Press release

Rising Online Digital Transactions Fuel Growth In The Tax Management Software Market Emerges as a Core Driver of the Tax Management Software Market in 2025

Stay ahead with our updated market reports featuring the latest on tariffs, trade flows, and supply chain transformations.What Is the Expected CAGR for the Tax Management Software Market Through 2025?

In recent times, there has been robust growth in the market size for tax management software. It's set to expand from $21.69 billion in 2024 to a staggering $24 billion in 2025 with a compound annual growth rate (CAGR) of 10.7%. The growth experienced in the historic period can be traced back to complex tax laws, advancements in digital transformation, globalization and cross-border transactions, efficiency and cost-saving measures, along with an intensified focus on data accuracy.

What's the Projected Size of the Global Tax Management Software Market by 2029?

Anticipated to witness significant expansion in the coming years, the market size for tax management software is projected to reach $40.24 billion by 2029, experiencing a compound annual growth rate (CAGR) of 13.8%. This increasing trajectory during the forecast period can be ascribed to the intensification of security measures, a concentration on customization and scalability, seamless integration with pre-existing systems, and the importance of data accuracy and integrity. The forecast period is likely to observe major industry trends like improved collaboration and workflow processes, an emphasis on data security, customization and scalability, integration with ERP and accounting systems, and the development of user-friendly interfaces and enhanced user experience (UX).

View the full report here:

https://www.thebusinessresearchcompany.com/report/tax-management-software-global-market-report

Top Growth Drivers in the Tax Management Software Industry: What's Accelerating the Market?

The surge in online digital transactions is anticipated to boost the expansion of the tax management software market moving ahead. Most governments are compelled to enhance tax compliance and revenue collections to fund public commodities and services. As such, tax authorities are going digital and automating their operations to ensure successful and sustainable tax reforms, while also ensuring the right taxation for the digital economy and lowering compliance obstacles. For example, Mint, an Indian financial news outlet reported a 33% YoY increase in India's digital payment volume during FY 2021-2022. The total digital payment transactions tallied 7,422 crores ($933 million), a significant rise from the 5,554 crores ($698.24 million) transactions made in FY 2020-21. Consequently, the uptick in online digital transactions is fueling the need for tax management software market growth.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=7163&type=smp

What Trends Will Shape the Tax Management Software Market Through 2029 and Beyond?

In the tax management software market, a prominent trend gaining traction is technological innovation. Key players in this sector are centered on the creation of highly advanced products in order to solidify their market place. Highlighting this, Bloomberg Tax & Accounting, hailing from the US, introduced the Bloomberg Tax Workpapers in March 2024. Designed as a cutting-edge automation solution, this new application is meant to simplify the tax workpapers process. This forward-thinking tool combines data preparation, spreadsheets and tax advice, perfectly suited for tax experts. It brings solutions to major hurdles in the tax workflow through automated processes such as purifying trial balances and handling M-1 flux analysis.

What Are the Main Segments in the Tax Management Software Market?

The tax management software market covered in this report is segmented -

1) By Component : Software, Professional Services

2) By Tax Type: Direct Taxes, Indirect Taxes

3) By Deployment Mode: On-Premises, Cloud

Subsegments:

1) By Software: Tax Compliance Software, Tax Planning Software, Tax Preparation Software, E-filing Software

2) By Professional Services: Consulting Services, Implementation Services, Support And Maintenance Services

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=7163&type=smp

Which Top Companies are Driving Growth in the Tax Management Software Market?

Major companies operating in the tax management software market include Avalara Inc., Shoeboxed Inc., SAXTAX Inc., H&R Block Inc., CrowdReason LLC, Drake Software, Bolt, Beanstalk Data LLC, Avantax Wealth Management, TaxSlayer LLC, Wolters Kluwer N. V., Intuit Inc., Sovos Compliance LLC, Sailotech Private Limited, Vertex Inc., Paychex Inc., TPS Unlimited Inc., Thomson Reuters Holdings Inc., Automatic Data Processing Inc., AccurateTax Inc., Bloomberg Industry Group, Corptax Inc., Taxware Systems Inc., Xero Limited., The Sage Group plc., TaxCloud LLC.

Which Regions Will Dominate the Tax Management Software Market Through 2029?

North America was the largest region in the tax management software market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the tax management software market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=7163

This Report Supports:

1. Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2. Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3. Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4. Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Rising Online Digital Transactions Fuel Growth In The Tax Management Software Market Emerges as a Core Driver of the Tax Management Software Market in 2025 here

News-ID: 4083214 • Views: …

More Releases from The Business Research Company

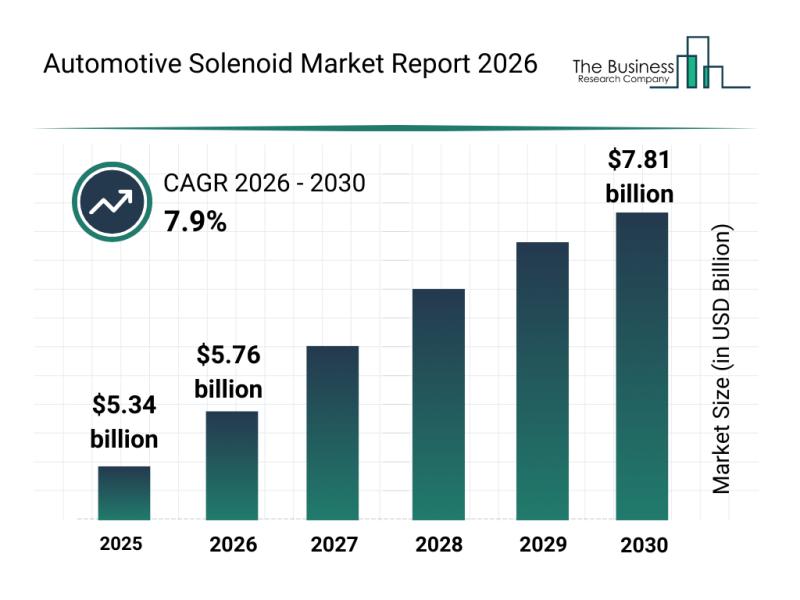

Leading Companies Fueling Growth and Innovation in the Automotive Solenoid Marke …

The automotive solenoid market is on the verge of significant expansion as advancements in technology and vehicle electrification continue to accelerate. Increasing integration of smart systems and the growing demand for efficient, eco-friendly automotive solutions are set to drive this market's development through the end of the decade.

Expected Growth Trajectory for the Automotive Solenoid Market by 2030

The automotive solenoid market is projected to reach a valuation of $7.81 billion…

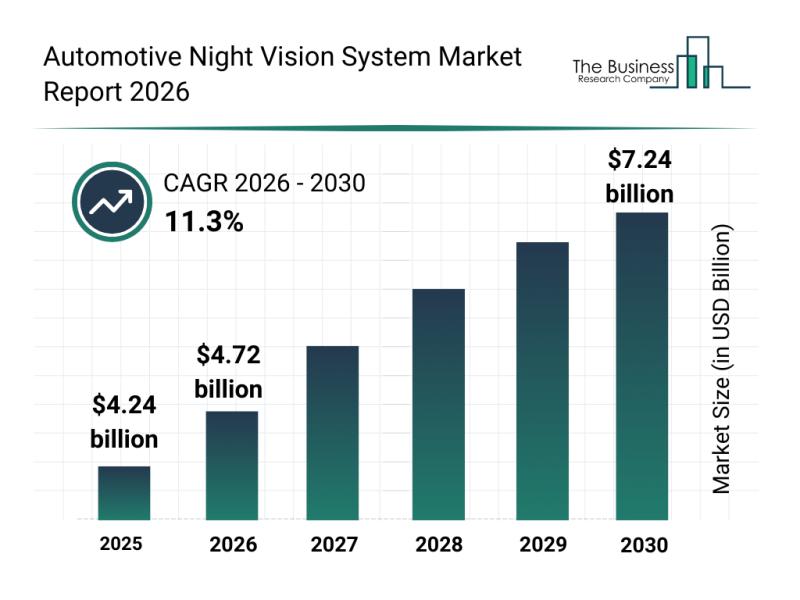

Automotive Night Vision System Market Analysis: Major Segments, Strategic Develo …

The automotive night vision system market is set to experience significant expansion over the coming years, driven by technological advancements and growing safety demands. As vehicle manufacturers continue to integrate more sophisticated safety features, this market shows promising potential for rapid growth and innovation through 2030.

Projected Expansion of the Automotive Night Vision System Market Size Through 2030

The market size for automotive night vision systems is anticipated to reach $7.24…

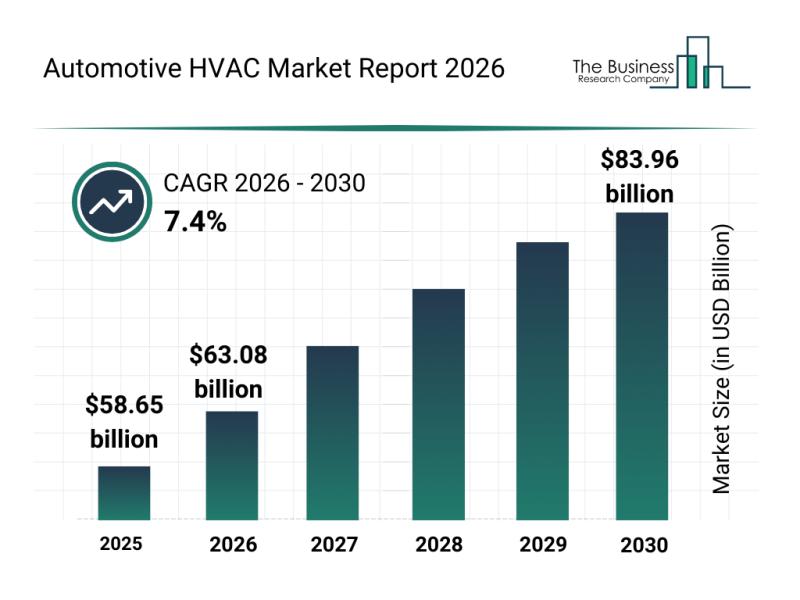

Segment Analysis and Major Growth Areas in the Automotive HVAC Market

The automotive HVAC market is on a trajectory of significant growth as vehicle climate control systems evolve with advanced technologies. Innovations aimed at improving energy efficiency and passenger comfort are driving the sector forward, setting the stage for substantial expansion through 2030. Let's explore the current market size, key players, influential trends, and detailed segment insights shaping this dynamic industry.

Automotive HVAC Market Size and Growth Outlook Through 2030

The automotive…

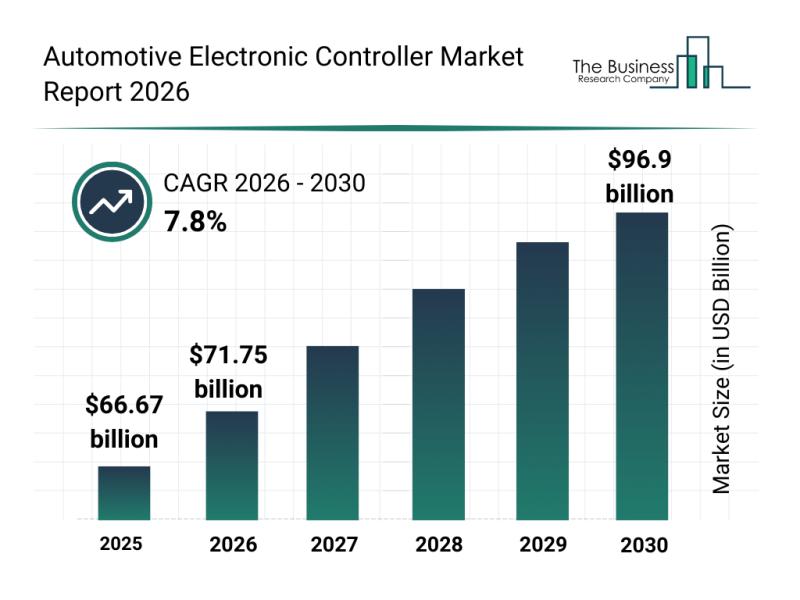

Key Strategic Developments and Emerging Changes Shaping the Automotive Electroni …

The automotive electronic controller market is on track for impressive expansion as technology continues to transform the automotive sector. With the industry embracing smarter and more connected vehicle systems, the demand for advanced controllers that manage and optimize vehicle functions is rapidly increasing. Below, we explore the market's projected growth, key players, notable trends, and the main segments shaping this dynamic field.

Projected Market Size and Growth of the Automotive Electronic…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…