Press release

Online Payment Fraud Detection Market to Reach US$ 19.99 Bn by 2032 Amid Rising Cybercrime and AI-Driven Solutions

✅Rapid Growth at 13.8% CAGR Driven by Increasing Digital Transactions and Real-Time Threat Detection NeedsAccording to the latest study by Persistence Market Research, the global online payment fraud detection market is projected to grow significantly from US$ 8,090.8 Mn in 2025 to US$ 19,997.9 Mn by 2032, registering a robust CAGR of 13.8% during the forecast period. This surge is largely driven by the unprecedented rise in online payment activity, the proliferation of digital wallets and e-commerce platforms, and the increasing sophistication of cyber threats. As businesses and consumers adopt digital payment methods, the need for advanced fraud detection tools has become paramount to protect sensitive data and maintain transaction integrity.

The market is experiencing strong momentum across industries, particularly in financial services, retail, and e-commerce, where real-time fraud detection and customer trust are critical. Key growth drivers include the growing volume of online transactions, regulatory pressures to secure customer data, and technological advancements in artificial intelligence (AI), machine learning (ML), and behavioral analytics. Among the segments, banking and financial services hold the largest share due to their high-risk profile and investment in fraud prevention technologies. North America emerges as the leading geographical region, attributed to a high concentration of digital transactions, stringent cybersecurity regulations, and early adoption of fraud detection platforms. Meanwhile, Asia Pacific is rapidly emerging as a high-growth region, spurred by increasing smartphone penetration and rising e-commerce activities.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.persistencemarketresearch.com/samples/33078

✅Key Market Insights

➤ Real-time fraud detection systems are increasingly being adopted to proactively identify and mitigate payment fraud before it occurs.

➤ AI and machine learning technologies are enhancing the accuracy and speed of fraud detection tools across industries.

➤ Regulatory mandates such as PSD2 in Europe and data protection laws globally are compelling enterprises to invest in fraud prevention.

➤ Mobile payment fraud is growing, especially with the rise of digital wallets and contactless transactions.

➤ The shift toward cloud-based fraud detection solutions is enabling scalability and cost-efficiency for enterprises of all sizes.

✅Why is fraud detection important in online payments?

Fraud detection in online payments is crucial to protect users and organizations from financial loss, identity theft, and data breaches. As digital payments become more prevalent, cybercriminals are constantly developing sophisticated tactics to exploit vulnerabilities. Effective fraud detection systems use AI, behavioral analytics, and real-time monitoring to identify suspicious activities, flag anomalies, and prevent unauthorized transactions. Beyond financial security, these systems help maintain customer trust, ensure regulatory compliance, and uphold brand reputation. For businesses, timely fraud detection also minimizes chargebacks and operational disruptions, contributing to long-term profitability and sustainability in the digital economy.

✅Market Dynamics

Market Drivers:

The increasing digitalization of financial services, rise in online retailing, and growing use of mobile payments are the primary forces driving market growth. Cyber threats are becoming more complex, with fraudsters leveraging automation, synthetic identities, and phishing attacks. This has led to a surge in demand for intelligent fraud detection systems capable of real-time risk analysis, user behavior profiling, and adaptive learning.

Market Restraining Factor:

Despite the growth, the high cost of implementing and maintaining sophisticated fraud detection systems can be a deterrent, especially for small and medium-sized enterprises (SMEs). Additionally, integrating these systems with existing IT infrastructures often poses challenges in terms of compatibility and resource allocation. Privacy concerns around user data collection and analysis also create resistance among consumers and regulators alike.

Key Market Opportunity:

An emerging opportunity lies in the development of fraud detection solutions tailored for SMEs, offering scalable, cost-effective tools that require minimal IT overhead. Furthermore, the integration of biometric authentication, blockchain, and multi-factor authentication (MFA) presents new possibilities for strengthening payment security across sectors. The untapped potential in developing regions, where online payments are rapidly growing, also offers a fertile ground for market expansion.

✅Market Segmentation

The online payment fraud detection market is segmented by component, deployment mode, application, organization size, and industry vertical. By component, it is divided into solutions and services, with solutions holding the dominant share due to the demand for real-time fraud detection tools. These include identity verification, authentication, and transaction monitoring solutions. Services such as managed services and professional consulting are also growing rapidly as organizations seek expert guidance for deploying and managing advanced security systems.

In terms of industry vertical, the market spans across banking and financial services, retail and e-commerce, IT and telecom, travel, healthcare, and others. The banking and financial services segment remains the frontrunner due to the sector's susceptibility to payment fraud and stringent compliance requirements. Meanwhile, retail and e-commerce is the fastest-growing segment, driven by the exponential growth in digital shopping, especially post-pandemic. Deployment-wise, cloud-based solutions are gaining preference due to their flexibility, cost-effectiveness, and scalability. On the basis of organization size, large enterprises lead the market, but SMEs are showing increasing interest, supported by the availability of subscription-based fraud detection platforms.

✅Regional Insights

North America leads the online payment fraud detection market, accounting for the largest revenue share. The region's early adoption of digital payments, high internet penetration, and stringent data security regulations contribute to its market dominance. The presence of major technology vendors and continuous investment in cybersecurity further bolster regional growth. Europe follows closely, driven by compliance with regulations like PSD2 and GDPR, which mandate strong customer authentication and fraud monitoring.

Asia Pacific is projected to witness the highest growth rate during the forecast period. The proliferation of smartphones, expansion of e-commerce, and government initiatives supporting digital payments in countries like China, India, and Southeast Asian nations are key contributors. Latin America and the Middle East & Africa are emerging markets, where rising internet usage and fintech developments are expected to increase the demand for online payment fraud detection solutions in the coming years.

✅Competitive Landscape

The market is highly competitive, with established players focusing on innovation, partnerships, and acquisitions to expand their offerings and global footprint. These companies are investing heavily in AI and data analytics to enhance fraud detection capabilities.

✅Company Insights

✦ ACI Worldwide

✦ NICE Actimize

✦ SAS Institute Inc.

✦ FICO

✦ LexisNexis Risk Solutions

✦ Experian

✦ IBM Corporation

✦ RSA Security

✦ Signifyd

✦ Riskified

✦ Kount (an Equifax company)

✦ Fraud.net

✦ PayPal Holdings, Inc.

For Customized Insights on Segments, Regions, or Competitors, Request Personalized Purchase Options @ https://www.persistencemarketresearch.com/request-customization/33078

✅Key Industry Developments

Recent industry developments highlight the growing importance of partnerships and technology integration. For instance, NICE Actimize has launched advanced AI-powered analytics tools designed to detect payment anomalies and mitigate fraud in real-time. Similarly, LexisNexis Risk Solutions expanded its fraud detection suite with behavioral biometrics capabilities, enabling more accurate identity verification.

Meanwhile, PayPal has enhanced its fraud protection features across its payment gateway, offering merchants advanced tools for detecting chargebacks and unauthorized transactions. Startups like Riskified and Signifyd are also innovating with AI-powered fraud scoring systems that assess user behavior, device fingerprinting, and geolocation to block fraudulent activity at checkout.

✅Innovation and Future Trends

The future of the online payment fraud detection market is closely tied to AI, machine learning, and behavioral analytics. AI-driven models are becoming more adept at identifying fraud patterns, self-learning from false positives, and adapting to new fraud tactics in real time. Behavioral biometrics, such as keystroke dynamics and mouse movements, are being integrated into fraud detection tools to build user-specific profiles that can instantly identify suspicious behavior.

In addition, blockchain technology is being explored for its ability to provide tamper-proof transaction records, enhancing transparency and traceability. The rise of embedded finance and Buy Now Pay Later (BNPL) services is expected to reshape the fraud landscape, prompting new security models. Future fraud detection systems will be increasingly cloud-native, API-driven, and designed for seamless integration across multiple payment platforms and customer touchpoints. These innovations will be vital to ensuring trust and security in the rapidly evolving digital economy.

✅Explore the Latest Trending "Exclusive Article" @

• https://techxpresstoday.wordpress.com/2025/07/03/pedestrian-entrance-control-systems-market-demand-rising-with-urban-security-needs/

• https://medium.com/@apnewsmedia/pedestrian-entrance-control-systems-market-share-by-leading-companies-5be92142b953

• https://vocal.media/stories/pedestrian-entrance-control-systems-market-growth-trends-and-future-outlook

• https://apsnewsmedia.blogspot.com/2025/07/automotive-camera-cleaning-system.html

• https://www.manchesterprofessionals.co.uk/article/information-technology/96656/pedestrian-entrance-control-systems-market-overview-and-key-insights

✅Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

✅About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Payment Fraud Detection Market to Reach US$ 19.99 Bn by 2032 Amid Rising Cybercrime and AI-Driven Solutions here

News-ID: 4092032 • Views: …

More Releases from Persistence Market Research

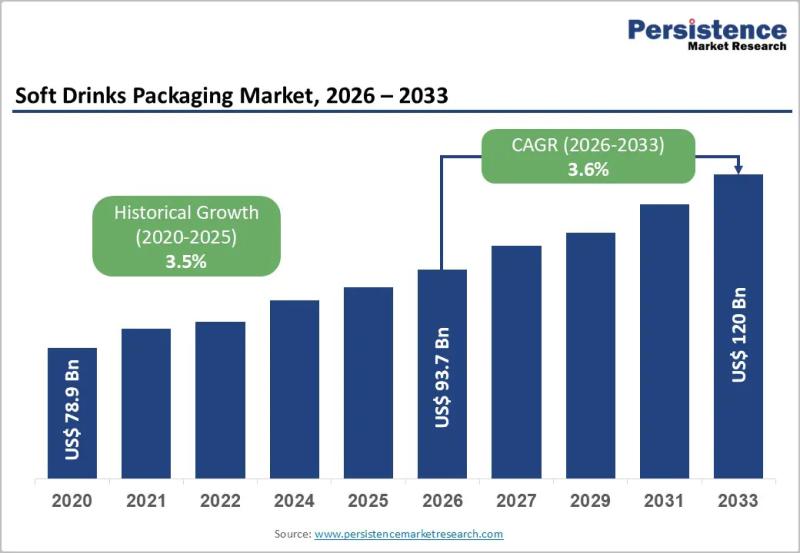

Soft Drinks Packaging Market to Reach US$120.0 Billion by 2033 - Persistence Mar …

The soft drinks packaging market plays a central role in the global beverage industry, serving carbonated drinks, juices, flavored water, energy drinks, and ready to drink teas and coffees. Packaging is no longer limited to containment and transportation; it has evolved into a critical component of branding, sustainability strategy, consumer convenience, and supply chain efficiency. Manufacturers are increasingly focusing on lightweight materials, recyclable packaging formats, and innovative designs that improve…

Christmas Tree Valves Market Size to Reach US$8.1 Billion by 2033 - Persistence …

The Christmas Tree Valves Market plays a critical role in the upstream oil and gas industry, serving as a central component in wellhead equipment systems. Christmas tree valves are installed on oil and gas wells to control pressure, regulate flow, and ensure safe extraction of hydrocarbons. These assemblies, commonly referred to as "Christmas trees," consist of multiple valves, spools, and fittings arranged in a structure that resembles a decorated tree.…

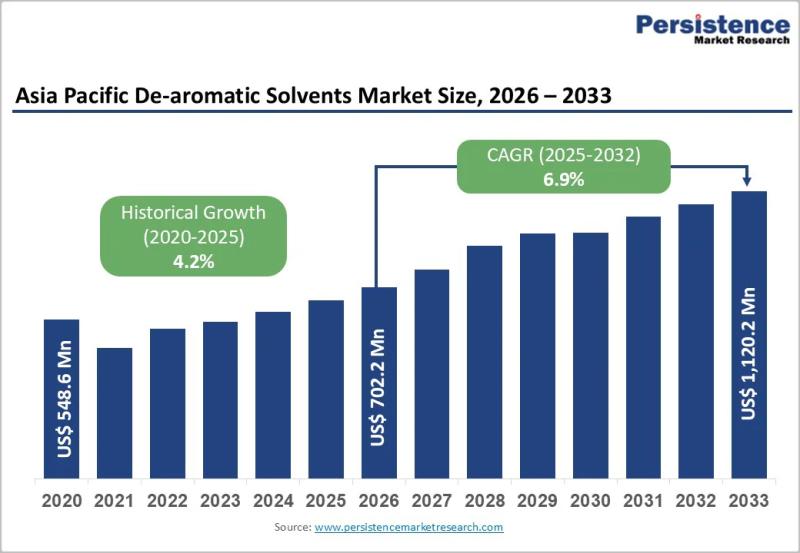

Asia Pacific De-aromatic Solvents Market to Reach US$1,120.2 Million by 2033 - P …

The Asia Pacific De-aromatic Solvents Market is gaining steady momentum as industries across the region increasingly shift toward low aromatic, high purity solvent formulations. De-aromatic solvents are hydrocarbon solvents that have significantly reduced aromatic content, making them suitable for applications requiring low odor, lower toxicity, and improved environmental performance. These solvents are widely used in paints and coatings, adhesives, inks, metalworking fluids, agrochemicals, and cleaning formulations. As regulatory scrutiny around…

Off-Highway Radiators Market to Reach US$ 7.2 Bn by 2033 as Leading Players Like …

The off-highway radiators market plays a vital role in ensuring efficient thermal management in heavy-duty equipment used across construction, agriculture, mining, and forestry sectors. These radiators regulate engine temperatures, prevent overheating, and support consistent equipment performance under extreme operating conditions. Growing mechanization and the expansion of infrastructure projects worldwide are increasing reliance on durable cooling systems. Equipment manufacturers are prioritizing high-performance radiators that offer reliability, longer service life, and resistance…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…