Press release

Surging Housing Costs Fueling Growth In Household Lending Market: Critical Driver Shaping the Household Lending Market in 2025

Stay ahead with our updated market reports featuring the latest on tariffs, trade flows, and supply chain transformations.Household Lending Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

Over the past few years, there has been a robust growth in the size of the household lending market. The projection is a rise from $5039.6 billion in 2024 up to $5535.2 billion in 2025, marking a compound annual growth rate (CAGR) of 9.8%. Factors that have contributed to the growth during the historic period include interest rates, monetary policy, state of the economy and employment trends. Additionally, government policies, housing programmes, consumer spending habits and confidence, risk appetite as well as credit market conditions have also played a significant role.

Household Lending Market Size Forecast: What's the Projected Valuation by 2029?

The size of the household lending market is projected to undergo robust expansion in the next few years. It is estimated that it will escalate to $8064.37 billion in 2029, with a compound annual growth rate (CAGR) of 9.9%. The anticipated growth during this period can be credited to demographic changes and population movements, shifts in societal financial habits, worldwide economic factors, and trade trends, along with innovations in loan offerings and frameworks. The forecast period is expected to observe trends such as the adoption of alternative credit score methods, the move towards securitizing household loans, the introduction of open banking systems, an emphasis on responsible and ethical lending, and the incorporation of blockchain technologies.

View the full report here:

https://www.thebusinessresearchcompany.com/report/household-lending-global-market-report

What Are the Drivers Transforming the Household Lending Market?

An anticipated surge in the cost of housing is predicted to fuel the expansion of the domestic lending industry in the near future. The term housing expenses encompasses rent and mortgage payments, encompassing both principal repayment and mortgage interest. A broader definition also includes obligatory service and charge costs, regular upkeep and repair expenses, taxes, and utility bills. The escalation in housing prices constrains a person's ability to fully purchase a house with cash, incentivizing them to borrow. Hence, the escalating housing costs are stimulating the household lending market's growth. For example, data from the Federal Housing Finance Agency, an independent federal entity in the US functioning as the regulatory replacement for the Federal Housing Finance Board, indicates that from the third quarter of 2021 to 2022, the price of homes in the United States rose by 12.4%. This was a slight uptick of 0.1 percent compared to the second quarter of 2022. Consequently, this steep rise in housing costs is a key driver for the household lending market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=9752&type=smp

What Long-Term Trends Will Define the Future of the Household Lending Market?

Leading businesses in the domestic lending sector are channeling their efforts towards creation of inventive solutions like wholly online residential loans to make the loaning process smoother. Fully digital home loans entail an entirely web-based procedure for applications, approvals, and administration of a house loan, eliminating the need for paper documentation and face-to-face discussions. For instance, the ANZ Banking Group, a financial establishment headquartered in Australia, introduced a remarkable product in November 2023, a full-on digital home loan for qualified residents of metropolitan areas in New South Wales and Victoria, looking to refinance. Launched via their ANZ Plus mobile app, it promises faster approvals, often within minutes, coupled with upfront property value estimates. The loan process is simplified, with a competitive variable interest rate of 6.14%, making it easy for users to monitor their applications.

Which Segments in the Household Lending Market Offer the Most Profit Potential?

The household lending market covered in this report is segmented -

1) By Types: Fixed Rate Loans, Home Equity Line Of Credit

2) By Service Providers: Banks, Online, Credit Union, Other Service Providers

3) By Source: Mortgage And Credit Union, Commercial Banks, Other Sources

4) By Interest Rate: Fixed-Rate Mortgage Loan, Adjustable-Rate Mortgage Loan

Subsegments:

1) By Fixed Rate Loans: Conventional Fixed Rate Mortgages, FHA Fixed Rate Loans, VA Fixed Rate Loans, USDA Fixed Rate Loans

2) By Home Equity Line Of Credit (HELOC): Variable Rate HELOC, Fixed Rate HELOC, Interest-Only HELOC

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=9752&type=smp

Which Firms Dominate the Household Lending Market by Market Share and Revenue in 2025?

Major companies operating in the household lending market include Bank of America Corporation, JPMorgan Chase & Co., Pentagon Federal Credit Union, Discover Financial Services Inc., LoanDepot.com LLC, Spring EQ LLC, Australia and New Zealand Banking Group Limited, Barclays plc, Citizens Commerce Bancshares Inc., Commonwealth Bank of Australia, Flagstar Bancorp Inc., HSBC Holdings plc, Navy Federal Credit Union, Roostify Inc., Royal Bank of Canada, Alltru Credit Union, American Express Company, Earnest Inc., Figure Technologies Inc., Even Financial Inc., First Tech Federal Credit Union, Happy Money Inc., Kikoff Inc., Klarna Bank AB, LendingClub Corporation, LendingUSA LLC, Mission Lane LLC, The Goldman Sachs Group Inc., Mariner Finance LLC, MoneyKey Inc., MoneyLion Inc., M&T Bank Corporation, Enova International Inc., OneMain Financial Holdings Inc., Oportun Inc., OppFi Inc., Peerform Inc., PNC Financial Services Group Inc., Prosper Marketplace Inc.

Which Regions Offer the Highest Growth Potential in the Household Lending Market?

North America was the largest region in the household lending market in 2024. The regions covered in the household lending market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=9752

This Report Supports:

1. Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2. Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3. Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4. Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Learn More About The Business Research Company

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Surging Housing Costs Fueling Growth In Household Lending Market: Critical Driver Shaping the Household Lending Market in 2025 here

News-ID: 4089312 • Views: …

More Releases from The Business Research Company

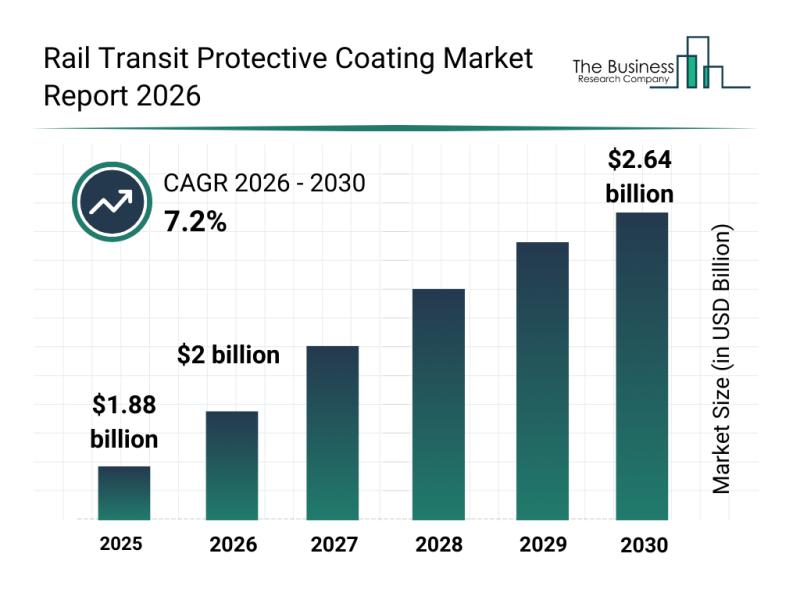

Rail Transit Protective Coating Market Overview: Major Segments, Strategic Devel …

The rail transit protective coating sector is positioned for significant expansion in the coming years, driven by technological advancements and increasing infrastructure investments. This market is evolving rapidly as stakeholders prioritize durability, sustainability, and efficiency in rail transit systems. Let's explore the market's valuation projections, leading companies, emerging trends, and detailed segment analysis to get a clearer understanding of its future trajectory.

Expected Market Size and Growth Outlook for Rail Transit…

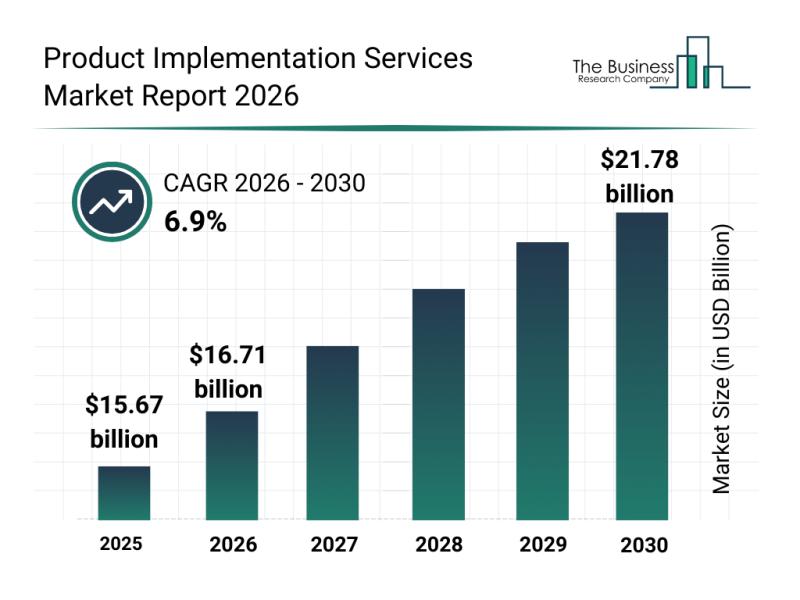

Analysis of Segments and Major Growth Areas in the Product Implementation Servic …

The product implementation services sector is on the verge of significant expansion, driven by evolving technology needs and increasing enterprise adoption of sophisticated systems. Understanding the current market size, key contributors, emerging trends, and segment breakdowns offers valuable insights into what lies ahead for this dynamic industry.

Market Size and Expected Growth Trajectory in the Product Implementation Services Market

The product implementation services market is projected to experience strong growth…

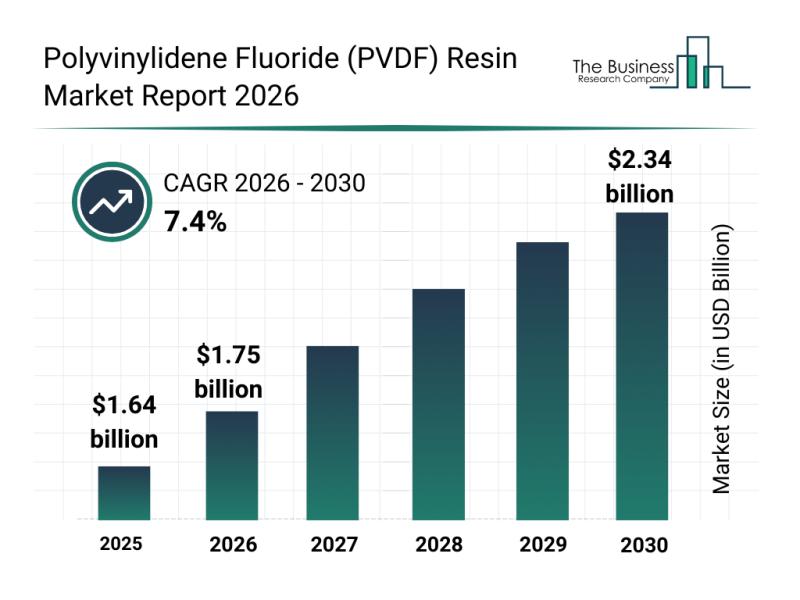

Key Strategic Developments and Emerging Changes Shaping the Polyvinylidene Fluor …

The polyvinylidene fluoride (PVDF) resin market is on track for significant expansion over the coming years. Driven by various technological advances and rising demands across multiple industries, this sector is expected to evolve rapidly. Let's explore the anticipated market growth, influential players, key trends, and detailed segmentation shaping the future of PVDF resin.

Projected Growth and Market Size of the Polyvinylidene Fluoride Resin Market

The PVDF resin market is forecasted…

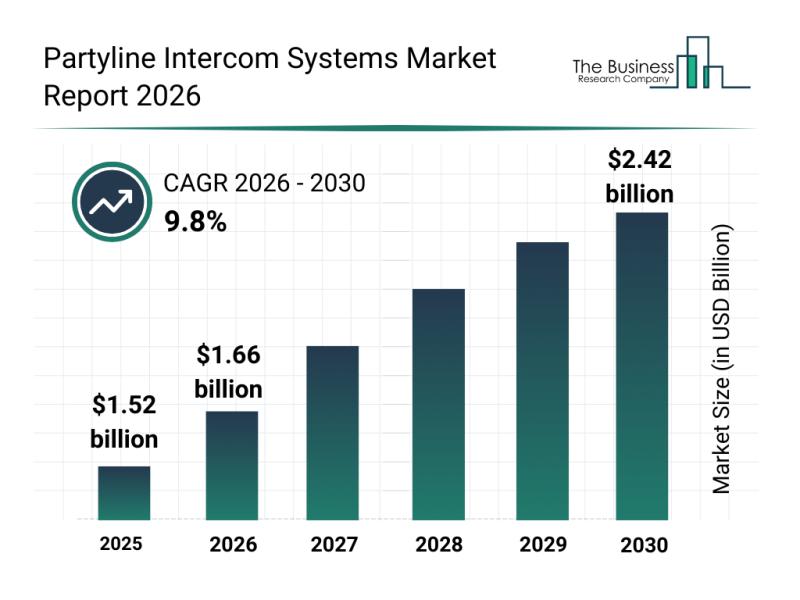

Leading Companies Fueling Innovation and Growth in the Partyline Intercom System …

The partyline intercom systems market is gearing up for significant expansion as communication needs evolve across various industries. With increasing demand for more versatile and efficient communication tools, this sector is set to witness rapid advancements and growing adoption over the coming years. Let's explore the market size projections, key drivers, major players, emerging trends, and important segments shaping this dynamic industry.

Projected Market Size and Growth Trajectory of the Partyline…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…