Press release

2025 Peer-to-Peer (P2P) Lending Industry Trends Report: Long-Term Outlook Through 2034

Stay ahead with our updated market reports featuring the latest on tariffs, trade flows, and supply chain transformations.How Large Will the Peer-to-Peer (P2P) Lending Market Size By 2025?

The size of the peer-to-peer (P2P) lending market has witnessed an exponential increase lately. It is projected to rise from $189.56 billion in 2024 to $251.34 billion in 2025, equating to a compound annual growth rate (CAGR) of 32.6%. Factors like market disruption, regulatory shifts, an increase in investor interest, and worldwide economic circumstances have contributed to this growth during the historic period.

How Big Is the Peer-to-Peer (P2P) Lending Market Size Expected to Grow by 2029?

The anticipated expansion of the peer-to-peer (P2P) lending market in the coming years is predicted to be significant. With a compound annual growth rate (CAGR) of 30.5%, the market is set to surge to $729.07 billion in 2029. The factors driving growth during this forecast period are largely tied to the evolving regulatory landscape and advancements in risk management. Key trends identified for this timeframe include a broadening of product offerings, collaborations with conventional institutions, international growth, and strides in technology.

View the full report here:

https://www.thebusinessresearchcompany.com/report/peer-to-peer-p2p-lending-global-market-report

Which Key Market Drivers Powering Peer-to-Peer (P2P) Lending Market Expansion and Growth?

The surge in digitization within the banking sector is anticipated to fuel the expansion of the peer to peer (P2P) lending market in the future. The advent of digital innovation in banking is revolutionizing financial services, including mobile money and P2P or marketplace lending. For example, in January 2022, a report from the European Banking Supervision, a regulatory organization tasked with preserving financial stability across the banking sector in the European Union (EU), revealed a 23% increase in digital users since the start of the pandemic. Consequently, the escalating digitization in the banking sector is driving the peer to peer (P2P) lending market's growth.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=7466&type=smp

Which Fast-Growing Trends Are Poised to Disrupt the Peer-to-Peer (P2P) Lending Market?

One significant trend that has been observed in the peer-to-peer lending market is the rise of decentralized peer-to-peer mobile browsers. To capitalize on this trend and expand their market presence, major players in the P2P lending industry are turning to these decentralized mobile browsers. In March 2022, for example, eQualitie, a Canadian digital security firm, introduced CENO, the world's first decentralized P2P mobile browser crafted specifically to circumvent modern censorship techniques. This technology also ensures accessibility in regions suffering from disrupted connectivity. Though the user experience of CENO mirrors that of standard mobile browsers, it offers superior reliability due to its use of a P2P network, as well as the open-source Ouinet library and BitTorrent protocols. Additionally, the decentralization via peer-to-peer routing makes it impossible for external parties to forcibly remove online content.

What Are the Emerging Segments in the Peer-to-Peer (P2P) Lending Market?

The peer-to-peer (P2P) lending market covered in this report is segmented -

1) By Loan Type: Consumer Credit Loans, Small Business Loans, Student Loans, Real Estate Loans

2) By Business Model: Traditional Lending, Alternate marketplace Lending

3) By End User: Business, Personal

Subsegments:

1) By Consumer Credit Loans: Personal Loans, Debt Consolidation Loans, Home Improvement Loans, Medical Expense Loans

2) By Small Business Loans: Start-Up Loans, Working Capital Loans, Equipment Financing, Franchise Financing

3) By Student Loans: Undergraduate Student Loans, Graduate Student Loans, Consolidation Loans, Short-Term Loans For Education

4) By Real Estate Loans: Residential Property Loans, Commercial Property Loans, Real Estate Investment Loans, Fix-And-Flip Loans

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=7466&type=smp

Who Are the Global Leaders in the Peer-to-Peer (P2P) Lending Market?

Major companies operating in the peer-to-peer (P2P) lending market include Upstart, Funding Circle, Peerform, Kiva, Mintos, RateSetter, Zopa, Clearbanc, Borrowers, Credibly, SoFi, Lendio, StreetShares, Funding Societies, Revolut, LoanNow, Tally, Patch of L, Bondora, Divvy, Slice, Lendable, Auxmoney, FairFinance, Crowdstacker, LendInvest, JustUs, MyConstant

Which are the Top Profitable Regional Markets for the Peer-to-Peer (P2P) Lending Industry?

North America was the largest region in the peer to peer (P2P) lending market in 2024.Aisa-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the peer-to-peer (P2P) lending market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=7466

This Report Supports:

1. Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2. Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3. Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4. Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Learn More About The Business Research Company

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release 2025 Peer-to-Peer (P2P) Lending Industry Trends Report: Long-Term Outlook Through 2034 here

News-ID: 4081503 • Views: …

More Releases from The Business Research Company

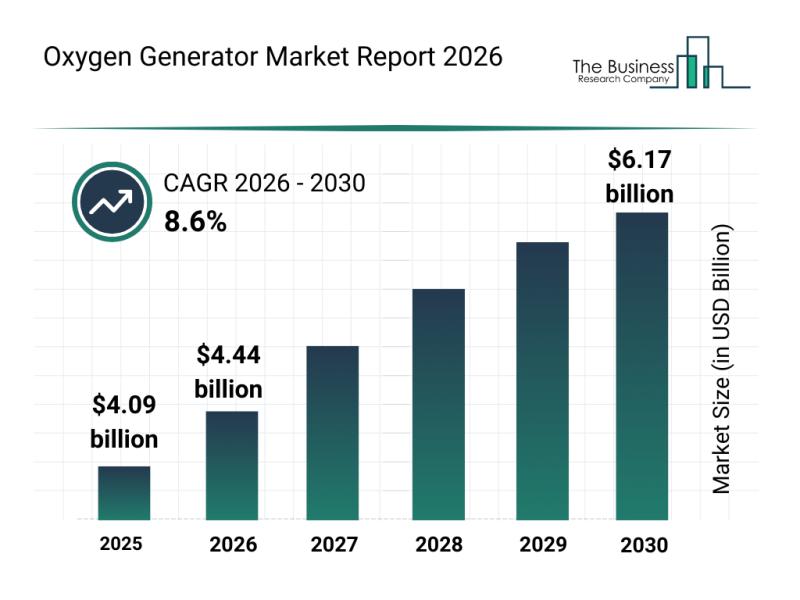

Worldwide Insights: The Rapid Development of the Oxygen Generator Market

"The oxygen generator market is positioned for significant expansion over the coming years, driven by diverse industrial and healthcare demands. With advancements in technology and increasing applications across various sectors, this market is set to witness robust growth as it adapts to evolving needs and innovations.

Projected Expansion and Market Size of Oxygen Generators Through 2030

The oxygen generator market is anticipated to grow steadily, reaching a value of $6.17 billion…

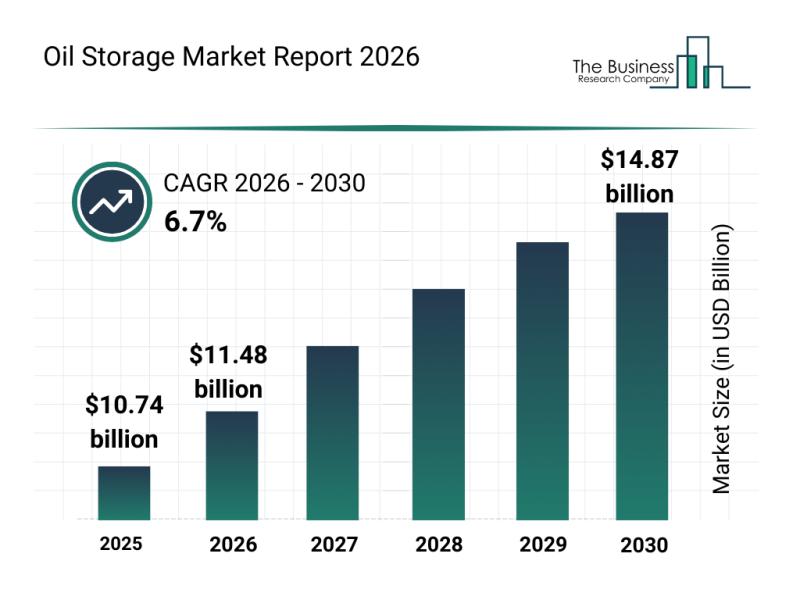

Segmentation, Major Trends, and Competitive Overview of the Oil Storage Market

"The oil storage sector is poised for notable expansion in the coming years, driven by increasing global energy needs and infrastructure development. As demand for efficient and secure storage solutions grows, the market is evolving with advanced technologies and strategic initiatives designed to meet the challenges of modern oil consumption and reserves management. Here's an overview of the market size, key players, emerging trends, and segmentation that define this industry's…

Worldwide Trends Examination: The Fast-Paced Development of the Motion Control M …

The motion control market is poised for significant expansion as industries increasingly adopt advanced automation technologies. With rising investments and technological breakthroughs, this sector is set to transform manufacturing and related fields by 2030. Let's explore the market's size, leading companies, emerging trends, and segment forecasts to understand its evolving landscape.

Expected Growth and Market Size of the Motion Control Market by 2030

The motion control market is on track for…

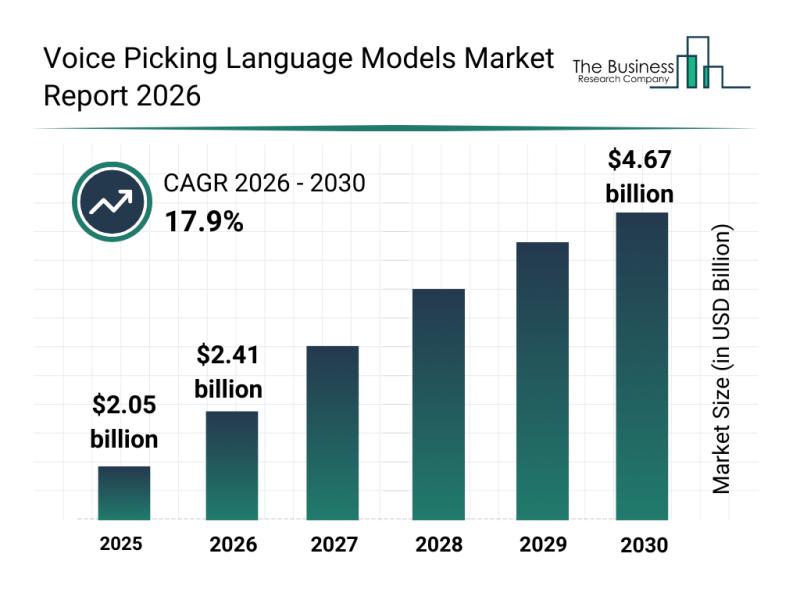

Global Trends Overview: The Rapid Evolution of the Voice Picking Language Models …

The voice picking language models market is poised for significant expansion in the coming years, driven by technological advancements and increasing adoption in logistics and warehouse environments. This sector is rapidly evolving as businesses prioritize efficiency and accuracy in their operations. Let's explore the market's size, growth factors, key companies, segmentation, and emerging trends shaping its future.

Projected Market Size and Growth Trajectory for the Voice Picking Language Models Market …

More Releases for Loan

Travel Loan Personal Loan Guide To Finance Domestic And International Trips Easi …

Image: https://www.abnewswire.com/upload/2026/02/71bfa2bd36a80322c40217cb0777143c.jpg

Travel opens up new worlds, fresh perspectives, and unforgettable memories. Whether it is a peaceful beach escape, a mountain adventure, or an international holiday, planning the perfect trip often requires careful budgeting. This is where a travel loan can help you turn your plans into reality without financial stress. As a type of personal loan, it offers flexible funding, easy repayment, and quick access to money, making travel planning…

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…