Press release

Key Factor Supporting Banking-As-A-Service (BaaS) Market Development in 2025: The Rising Adoption Of Banking-As-A-Service (BAAS) Redefining Financial Services Landscape

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.How Large Will the Banking-As-A-Service (BaaS) Market Size By 2025?

The market size of banking-as-a-service (BaaS) has seen a significant increase in recent times. This upward trend is projected to continue, as the market's worth is expected to rise from $716 billion in 2024 to a staggering $842.44 billion in 2025, with a compound annual growth rate (CAGR) of 17.7%. This surge during the historical period was primarily due to the growing demand for digital banking services, personalized financial services, and embedded finance solutions. Expansion in globalization and international trade, along with higher regulatory requirements, were also contributing factors.

How Big Is the Banking-As-A-Service (BaaS) Market Size Expected to Grow by 2029?

The size of the banking-as-a-service (BaaS) market is set to witness remarkable growth in the foreseeable future. The market is likely to balloon to $1829.95 billion by 2029, exhibiting a compound annual growth rate (CAGR) of 21.4%. This growth during the predicted period can be ascribed to factors such as increasing demand for embedded finance solutions, a broader market span, and greater global diversity. Other factors include greater attention to risk management, growing needs for digital banking services, and the effect of geopolitical occurrences and regulatory adaptations. Key trends anticipated during the forecasted period involve rising strategy adoption by key players, technological progress in BaaS solutions, addition of safety and quality control features in BaaS products, development of standardized application programming interfaces (apis), and boosted cooperation among traditional banks, fintech firms, and non-financial entities.

View the full report here:

https://www.thebusinessresearchcompany.com/report/banking-as-a-service-baas-global-market-report

Which Key Market Drivers Powering Banking-As-A-Service (BaaS) Market Expansion and Growth?

The surge in digital banking usage is projected to boost the advancement of the banking-as-a-service (BaaS) sector in the future. Digital banking involves the use of computer technology to access bank services via the bank's web portal. The advent of digital banking is driving growth in the BaaS sector, as it meets growing customer demands for easy-to-use and tailored financial services. It also offers smooth integration, faster market entry, and efficient scalability for banking service providers. For example, the European Central Bank, based in Germany, reported in November 2023 that the total quantity of non-cash payments in Europe surged by 8.8% to 65.9 billion over the last six months of 2022 as compared to the first half of the year. The total value of these transactions elevated by 2.8%, touching €118.8 ($128.55) trillion. So, it is the increased acceptance of digital banking which is invigorating the growth of the BaaS market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=12627&type=smp

Which Fast-Growing Trends Are Poised to Disrupt the Banking-As-A-Service (BaaS) Market?

The rising trend of adopting cloud-native architecture is becoming increasingly prevalent within the banking-as-a-service (BaaS) sector. Essentially, cloud-native architecture is a method used in software development and implementation specifically because of its advantageous utilization of cloud computing environments. Companies that are active within the BaaS market are progressively making use of this architecture to build and distribute their services, thereby maintaining their industry standing. As an example, in February 2023, a high-profile US-based cloud technology company, Oracle, introduced Oracle Banking Cloud Services. This novel set of component-based, composable cloud-native services included banking accounts, payments, enterprise limits and collateral management, origination, digital experience and API's cloud services. Banks are given access to six innovative services that encourage scalable corporate demand deposit processing, company-wide limit and collateral management, instantaneous global payments, API administration, retail customer onboarding, and self-administered digital experiences. These services encourage the swift and safe modernization of banking enterprise abilities through a microservices structure.

What Are the Emerging Segments in the Banking-As-A-Service (BaaS) Market?

The banking-as-a-service (BaaS) market covered in this report is segmented -

1) By Type: API-Based Bank-As-A-Service, Cloud-Based Bank-As-A-Service

2) By Component: Platform, Services

3) By Enterprise: Large Enterprise, Small And Medium Enterprise

4) By End User: Banks, Non-Bank Financial Company (NBFC), Government, Other End-Users

Subsegments:

1) By API-Based Bank-As-A-Service: Payment Processing APIs, Account Management APIs, Compliance And Identity Verification APIs

2) By Cloud-Based Bank-As-A-Service: Core Banking Solutions, Digital Banking Platforms, Customer Relationship Management (CRM) Systems

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=12627&type=smp

Who Are the Global Leaders in the Banking-As-A-Service (BaaS) Market?

Major companies operating in the banking-as-a-service (BaaS) market include Banco Bilbao Vizcaya Argentaria S.A., PayPal Holdings Inc., Square Inc., Green Dot Corporation, Paytm Payments Bank, Marqeta Inc., Starling Bank Ltd., Cross River Bank, Mambu GmbH, 10x Future Technologies, ClearBank Ltd., Currency Cloud, Thought Machine, Railsbank Technology Ltd., FinXact, MatchMove Pay Pte. Ltd., Fidor Bank AG, Bnkbl Ltd., Treezor SAS, Bankable, Treasury Prime, Movencorp Inc., Bankifi, Solaris Bank LLC, Project Imagine Ltd.

Which are the Top Profitable Regional Markets for the Banking-As-A-Service (BaaS) Industry?

North America was the largest region in the banking-as-a-service (BaaS) market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the banking-as-a-service (BaaS) market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=12627

This Report Supports:

1. Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2. Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3. Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4. Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Key Factor Supporting Banking-As-A-Service (BaaS) Market Development in 2025: The Rising Adoption Of Banking-As-A-Service (BAAS) Redefining Financial Services Landscape here

News-ID: 4099633 • Views: …

More Releases from The Business Research Company

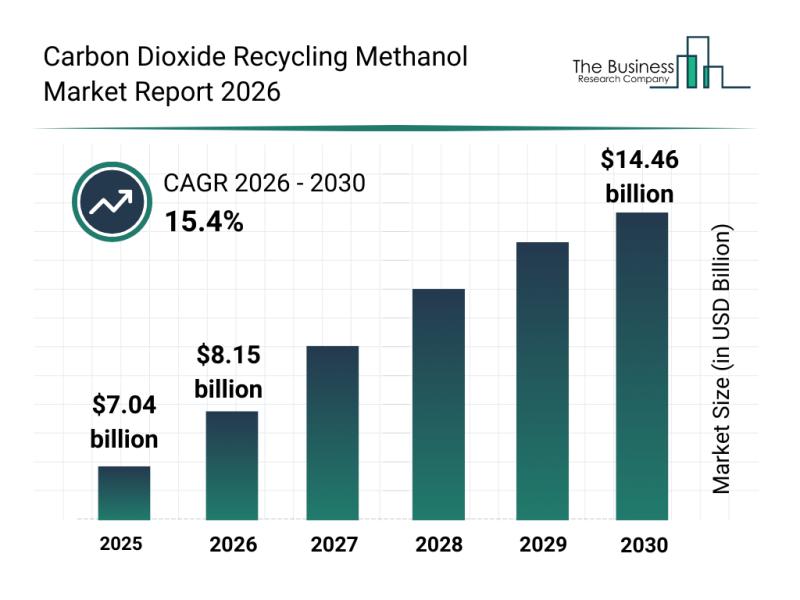

Top Players and Competitive Environment in the Carbon Dioxide Recycling Methanol …

The carbon dioxide recycling methanol market is poised for remarkable expansion as the world intensifies efforts toward sustainability and carbon neutrality. With increasing emphasis on reducing greenhouse gas emissions and boosting renewable energy sources, this market is set to play a pivotal role in the global transition to cleaner fuels and circular carbon economies. Here's a detailed look at its projected growth, influential players, emerging trends, and segmentation.

Forecasted Market Growth…

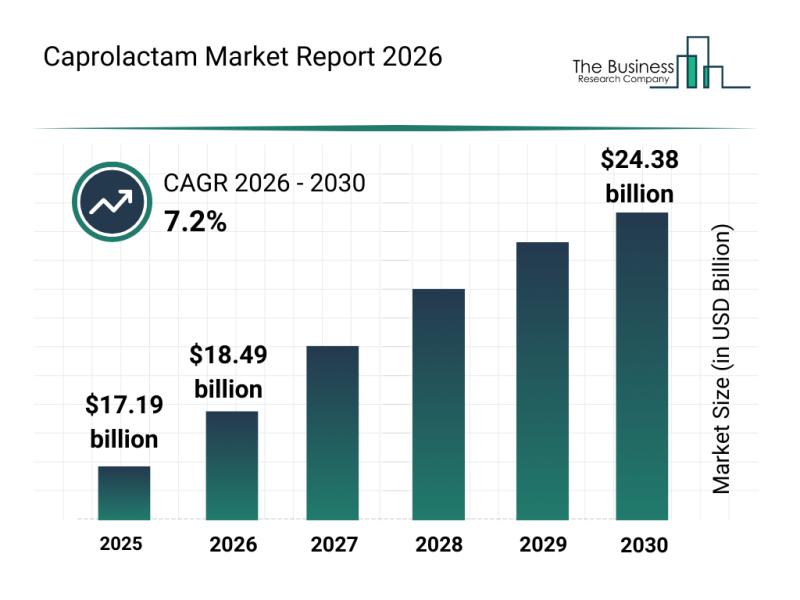

Emerging Sub-Segments Transforming the Caprolactam Market Landscape

The caprolactam market is set for significant expansion in the coming years, driven by evolving industrial needs and sustainability initiatives. This report delves into the anticipated growth, key players, emerging trends, and detailed market segmentation to offer a comprehensive view of the sector's future trajectory.

Caprolactam Market Size Forecast Through 2030

The caprolactam market is projected to reach a value of $24.38 billion by 2030, growing at a compound annual…

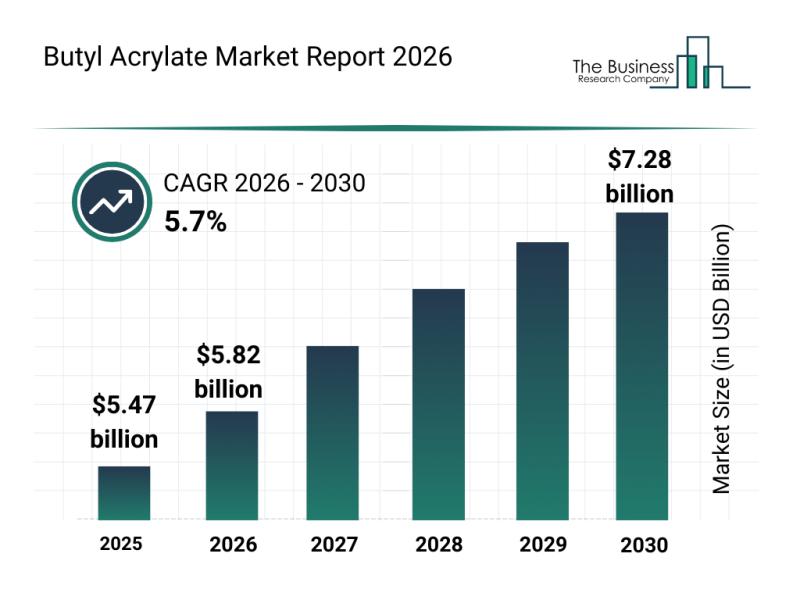

Emerging Growth Patterns Driving Expansion in the Butyl Acrylate Market

The butyl acrylate market is gaining considerable attention as industries increasingly seek versatile chemical compounds to enhance their products. With its broad utility across coatings, adhesives, and textiles, the market is set for significant growth in the coming years. Let's explore the current market size, the main players, key trends, and segment insights shaping this industry.

Projected Market Size and Growth in Butyl Acrylate

The butyl acrylate market is poised…

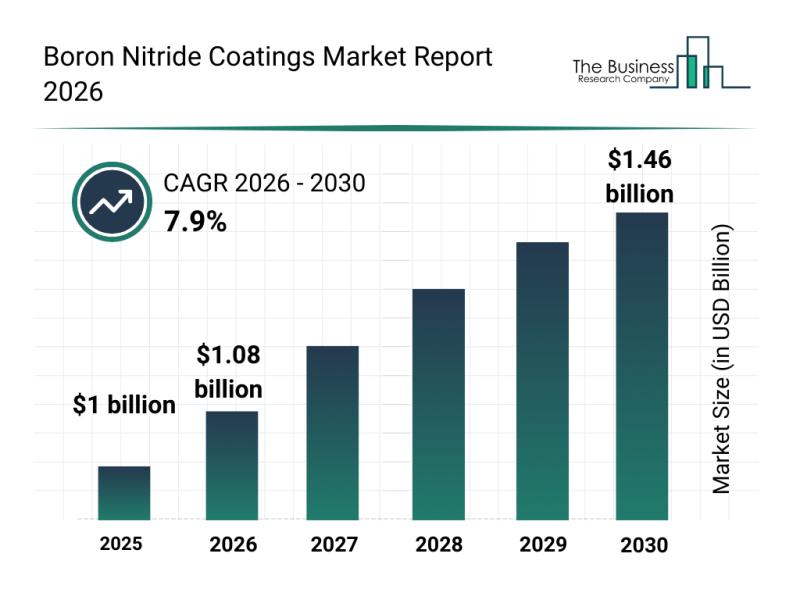

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Bo …

Boron nitride coatings are gaining increased attention due to their versatile applications and enhanced protective qualities. As industries like automotive, aerospace, and electronics evolve, the demand for advanced coating solutions that can withstand extreme conditions is rising. This overview explores the current market size, key players, important trends, and dominant segments shaping the boron nitride coatings market.

Strong Market Growth Expected for Boron Nitride Coatings by 2030

The boron nitride…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…