Press release

Fuel Card Market to Hit USD 59.2 Billion by 2031, Growing at 5.6% CAGR

The global fuel card market was valued at USD 35.1 billion in 2021 and is projected to reach USD 59.2 billion by the end of 2031. The market is anticipated to grow at a CAGR of 5.6% from 2022 to 2031, driven by the increasing adoption of digital payment solutions, growing fleet management needs, and demand for fuel expense monitoring among commercial vehicle operators.Rise in adoption of contactless and prepaid cards; and advancements in fuel card services are projected to offer lucrative opportunities to the global market during the forecast period. Fuel cards are convenient to use and offer various benefits to consumers. Smart cards let consumers and fleet owners make quick payments without the hassle of paying in cash.

Dive Deeper into Data: Get Your In-Depth Sample Now! https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=32990

Market Segmentation

The fuel card market can be segmented based on various factors, providing a granular view of its dynamics:

By Service Type

Fuel Refill: This remains the primary application, enabling cashless and convenient fuel purchases.

Vehicle Service: Covers expenses related to vehicle maintenance, repairs, and servicing.

Parking: Facilitates payment for parking fees.

Toll Charge: Allows for seamless payment of road tolls.

Other Applications: May include car wash, breakdown assistance, and other related services.

By Sourcing Type (Card Type)

Branded Fuel Cards: Issued by specific oil companies (e.g., Shell, BP, ExxonMobil) and accepted only at their branded stations. These often offer brand-specific discounts and loyalty programs.

Universal Fuel Cards: Widely accepted across multiple fuel stations and networks, offering greater flexibility and choice for users. This segment held the largest market share in 2022 due to their versatility and comprehensive expense management features.

Merchant Fuel Cards: Issued by general retailers or merchants, often with associated loyalty programs.

By Technology

Smart Cards: Equipped with embedded microchips, offering enhanced security, data storage, and the ability to process more complex transactions. This segment held the largest market share in 2022, driven by the preference for hassle-free and secure payments.

Standard Cards: Traditional magnetic stripe cards.

By Application (End-user)

Individual: Fuel cards offered to personal consumers for their private vehicles, often with cashback or loyalty benefits.

Corporate (Commercial Fleets): Designed for businesses of all sizes, from sole traders and SMEs to large enterprises, to manage fuel expenses for their vehicle fleets. This is the largest segment and a significant driver of market growth.

By Industry Vertical

Fuel cards are utilized across a wide array of industries that rely on vehicle fleets, including:

Transportation and Logistics

Construction

Government

E-commerce and Delivery Services

Utilities

Field Services

By Region

The global fuel card market is geographically segmented into:

North America: Held a significant market share in 2022, driven by the large commercial fleet sector, rising fuel costs, and adoption of multiple services in fuel cards. The U.S. market alone was valued at US$ 178.2 billion in 2022.

Europe: Dominates the market in terms of market share, propelled by well-established transportation infrastructure, increasing adoption of prepaid and contactless technologies, and the need for efficient fuel consumption monitoring. The Europe commercial fleet market is expected to reach US$ 59,557.40 million by 2031, growing at a CAGR of 6.4% from 2024.

Asia Pacific: Anticipated to witness rapid growth, particularly in economies like India and China, due to increasing adoption of prepaid and contactless payment technologies, and the expansion of the logistics and transportation sectors.

Middle East & Africa (MEA)

South America

Regional Analysis

Europe, particularly, has seen robust growth driven by increased demand for monitoring fuel economy and secure cashless fuel transactions. The integration of advanced telematics and GPS technologies into fuel card systems is a key technological advancement in this region, allowing for real-time monitoring and route optimization. North America also exhibits strong growth, with rising fuel costs and the inclusion of multiple services in fuel cards boosting the market. Asia Pacific is emerging as a significant growth region, fueled by digital payment adoption and growing fleet operations.

Market Drivers and Challenges

Market Drivers:

Need for Improved Fuel Management and Cost Control: Businesses and fleet operators are increasingly seeking solutions to track, manage, and optimize fuel expenses, prevent fraud, and gain insights into consumption patterns.

Digital Transformation and Technological Advancements: The shift towards digital payment solutions, mobile apps, contactless payments, and online account management tools enhances convenience and efficiency.

Integration with Telematics and Fleet Management Software: Real-time data on vehicle location, driver behavior, and fuel consumption allows for better route optimization and operational efficiency.

Increased Demand for Cashless Transactions: Growing preference for secure and convenient cashless payments over traditional cash transactions.

Inclusion of Value-Added Services: Fuel card providers are offering additional benefits like discounts, loyalty programs, rewards, and comprehensive reporting tools.

Growth in Logistics and Transportation Sectors: The expansion of these sectors, particularly with the rise of e-commerce, directly fuels the demand for efficient fuel management solutions.

Market Challenges:

Security Concerns and Fraud Risks: Despite advanced security features, fuel cards remain susceptible to fraud, data breaches, and unauthorized transactions, necessitating continuous investment in robust security measures.

Limited Acceptance of Branded Fuel Cards: Branded cards may not be accepted at all fuel stations, particularly in remote areas or across different regions, which can be inconvenient for fleet operators.

Volatility in Fuel Prices: Fluctuating fuel prices make it challenging for businesses to plan and budget fuel expenses effectively.

Transition to Electric Vehicles (EVs): The increasing adoption of EVs poses a long-term challenge to traditional fuel card models, requiring providers to adapt their offerings to include EV charging solutions.

Transaction Fees: High transaction fees associated with some fuel cards can reduce their cost-efficiency, especially for smaller businesses.

Market Trends

Integration of Digital Wallets and Mobile Payments: Fuel card providers are increasingly offering mobile apps and integrating with digital wallets for seamless transactions.

Contactless Payment Adoption: The preference for contactless transactions is growing, enhancing convenience and speed at the pump.

AI and Data Analytics for Expense Management: Leveraging AI and machine learning to provide predictive analytics, automate expense management, and offer deeper insights into fuel consumption patterns.

Real-time Monitoring and Reporting: Enhanced capabilities for real-time tracking of fuel purchases, driver behavior, and vehicle performance.

Personalization and Customization of Services: Tailored offerings, loyalty programs, and discounts to attract and retain customers.

Focus on Sustainability and EV Charging Solutions: Providers are adapting to the shift towards greener transportation by incorporating EV charging networks into their services and promoting fuel efficiency.

EMV Migration: Increased adoption of chip-based EMV cards for improved security and offline transaction control.

Strategic Partnerships: Collaborations between fuel card issuers and network providers to expand card acceptance globally.

Future Outlook

The fuel card market is poised for continued growth, driven by the ongoing need for efficient fuel management, the deepening integration of technology, and the evolving transportation landscape. The market will likely see further advancements in AI and machine learning for predictive analytics and advanced fleet optimization. The integration of fuel card systems with broader Enterprise Resource Planning (ERP) solutions will provide businesses with a holistic view of their operations. As the world shifts towards greener transportation, the market will increasingly incorporate solutions for electric vehicle charging, demonstrating its adaptability and resilience. Emerging markets are expected to witness rapid expansion, supported by infrastructure investments and the growth of e-commerce and logistics industries.

Key Market Study Points

Understanding the evolving needs of fleet operators and individual consumers for fuel expense management.

Analyzing the impact of digital payment technologies and their integration with fuel card systems.

Assessing the growth potential of different card types (branded, universal, merchant) and technologies (smart cards, standard cards).

Evaluating the influence of regional regulatory frameworks and economic conditions on market growth.

Monitoring the competitive landscape and identifying strategic opportunities for mergers, acquisitions, and partnerships.

Forecasting the long-term impact of electric vehicle adoption and the need for diversified service offerings.

Exploring the role of data analytics and AI in enhancing fuel card functionalities and value propositions.

Competitive Landscape

The global fuel card market is characterized by a mix of large, established players and emerging innovators. Key players are constantly investing in product innovation, technological advancements, and strategic partnerships to gain a competitive edge. Prominent companies in this market include:

Shell Group

BP plc.

TotalEnergies SE

WEX Inc.

FLEETCOR Technologies, Inc.

Exxon Mobil Corporation

Caltex

Puma Energy

Engen Petroleum Ltd.

Absa Bank Limited

Standard Bank

First National Bank (FNB)

Comdata Inc.

Arval BNP Paribas Group

Voyager Fleet Systems Inc.

U.S. Bank

These companies are focusing on enhancing their service portfolios, improving security features, and expanding their geographical reach to capture a larger market share.

Recent Developments

Integration with E-commerce Platforms: Fuel cards are being integrated with e-commerce platforms to streamline fuel expense management for businesses involved in deliveries.

Launch of Innovative Payment Solutions: Companies are introducing new solutions like the "Edenred Essentials" developed in partnership with Visa, offering an innovative fuel, EV charge, and vehicle expenses commercial card.

Enhanced Security Features: Continuous development of advanced security measures like biometric authentication, tokenization, and real-time fraud detection to protect cardholder data.

Expansion of Acceptance Networks: Key partnerships between fuel card issuers and network providers are expanding card acceptance at fuel stations globally.

Focus on Driver Behavior Analytics: Leveraging telematics to track driver performance, optimize routes, and reduce fuel wastage.

Customization and Loyalty Programs: Introduction of personalized fuel card programs and loyalty incentives to enhance customer retention and satisfaction.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=32990<ype=S

The fuel card market is set for an exciting decade, driven by technological innovation and the unwavering demand for efficient, secure, and cost-effective fuel management solutions across diverse industries. The ability of market players to adapt to new technologies, address evolving customer needs, and navigate the transition to alternative fuels will be crucial for success in this dynamic landscape.

Explore Latest Research Reports by Transparency Market Research:

Reusable/Washable Hygiene Products Market - https://www.transparencymarketresearch.com/reusable-washable-hygiene-products-market.html

Handheld Marijuana Vaporizer Market - https://www.transparencymarketresearch.com/handheld-marijuana-vaporizer-market.html

Doorbell Camera Market - https://www.transparencymarketresearch.com/doorbell-camera-market.html

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Want to know more? Get in touch now. -https://www.transparencymarketresearch.com/contact-us.html

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fuel Card Market to Hit USD 59.2 Billion by 2031, Growing at 5.6% CAGR here

News-ID: 4070655 • Views: …

More Releases from transparencymarketresearch

Microgreens Market to Surge at 10.9% CAGR, Set to Reach USD 8.56 Billion by 2036

The global microgreens market was valued at USD 2,780.5 million in 2025 and is projected to reach USD 8,563.5 million by 2036. Driven by rising demand for nutrient-dense foods and growing adoption across foodservice and retail channels, the industry is expected to expand at a robust CAGR of 10.9% from 2026 to 2036.

The global microgreens market represents a specialized, high-value segment within the broader fresh produce and specialty horticulture industry,…

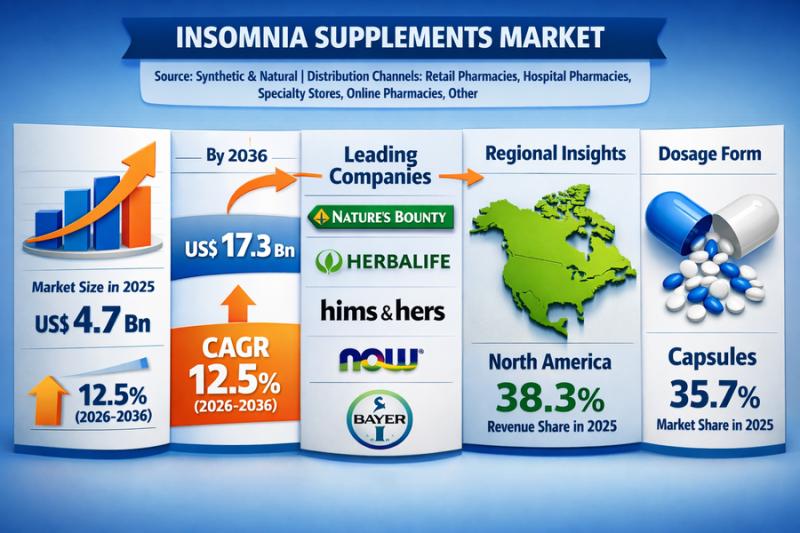

Insomnia Supplements Market Set to Reach US$ 17.3 Bn by 2036, Growing at a Robus …

The global insomnia supplements market was valued at USD 4.7 billion in 2025 and is projected to reach USD 17.3 billion by 2036, reflecting strong growth potential. The market is anticipated to expand at a CAGR of 12.5% from 2026 to 2036, driven by rising sleep disorder prevalence, increasing consumer focus on mental wellness, and growing demand for natural and non-prescription sleep aids.

The insomnia supplements market is expected to witness…

Fiber-Based Blister Pack Market Set to Surge at 21.5% CAGR Through 2036

The global fiber-based blister pack market was valued at US$ 1,633.8 million in 2025 and is projected to surge to US$ 13,591.8 million by 2036. Driven by rising demand for sustainable and eco-friendly packaging solutions, the market is expected to grow at a robust CAGR of 21.5% from 2026 to 2036.

Fiber-based blister packaging is a type of packaging that substitutes the usual plastic blister with paperboard or molded fiber components…

Psychotropic Drugs Market to Reach US$ 41.2 Bn by 2036, Growing at 5.4% CAGR

The global psychotropic drugs market was valued at USD 23.1 Bn in 2025 and is projected to reach USD 41.2 Bn by 2036. Driven by rising awareness of mental health disorders, increasing diagnosis rates, and ongoing pharmaceutical innovations, the industry is expected to grow at a CAGR of 5.4% from 2026 to 2036.

The primary drivers of the expanding psychotropic drugs market include the rising prevalence of mental disorders such as…

More Releases for Fuel

Fuel Cell Market to Expand Significantly by 2024 | Horizon Fuel Cell Technologie …

The "Fuel Cell Market" intelligence report, just published by USD Analytics, covers insurers' micro-level study of important market niches, product offers, and sales channels. In order to determine market size, potential, growth trends, and competitive environment, the Fuel Cell Market provides dynamic views. Both primary and secondary sources of data were used to generate the research, which has both qualitative and quantitative depth. Several of the major figures the study…

Electronic Fuel Management System Market Share and Future Forecast 2022 to 2028 …

The global Electronic Fuel Management System market revenue is expected to register a CAGR of 8.8% during the forecast period.

Latest Study on Industrial Growth of Electronic Fuel Management System Market 2022-2028. A detailed study accumulated to offer current insights about important features of the Electronic Fuel Management System market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, value chain optimization, price, and other substantial factors. While emphasizing…

Marine Gensets Market: Information by Vessel Type (Commercial Vessel, Defense Ve …

A marine genset is a power unit generator that supplies electricity to ships. It offers reliable and fuel-efficient electric power generation for onboard power, emergency gensets, and diesel-electric propulsion. It can be fueled by gas, diesel, hybrid fuel, and others. It has application in offshore commercial vessels, defense vessels, and offshore vessels, among others. Nowadays, most of the marine gensets are fueled by diesel. However, the introduction of alternative fuels…

Fuel Card Market to 2027 - Global Analysis and Forecasts By Type (Branded Fuel C …

The global fuel card market is estimated to account US$ 6.29 Bn in 2018 and is expected to grow at a CAGR of 5.8% during the forecast period 2019 – 2027, to account to US$ 10.39 Bn by 2027.

Request Sample Pages of “Fuel Card Market” Research Report @ www.theinsightpartners.com/sample/TIPRE00003099/?utm_source=openpr&utm_medium=10387

Fuel Card Market: Key Insights

Fuel Card Market Size 2021, by manufacturer, region, types, and application, forecast till 2028 is analyzed and researched on…

Clean Fuel Technology Market – Development Assessment 2025 | Clean Fuel Develo …

Global Clean Fuel Technology Market: Overview

Clean technology in general implies the use of any service, product, or system that has as little of a negative impact on the environment as possible. Aspects of clean technology include the conservation of energy, sustainable resources, and clean sources of fuels. Clean fuels can refer to the use of renewable fuels such as biogas, or also blended fuels such as fossil fuels with renewable…

Fuel Cell Interconnectors Market By Product Type Ceramic based, Metal based; By …

Global Fuel Cell Interconnectors Market Introduction

A fuel cell is a battery that generates electricity through an electrochemical reaction where the fuel cell interconnector is a layer made up of either ceramic or metallic material, which combines the electricity generated by each individual cell. Fuel cell interconnectors are placed between each individual cell to connect the cells in the series. Ceramic fuel cell interconnectors are more suitable for high-temperature working conditions…