Press release

Navigating the Future: Real-Time Payments Market Trends and Forecast Insights, 2025 Edition

Stay ahead with our updated market reports featuring the latest on tariffs, trade flows, and supply chain transformations.Real-Time Payments Market Size Growth Forecast: What to Expect by 2025?

There has been a significant expansion in the real-time payments market size over the past few years. The market, which stood at $37.22 billion in 2024, is projected to rise to $48.97 billion in 2025, equating to a compound annual growth rate (CAGR) of 31.6%. Factors contributing to the growth during the historical period include rising consumer expectations for immediate satisfaction, increased adoption of mobile and digital wallets, global scaling and cross-border transactions, regulatory efforts, and the expansion of e-commerce.

How Will the Real-Time Payments Market Size Evolve and Grow by 2029?

Expectations are high for a significant expansion of the real-time payments market in the upcoming years. The market is predicted to multiply to $169.32 billion by 2029, boasting a compound annual growth rate (CAGR) of 36.4%. Several factors are contributing to this projected growth during the forecast period, including a surge in the need for business proficiency, shifts in consumer habits, heightened security precautions, amplified initiatives for financial inclusivity, and the emergence of central bank digital currencies (CS). In the same period, key trends like open banking and API integration, peer-to-peer (P2P) and social payments, blockchain and distributed ledger technology, immediate payroll and business payments, and customer experience enhancement are anticipated.

View the full report here:

https://www.thebusinessresearchcompany.com/report/real-time-payments-global-market-report

What Drivers Are Propelling the Growth of Real-Time Payments Market Forward?

The rise in smartphone usage is projected to boost the development of the real-time payment market in the future. A smartphone is a handheld electronic device that merges a computer with sophisticated functionalities previously unseen in phones, including an operating system, internet access, and the capability to use software applications. The expansive usage of smartphones globally has allowed for real-time payment transactions, making smartphone payments a preferred option for consumers. For instance, as of October 2023, the GSMA, a non-profit organization based in the UK, states that 4.6 billion people utilize mobile internet, nearly 4 billion of these via smartphones. This equates to almost half (49%) of the global populace. Additionally, approximately 600 million individuals, accounting for 8% of the global population, connect to the internet utilizing feature phones. This underscores smartphones' crucial role in global connectivity. The tendency favors smartphones over feature phones for internet access, signifying the significant influence of rising smartphone usage on the expansion of the real-time payment market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=6864&type=smp

Which Emerging Trends Are Transforming the Real-Time Payments Market in 2025?

The evolution of technology is a prevalent trend gaining traction in the real-time payments industry. The principal companies in this sector are centred on innovating new technologies to enhance their standing within the market. For example, in April 2022, IBM, an American tech corporation active in the real-time payments market, introduced a new generation mainframe equipped with artificial intelligence technology. This latest IBM z16 processor is capable of facilitating deep learning-based fraud detection for all transactions.

What Are the Key Segments in the Real-Time Payments Market?

The real-time payments market covered in this report is segmented -

1) By Component: Solutions, Services

2) By Type: Person-To-Person (P2P), Person-To-Business (P2B), Business-To-Person (B2P), Others (Business-To-Government (B2G), Government-To-Business (G2B), Business-To-Business (B2B), Person-To-Government (P2G), And Government-To-Person (G2P))

3) By Enterprise Size: Small And Medium-Sized Enterprises (SMEs), Large Enterprises

4) By Deployment: On-Premise, Cloud

5) By End Users: Retail And E-commerce, Government And Utilities, Healare, Telecom And IT, Travel And Hospitality, BFSI, Other End-Users

Subsegments:

1) By Solutions: Payment Processing Solutions, Payment Gateway Solutions, Fraud Detection And Prevention Solutions, Real-Time Payment Systems

2) By Services: Consulting Services, Integration Services, Maintenance And Support Services, Managed Services

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=6864&type=smp

Who Are the Key Players Shaping the Real-Time Payments Market's Competitive Landscape?

Major companies operating in the real-time payments market include ACI Worldwide Inc., FIS Corporation, Fiserv Inc., Mastercard Inc., Visa Inc., Temenos AG, Wirecard AG, Capgemini SE, Finastra Limited, Montran Corporation Ltd., Ripple Labs Inc., PelicanFast, IntegraPay Pty Ltd., Worldpay Inc., Volante Technologies Inc., PayPal Holdings Inc., Square Inc., Stripe Inc., Worldline SA, Global Payments Inc., Adyen N. V., Ant Financial Services Group, Apple Inc., Google LLC, Samsung Electronics Co. Ltd., Tencent Holdings Limited, Paytm (One97 Communications Ltd. ), PayU (Naspers Ltd. ), Dwolla Inc., TransferWise Ltd.

What Geographic Markets Are Powering Growth in the Real-Time Payments Market?

Asia-Pacific was the largest region in the real-time payments market in 2024.North America is expected to be the fastest-growing region in the forecast period. The regions covered in the real-time payments market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Purchase the full report:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=6864

This Report Supports:

1. Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2. Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3. Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4. Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Navigating the Future: Real-Time Payments Market Trends and Forecast Insights, 2025 Edition here

News-ID: 4081522 • Views: …

More Releases from The Business Research Company

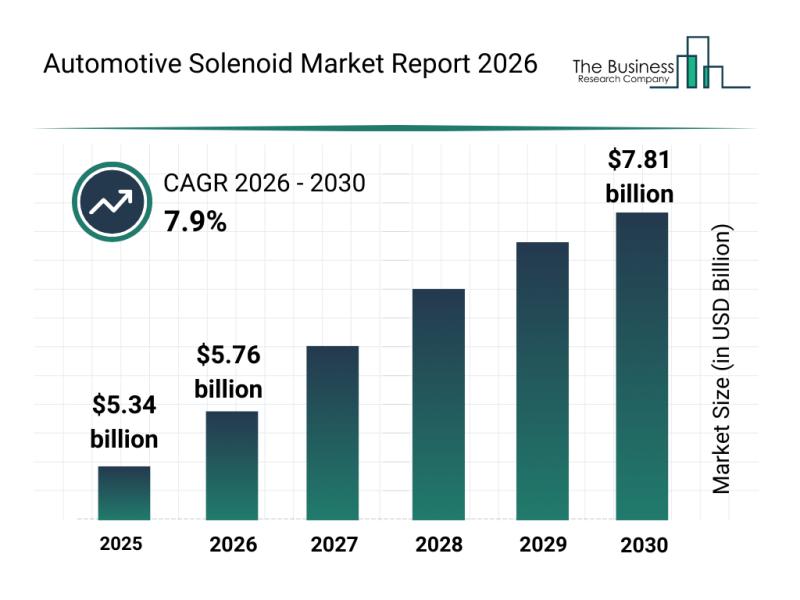

Leading Companies Fueling Growth and Innovation in the Automotive Solenoid Marke …

The automotive solenoid market is on the verge of significant expansion as advancements in technology and vehicle electrification continue to accelerate. Increasing integration of smart systems and the growing demand for efficient, eco-friendly automotive solutions are set to drive this market's development through the end of the decade.

Expected Growth Trajectory for the Automotive Solenoid Market by 2030

The automotive solenoid market is projected to reach a valuation of $7.81 billion…

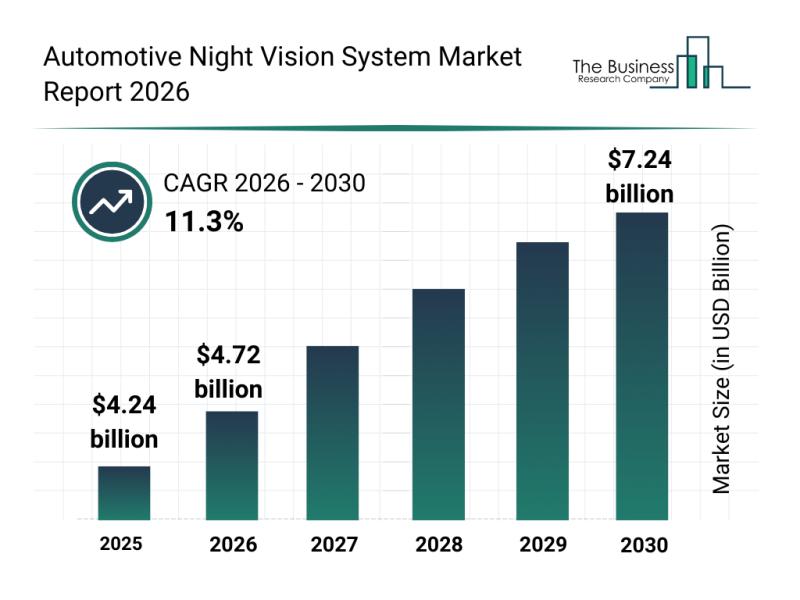

Automotive Night Vision System Market Analysis: Major Segments, Strategic Develo …

The automotive night vision system market is set to experience significant expansion over the coming years, driven by technological advancements and growing safety demands. As vehicle manufacturers continue to integrate more sophisticated safety features, this market shows promising potential for rapid growth and innovation through 2030.

Projected Expansion of the Automotive Night Vision System Market Size Through 2030

The market size for automotive night vision systems is anticipated to reach $7.24…

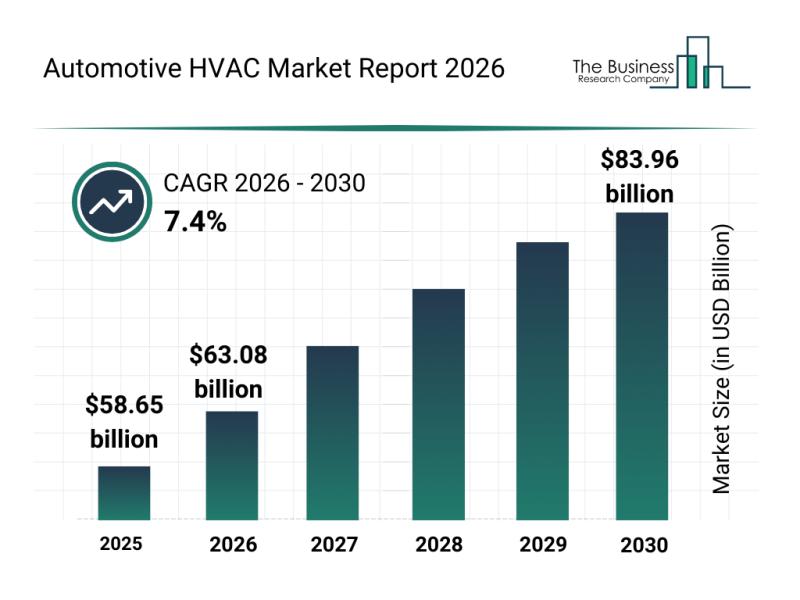

Segment Analysis and Major Growth Areas in the Automotive HVAC Market

The automotive HVAC market is on a trajectory of significant growth as vehicle climate control systems evolve with advanced technologies. Innovations aimed at improving energy efficiency and passenger comfort are driving the sector forward, setting the stage for substantial expansion through 2030. Let's explore the current market size, key players, influential trends, and detailed segment insights shaping this dynamic industry.

Automotive HVAC Market Size and Growth Outlook Through 2030

The automotive…

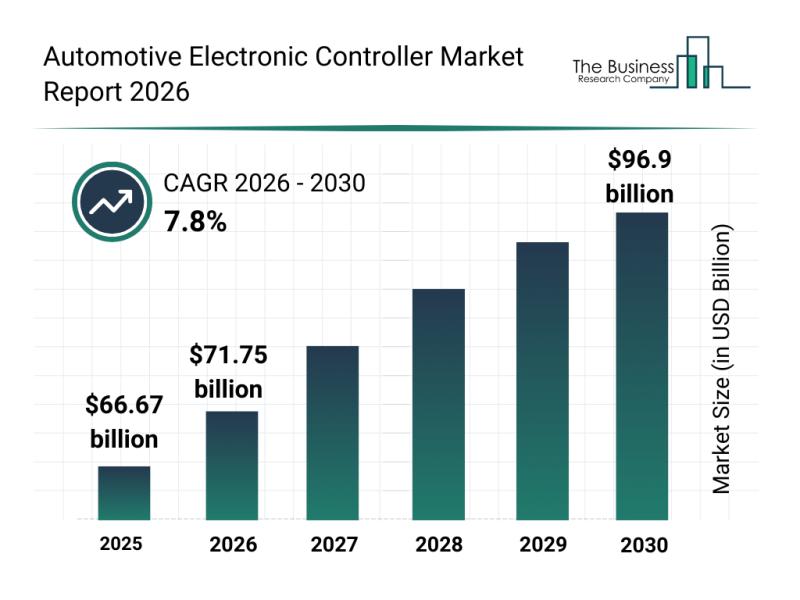

Key Strategic Developments and Emerging Changes Shaping the Automotive Electroni …

The automotive electronic controller market is on track for impressive expansion as technology continues to transform the automotive sector. With the industry embracing smarter and more connected vehicle systems, the demand for advanced controllers that manage and optimize vehicle functions is rapidly increasing. Below, we explore the market's projected growth, key players, notable trends, and the main segments shaping this dynamic field.

Projected Market Size and Growth of the Automotive Electronic…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…