Press release

Global Facade Market 2025 2033: Trends, Forecast & Smart Facades Insights

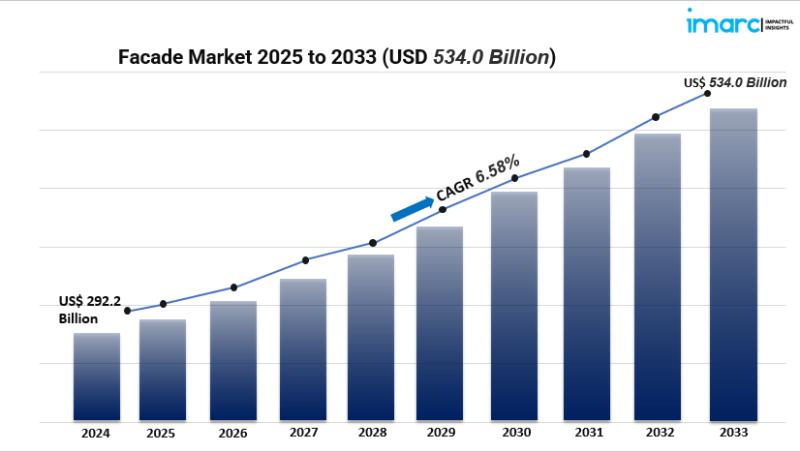

Market OverviewThe global facade market reached USD 292.2 billion in 2024 and is projected to surge to USD 534.0 billion by 2033, growing at a 6.58% CAGR. Driven by rapid urbanization, rising focus on sustainability & energy efficiency, and strict regulations, the market is also propelled by ongoing innovations in smart facades and increasing renovation of aging infrastructure.

Study Assumption Years

• Base Year: 2024

• Historical Year: 2019-2024

• Forecast Year: 2025-2033

Facade Market Key Takeaways

• Market Size & Growth: From USD 292.2 billion in 2024 to USD 534.0 billion by 2033, at a CAGR of 6.58%.

• Regional Leader: North America holds the largest share, spurred by regulation and green building initiatives.

• Product Type: Ventilated facades dominate due to energy efficiency, acoustics, and maintenance benefits.

• Material Trends: Glass leads for aesthetics and insulation, while metal follows for durability and recyclability.

• End Use Focus: Commercial buildings are the top segment, emphasizing brand image and employee well being.

• Technological Edge: Smart facades, including self-cleaning surfaces, dynamic glass, IoT sensors, and PV integration, are rapidly growing.

Market Growth Factors

1. Urbanization & Infrastructure Development

Rising global urbanization is fueling a significant boom in construction across various sectors, including residential, commercial, and public infrastructure like hospitals and schools. This growth calls for high-quality facades that not only serve practical purposes but also enhance aesthetics while providing protection against the elements-think wind, rain, and heat. As cities expand, architects are increasingly leaning towards ventilated facades to help regulate internal temperatures and boost energy efficiency. With reduced reliance on HVAC systems, building owners are discovering substantial long-term savings. Plus, facades play a crucial role in shaping architectural identities, allowing for customization in texture and design, and supporting the transition to green buildings and sustainable urban development.

2. Sustainability & Regulatory Impact

Governments around the globe are tightening green building codes and emissions standards, which is driving up the demand for eco-friendly facades. Materials such as energy-efficient glass and bio-based systems are helping to lower carbon footprints and cut down on energy consumption. These regulations, along with incentives like tax rebates, are encouraging developers to embrace thermally efficient facade systems. The outcome? Buildings that use less energy indoors, lower heating and cooling loads, and meet environmental goals. Facades made from recyclable or naturally sourced materials further enhance the market's sustainability credentials.

3. Innovation & Smart Technology Integration

Technological advancements are transforming the functionality of facades. Self-cleaning coatings minimize maintenance, while dynamic glass adjusts to varying light conditions. The incorporation of photovoltaic cells turns facades into power generators. IoT-enabled sensors allow for real-time performance monitoring, managing temperature, light, and user comfort. These innovations not only enhance energy efficiency but also add an interactive, intelligent architectural flair, making them highly valuable assets. As a result, tech-savvy developers and urban planners are increasingly investing in smart facade systems.

Request for a sample copy of this report: https://www.imarcgroup.com/facade-market/requestsample

Market Segmentation

By Product Type

• Ventilated - Incorporates an air gap to regulate internal climate and improve energy efficiency.

• Non Ventilated - Traditional facades without air gaps, focusing on aesthetics and insulation.

• Others - Includes hybrid or specialty facade types not covered by standard categories.

By Material

• Glass - Provides natural lighting and thermal insulation; favoured in commercial & high rise buildings.

• Metal - Involves durable, low maintenance materials like aluminum and steel; recyclable.

• Plastic and Fiber - Lightweight, cost effective, suitable for residential/lower rise settings.

• Stones - Natural, long lasting materials like granite and marble; used in luxury or heritage projects.

• Others - Covers wood, composite, and other niche materials meeting specific functional or aesthetic needs.

By End Use

• Commercial - Primary focus on brand image, smart features, and employee well being.

• Residential - Homes emphasizing energy efficiency and visual appeal.

• Industrial - Factories and warehouses requiring durable, functional facades.

Breakup by Region

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

Regional Insights

North America dominates the facade market, driven by stringent energy and green building regulations, government incentives, and robust commercial development. Aging infrastructure prompts large-scale renovation projects, favoring energy efficient smart facades. With high environmental awareness and tech savvy architects, this region leads in implementing dynamic glass, IoT enabled sensors, and photovoltaic-integrated facades.

Recent Developments & News

Exciting innovations are transforming the facade industry: in July 2021, Rockwool North America opened a state-of-the-art stone wool insulation facility featuring advanced emission controls. Then, in September 2022, Saint Gobain made a significant investment in BIPV specialist Megasol, enhancing sustainable facade solutions across Europe. By January 2023, Enclos expanded its offerings by acquiring PFEIFER Structures America, which brought custom tensile membrane systems and kinetic glass facades into the mix. These strategic moves highlight the industry's shift towards energy-efficient, smart, and design-driven facade technologies.

Key Players

• Compagnie de Saint Gobain S.A

• Enclos Corp. (CH Holdings USA Inc.)

• EOS Framing Limited

• FunderMax GmbH

• Harmon Inc. (Apogee Enterprises Inc.)

• Kawneer Company Inc. (Arconic Corporation)

• Permasteelisa S.p.A. (Lixil Group Corporation)

• Rockwool International A/S

• Walters & Wolf Glass Company

• YKK AP Inc. (YKK Corporation)

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=2755&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: +1-631-791-1145

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Facade Market 2025 2033: Trends, Forecast & Smart Facades Insights here

News-ID: 4088002 • Views: …

More Releases from IMARC Group

Green Tea Bags Manufacturing Plant DPR 2026: Investment Cost, Market Growth & RO …

Setting up a green tea bags manufacturing plant positions investors within one of the steadily expanding and health-oriented segments of the global beverage industry, driven by increasing consumer awareness of wellness, rising preference for natural antioxidants, and growing demand for convenient herbal drink options. Green tea is widely valued for its perceived health benefits, including metabolism support and antioxidant properties, making it popular among health-conscious urban populations.

The shift toward…

Calcium Acetate Prices Q4 2025: USA Reaches USD 1,165/MT While China Trades at U …

North America Calcium Acetate Price Outlook Q4 2025:

United States Calcium Acetate Price Overview:

In Q4 2025, calcium acetate prices in the United States reached USD 1165 per metric ton. The market remained firm due to steady demand from food processing, pharmaceuticals, and wastewater treatment sectors. Stable consumption patterns and moderate production costs supported pricing levels. Supply chain efficiency and consistent raw material availability helped prevent sharp fluctuations during the quarter.

Get the…

Automotive Radiator Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis …

Setting up an Automotive Radiator manufacturing plant positions investors in one of the most critical and high-demand segments of the global automotive components and thermal management industry, backed by sustained global growth driven by rising vehicle production, increasing regulatory focus on engine efficiency and emission reduction, and the growing adoption of electric and hybrid vehicles requiring advanced cooling solutions. As global automotive production expands across emerging economies, regulatory frameworks continue…

Watch Manufacturing Plant DPR & Unit Setup - 2026: Machinery, CapEx/OpEx, ROI an …

Setting up a watch manufacturing plant positions investors at the convergence of precision engineering, consumer lifestyle, luxury goods, and wearable technology - one of the most dynamic and diversified segments of the global consumer goods industry - driven by rising demand for luxury and premium accessories, increasing adoption of smart and hybrid watches, growing disposable incomes across emerging markets, and expanding e-commerce and organized retail channels enabling access to global…

More Releases for Facade

A Complete Guide to Facade

The facade market is projected to reach US$ 275.24 billion by 2031 from US$ 205.60 billion in 2023. The market is expected to register a CAGR of 3.7% during 2023-2031. The growing construction industry across the globe is likely to remain key facade market trends.

Get Sample PDF - https://www.theinsightpartners.com/sample/TIPMC00002592/?utm_source=Openpr&utm_medium=10324

Smart building design in the construction industry is closely linked to sustainability. Applying smart elements to upcoming facades includes selecting and testing…

Facade Market: Trends, Growth Dynamics, and Future Opportunities

The facade market is witnessing substantial growth, driven by increasing urbanization, rising demand for energy-efficient buildings, and advancements in facade materials and technology. Facade play a critical role in the aesthetics, thermal performance, and sustainability of buildings. Modern construction trends emphasize the integration of innovative facade that enhance both functionality and design, leading to increased adoption across residential, commercial, and industrial structures.

The growing need for green buildings and compliance with…

Facade Systems Market 2024-2030 Giants Spending is Going To Boom | Enclos, Innov …

Global "Facade Systems Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…

Facade Market Value Projected to Expand by 2029

Facade is anticipated to grow at a considerable CAGR of 8.1% during the forecast period. A facade is referred to the deceptive outward appearance of the building. Facades cover the roof, ventilator louvers, and street awnings, including the vertical and horizontal aspects of the building. Besides just giving aesthetics to the building, the facade materials are increasingly being used for energy recreation. It helps in temperature management of the…

Facade Market Real Time Analysis & Forecast 2021 - 2031

Global Facade Market: Snapshot

The global facade market is projected to attract growth at a CAGR of 6.4% during the forecast period, 2021-2028. The valuation of the market for facade was US$ 217.9 Bn in 2020. Fabrication, waterproofing, resistance to extreme climate, and durability are some of the key factors that play key role in the construction of facades.

Companies operating in the global facade market are increasing efforts to develop technologically…

Global Facade Systems Market Size - Forecasts to 2026

The findings reviewed by GME stated that the Global Facade Systems Market will expand with a CAGR value of 7.2 percent from 2021 to 2026. The rise in construction activities, with changing lifestyles, rapid urbanization, and a growing population worldwide are propelling the market’s growth. With the development process and individuals' migration, the demand is growing significantly for facade systems. Moreover, the allocation of funds for the construction of robust…