Press release

Fintech as a Service Market Size, Growth Forecast & Key Players 2025-2032 | FaaS Industry Report

Global Fintech as a Service (Faas) Market reached US$ 321.04 billion in 2024 and is expected to reach US$ 1,059.78 billion by 2032, growing with a CAGR of 16.10% during the forecast period 2025-2032.The Fintech as a Service Market Report by DataM Intelligence offers comprehensive insights into the latest market trends, key growth drivers, and emerging challenges. Crafted to support smarter and faster decision-making, our reports blend in-depth data analysis with expert insights. At DataM Intelligence, we simplify complex market dynamics into actionable strategies empowering businesses to remain competitive, scale confidently, and capitalize on the right opportunities in an ever-evolving landscape.

Unlock exclusive insights with our detailed sample report (Corporate Email ID gets priority access): https://datamintelligence.com/download-sample/fintech-as-a-service-market?kb

Fintech as a Service Market Overview

Fintech as a Service (FaaS) refers to the delivery of financial technology solutions through APIs and cloud-based platforms, allowing businesses to integrate banking, payments, lending, insurance, and other financial services into their applications without building the infrastructure from scratch. It enables companies to offer secure, scalable, and compliant financial products quickly and cost-effectively.

Research Methodology:

The global Fintech as a Service Market research report is based on a combination of primary and secondary data sources. The study carefully analyzes various factors influencing the industry, including government regulations, market dynamics, competitive landscape, historical trends, current conditions, and technological progress. It also evaluates future developments, related industry trends, market volatility, growth prospects, potential obstacles, and emerging challenges.

Segment Covered in the Fintech as a Service Market:

By Type: Payments as a Service, Banking as a Service (BaaS), Lending as a Service, Insurance as a Service (InsurTech), Others

By Deployment: Cloud-Based, On-Premises, Hybrid

By Technology: API-based Services, Blockchain, AI & Machine Learning, Robotic Process Automation (RPA), Others

By Application: Banks & Financial Institutions, Insurance Companies, Fintech Startups, eCommerce & Retail Businesses, Telecom Companies, Government Agencies, Others

Speak to Our Analyst and Get Customization in the report as per your requirements: https://datamintelligence.com/customize/fintech-as-a-service-market?kb

List of the Key Players in the Fintech as a Service Market:

Finastra, Stripe, Inc, Rapyd Financial Network Ltd, foo.mobi, Solid Financial Technologies, Inc, Synctera Inc, SAP Fioneer, TCS BaNCS, PayMate, Backbase and among others.

Industry Development:

Stripe, a prominent Fintech as a Service (FaaS) provider, delivers embedded payment infrastructure for platforms such as Shopify and Amazon, enabling smooth transactions across global markets. The FaaS market is growing rapidly, driven by supportive fintech regulations in regions like the EU, India, and the US. As startups and established enterprises seek scalable, secure, and cost-efficient financial solutions, the FaaS model is emerging as a critical component in the transformation of the digital finance landscape.

Regional Analysis for Fintech as a Service Market:

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

The Report Includes:

➡ A descriptive analysis of demand-supply gap, market size estimation, SWOT analysis, PESTEL Analysis and forecast in the global market.

➡ Top-down and bottom-up approach for regional analysis

➡ Go-to-market Strategy.

➡ Neutral perspective on the market performance.

➡ Customized regional/country reports as per request and country level analysis.

➡ Potential & niche segments and regions exhibiting promising growth covered.

People Also Ask:

➠ What are the global sales, production, consumption, imports, and exports in the Fintech as a Service market?

➠ Who are the top manufacturers, and what are their capacity, production, sales, pricing, and revenue stats?

➠ What key opportunities and challenges do vendors face in the Fintech as a Service industry?

➠ Which product types, applications, or end-users are driving market growth, and what is their market share?

➠ What are the major growth drivers and restraints of the Fintech as a Service market?

Stay informed with the latest industry insights-start your subscription now: https://www.datamintelligence.com/reports-subscription?kb

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fintech as a Service Market Size, Growth Forecast & Key Players 2025-2032 | FaaS Industry Report here

News-ID: 4083778 • Views: …

More Releases from DataM Intelligence 4 Market Research LLP

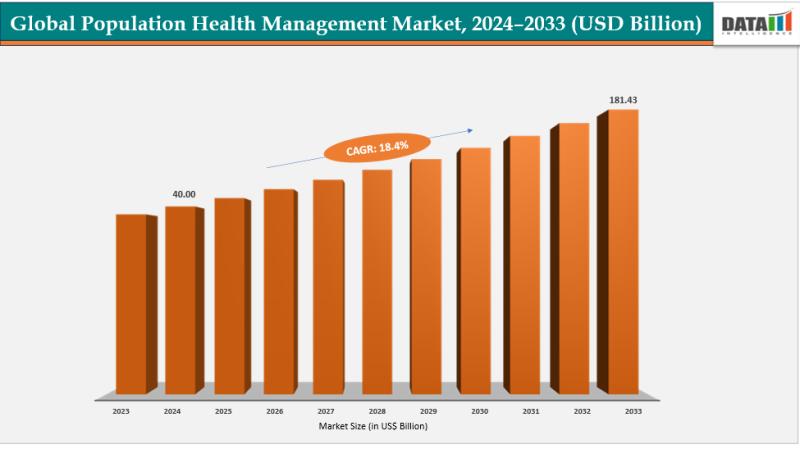

Population Health Management Market Set for Explosive Growth to USD 181.43 Billi …

The Global Population Health Management Market size reached USD 40.00 billion in 2024 and is expected to reach USD 181.43 billion by 2033, growing at a CAGR of 18.4% during the forecast period 2025-2033.

Market growth is driven by the rising prevalence of chronic diseases, increasing adoption of digital health solutions, and growing demand for value-based care models. Advancements in AI and predictive analytics, expanding healthcare IT infrastructure, surging investments in…

Organic Infant Formula Market Set to Grow to US$ 36,046 Million by 2032 at 6.3% …

AUSTIN, Texas and TOKYO -- According to DataM Intelligence, The Organic Infant Formula Market Size reached US$ 20,800 million in 2023, rose to US$ 22,110 million in 2024 and is projected to reach US$ 36,046 million by 2032, expanding at a CAGR of 6.3% from 2025 to 2032. The Organic Infant Formula Market is transforming early childhood nutrition by providing parents with certified organic, high-quality alternatives free from synthetic pesticides,…

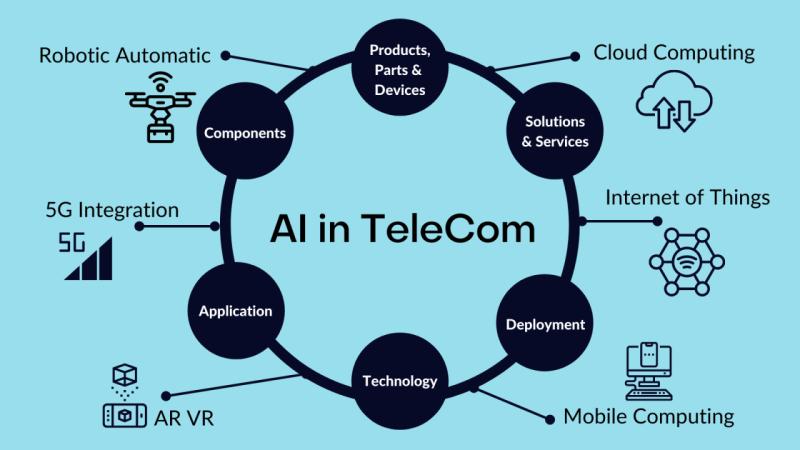

Future of Ai in telecommunication market. AI + Telecommunications Top Technologi …

The global AI in telecommunication market reached US$ 2.25 billion in 2023, with a rise to US$ 2.90 billion in 2024, and is expected to reach US$ 48.98 billion by 2033, growing at a CAGR of 36.9% during the forecast period 2025-2033.

AI in telecommunication market growth is driven by rising data traffic, demand for automated network optimization, predictive maintenance, improved customer experience, cost reduction, and rapid deployment of 5G and…

Bioresorbable Implants Market to Double, Reaching US$ 14.34 Billion by 2033 at 7 …

AUSTIN, Texas and TOKYO -- According to DataM Intelligence, The Bioresorbable Implants Market Size reached US$ 7.00 billion in 2024 and is projected to reach US$ 14.34 billion by 2033, expanding at a CAGR of 7.4% during the forecast period 2025-2033. The Bioresorbable Implants Market is transforming surgical outcomes by dissolving after fulfilling their role, leaving no permanent foreign body and lowering revision risks.

The shift from traditional metallic implants to…

More Releases for Fintech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…