Press release

India Buy Now Pay Later Services Market to Reach USD 78.5 Billion by 2030, Fueled by Youth-Centric Digital Credit Demand and Retail Partnerships

Mordor Intelligence has published a new report on the "India Buy Now Pay Later Services Market" offering a comprehensive analysis of trends, growth drivers, and future projectionIntroduction: Flexible Credit Models Gain Momentum Among Indian Consumers

The India Buy Now Pay Later (BNPL) Services Market is reached USD 30.88 billion in 2025 and is projected to expand to USD 78.50 billion by 2030, reflecting a strong 20.52% CAGR. This growth is being driven by rising consumer demand for convenient, short-term credit, especially among younger demographics, and the increasing digitization of retail finance.

BNPL, which allows consumers to make purchases and defer payments with little to no interest, is becoming an alternative to traditional credit options. Its quick approval process, digital-first model, and seamless integration with e-commerce platforms have made it popular across urban India.

Report Overview: https://www.mordorintelligence.com/industry-reports/india-buy-now-pay-later-services-market?utm_source=openpr

Key Trends: Urban Digital Natives, Retail Integration, and Expanding Use Cases

The BNPL model in India is rapidly evolving in response to consumer behavior, regulatory guidelines, and financial partnerships. Several key trends are defining its trajectory:

1. Widespread Retail Integration and Checkout Optimization

BNPL is being increasingly offered at the point of sale, both online and offline. Retailers across electronics, fashion, and personal care segments are integrating BNPL providers to improve conversion rates and reduce cart abandonment. For e-commerce players, BNPL boosts average order value and customer loyalty.

2. Usage Expanding Beyond E-commerce

While e-commerce continues to be the dominant sector, BNPL is now entering healthcare, travel, education, and local services. This is giving consumers more flexible options for managing non-discretionary and high-value purchases, such as diagnostic procedures, coaching classes, or holiday bookings.

3. Increased Focus on Credit Risk and Regulation

With its rapid growth, BNPL has come under the regulatory lens of the Reserve Bank of India (RBI), especially after digital lending guidelines were introduced. Service providers are now building better risk assessment models and ensuring regulatory compliance, especially concerning disclosures and grievance redressal mechanisms.

4. Rise of Embedded Finance and Fintech-Bank Partnerships

Fintech firms are collaborating with banks and NBFCs to offer embedded BNPL solutions on various platforms. These collaborations help traditional institutions reach new demographics while fintechs leverage institutional backing for regulatory alignment and capital sourcing.

5. Financial Inclusion for the 'New-to-Credit' Segment

BNPL serves a large segment of India's young population that lacks access to credit cards or formal credit history. Many BNPL platforms are now using alternative data and behavioral insights to underwrite loans, making it easier for the underbanked to gain access to formal finance.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/india-buy-now-pay-later-services-market?utm_source=openpr

Market Segmentation: Diverse Applications Across Channels and Enterprise Sizes

According to the report, the India BNPL Services Market is segmented based on Channel, Enterprise Size, and End-User categories:

By Channel

Online: The dominant segment, benefiting from India's growing e-commerce penetration and smartphone usage. BNPL is frequently used in online fashion, electronics, and ticketing platforms.

Point-of-Sale (POS): Gaining traction in organized retail and healthcare. POS-based BNPL solutions are being adopted in physical stores for high-ticket purchases.

By Enterprise Size

Large Enterprises: Already well-established in retail, electronics, and consumer durables, these companies adopt BNPL to enhance their value proposition and boost sales.

Small and Medium Enterprises (SMEs): Rapidly exploring BNPL as a customer engagement strategy, particularly in the D2C segment and smaller online stores.

By End-User

Consumer Electronics: Accounts for a significant portion of BNPL usage due to high average transaction values and easy monthly installment options.

Fashion & Garment: High-frequency, mid-ticket items in this segment make BNPL an attractive option for budget-conscious, trend-oriented buyers.

Healthcare: Gaining adoption for diagnostic services and elective treatments.

Others: Includes categories like travel, education, and lifestyle services that are beginning to see growth in BNPL adoption.

Explore Our Full Library of Financial Services and Investment Intelligence Research Industry Reports: https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=openpr

Key Players: Fintech Providers and Payment Platforms Lead the Market

India's BNPL space is competitive, with both standalone fintech companies and large e-commerce ecosystems participating in the market. Key players include:

LazyPay: Offers small-ticket BNPL solutions with quick approvals and is integrated with many popular consumer service platforms.

ZestMoney: Known for partnering with online and offline retailers to offer installment-based BNPL, even for customers without a credit card.

Simpl: Provides a "pay later" option for everyday purchases and bills, catering especially to younger customers.

Amazon Pay Later: Offers seamless credit at checkout for Amazon users, with the benefit of repaying in installments or by the next month.

Flipkart Pay Later: Embedded into the Flipkart ecosystem to increase consumer convenience and spending.

Paytm Postpaid: Part of the larger Paytm financial ecosystem, enabling users to make a wide range of purchases with deferred payments.

Each of these players is investing in risk analytics, customer acquisition, and merchant onboarding to expand their reach.

Explore more details about India Buy Now Pay Later Services Market Competitive Landscape: https://www.mordorintelligence.com/industry-reports/india-buy-now-pay-later-services-market/companies?utm_source=openpr

Conclusion: BNPL is Reshaping Consumer Credit in India's Digital Economy

The India Buy Now Pay Later Services Market is growing at a rapid pace, driven by rising digital transactions, urban youth preferences, and expanding merchant participation. It is becoming a significant part of India's consumer credit landscape, offering a viable alternative to traditional credit cards and personal loans.

However, with growth comes responsibility. Players in the BNPL ecosystem are navigating tighter regulations and evolving consumer expectations. The focus is now on sustainable credit practices, transparency, and innovation in underwriting.

As India continues its digital journey, BNPL is expected to play a deeper role in enabling financial access, especially for the underbanked and new-to-credit population. Whether used for a mobile phone purchase or a medical consultation, BNPL is shaping new spending behaviors across the country.

For complete market analysis, visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/india-buy-now-pay-later-services-market?utm_source=openpr

Industry Related Reports

Saudi Arabia Buy Now Pay Later Services Market: Saudi Arabia Buy Now Pay Later Services Market is Segmented by Channel (Online and POS) and End-User Type (Kitchen Appliances, Other Consumer Electronics, Fashion and Personal Care, Healthcare, and Other End-User Types).

Get more insights: https://www.mordorintelligence.com/industry-reports/saudi-arabia-buy-now-pay-later-services-market?utm_source=openpr

US Buy Now Pay Later Services Market: US Buy Now Pay Later Services Market is Segmented by Channel (Online and POS), End User Type (Consumer Electronics, Fashion & Apparel, Healthcare and Wellness, Home Improvement, and More), Age Group (Generation Z, Millennials, Generation X, and More), and Provider (Fintechs, Banks, Others).

Get more insights: https://www.mordorintelligence.com/industry-reports/us-buy-now-pay-later-services-market?utm_source=openpr

Australia Buy Now Pay Later Services Market: Australia Buy Now Pay Later Services Market is Segmented by Channel (Online and POS), by End-Use Industry (Consumer Electronics, Fashion & Apparel, Healthcare & Wellness, and More), by Age Group (Generation Z, Millennials, Generation X, and More), and by Provider (Fintechs, Banks, and Others).

Get more insights: https://www.mordorintelligence.com/industry-reports/australia-buy-now-pay-later-services-market?utm_source=openpr

France Buy Now Pay Later Services Market: France Buy Now Pay Later Services Market is Segmented by Channel (Online and POS), End User Type (Consumer Electronics, Fashion & Apparel, Healthcare and Wellness, Home Improvement, and More), Age Group (Generation Z, Millennials, Generation X, Baby Boomers, and More), and Provider (Fintechs, Banks, Others).

Get more insights: https://www.mordorintelligence.com/industry-reports/france-buy-now-pay-later-services-market?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Buy Now Pay Later Services Market to Reach USD 78.5 Billion by 2030, Fueled by Youth-Centric Digital Credit Demand and Retail Partnerships here

News-ID: 4083355 • Views: …

More Releases from Mordor Intelligence

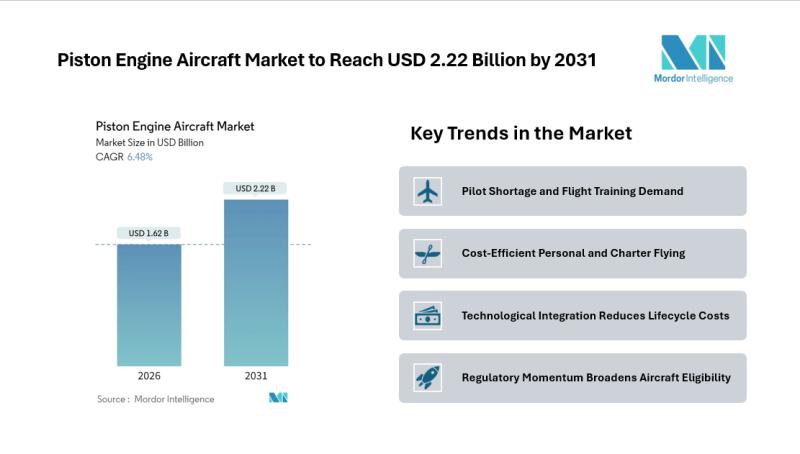

Piston Engine Aircraft Market to Reach USD 2.22 Billion by 2031, Anchored by Pil …

Introduction

The Piston Engine Aircraft Market size is projected to grow from USD 1.62 billion in 2026 to USD 2.22 billion by 2031, registering a CAGR of 6.48% during the forecast period. Growth is driven by escalating pilot shortages, an expanding flight-training fleet, and rising demand for economical personal and charter aviation solutions. Flight schools and general aviation operators prefer piston engine aircraft due to their lower acquisition and operating…

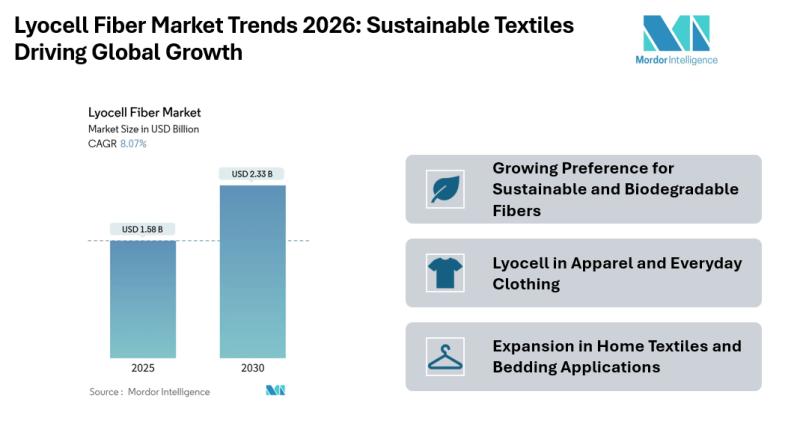

Lyocell Fiber Market Size Shows USD 2.33 Billion Revenue Potential by 2030 Amid …

Mordor Intelligence has published a new report on the Lyocell Fiber Market, offering a comprehensive analysis of trends, growth of drivers, and future projections.

According to Mordor Intelligence, the Lyocell fiber market was valued at USD 1.58 billion in 2025 and is projected to reach USD 2.33 billion by 2030, supported by steady demand from apparel, home textiles, and hygiene applications.

Explore the full report for in-depth insights and Lyocell Fiber…

Luxury Perfume Market Size to Hit USD 86.23 Billion by 2031 as Niche Fragrances …

Luxury Perfume Market Size and Growth Outlook

The Luxury Perfume Market is witnessing sustained expansion as fragrances increasingly represent personal identity, emotional expression, and lifestyle positioning. According to Mordor Intelligence, the market size is valued at USD 56.28 billion in 2026 and is projected to reach USD 86.23 billion by 2031, supported by premiumization, evolving consumer preferences, and rising demand across both mature and emerging economies.

Luxury fragrances are no longer limited…

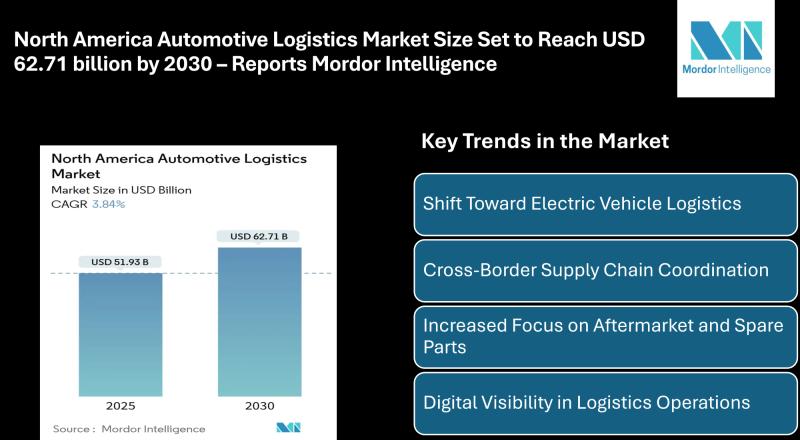

North America Automotive Logistics Market Size Set to Reach USD 62.71 billion by …

North America Automotive Logistics Market Overview:

According to Mordor Intelligence, the North America automotive logistics market size is estimated at USD 51.93 billion in 2025, and is expected to reach USD 62.71 billion by 2030, at a CAGR of 3.84%. The market plays a central role in keeping vehicle manufacturing and distribution running smoothly across the United States, Canada, and Mexico.

The OEMs and suppliers rely on specialized logistics services…

More Releases for BNPL

How New BNPL Regulations Will Transform Ecommerce Technology Infrastructure

The UK government's announcement of comprehensive Buy Now Pay Later regulations represents more than just consumer protection measures-it signals a fundamental shift in how payment technology will operate across ecommerce platforms. As these rules prepare to take effect next year, technology teams, payment processors, and platform developers face the challenge of rebuilding infrastructure that has largely operated in an unregulated environment since BNPL's explosive growth began.

The regulatory framework demands sophisticated…

The Malaysia BNPL Market is growing owing to Digitalization, Rising Tech-Savvy P …

Focus On Shifting Preference Towards BNPL And Adoption of Online Payments Technology Are Major Factor Contributing Towards Development of BNPL Market in Malaysia

Adoption within Retail: With e-commerce growing faster than before the pandemic, it presents a big opportunity due to increased online payments. This coupled with the fact that BNPL giants have witnessed immense adoption within retail and the wider community is a major growth driver for BNPL industry in…

PayNXT360 Expects the BNPL Industry in Netherlands to Grow at a CAGR of 32.8% Du …

BNPL payment industry in the Netherlands has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 74.8% on annual basis to reach US$ 7606.1 million in 2022.

Medium to long term growth story of BNPL industry in the…

PayNXT360 Expects the Norway BNPL Industry to Grow at a CAGR of 17.5% During 202 …

BNPL payment industry in Norway has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 39.8% on annual basis to reach US$ 6358.9 million in 2022.

Medium to long term growth story of BNPL industry in Norway remains…

PayNXT360 Expects the Russian BNPL Industry to Grow at a CAGR of 45.3% During 20 …

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in Russia is expected to grow by 91.9% on annual basis to reach US$ 7361.2 million in 2022.

Medium to long term growth story of BNPL industry in Russia remains strong. The BNPL payment adoption is expected to grow steadily over the forecast period, recording a CAGR of 45.3% during 2022-2028. The BNPL Gross Merchandise Value in the country will increase from…

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL Payment in Switzerland is E …

BNPL payment industry in Switzerland has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL payment in the country is expected to grow by 49.6% on annual basis to reach US$ 1020.4 million in 2021.

Medium to long term growth story of BNPL industry in Switzerland remains…