Press release

Australia Wealth Management Market Size, Share, Trends and Forecast by 2033

The latest report by IMARC Group, titled "Australia Wealth Management Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia wealth management market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia wealth management market size reached USD 110.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 213.2 Million by 2033, exhibiting a growth rate (CAGR) of 7.60% during 2025-2033.• Base Year: 2024

• Forecast Years: 2025-2033

• Historical Years: 2019-2024

• Market Size in 2024: USD 110.3 Million

• Market Forecast in 2033: USD 213.2 Million

• Market Growth Rate 2025-2033: 7.60%

Request For Sample Report:

https://www.imarcgroup.com/australia-wealth-management-market/requestsample

Australia Wealth Management Market Overview

The Australia wealth management market is seeing strong development, fueled by a rising number of high-net-worth people, solid financial basics, and progressing administrative changes. Riches administration in Australia is being molded by a vigorous superannuation framework, expanding request for retirement arranging, and developing appropriation of advanced counseling stages. The segment is additionally profiting from globalization and assess motivations, which are growing speculation openings and empowering riches conservation over a broader client base.

Key Features and Trends of Australia Wealth Management Market

The advertise is encountering quick advanced change, with the appropriation of robo-advisors, portable riches administration apps, and data-driven speculation methodologies. Administrative systems such as FOFA are upgrading straightforwardness and financial specialist believe. Riches administration firms are moving toward fee-based counseling models and all encompassing monetary arranging. The integration of manufactured insights and analytics is empowering more personalized portfolio administration, whereas the center on bequest and assess arranging is getting to be progressively unmistakable in riches administration in Australia.

Growth Drivers of Australia Wealth Management Market

Development within the Australia riches administration showcase is being moved by a surge in HNWIs, request for retirement and domain arranging, and the accessibility of tax-efficient speculation alternatives. Administrative changes are cultivating a client-centric environment, whereas advanced advancement is growing get to to riches administration administrations. Solid property values, entrepreneurial action, and globalization are making openings for broadened portfolios. The require for master counsel to ensure and develop resources is quickening the appropriation of proficient riches administration in Australia.

Browse Full Report with TOC & List of Figures:

https://www.imarcgroup.com/australia-wealth-management-market

Innovation & Market Demand of Australia Wealth Management Market

• Wealth managers are launching robo-advisory and hybrid platforms for tailored financial planning

• Digital transformation is enabling real-time portfolio insights and mobile investment management

• FOFA reforms are driving the shift to transparent, fee-based advisory services

• Fintech partnerships are expanding the range of investment products and services

• Globalization is opening access to international investment opportunities for Australian clients

Australia Wealth Management Market Opportunities and Challenges

• Growing HNWI and retirement planning needs are creating new market opportunities

• Regulatory compliance and transparency requirements are enhancing investor trust

• High competition and the need for continuous technology upgrades challenge providers

• Digital literacy and cybersecurity are critical for client engagement and data protection

• Evolving client expectations require ongoing innovation in service delivery

Australia Wealth Management Market Analysis

• Segment growth is notable in human, robo, and hybrid advisory business models

• Providers include fintech advisors, banks, and traditional wealth managers

• End users span HNWIs, ultra-HNWIs, corporates, and other affluent segments

• Regional demand is strong in New South Wales, Victoria, and Queensland

• Competitive strategies focus on digital innovation, regulatory compliance, and client-centric services

Australia Wealth Management Market Segmentation:

1. By Business Model:

o Human Advisory

o Robo Advisory (Direct Plan-Based/Goal-Based, Comprehensive Wealth Advisory)

o Hybrid Advisory

2. By Provider:

o FinTech Advisors

o Banks

o Traditional Wealth Managers

o Others

3. By End User:

o High Net Worth Individuals

o Ultra High Net Worth Individuals

o Corporates

o Others

4. By Region:

o Australia Capital Territory & New South Wales

o Victoria & Tasmania

o Queensland

o Northern Territory & Southern Australia

o Western Australia

Australia Wealth Management Market News & Recent Developments:

• In 2024, further digitalization of wealth management platforms increased adoption of robo-advisory services and mobile investment tools.

• In 2025, regulatory bodies enhanced compliance frameworks, strengthening investor protection and transparency across the sector.

Australia Wealth Management Market Key Players:

• Macquarie Bank Limited

• National Australia Bank Limited

• Westpac Banking Corporation

• CommBank Group

• Morgan Stanley & Co International plc

• Shadforth Financial Group Limited

• Perpetual Limited

Key Highlights of the Report:

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter's Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=24704&flag=E

🔍 FAQs: Australia Wealth Management Market

Q1: What was the market size of the wealth management market in Australia in 2024?

A: The market size reached USD 110.3 Million in 2024.

Q2: What is the expected market value of the wealth management market in Australia by 2033?

A: The market is forecast to reach USD 213.2 Million by 2033.

Q3: What is the projected CAGR for the wealth management market in Australia during 2025-2033?

A: The market is expected to grow at a CAGR of 7.60% during 2025-2033.

Q4: What are the key trends shaping the wealth management market in Australia?

A: Key trends include digital transformation, regulatory reforms, and the rise of robo-advisory services.

Q5: Which regions are leading the wealth management market in Australia?

A: Major regions include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Other Reports by IMARC Group:

https://www.imarcgroup.com/australia-data-center-storage-market

https://www.imarcgroup.com/australia-auto-parts-aftermarket-market

https://www.imarcgroup.com/australia-venture-capital-market

https://www.imarcgroup.com/australia-family-offices-market

https://www.imarcgroup.com/australia-solar-inverter-market

Contact Us:

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

About Us:

IMARC Group is a leading market research company that provides management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our solutions include comprehensive market intelligence, custom consulting, and actionable insights to help organizations make informed decisions and achieve sustainable growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Wealth Management Market Size, Share, Trends and Forecast by 2033 here

News-ID: 4077054 • Views: …

More Releases from IMARC Services Private Limited

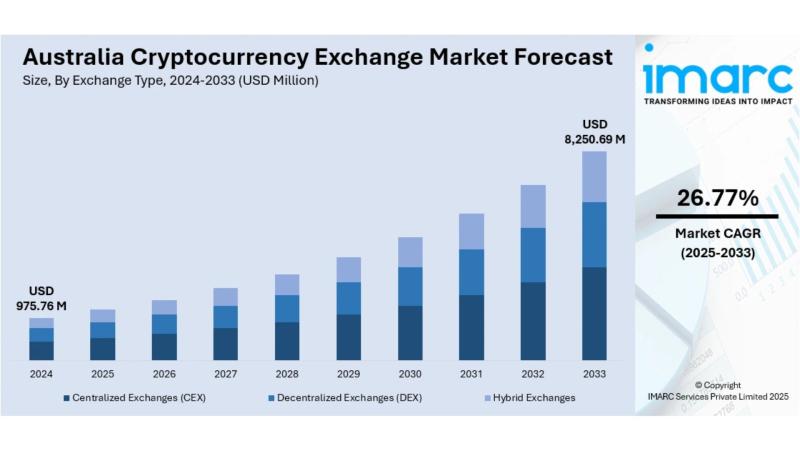

Australia Cryptocurrency Exchange Market Size, Share, Trends 2025-2033

Australia Cryptocurrency Exchange Market Overview

Market Size in 2024: USD 975.76 Million

Market Size in 2033: USD 8,250.69 Million

Market Growth Rate 2025-2033: 26.77%

According to IMARC Group's latest research publication, "Australia Cryptocurrency Exchange Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia cryptocurrency exchange market size was valued at USD 975.76 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 8,250.69 Million by 2033, exhibiting a…

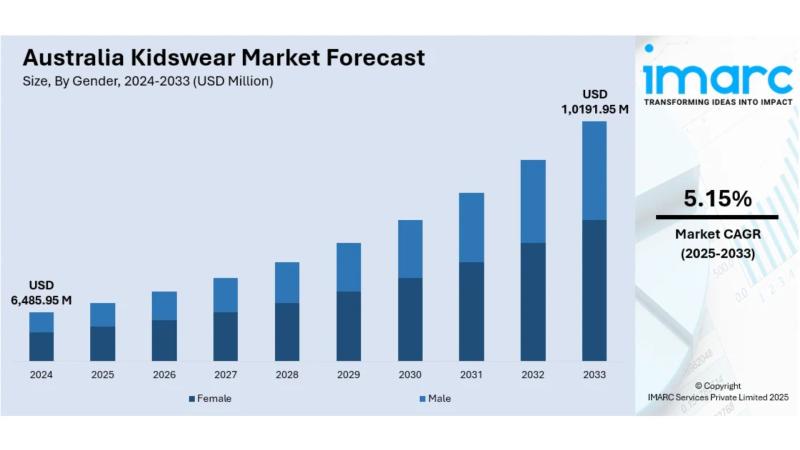

Australia Kidswear Market Size, Share, Trends and Forecast by 2025-2033

Australia Kidswear Market Overview

Market Size in 2024: USD 6,485.95 Million

Market Size in 2033: USD 10,191.95 Million

Market Growth Rate 2025-2033: 5.15%

According to IMARC Group's latest research publication, "Australia Kidswear Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia kidswear market size was valued at USD 6,485.95 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 10,191.95 Million by 2033, exhibiting a CAGR of 5.15%…

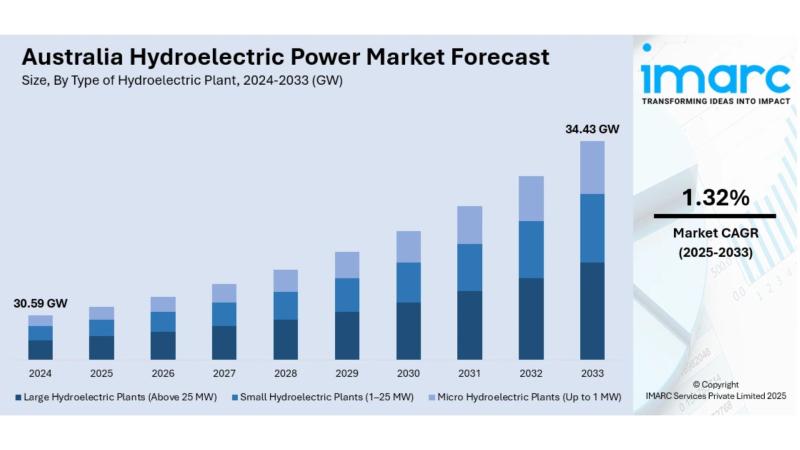

Australia Hydroelectric Power Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Hydroelectric Power Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia hydroelectric power market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia hydroelectric power market size reached 30.59 GW in 2024. Looking forward, IMARC Group expects the market to reach 34.43 GW…

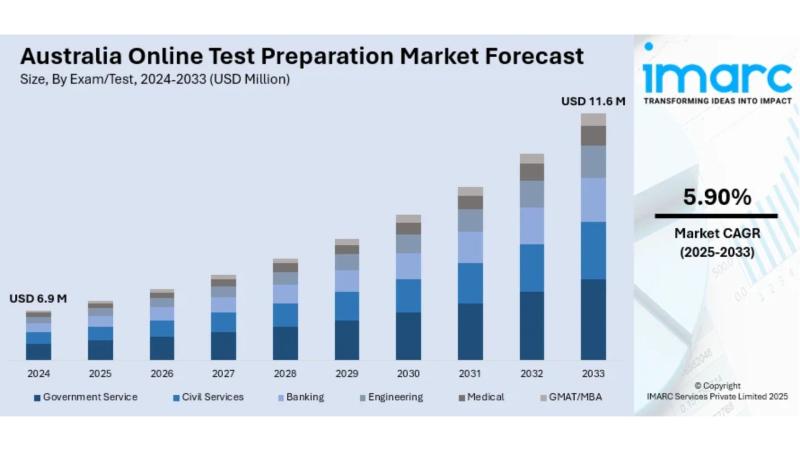

Australia Online Test Preparation Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Online Test Preparation Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia online test preparation market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia online test preparation market size reached USD 6.9 Million in 2024. Looking forward, IMARC Group expects the market…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…