Press release

Saudi Arabia Cryptocurrency Market Is Expected to Reach USD 45.9 Billion by 2033, Grow at a CAGR Of 7.9%

Saudi Arabia Cryptocurrency Market OverviewMarket Size in 2024 : USD 23.1 Billion

Market Size in 2033: USD 45.9 Billion

Market Growth Rate 2025-2033: 7.9%

According to IMARC Group's latest research publication,"Saudi Arabia Cryptocurrency Market Report by Component (Hardware, Software), Type (Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, and Others), Process (Mining, Transaction), Application (Trading, Remittance, Payment, and Others), and Region 2025-2033", The Saudi Arabia cryptocurrency market size reached USD 23.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 45.9 Billion by 2033, exhibiting a growth rate (CAGR) of 7.9% during 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-cryptocurrency-market/requestsample

Growth Factors in the Saudi Arabia Cryptocurrency Market

Government Initiatives for Economic Diversification

Saudi Arabia's Vision 2030 plan drives growth in the cryptocurrency market. It aims to reduce dependency on oil and diversify the economy. The government is looking into blockchain technology. They want to modernize finance, logistics, and supply chain management. In 2022, the Saudi Central Bank appointed a "Crypto Chief" to lead digital transformation. This move shows their openness to blockchain innovation. It also helps fintech startups and blockchain projects. This creates a friendly space for cryptocurrency. These efforts align with national goals, attracting institutional investors and entrepreneurs. This boosts the market's growth.

Increasing Internet and Mobile Penetration

Smartphones and high-speed internet are growing rapidly in Saudi Arabia. This has opened doors for cryptocurrency. The youth, who are tech-savvy, find it easy to trade and manage digital assets online. For instance, Rain, a local crypto exchange, has gained many users thanks to its simple mobile app. This ease of use allows retail investors to add cryptocurrencies to their portfolios. They see these assets as new investment chances, similar to the early internet days. Better connectivity makes transactions smooth, making cryptocurrencies attractive for personal and business needs.

Rising Institutional Investment

Institutional interest is driving the cryptocurrency market. Major organizations see the potential of digital assets. The Public Investment Fund's ventures, like Sanabil, have invested in blockchain startups. This shows confidence in the sector. A key example is the 2024 partnership between SBI Holdings and Saudi Aramco. This partnership aims to support digital asset projects and spark innovation. Institutional backing brings capital and credibility. This encourages more businesses to consider cryptocurrencies for payments and investments. As a result, market growth is expanding across Saudi Arabia.

Key Trends in the Saudi Arabia Cryptocurrency Market

Surge in Blockchain and DeFi Applications

Blockchain technology and decentralized finance (DeFi) platforms are changing Saudi Arabia's financial scene. Blockchain is being used more in banking and supply chain sectors. In 2022, the Saudi Digital Academy joined forces with the BSV Blockchain Association. They aimed to train blockchain professionals. DeFi platforms let users lend and trade without middlemen. This appeals to tech-savvy investors. These platforms provide smart contracts, which boost transparency and efficiency. This makes them appealing for both businesses and individuals.

Growing Popularity of Non-Fungible Tokens (NFTs)

Non-fungible tokens (NFTs) are becoming a major trend in Saudi Arabia. They provide a safer way to access digital assets since they are not part of the country's cryptocurrency restrictions. Platforms like NIFTY Souq let local artists and creators tokenize their digital art and collectibles. This attracts younger audiences. Saudi artists use NFTs to showcase their cultural heritage. This helps them gain global recognition. This trend supports the goals of Vision 2030 by promoting innovation and offering new income for creators. It also raises interest in the wider crypto market.

Advancements in Fintech Solutions

Fintech innovations are changing the cryptocurrency market in Saudi Arabia. This is especially true for security and payment channels. In 2024, Mesh and CoinMENA teamed up. They aimed to simplify crypto transactions with API solutions. This partnership removed the hassle of complex crypto addresses. These advancements enhance user experience and security, addressing concerns about volatility and fraud. Fintech firms are integrating cryptocurrencies into digital payment systems. This makes digital assets more practical for everyday use, like remittances and online purchases. As a result, more retail and institutional users are adopting them.

Buy Full Report: https://www.imarcgroup.com/checkout?id=20581&method=1315

Saudi Arabia Cryptocurrency Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Component:

●Hardware

●Software

Breakup by Type:

●Bitcoin

●Ethereum

●Bitcoin Cash

●Ripple

●Litecoin

●Dashcoin

●Others

Breakup by Process:

●Mining

●Transaction

Breakup by Application:

●Trading

●Remittance

●Payment

●Others

Breakup by Region:

●Northern and Central Region

●Western Region

●Eastern Region

●Southern Region

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=20581&flag=C

Future Outlook

The Saudi Arabia cryptocurrency market is ready for major changes. This shift comes from a mix of careful regulation and eager adoption. The government is exploring blockchain with Vision 2030. Clearer rules can help build investor trust and lower risks, such as fraud. Increased interest from institutions and a tech-savvy youth will likely grow the user base, especially for DeFi and NFTs. Partnerships with global firms like Ripple Labs hint at a future where Saudi Arabia could be a regional center for crypto innovation. Fintech and blockchain are growing fast. So, the market will mix more with mainstream finance. This blend brings new ideas and stability together.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Cryptocurrency Market Is Expected to Reach USD 45.9 Billion by 2033, Grow at a CAGR Of 7.9% here

News-ID: 4087806 • Views: …

More Releases from IMARC Group

Trinitrotoluene Production Plant DPR & Unit Setup 2026: Demand Analysis and Proj …

Setting up a trinitrotoluene production plant involves strategic planning, substantial capital investment, and a comprehensive understanding of production technologies. This critical explosive compound serves military and defense, mining and quarrying, construction and demolition, and industrial explosives manufacturing applications. Success requires careful site selection, efficient nitration processes, stringent safety protocols for handling hazardous materials, reliable raw material sourcing, and compliance with industrial safety regulations to ensure profitable and sustainable operations.

Market Overview…

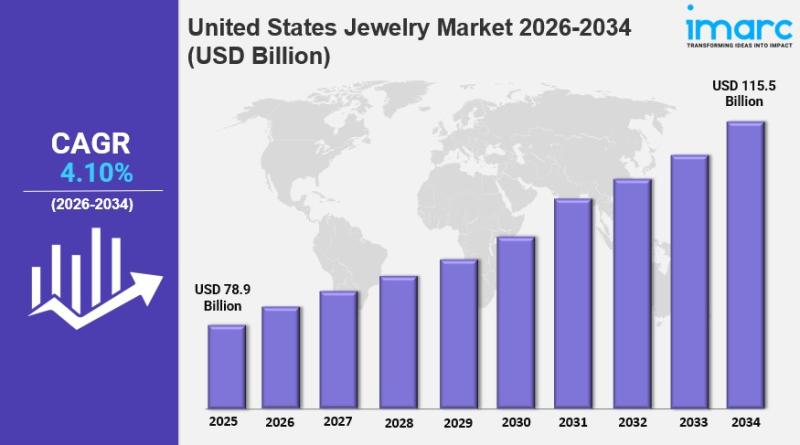

United States Jewelry Market Size, Share, Industry Overview, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Jewelry Market Report by Product (Necklace, Ring, Earrings, Bracelet, and Others), Material (Gold, Platinum, Diamond, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Jewelry Market Overview

The United States jewelry market size reached USD 78.9 Billion in 2025.…

United States Air Freight Market Size, Share, Industry Trends, Growth and Foreca …

IMARC Group has recently released a new research study titled "United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Air Freight Market Overview

The United States air freight market size was valued at USD 64.06 Billion in 2025.…

Mexico Medical Tourism Market 2026 : Industry Size to Reach USD 10.6 Billion by …

IMARC Group has recently released a new research study titled "Mexico Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Medical Tourism Market Overview

The Mexico medical tourism market size reached USD 2.1 Billion in 2025. Looking forward, the market is projected…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…