Press release

FinTech Market Demand Will Reach a Value of US$ 1,537.93 Billion With 16.3% CAGR Growth Forecast Period 2025 to 2034

The FinTech market research report by Polaris Market Research offers a comprehensive analysis of the rapidly growing sector. It covers all the key market aspects, including market share, size, top trends, and recent developments. In addition, an assessment of the key regions and top market players has been provided.The report analyzes the market for FinTech to exhibit a compound annual growth rate (CAGR) of 16.3% during the forecast period, 2025 to 2034. The market was valued at USD 340.76 billion in 2024 and is projected to grow to USD 1,537.93 billion by 2034.

Get Exclusive Sample Pages of This Report:

https://www.polarismarketresearch.com/industry-analysis/fintech-market/request-for-sample

Market Overview:

FinTech refers to the use of technology to deliver financial products, services, and processes. It covers a diverse range of financial services, including banking, investing, insurance, lending, payments, and more. FinTech leverages digital tools like mobile apps, software, and platforms to provide financial solutions and services. It helps financial institutions automate tasks and processes that were traditionally manual, such as loan applications or inventory management. Fintech aims to make financial services more accessible to a wider audience, including those who traditional institutions may have underserved.

Market Growth Drivers:

Rising Digital Payments Adoption:

Individuals today seek safer, faster, and more convenient ways to pay for goods and services. Businesses also prefer digital transactions as they are easier to track and reduce the risk of theft. FinTech companies are responding to this shift by offering user-friendly payment options that cater to the needs of both individuals and businesses, thereby driving the FinTech market growth.

Growing Smartphone and Internet Penetration:

More people globally now how access to smartphones and the Internet. This increased access to smartphones and the Internet has made it easier to use digital financial services. In many regions, users now prefer using their phones for banking, shopping, and even investing. This rising connectivity helps FinTech firms reach millions of users in a quick and affordable way.

Request for a Discount on this Report Before Purchase:

https://www.polarismarketresearch.com/industry-analysis/fintech-market/request-for-discount-pricing

Competitive Landscape:

The market features a diverse array of players continuously striving for innovation to gain a competitive edge.

A few of the major market participants include:

• Adyen

• Block Inc.

• Finastra

• Fiserv, Inc.

• Mastercard

• Neo Mena Technologies Ltd.

• Plaid Inc.

• Rapyd Financial Network Ltd.

• Stripe, Inc.

• Unicorn Payment Ltd.

FinTech Market Report Highlights:

• In 2024, fraud detection segment dominated the fintech market in 2024 due to rapid increase in digital transactions leading to the growing concerns about online fraud and data breaches.

• The AI is expected to witness fastest growth in the forecast period due to increasing usage of AI in customer service and to analyze customer behavior.

• In 2024, North America dominated the fintech market driven by strong technology infrastructure and a high level of digital adoption.

• Asia Pacific is expected to record significant share in the forecast period due to a large population, increasing internet usage, and rising smartphone penetration.

Explore The Complete Comprehensive Report Here:

https://www.polarismarketresearch.com/industry-analysis/fintech-market

Segmental Analysis:

The FinTech market is primarily segmented on the basis of technology, application, end use, and region.

Based on technology, the AI segment is projected to register the fastest growth from 2025 to 2034. This is largely due to the growing use of AI to improve customer service through bots service and detect fraud in real time. FinTech companies are also leveraging AI to offer personalized financial advice based on user behavior.

By application, the fraud monitoring segment led the market in 2024. The significant rise in digital transactions has led to increased concerns about online fraud and data breaches. Businesses and financial institutions are placing a strong emphasis on protecting user information and ensuring secure financial activities.

FinTech Market, Technology Outlook (Revenue - USD Billion, 2020-2034)

• AI

• Blockchain

• RPA

• Others

FinTech Market, Applications Outlook (Revenue - USD Billion, 2020-2034)

• Fraud Monitoring

• KYC Verification

• Compliance & Regulatory Support

FinTech Market, End-use Outlook (Revenue - USD Billion, 2020-2034)

• Banks

• Financial Institutions

• Insurance Companies

• Others

By Regional Outlook (Revenue - USD Billion, 2020-2034)

• North America

o U.S.

o Canada

• Europe

o Germany

o UK

o France

o Italy

o Spain

o Russia

o Netherlands

o Rest of Europe

• Asia Pacific

o China

o India

o Japan

o South Korea

o Indonesia

o Malaysia

o Australia

o Rest of APAC

• Latin America

o Argentina

o Brazil

o Mexico

o Rest of Latin America

• Middle East & Africa

o UAE

o Saudi Arabia

o Israel

o South Africa

o Rest of MEA

More Trending Latest Reports by Polaris Market Research:

Messaging Application API Market:

https://www.polarismarketresearch.com/industry-analysis/messaging-application-api-market

Creator Economy Platforms Market:

https://www.polarismarketresearch.com/industry-analysis/creator-economy-platforms-market

Decentralized Workforce Tools Market:

https://www.polarismarketresearch.com/industry-analysis/decentralized-workforce-tools-market

Operational Technology Market:

https://www.polarismarketresearch.com/industry-analysis/operational-technology-market

Contact:

Likhil G

8 The Green Ste 19824,

Dover, DE 19901,

United States

Phone: +1-929 297-9727

Email: sales@polarismarketresearch.com

Web: https://www.polarismarketresearch.com

Follow Us: LinkedIn | Twitter

About Polaris Market Research & Consulting, Inc:

Polaris Market Research is a global market research and consulting company. The company specializes in providing exceptional market intelligence and in-depth business research services for PMR's clientele spread across different enterprises. We at Polaris are obliged to serve PMR's diverse customer base present across the industries of healthcare, technology, semiconductors, and chemicals among various other industries present around the world. We strive to provide PMR's customers with updated information on innovative technologies, high-growth markets, emerging business environments, and the latest business-centric applications, thereby helping them always to make informed decisions and leverage new opportunities. Adept with a highly competent, experienced, and extremely qualified team of experts comprising SMEs, analysts, and consultants, we at Polaris endeavor to deliver value-added business solutions to PMR's customers.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release FinTech Market Demand Will Reach a Value of US$ 1,537.93 Billion With 16.3% CAGR Growth Forecast Period 2025 to 2034 here

News-ID: 4063184 • Views: …

More Releases from Polaris Market Research & Consulting

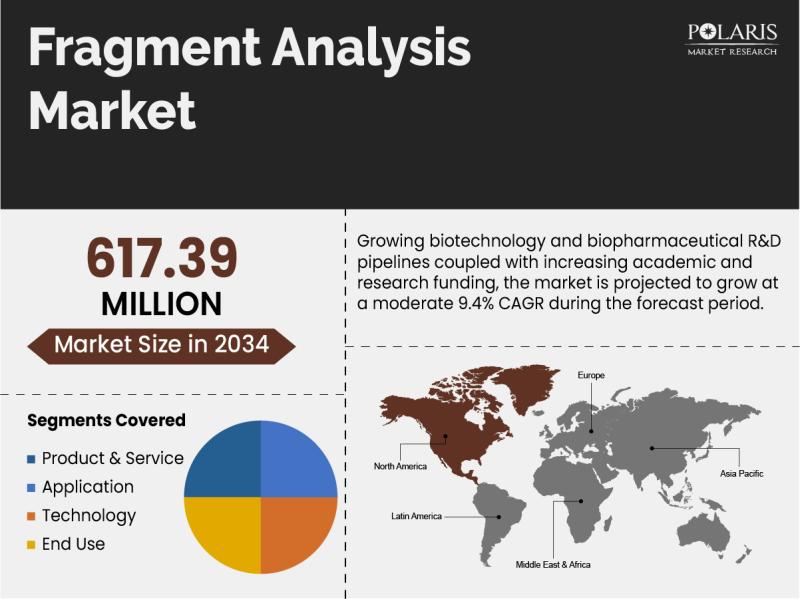

Fragment Analysis Market Size Projected to Reach USD 617.39 Million by 2034, Gro …

Global Fragment Analysis Market is currently valued at USD 275.72 Million in 2025 and is anticipated to generate an estimated revenue of USD 617.39 Million by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 9.4% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2026 - 2034.

Polaris Market Research recently introduced the latest update on Fragment Analysis Market…

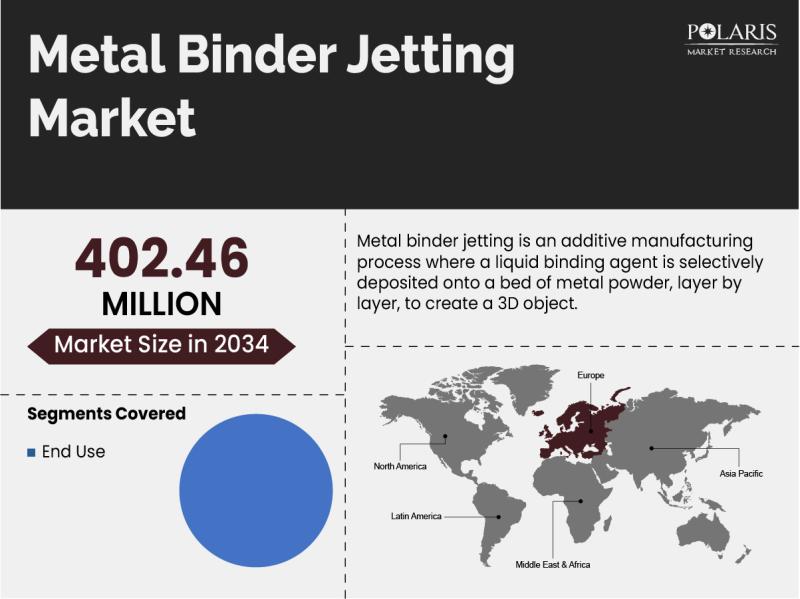

Metal Binder Jetting Market Growth Projected at 10.6% CAGR, Reaching USD 402.46 …

Global Metal Binder Jetting Market is currently valued at USD 147.51 Million in 2024 and is anticipated to generate an estimated revenue of USD 402.46 Million by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 10.6% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2025 - 2034.

Polaris Market Research recently introduced the latest update on Metal Binder…

Rigid Food Packaging Market to Reach USD 354.25 Billion by 2034, Growing at a CA …

The quantitative market research report published by Polaris Market Research on Rigid Food Packaging Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, Rigid Food Packaging Market size, financial data, and projected future growth. All the…

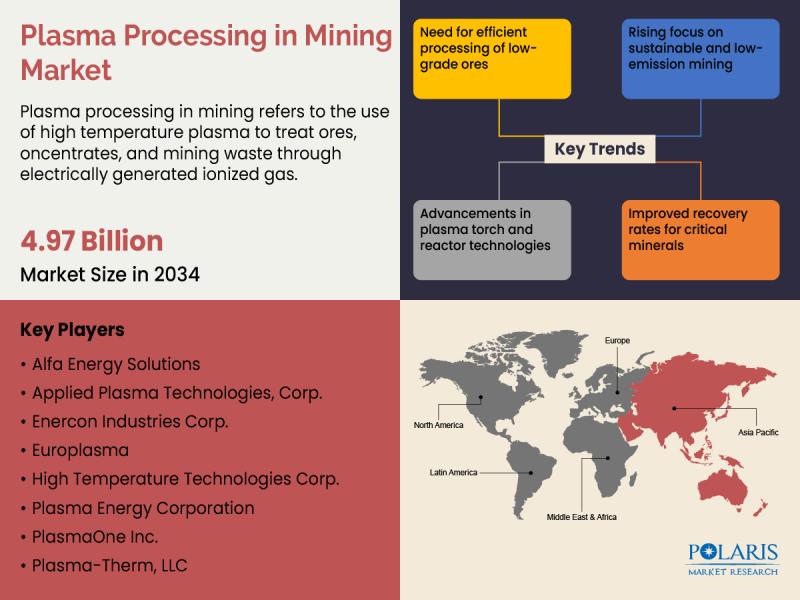

Global Plasma Processing in Mining Market to Reach USD 4.97 Billion by 2034, Reg …

Market Size and Share:

The global plasma processing in mining market is estimated to reach approximately USD 2.62 billion in 2025 and is expected to experience steady growth from 2026 to 2034, expanding at a projected CAGR of 7.4% during the forecast period.

Polaris Market Research has introduced the latest market research report titled Plasma Processing in Mining Market that highlights the major revenue stream for the forecast period. The report contains…

More Releases for FinTech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…