Press release

Cryptocurrency Tax Software Market Growth Prospects Are Still Attractive: ZenLedger, Bittax, TaxBit

HTF MI recently introduced Global Cryptocurrency Tax Software Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2025-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study CoinTracking (United States), TokenTax (United States), BearTax Inc (United States), Coin Ledger, Inc. (United States), ZenLedger, Inc. (United States), Bittax (Israel), Node40, LLC (New Zealand), Happy Tax Franchising, LLC (United States), Accointing Services AG (Switzerland), CoinsTax LLC (United States), TaxBit, Inc. (United States).Download Sample Report PDF (Including Full TOC, Table & Figures) @ https://www.htfmarketinsights.com/sample-report/2833751-cryptocurrency-tax-software-market

According to HTF Market Intelligence, the Global Cryptocurrency Tax Software market is expected to grow from 0.8 Billion USD in 2024 to 2 Billion USD by 2032, with a CAGR of 25%% from 2025 to 2032. The Cryptocurrency Tax Software market is segmented by Types (Cloud-based, Automated, Real-time, Blockchain-integrated, Compliance-focused), Application (Financial Services, Cryptocurrency, Accounting, Tax, E-commerce) and by Geography (North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA).

Definition:

Cryptocurrency Tax Software are used to calculate crypto taxes. These softwares are designed specifically for calculating your tax exposure from cryptocurrency trading activity. These software also reconciles the transactions and produces detailed gain and loss reports compatible with the IRS guidelines. The ease to trades and generates real-time reports using cryptocurrency tax software has majorly driven the market growth globally.

Dominating Region:

North America

Fastest-Growing Region:

Europe

Market Trend:

Automation, Real-time Tracking, AI Integration

Market Growth Driver:

Increasing Adoption of Cryptocurrency Tax Software to Track Transaction Data,,

Easy Demand for Cloud-based Cryptocurrency Tax Software,,

Rising Cost of IRS Service Providers for Tax Filing,,

Browse Complete Summary and Table of Content @ https://www.htfmarketinsights.com/report/2833751-cryptocurrency-tax-software-market

The titled segments and sub-section of the market are illuminated below:

In-depth analysis of Cryptocurrency Tax Software market segments by Types: Cloud-based, Automated, Real-time, Blockchain-integrated, Compliance-focused

Detailed analysis of Cryptocurrency Tax Software market segments by Applications: Financial Services, Cryptocurrency, Accounting, Tax, E-commerce

Geographically, the detailed analysis of consumption, revenue, market share, and growth rate of the following regions:

• The Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.)

• North America (United States, Mexico & Canada)

• South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

• Europe (Turkey, Spain, Turkey, Netherlands Denmark, Belgium, Switzerland, Germany, Russia UK, Italy, France, etc.)

• Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia).

Buy Now Latest Edition of Cryptocurrency Tax Software Market Report @ https://www.htfmarketinsights.com/buy-now?format=1&report=2833751

Cryptocurrency Tax Software Market Research Objectives:

- Focuses on the key manufacturers, to define, pronounce and examine the value, sales volume, market share, market competition landscape, SWOT analysis, and development plans in the next few years.

- To share comprehensive information about the key factors influencing the growth of the market (opportunities, drivers, growth potential, industry-specific challenges and risks).

- To analyze the with respect to individual future prospects, growth trends and their involvement to the total market.

- To analyze reasonable developments such as agreements, expansions new product launches, and acquisitions in the market.

- To deliberately profile the key players and systematically examine their growth strategies.

FIVE FORCES & PESTLE ANALYSIS:

In order to better understand market conditions five forces analysis is conducted that includes the Bargaining power of buyers, Bargaining power of suppliers, Threat of new entrants, Threat of substitutes, and Threat of rivalry.

• Political (Political policy and stability as well as trade, fiscal, and taxation policies)

• Economical (Interest rates, employment or unemployment rates, raw material costs, and foreign exchange rates)

• Social (Changing family demographics, education levels, cultural trends, attitude changes, and changes in lifestyles)

• Technological (Changes in digital or mobile technology, automation, research, and development)

• Legal (Employment legislation, consumer law, health, and safety, international as well as trade regulation and restrictions)

• Environmental (Climate, recycling procedures, carbon footprint, waste disposal, and sustainability)

Get 10-25% Discount on Immediate purchase @ https://www.htfmarketinsights.com/request-discount/2833751-cryptocurrency-tax-software-market

Points Covered in Table of Content of Global Cryptocurrency Tax Software Market:

Chapter 01 - Cryptocurrency Tax Software Executive Summary

Chapter 02 - Market Overview

Chapter 03 - Key Success Factors

Chapter 04 - Global Cryptocurrency Tax Software Market - Pricing Analysis

Chapter 05 - Global Cryptocurrency Tax Software Market Background or History

Chapter 06 - Global Cryptocurrency Tax Software Market Segmentation (e.g. Type, Application)

Chapter 07 - Key and Emerging Countries Analysis Global Cryptocurrency Tax Software Market

Chapter 08 - Global Cryptocurrency Tax Software Market Structure & worth Analysis

Chapter 09 - Global Cryptocurrency Tax Software Market Competitive Analysis & Challenges

Chapter 10 - Assumptions and Acronyms

Chapter 11 - Cryptocurrency Tax Software Market Research Methodology

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, LATAM, Europe, Japan, Australia or Southeast Asia.

Contact US:

Nidhi Bhavsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketreport.com

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to empower businesses with growth strategies. We offer services with extraordinary depth and breadth of thought leadership, research, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cryptocurrency Tax Software Market Growth Prospects Are Still Attractive: ZenLedger, Bittax, TaxBit here

News-ID: 4086831 • Views: …

More Releases from HTF Market Intelligence Consulting Private Limited

Marking Coating Market Is Going to Boom | Major Giants Sherwin-Williams, PPG Ind …

The latest study released on the Global Marking Coating Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Marking Coating study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

Xenon Gas Market Hits New High | Major Giants Air Liquide, Linde plc, Air Produc …

The latest study released on the Global Xenon Gas Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Xenon Gas study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

Fluorosurfactants Market Is Going to Boom | Major Giants Chemours, 3M, Solvay, A …

The latest study released on the Global Fluorosurfactants Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Fluorosurfactants study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these insights might…

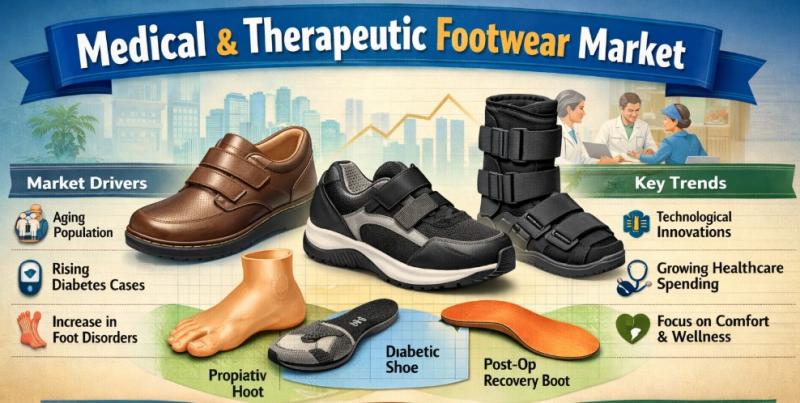

Medical & Therapeutic Footwear Market Is Likely to Experience a Tremendous Growt …

HTF MI just released the Global Medical & Therapeutic Footwear Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Key Players in This Report Include:

Orthofeet, Dr. Comfort, Aetrex,…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…