Press release

Saudi Arabia Logistics Market Set to Surge to USD 81.2 Billion by 2033 at a CAGR of 4.9%

Saudi Arabia Logistics Market OverviewMarket Size in 2024: USD 52.7 Billion

Market Size in 2033: USD 81.2 Billion

Market Growth Rate 2025-2033: 4.9%

According to IMARC Group's latest research publication, "Saudi Arabia Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Region, 2025-2033", The Saudi Arabia logistics market size was valued at USD 52.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 81.2 Billion by 2033, exhibiting a CAGR of 4.9% from 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-logistics-market/requestsample

Growth Factors in the Saudi Arabia Logistics Market

● Vision 2030 and Economic Diversification

Vision 2030 is a driver of the logistics market in Saudi Arabia because it intends to put Saudi Arabia on the map as a global logistics hub. The plan emphasizes infrastructure development, which supports the diversification of the economy. The plan has already resulted in committed funds for enhanced infrastructure, including the King Abdulaziz Port in Dammam and the Red Sea Gateway Terminal, improving trade connectivity with Asia, Europe, and Africa. For example, the NEOM project will rely on a strong logistics network to move materials and, as a result, boost demand for warehousing and other freight services. With government incentives for companies engaged in logistics and special economic zones such as King Abdullah Economic City, investment will continue to flow into the logistics and transportation sector, and returns on investment will improve as investments that produce value become more efficient.

● E-commerce Boom and Last-Mile Delivery Demand

Its rapid development due to the tech-savvy market and high levels of internet penetration is changing the logistics environment in Saudi Arabia. It is important for Amazon and Noon to have efficient last mile services to upkeep consumer expectations of fast delivery, which has led to investments in last mile logistics infrastructures and operations, and better delivery options for consumers, including courier companies building delivery fleets and urban distribution centers. One example is Aramex who has invested their time and resources into expanding its smart lockers across Riyadh in order to optimize parcel delivery. Now that more than 80% of Saudis shop online, it is clear that logistics services are needed and in demand, along with various offerings such as reliable cold chain solutions for groceries. The willingness to experiment with new solutions is at an all-time high, and with the growing demand, logistics providers have intensified their competitive nature and have taken proactive steps to better address and service consumers in hopes of improving customer satisfaction.

● Strategic Geographic Location

Saudi Arabia's geographical position at the intersection of three continents is significant to global trade routes. Also, the country is situated near major shipping routes such as the Red Sea and Arabian Gulf, and it is pursuing its ambition of encroaching on world logistics players. A major investment in the Kingdom, the Saudi Landbridge will connect port facilities on the east coast versus the west coast of the Kingdom, thereby shortening transit times of goods. To facilitate this opportunity, freight to Europe and Asia alongside attracting multi-national firms through DP World's operations at the Jeddah Islamic Port. In summary, Saudi Arabia's strategic position in global supply chains continues to generate demand for logistics infrastructure, including ports, rail, and airport facilities that allow the expansion of the market and global reach.

Key Trends in the Saudi Arabia Logistics Market

● Digitalization and Technology Adoption

The digitization of logistics is transforming and making Saudi Arabia's logistics sector more efficient and transparent. Digital technologies-AI, IoT, blockchain, etc.-are increasingly streamlining supply chain processes, including inventory management, monitoring and tracking shipment from point-A to the final destination of point-B. For example, Saudi Post has launched "smart" logistics platforms to improve delivery routes that will both save costs and improve delays. International logistics companies are utilizing blockchain to improve transparency when it comes to global trade documentation. Digitizing systems are appealing to businesses who are looking for real time information and efficiencies in operations, which aligns with Saudi Arabia's Vision 2030 that has identified a transition to a digital economy. That is why logistics companies are invested in technology to stay competitive and/or to respond to changing market demands.

● Growth of Green Logistics

Sustainability is currently trending in Saudi Arabia's logistics market, driven by environmental targets under Vision 2030. Companies are implementing sustainable green strategies, such as electric delivery vehicles and energy-efficient warehouses, helping to reduce their carbon footprints. For example, DHL is implementing electric vans we can see in Riyadh to support electrified last-mile delivery. Additionally, we are seeing investment opportunities in rail infrastructure, such as the North-South Railway, to move goods by lower-emission freight than trucking increases. These changes align with global sustainability efforts and appeal to eco-conscious customers and investors alike, giving Saudi Arabia an early-mover advantage on green logistics in the region.

● Rise of Integrated Logistics Parks

Logistics parks are becoming a more prevalent trend by providing centralized locations for warehousing, distribution, and value-added services. Logistics parks are more streamlined and cost-effective for businesses, like the Riyadh Integrated Logistics Park built by Agility for e-commerce and manufacturers, as well as the Jeddah Logistics Park that provides more services relating to port operations and activities to enhance trade. Logistics parks are building toward the demand for scalable logistics solutions through e-commerce and global trade. Logistics parks enhance the flexibility of logistics by consolidating services and opportunities for logistics players to collaborate, enhancing the competitiveness of the logistics sector while supporting the economic initiative of Vision 2030 as this will lead to more partnerships with logistics players in Saudi Arabia.

Buy Full Report: https://www.imarcgroup.com/checkout?id=16517&method=1315

Saudi Arabia Logistics Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Model Type:

● 2 PL

● 3 PL

● 4 PL

Analysis by Transportation Mode:

● Roadways

● Seaways

● Railways

● Airways

Analysis by End Use:

● Manufacturing

● Consumer Goods

● Retail

● Food and Beverages

● IT Hardware

● Healthcare

● Chemicals

● Construction

● Automotive

● Telecom

● Oil and Gas

● Others

Regional Analysis:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

● Future Outlook

The logistics market in Saudi Arabia will see strong growth as Vision 2030 expenditure on infrastructure and the presence of Saudi Arabia in global trade continues. Continued growth in the e-commerce sector along with occurrences such as EXPO 2030 and FIFA World Cup 2034 will drive demand for sophisticated logistics solutions involving warehousing and last mile delivery. There are challenges with levels of regulation and skills gaps and labour shortages will likely remain, however the government reforms and increased adoption of technology will address this to some extent. The logistics market will be centered around sustainability and digitalization and therefore is likely to attract global players and set Saudi Arabia up as a logistics hub confident in the long-term growth and sustainability of the sector with the opportunity to innovate.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=16517&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Logistics Market Set to Surge to USD 81.2 Billion by 2033 at a CAGR of 4.9% here

News-ID: 4071583 • Views: …

More Releases from IMARC Group

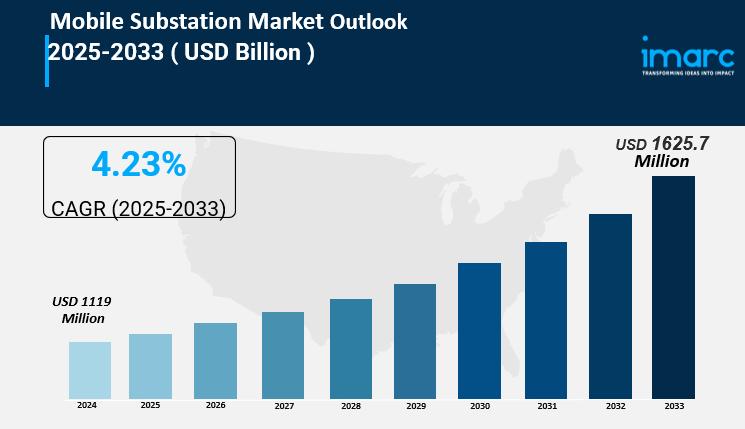

Mobile Substation Market is Expected to Grow USD 1,625.7 Million by 2033 | At CA …

IMARC Group, a leading market research company, has recently released a report titled " Mobile Substation Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the Mobile Substation Market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Mobile Substation Market…

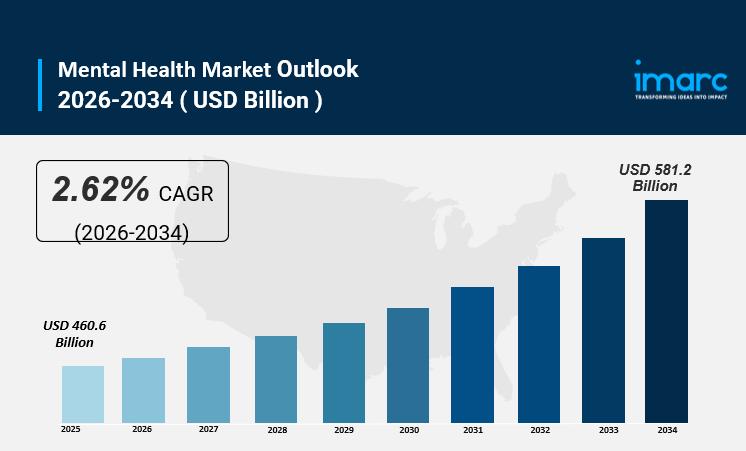

Mental Health Market Size, Share, Trends, and Forecast by Disorder, Service, Age …

IMARC Group, a leading market research company, has recently released a report titled " Mental Health Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2026-2034."The study provides a detailed analysis of the industry, including the Mental Health Market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Mental Health Market Overview

The…

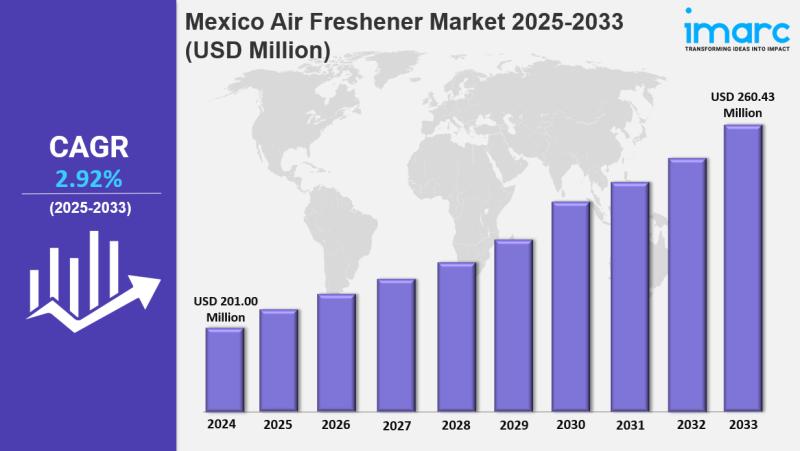

Mexico Air Freshener Market Size, Share, Latest Insights and Forecast to 2033

IMARC Group has recently released a new research study titled "Mexico Air Freshener Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico air freshener market reached USD 201.00 Million in 2024 and is projected to grow to USD…

Global Video Conferencing Market Report 2026-2034: Size, Share, Trends & Strateg …

The global video conferencing market size was valued at USD 13.8 Billion in 2025 and is forecasted to reach USD 31.4 Billion by 2034, exhibiting a CAGR of 9.60% during the forecast period of 2026-2034. The market growth is driven by increased reliance on high-speed internet, mobile devices, and the adoption of advanced features that enhance virtual communication. North America leads the market with a share of over 39.8% in…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…