Press release

Global Banking As A Service Market Report Insights and Growth Outlook to 2034 - Strategic Trade Shifts, Tariff Impacts, and Supply Chain Reinvention Driving Competitive Advantage

Banking As A Service Market Analysis 2025-2034: Industry Size, Share, Growth Trends, Competition and Forecast Report

Get a Free Sample: https://www.oganalysis.com/industry-reports/banking-as-a-service-market

Banking As A Service Market Overview

The Banking as a Service (BaaS) market is rapidly gaining momentum as financial institutions, fintechs, and non-financial brands embrace embedded finance models to deliver seamless, digital-first banking experiences. BaaS refers to a model where licensed banks provide core banking infrastructure-such as account creation, payments, loans, card issuing, and compliance tools-via APIs to third-party developers and platforms. This enables non-bank companies to integrate financial services into their offerings without becoming fully regulated financial entities. The rise of e-commerce platforms, ride-sharing apps, online marketplaces, and neobanks has fueled demand for BaaS, allowing these platforms to offer features like digital wallets, debit cards, credit lines, and investment tools directly to users. As consumer expectations shift toward real-time, integrated, and mobile-accessible financial experiences, BaaS platforms are enabling a new wave of innovation and customer engagement. The market is particularly strong in North America and Europe, where regulatory clarity and digital infrastructure are mature. Meanwhile, Asia-Pacific is emerging as a high-growth region due to its mobile-first economies and large underbanked populations. Established banks are leveraging BaaS to modernize legacy systems and tap into new revenue streams, while fintech startups use it to scale rapidly without building their own banking stack from scratch.

Technological advancements, favorable regulations, and competitive pressures are reshaping the BaaS landscape. APIs, cloud-native architecture, and microservices are allowing greater flexibility, speed, and scalability in delivering financial functions to third parties. At the same time, regulators are increasingly supporting open banking frameworks and digital licensing regimes, enabling a more inclusive and competitive financial ecosystem. Strategic partnerships between traditional banks, fintechs, and platform companies are accelerating market penetration, while venture capital investments continue to pour into BaaS providers. The market is also witnessing increased specialization, with players focusing on niche areas such as SME lending, cross-border payments, or ESG-integrated banking services. Compliance-as-a-service and Know Your Customer (KYC)/Anti-Money Laundering (AML) modules are becoming standard components of BaaS platforms, allowing partners to ensure regulatory adherence while focusing on user experience. Challenges such as data privacy, cybersecurity, and operational integration persist, particularly when onboarding non-financial players into regulated environments. However, modular design, sandbox environments, and developer-friendly tools are helping ease these transitions. As demand grows for financial inclusivity, product personalization, and real-time finance, the BaaS model is evolving from a fintech trend into a structural pillar of modern banking. It is enabling a future where banking becomes invisible, embedded, and accessible-powering a decentralized, user-centric financial services ecosystem.

Access Full Report @ https://www.oganalysis.com/industry-reports/banking-as-a-service-market

Key Banking As A Service Market Companies Analysed in this Report include -

Green Dot Bank

Solarisbank

PayPal

Fidor Solutions

Moven

Currencycloud

Treezor

Bnkbl

MatchMove

Block

Key Insights from the report -

Embedded Finance Integration Across Industries

Non-financial companies-like e-commerce, retail, and mobility platforms-are embedding banking features directly into their apps.

This includes offerings such as payments, wallets, lending, and insurance through API connections.

BaaS enables these brands to enhance customer loyalty and generate new revenue streams.

API-Driven Modular Banking Architecture

BaaS platforms are leveraging open APIs and microservices to deliver scalable, plug-and-play financial tools.

Modularity allows businesses to choose only the services they need, reducing time-to-market.

This flexibility is key for startups, neobanks, and digital-first enterprises.

Regulatory Support and Open Banking Acceleration

Global regulators are encouraging open banking, digital licenses, and third-party access to core financial infrastructure.

This is fostering a more competitive and innovation-friendly environment for BaaS providers.

Markets like the EU, UK, Singapore, and India are setting the pace in regulatory adoption.

Rise of Specialized and Vertical-Focused BaaS Providers

New BaaS players are emerging with niche offerings tailored for sectors like healthcare, education, and SMB lending.

These providers offer industry-specific compliance, underwriting models, and user experiences.

Specialization helps address gaps left by traditional banks and generalist platforms.

Expansion of Compliance-as-a-Service Capabilities

BaaS platforms are incorporating built-in tools for KYC, AML, fraud detection, and regulatory reporting.

This offloads the compliance burden from non-financial companies integrating financial services.

As regulatory scrutiny increases, these capabilities are becoming a key differentiator.

Growing Investment and Bank-Fintech Collaborations

Banks are partnering with or acquiring BaaS providers to modernize their infrastructure and reach new customer segments.

Meanwhile, venture capital continues to flow into BaaS startups driving global expansion.

These collaborations are reshaping traditional banking and accelerating financial innovation.

Tailor the Report to Your Specific Requirements @ https://www.oganalysis.com/industry-reports/banking-as-a-service-market

Get an In-Depth Analysis of the Banking As A Service Market Size and Market Share split -

by Component

- Platform

- Services

by Product Type

- API-Based Banking-as-a-Service

- Cloud-Based Banking-as-a-Service

by Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

by End-user

- Banks

- NBFC

- Government

- Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

DISCOVER MORE INSIGHTS: EXPLORE SIMILAR REPORTS!

https://www.oganalysis.com/industry-reports/semiconductor-grade-ammonia-market

https://www.oganalysis.com/industry-reports/semiconductor-foundry-market

https://www.oganalysis.com/industry-reports/quantum-key-distribution-market

https://www.oganalysis.com/industry-reports/qr-codes-payment-market

Contact Us:

John Wilson

Phone: 8886499099

Email: sales@oganalysis.com

Website: https://www.oganalysis.com

Follow Us on LinkedIn: linkedin.com/company/og-analysis/

OG Analysis

1500 Corporate Circle, Suite # 12, Southlake, TX-76254

About OG Analysis:

OG Analysis has been a trusted research partner for 14+ years delivering most reliable analysis, information and innovative solutions. OG Analysis is one of the leading players in market research industry serving 980+ companies across multiple industry verticals. Our core client centric approach comprehends client requirements and provides actionable insights that enable users to take informed decisions.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Banking As A Service Market Report Insights and Growth Outlook to 2034 - Strategic Trade Shifts, Tariff Impacts, and Supply Chain Reinvention Driving Competitive Advantage here

News-ID: 4065892 • Views: …

More Releases from OG Analysis

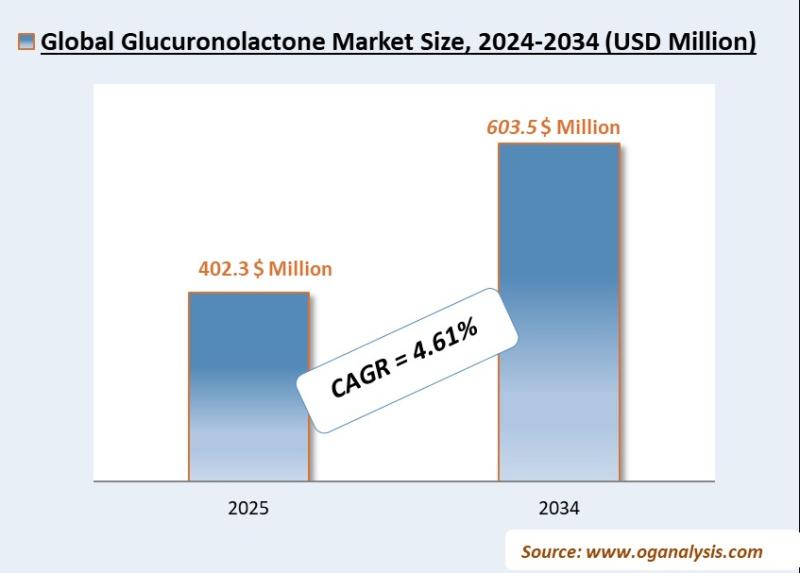

Global glucuronolactone-market Report Insights and Growth Outlook to 2034 - Stra …

According to OG Analysis, a renowned market research firm, the Global glucuronolactone-market was valued at USD 383.7 Million in 2024. The market is projected to grow at a compound annual growth rate (CAGR) of 4.61%, rising from USD 402.3 Million in 2025 to an estimated USD 603.5 Million by 2034.

Get a Free Sample: https://www.oganalysis.com/industry-reports/glucuronolactone-market

glucuronolactone-market Overview

The glucose market covers the production and use of glucose (dextrose) and glucose syrups derived primarily…

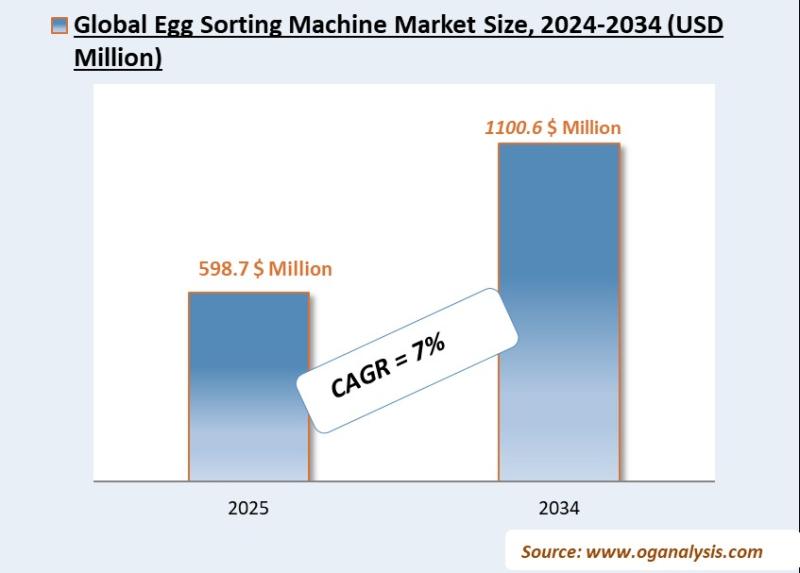

Global Egg Sorting Machine Market Report Insights and Growth Outlook to 2034 - S …

According to OG Analysis, a renowned market research firm, the Global Egg Sorting Machine Market was valued at USD 556.7 Million in 2024. The market is projected to grow at a compound annual growth rate (CAGR) of 7%, rising from USD 598.7 Million in 2025 to an estimated USD 1100.6 Million by 2034.

Get a Free Sample: https://www.oganalysis.com/industry-reports/egg-sorting-machine-market

Egg Sorting Machine Market Overview

The egg sorting machine market supports commercial egg processing by…

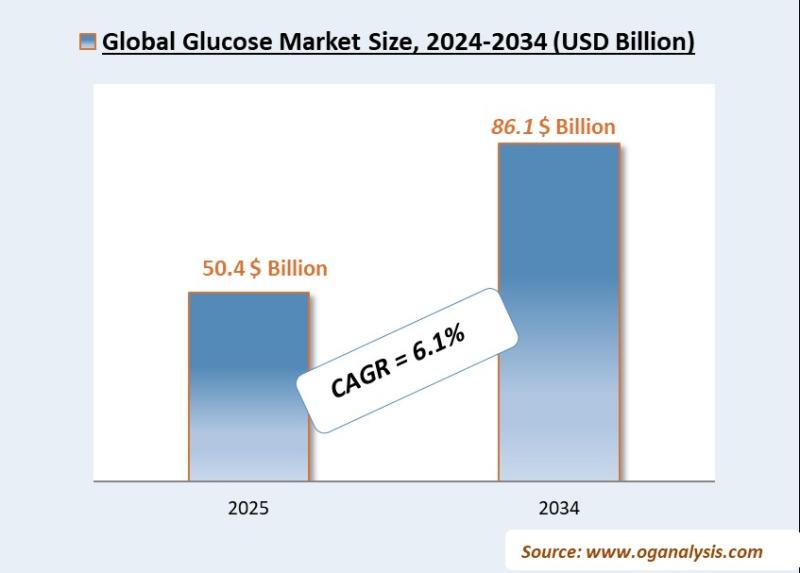

Global Glucose Market Report Insights and Growth Outlook to 2034 - Strategic Tra …

According to OG Analysis, a renowned market research firm, the Global Glucose Market was valued at USD 47.3 Billion in 2024. The market is projected to grow at a compound annual growth rate (CAGR) of 6.1%, rising from USD 50.4 Billion in 2025 to an estimated USD 86.1 Billion by 2034.

Get a Free Sample: https://www.oganalysis.com/industry-reports/glucose-market

Glucose Market Overview

The glucose market covers the production and use of glucose (dextrose) and glucose syrups…

Global Food Glazing Agents Market Report Insights and Growth Outlook to 2034 - S …

According to OG Analysis, a renowned market research firm, the Global Food Glazing Agents Market was valued at USD 5.7 Billion in 2024. The market is projected to grow at a compound annual growth rate (CAGR) of 6.8%, rising from USD 6.2 Billion in 2025 to an estimated USD 11.2 Billion by 2034.

Get a Free Sample: https://www.oganalysis.com/industry-reports/food-glazing-agents-market

Food Glazing Agents Market Overview

The food glazing agents market covers edible coatings applied to…

More Releases for BaaS

Key Factor Supporting Banking-As-A-Service (BaaS) Market Development in 2025: Th …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

How Large Will the Banking-As-A-Service (BaaS) Market Size By 2025?

The market size of banking-as-a-service (BaaS) has seen a significant increase in recent times. This upward trend is projected to continue, as the market's worth is expected to rise from $716 billion in 2024 to a staggering $842.44 billion…

Global Blockchain As A Service Baas Platform Market Size by Application, Type, a …

USA, New Jersey- According to Market Research Intellect, the global Blockchain As A Service Baas Platform market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The Blockchain as a Service (BaaS) platform market is set to experience substantial growth from 2025 to 2032, with a strong…

Global Battery As A Service (BaaS) Market Size by Application, Type, and Geograp …

USA, New Jersey- According to Market Research Intellect, the global Battery As A Service (BaaS) market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The Battery as a Service (BaaS) market is witnessing rapid growth, driven by the global transition toward sustainable mobility and clean energy…

BaaS Market Size, Share, Growth, Trends, Opportunities Analysis Report

The global BaaS Market size to grow from USD 632 million in 2020 to USD 11,519 million by 2026, at a Compound Annual Growth Rate (CAGR) of 62.2% during the forecast period.

Download Report Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=246499192

Increasing demand for BaaS due to COVID-19 outbreak, growing need for supply chain transparency across verticals, and rising demand for enhanced security are major growth factors for the market. Increasing integration of blockchain and IoT,…

Backend-as-a-Service (BaaS) Market Report Up to 2031

Visiongain has published a new report on Backend-as-a-Service (BaaS) Market Report to 2031: Forecasts by type (Consumer BaaS, Enterprise BaaS), by organization size (Small & Medium-sized Enterprises, Large Enterprises), by services (Data Integration, Identity & Access Management, Support & Maintenance, Others). PLUS Profiles of Leading Backend-as-a-Service (BaaS) Companies and Regional and Leading National Market Analysis. PLUS COVID-19 Recovery Scenarios.

Backend-as-a-Service (BaaS) is an alternative approach that uses software development kits (SDKs)…

Game BaaS Market VALUATION TO BOOM THROUGH 2030

(United States, OR Poland) The Game BaaS Market report is composed of major as well as secondary players describing their geographic footprint, products and services, business strategies, sales and market share, and recent developments among others. Furthermore, the Game BaaS report highlights the numerous strategic initiatives such as product launches, new business agreements and collaborations, mergers and acquisitions, joint ventures, and technological advancements that have been implemented by the major…