Press release

Strong Growth Ahead: Equity Management Software Market Size To Grow At Arecord 13.1% Cagr By 2029

Our market reports now include the latest updates on global tariffs, trade impacts, and evolving supply chain dynamics.How Big Is the Equity Management Software Market Size Expected to Be by 2034?

The market for equity management software has seen swift expansion in the prior years. An increase from $0.61 billion in 2024 to $0.69 billion in 2025 is projected, with a compound annual growth rate (CAGR) of 13.3%. Numerous factors have contributed to this historic period growth, such as the escalating need for real-time analytics, its rising application in large and medium-sized companies, the surge in artificial intelligence (AI) and automation, the progressive shift to digitalization, and an intensified emphasis on employee share ownership.

Anticipated to experience a swift expansion in the forthcoming years, the size of the equity management software market is projected to ascend to $1.13 billion by 2029, registering a compound annual growth rate (CAGR) of 13.1%. This surge during the projected duration is linked to the escalating demand for equity management software, an amplified focus on employee engagement, growing requirements for real-time analytics, an increasing acceptance of systems based on the cloud, along with rising urbanization and globalization. During the forecasted timeline, major market trends include an augmented focus on solutions based in the cloud, system integration with other financial constructs, the application of advanced analytics and reporting functionalities, the incorporation of blockchain technology, plus the growth of artificial intelligence and machine learning adoption.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=20779

What Are the Emerging Segments Within the Equity Management Software Market?

The equity management software market covered in this report is segmented -

1) By Type: Basic (Under $50 Per Month); Standard ($50-$100 Per Month); Senior (Above $100 Per Month)

2) By Deployment: On-Premise; Cloud

3) By Application: Private Corporation; Start-Ups; Listed Company; Financial Team; Other Applications

Subsegments:

1) By Basic (Under $50 Per Month): Small Business Equity Management Software; Startup Equity Management Solutions; Limited Feature Software For Individual Investors; Basic Cap Table Management Tools; Low-Cost Option For Early-Stage Companies; Basic Stock Option Tracking Systems

2) By Standard ($50-$100 Per Month): Mid-Tier Equity Management Platforms; Advanced Cap Table Management Software; Stock Option and Equity Grant Administration; Shareholder Communication and Reporting Tools; Compliance and Tax Reporting For SMEs; Performance Tracking For Employee Stock Plans

3) By Senior (Above $100 Per Month): Enterprise-Level Equity Management Software; Comprehensive Stock Option and RSU Management; Advanced Reporting and Analytics Features; Multi-Country and Multi-Currency Compliance Tools; Full-Scale Shareholder Communication Systems; Integration With Payroll and HR Platforms; Customizable Equity Plans and Employee Benefits

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=20779&type=smp

What Long-Term Drivers Are Shaping Equity Management Software Market Trends?

The growing interest in a range of investment methods could fuel the expansion of the equity management software market in the future. These methods entail strategic plans that investors formulate to distribute capital into different financial tools with the aim of attaining certain financial targets while also handling risk. The surge in risk management has led investors to look for diversification as a buffer against market fluctuations and unexpected interruptions. Equity management software leverages various investment strategies to achieve their financial goals, which usually involve generating positive returns while managing risk and preserving capital. For example, foreign multinational corporations reportedly earned $289.9 billion in 2022 from their diverse investment in the United States, marking a 1.7 percent rise from 2021, according to the U.S. Bureau of Economic Analysis in July 2023. Consequently, the growing need for diverse investment methods is invigorating the expansion of the equity management software market.

Who Are the Top Competitors in Key Equity Management Software Market Segments?

Major companies operating in the equity management software market are Morgan Stanley, Computershare Limited, Diligent Corporation, Carta Inc., Dynamo Software Inc., Gust Inc., Vestd Ltd., EquityZen Inc., Altvia Solutions LLC, Qapita Fintech Pte. Ltd., Certent Inc., Solium Capital LLC, Eqvista Inc., Ledgy AG, Cake Equity Holdings Inc., RuleZero, Plan Management Corporation, Fundwave Technologies Private Limited, Global Shares Limited, E-List Technologies Pvt Ltd., Trica equity, AL Advisors Management Inc

What Actigraphy Devices Market Trends Are Gaining Traction Across Different Segments?

Leading firms in the equity management software market are focusing on creating cutting-edge AI-enhanced equity management tools to enhance equity management's efficiency and effectiveness. Essentially, an AI-enabled equity management tool is a software system that uses AI to automate and enhance equity ownership processes, increasing accuracy and efficiency while reducing human error. For example, SeedBlink, an equity crowdfunding platform from Romania, introduced the comprehensive SeedBlink equity management and investment platform in May 2024. This platform facilitates equity management for European tech start-ups and investors, providing four consolidated services like SeedBlink Equity for cap table management, ESOP, and governance; SeedBlink Ventures to link start-ups with investors; SeedBlink Syndicates for cooperative angel investments; and SeedBlink Secondaries for trading matured shares and facilitating early liquidity. By streamlining complex equity procedures and aiding strategic investment, this inclusive platform becomes a critical tool for growth-focused start-ups and investors looking for diverse prospects.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/equity-management-software-global-market-report

Which Regions Are Becoming Hubs for Equity Management Software Market Innovation?

North America was the largest region in the equity management software market in 2024. Asia-Pacific is expected to be the fastest growing region in the market going forward. The regions covered in the equity management software market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Equity Management Software Market?

2. What is the CAGR expected in the Equity Management Software Market?

3. What Are the Key Innovations Transforming the Equity Management Software Industry?

4. Which Region Is Leading the Equity Management Software Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Strong Growth Ahead: Equity Management Software Market Size To Grow At Arecord 13.1% Cagr By 2029 here

News-ID: 4067111 • Views: …

More Releases from The Business Research Company

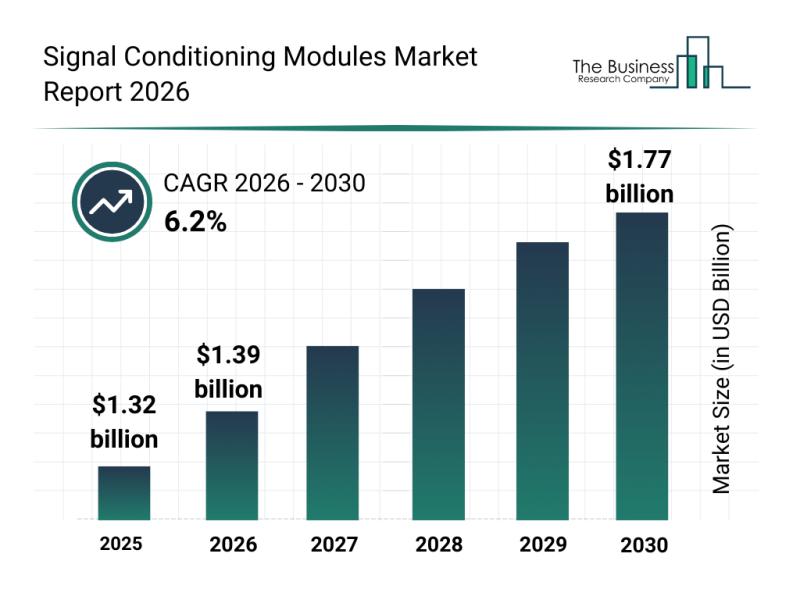

Future Perspective: Key Trends Shaping the Signal Conditioning Modules Market Up …

The signal conditioning modules market is on track for significant expansion over the coming years, driven by advancements in various industrial and technological sectors. This growth reflects the increasing need for precise signal management and integration with emerging smart technologies that are shaping modern automation and data acquisition systems.

Projected Growth Trajectory of the Signal Conditioning Modules Market

The signal conditioning modules market is anticipated to reach a valuation of $1.77…

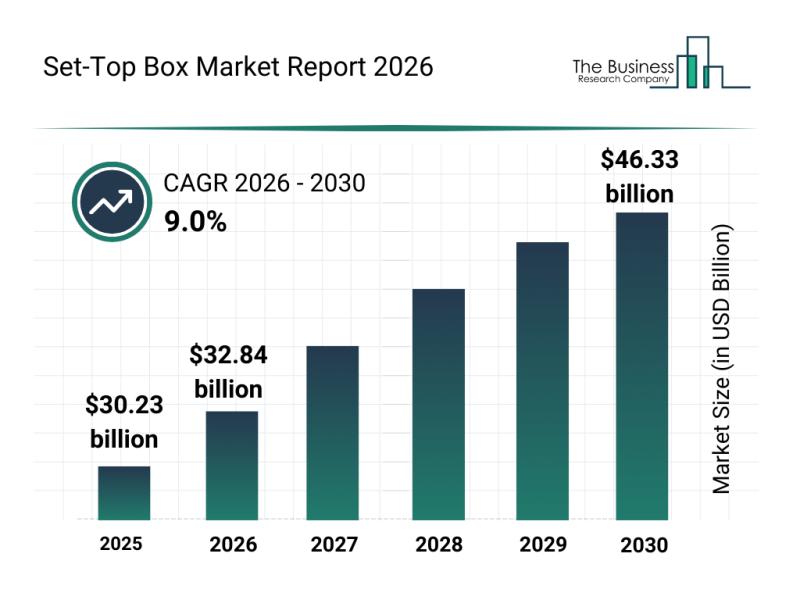

Emerging Sub-Segments Transforming the Set-Top Box Market Dynamics

The set-top box market is on the cusp of significant expansion as technology and consumer preferences continue to evolve rapidly. With the increasing demand for advanced streaming and broadcasting solutions, this sector is poised for substantial growth over the coming years. Let's explore the market's projected size, leading companies, key trends, and the segments driving this development.

Projected Market Growth of the Set-Top Box Industry by 2030

The set-top box market…

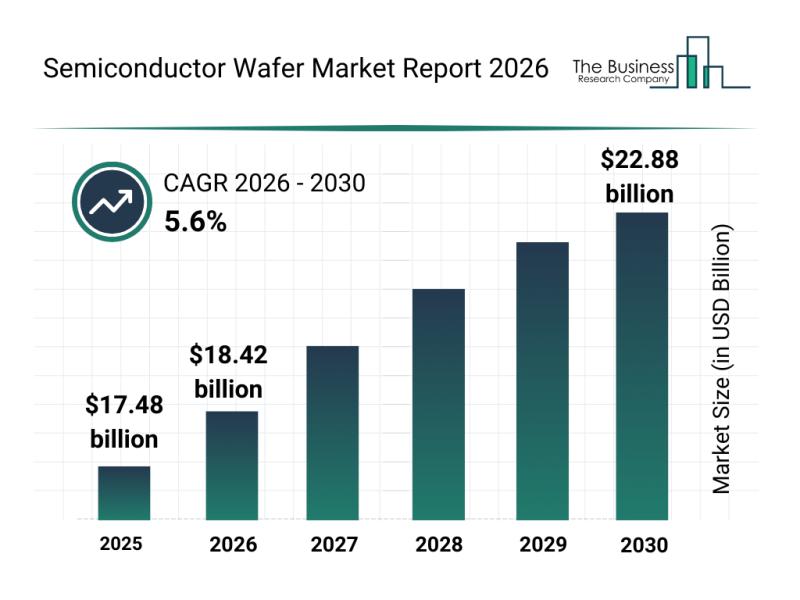

Market Trend Analysis: The Impact of Recent Innovations on the Semiconductor Waf …

The semiconductor wafer sector is gearing up for significant expansion as technological advancements and diverse industry demands drive its growth. With applications spanning from electric vehicles to telecommunications, this market is positioned for steady development in the years ahead. Let's explore the anticipated market size, key players, emerging trends, and segmentation details shaping the future of this vital industry.

Projected Market Size and Growth Trajectory of the Semiconductor Wafer Market

Forecasts…

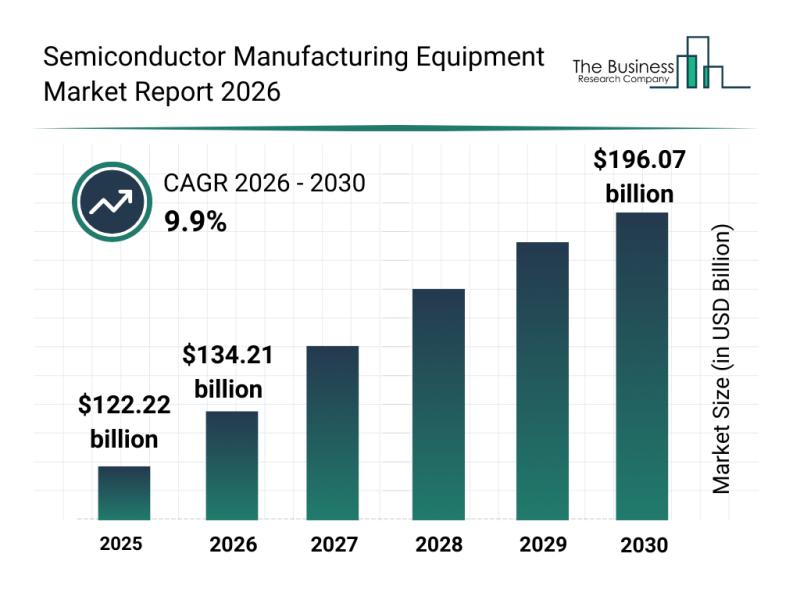

Leading Companies Reinforce Their Presence in the Semiconductor Manufacturing Eq …

The semiconductor manufacturing equipment market is poised for significant expansion as the demand for high-performance chips and advanced packaging technologies continues to grow. This evolving sector is driven by technological progress and increased investments, setting the stage for substantial developments through 2030.

Projected Semiconductor Manufacturing Equipment Market Size and Growth

The semiconductor manufacturing equipment market is forecasted to reach a value of $196.07 billion by 2030, growing at a compound annual…

More Releases for Equity

Shah Equity Launches the World's First Integrated Global Private Equity & Hedge …

Shah Equity, a leading innovator in financial services, proudly announces the launch of the world's first integrated Global Private Equity & Hedge Fund. With a strategic focus on Commercial Real Estate, Healthcare, Home Services, and a robust Hedge Fund, Shah Equity is dedicated to maximizing value and fueling sustainable growth, all while expertly hedging investment risks.

In an era where traditional investment models face unprecedented challenges, Shah Equity steps forward with…

real estate private equity firms,private equity manager,private equity financing …

Real estate private equity is the practice of investing in real estate properties or real estate-related assets using private capital. Private equity firms, high net worth individuals, and institutional investors are among the primary players in this market. These investors provide the capital for real estate transactions, such as the purchase of properties, and in return, they receive a share of the profits generated by the properties.

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

private investment,private equity,private equity firms,private equity fund,capit …

Private investment refers to the purchase or financing of a private company or a portion of it, typically by a private equity firm, venture capital firm, or angel investor. Private investments can take various forms, including equity investments, debt investments, or a combination of both.

http://pandacuads.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private equity firms typically invest in mature companies that have a proven track record of revenue and earnings, but that may be underperforming…

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

China Private Equity Establishment Consultation,Chinese private equity company,

Pandacu China is a leading private equity firm that specializes in making long-term investments in small and medium-sized enterprises (SMEs) in China. The company was founded in China by a team of experienced finance professionals with a deep understanding of the Chinese market and a strong network of contacts in the private equity and venture capital industry.

https://boomingfaucet.com/

China Private Equity Establishment Consultation

E-mail:nolan@pandacuads.com

SMEs are the backbone of the Chinese economy, and they…