing

By Premium Type:

Single-premium policies

Regular-premium policies

By Policy Term:

Short-term policies

Long-term policies

By Purchase Mode (Life Insurance):

Individual

Group policies

By End User:

Individual customers

Corporate and group customers

By Region:

Java

Sumatra

Kalimantan

Sulawesi

Papua & Maluku

Other regions

Explore Our Full Library of Financial Services and Investment Intelligence Research Industry Reports: https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=openpr?utm_source=openpr

Key Players

Key insurers driving Indonesia's life and non-life insurance market include:

PT Prudential Life Assurance - Leading the life insurance segment with a strong portfolio of health and savings-linked products.

PT Asuransi Astra Buana - Well-established in the non-life segment, particularly motor and property insurance.

PT Allianz Life Indonesia - Offers a broad range of life and health insurance products catering to middle and upper-income customers.

PT AIA Financial - Focused on life and group insurance products with strong distribution partnerships.

PT Asuransi Sinar Mas - Operates across life and non-life insurance with competitive motor and property offerings.

These companies compete alongside other players such as Manulife Indonesia, AXA Financial Indonesia, Zurich, Chubb, and Tokio Marine, ensuring healthy competition and a wide choice of products for consumers.

Explore more details about Indonesia Life and Non-Life Insurance Market Competitive Landscape: https://www.mordorintelligence.com/industry-reports/life-non-life-insurance-market-in-indonesia/companies?utm_source=openpr

Conclusion

Indonesia's life and non-life insurance market is entering a dynamic phase marked by digital transformation, regulatory clarity, and shifting consumer expectations. While life insurance maintains its leadership due to strong savings and protection needs, non-life insurance is catching up quickly, driven by motor, health, and property segments. The expansion of digital channels, bancassurance, micro-insurance, and Takaful products creates opportunities to reach underinsured populations and strengthen financial inclusion. Insurers that adapt quickly to regulatory requirements and evolving customer preferences will be well-positioned to thrive in Indonesia's evolving insurance landscape.

For complete market analysis, visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/life-non-life-insurance-market-in-indonesia?utm_source=openpr

Industry Related Reports

India Life And Non-Life Insurance Market: The India Life and Non-Life Insurance Market is Segmented by (Life Insurance, (endowment, Term-Life, Whole-Life, Unit-Linked and More), Non-Life Insurance (Motor, Health, Fire and Engineering, Marine and Cargo and More), Distribution Channel (Agency, Bancassurance, Direct and More), Customer Type (Individual and Group) and Region. The Market Forecasts are Provided in Terms of Value (USD).

Get more insights: https://www.mordorintelligence.com/industry-reports/life-non-life-insurance-market-in-india?utm_source=openpr

Australia Life And Non-life Insurance Market: Australia Life and Non-Life Insurance Market is Segmented by Insurance Type (Life Insurance and Non-Life Insurance), Distribution Channel (Direct, Brokers, Banks, and More), Customer Segment (Individual Policyholders, Small & Medium Enterprises, and More), Premium Frequency (Regular Premium and Single Premium), and Region.

Get more insights: https://www.mordorintelligence.com/industry-reports/life-non-life-insurance-market-in-australia?utm_source=openpr

UAE Health And Medical Insurance Market: The UAE Health and Medical Insurance Market is Segmented by Insurance Type (Individual, Group), by Service Provider (Private Health Insurance Providers, Public/Social Health Insurance Schemes), by Distribution Channel (Direct Sales, Online Sales, Brokers/Agents, and Banks), by End-User/Customer Type (Corporate/Employer, Individual/Families, and More), and Region. The Market Forecasts are Provided in Value (USD).

Get more insights: https://www.mordorintelligence.com/industry-reports/uae-health-and-medical-insurance-market?utm_source=openpr

Singapore Life And Non-Life Insurance Market: The Singapore Life and Non-Life Insurance Market is Segmented by Insurance Type (Life (Term, Whole Life and More), Non-Life (Motor, Health, Property, Liability, Travel, and More)), Distribution Channel (Agents, Bancassurance, Brokers and More), End-Users (Individuals, Sme's and More), Premium Type (New Business, Renewal) and Region.

Get more insights: https://www.mordorintelligence.com/industry-reports/life-non-life-insurance-market-in-singapore

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Indonesia Life and Non-Life Insurance Market to Reach USD 40.2 Billion by 2030, Driven by Digital Expansion and Regulatory Reforms here

News-ID: 4092882 • Views: …

More Releases from Mordor Intelligence

Egypt Residential Construction Market to Reach USD 29.96 Billion by 2031 as Gove …

Mordor Intelligence has published a new report on the offering a Egypt Residential Construction comprehensive analysis of trends, growth drivers, and future projections

Egypt Residential Construction Market Overview

According to Mordor Intelligence, the Egypt residential construction market size was valued at USD 18.80 billion in 2025 and expanded to USD 20.32 billion in 2026, with the market forecast to reach USD 29.96 billion by 2031. This growth outlook reflects the…

Canned Meat Market Size to Reach USD 22.69 Billion by 2031 as Protein Demand and …

The global canned meat market size is projected to expand from usd 18.61 billion in 2026 to usd 22.69 billion by 2031, registering a cagr of 4.04% during the forecast period, according to Mordor Intelligence. This steady expansion reflects rising reliance on shelf-stable protein sources, changing household structures, and growing institutional procurement across both developed and emerging economies. The canned meat industry continues to benefit from its dual positioning as…

Canned Alcoholic Beverages Market Size to Reach USD 48.78 Billion by 2030 as RTD …

The Global canned alcoholic beverages market size is projected to expand from USD 34.81 billion in 2025 to USD 48.78 billion by 2030, registering a CAGR of 6.98% during the forecast period, according to Mordor Intelligence. This steady expansion reflects a structural shift in alcohol consumption toward convenient, portable, and premium-ready formats.

The Canned Alcoholic Beverages Industry is benefiting from changing lifestyle patterns, growing demand for ready-to-drink (RTD) options, and increasing…

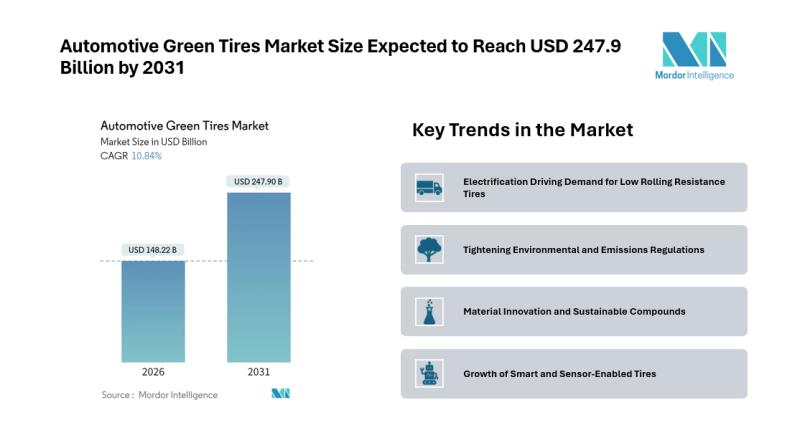

Automotive Green Tires Market Size Expected to Reach USD 247.9 Billion by 2031 - …

Introduction

The Automotive Green Tires Market is gaining traction as sustainability, fuel efficiency, and emissions reduction become central priorities for automotive manufacturers and regulators. According to Mordor Intelligence, the Automotive Green Tires market size is expected to grow from USD 133.73 billion in 2025 to USD 148.22 billion in 2026, and is forecast to reach USD 247.90 billion by 2031, registering a CAGR of 10.84% during the 2026-2031 forecast period.…

More Releases for Life

Life Heater Reviews - How Does Life Heater Work? Read life heater reviews consum …

The Life Heater emerges as a revolutionary heating solution, redefining efficiency and safety standards for residents in the United States and Canada. More than a conventional heater, it boasts impressive energy savings of up to 30%, making it a beacon of sustainability in the realm of home heating. The device's convection heating system ensures rapid warmth, promising to elevate the comfort of spaces across North American homes with unprecedented speed.

The…

Russia Life Insurance Market to Eyewitness Massive Growth by 2026 | Renaissance …

A new research document is added in HTF MI database of 74 pages, titled as 'Russia Life Insurance - Key Trends and Opportunities to 2025' with detailed analysis, Competitive landscape, forecast and strategies. Latest analysis highlights high growth emerging players and leaders by market share that are currently attracting exceptional attention. The identification of hot and emerging players is completed by profiling 50+ Industry players; some of the profiled…

Life Insurance Market is Booming Worldwide | Sumitomo Life Insurance, Nippon Lif …

HTF MI recently added Global Life Insurance Market Study that gives deep analysis of current scenario of the Market size, demand, growth, trends, and forecast. Revenue for Life Insurance Market has grown substantially over the five years to 2019 as a result of strengthening macroeconomic conditions and healthier demand, however with current economic slowdown and Face-off with COVID-19 Industry Players are seeing Big Impact in operations and identifying ways to…

Online Life Insurance Market Swot Analysis by Key Players Nippon Life Insurance, …

Global Online Life Insurance Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Online…

Life Insurance Market Next Big Thing with Major Giants HDFC Life Insurance, SBI …

A new business intelligence report released by HTF MI with title "Life Insurance Market in India 2019" is designed covering micro level of analysis by manufacturers and key business segments. The Life Insurance Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and it comprises both qualitative and quantitative detailing. Some of…

Life Insurance Market to Witness Massive Growth| Allan Gray Life, Coronation Lif …

HTF Market Intelligence released a new research report of 35 pages on title 'Strategic Market Intelligence: Life Insurance in South Africa - Key Trends and Opportunities to 2022' with detailed analysis, forecast and strategies. The study covers key regions and important players such as Allan Gray Life, Coronation Life Assurance, Sygnia Life etc.

Request a sample report @ https://www.htfmarketreport.com/sample-report/1854964-strategic-market-intelligence-38

Summary

The ""Strategic Market Intelligence: Life Insurance in South Africa - Key Trends…