Press release

Payment Security Market Trends, Demand Drivers, Competitive Landscape, and Forecast 2025-2032

"The Payment Security Market is experiencing substantial growth, fueled by the increasing prevalence of digital transactions and the escalating sophistication of cyber threats targeting payment systems. This surge in online and mobile payments has created a heightened demand for robust security solutions to protect sensitive financial data and prevent fraud. Key drivers for growth include the widespread adoption of e-commerce, the proliferation of mobile payment technologies, and the stringent regulatory requirements mandating data protection and compliance. Technological advancements such as advanced encryption methods, tokenization, behavioral biometrics, and AI-powered fraud detection systems are continuously evolving to counteract emerging threats and safeguard payment ecosystems. The market's role in addressing global challenges is critical, as it provides the infrastructure and tools necessary to foster trust and security in digital transactions, thereby supporting economic growth and consumer confidence. The rapid expansion of the Internet of Things (IoT) and the increasing interconnectedness of devices have further expanded the attack surface, necessitating advanced payment security measures. Moreover, the growing awareness of data breaches and their potential financial and reputational repercussions has prompted businesses to invest heavily in robust payment security solutions. This proactive approach not only mitigates risks but also enhances brand reputation and customer loyalty. As the global landscape continues to evolve, the Payment Security Market is poised to play a crucial role in ensuring the safety and integrity of financial transactions, thereby fostering a secure and reliable digital economy. This market's ongoing innovation and adaptation are essential for maintaining pace with the dynamic nature of cyber threats and meeting the evolving needs of consumers and businesses worldwide.

Get the full PDF sample copy of the report: (TOC, Tables and figures, and Graphs) https://www.consegicbusinessintelligence.com/request-sample/2360

Market Size:

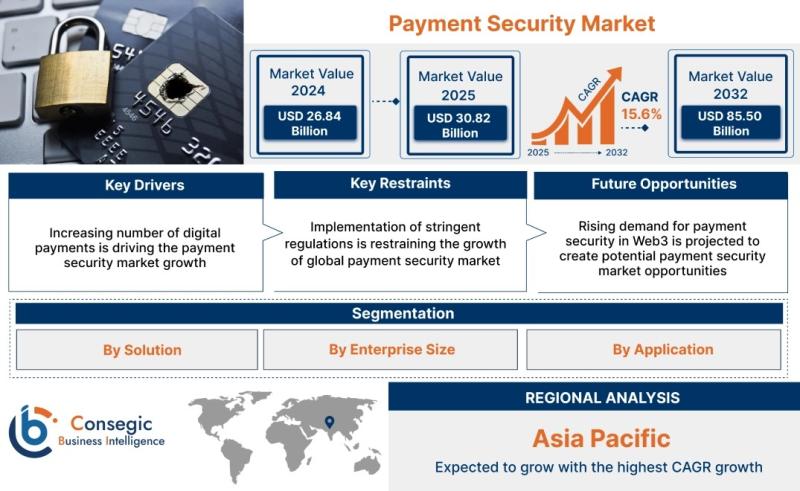

The Payment Security Market size is estimated to reach over USD 85.50 Billion by 2032 from a value of USD 26.84 Billion in 2024. The market is projected to grow by USD 30.82 Billion in 2025, growing at a CAGR of 15.6% from 2025 to 2032.

Definition of Market:

The Payment Security Market encompasses the technologies, solutions, and services designed to protect payment systems and sensitive financial data from unauthorized access, fraud, and cyber threats. It aims to ensure the confidentiality, integrity, and availability of payment transactions across various channels, including online, mobile, and point-of-sale (POS) systems.

Key components of the market include:

Encryption: The process of converting data into an unreadable format to prevent unauthorized access.

Tokenization: Replacing sensitive data, such as credit card numbers, with non-sensitive equivalents (tokens) to reduce the risk of data breaches.

Fraud Detection and Prevention: Systems and technologies that identify and prevent fraudulent activities by analyzing transaction patterns and user behavior.

Authentication and Access Control: Mechanisms for verifying the identity of users and controlling access to payment systems and data.

Security Software and Hardware: Tools and devices designed to protect payment infrastructure from malware, viruses, and other cyber threats.

Compliance Solutions: Services and technologies that help organizations comply with regulatory requirements, such as PCI DSS.

Key terms related to the market include:

PCI DSS (Payment Card Industry Data Security Standard): A set of security standards designed to protect credit card data.

EMV (Europay, MasterCard, and Visa): A security standard for chip-based credit and debit cards.

3D Secure: An authentication protocol used to verify the identity of online shoppers.

Chargeback: A process by which a cardholder disputes a transaction with their bank.

In essence, the Payment Security Market is the comprehensive ecosystem of tools and processes that collectively safeguard the integrity and security of financial transactions in an increasingly digital world.

Get Discount On Report @ https://www.consegicbusinessintelligence.com/request-discount/2360

Market Scope and Overview:

The Payment Security Market's scope spans a wide range of technologies, applications, and industries. Its technologies encompass encryption, tokenization, fraud detection, authentication, and compliance solutions. These technologies are deployed across various applications, including e-commerce, mobile payments, point-of-sale (POS) systems, and banking infrastructure. The industries served are equally diverse, ranging from retail and e-commerce to travel and hospitality, healthcare, telecom & IT, education, and media & entertainment. Essentially, any industry that processes payment transactions is within the purview of the Payment Security Market.

The importance of the Payment Security Market cannot be overstated in the context of global trends. As digital transactions continue to proliferate, the risk of cyber threats and fraud intensifies. Data breaches can lead to significant financial losses, reputational damage, and legal liabilities. The Payment Security Market plays a crucial role in mitigating these risks by providing the tools and solutions necessary to protect sensitive financial data. Furthermore, regulatory compliance, such as PCI DSS, mandates that organizations implement robust security measures to safeguard payment card data. The Payment Security Market enables businesses to meet these compliance requirements and avoid costly penalties. Beyond risk mitigation and compliance, the Payment Security Market fosters trust and confidence in digital transactions, which is essential for driving economic growth and consumer adoption of new payment technologies. In an increasingly interconnected and digital world, the Payment Security Market is a critical enabler of secure and seamless financial transactions, underpinning the global economy.

Top Key Players in this Market

Elavon Inc. (United States) Ingenico (France) Thales (France) Cybersource (United States) Utimaco Management GmbH (Germany) Shift4 Payments Inc. (United States) Mastercard (United States) Intelligent Payment Solutions Pvt Ltd. (India) TokenEx, LLC (United States) Paypal Holdings, Inc. (United States) Bluefin Payment Systems (United States) Visa Inc. (United States)

Market Segmentation:

The Payment Security Market is segmented based on several factors, each contributing uniquely to its growth:

By Solution: This segment includes Encryption, Tokenization, and Fraud Detection & Prevention. Encryption and Tokenization safeguard data, while Fraud Detection & Prevention solutions actively combat fraudulent activities.

By Enterprise Size: The market is divided into Large Enterprises and Small and Medium Enterprises (SMEs). Large enterprises typically require comprehensive, enterprise-grade solutions, while SMEs often seek cost-effective, scalable options.

By Application: Key application areas include Retail & E-commerce, Travel & Hospitality, Healthcare, Telecom & IT, Education, Media & Entertainment, and Others. Each application area has specific security needs, driving the demand for tailored payment security solutions.

Each of these segments plays a crucial role in driving market growth. For instance, the increasing adoption of e-commerce fuels demand for robust fraud detection solutions, while the growing number of SMEs entering the digital marketplace necessitates scalable and affordable payment security solutions.

Market Drivers:

Increasing Prevalence of Cyber Threats: The rising sophistication and frequency of cyber attacks targeting payment systems are driving demand for advanced security solutions.

Growth of E-Commerce and Mobile Payments: The widespread adoption of online and mobile payment channels is expanding the attack surface, necessitating robust payment security measures.

Stringent Regulatory Requirements: Compliance mandates such as PCI DSS are compelling organizations to invest in payment security solutions.

Growing Awareness of Data Breaches: The increasing awareness of the financial and reputational risks associated with data breaches is driving businesses to prioritize payment security.

Technological Advancements: Innovations in encryption, tokenization, and fraud detection are providing more effective ways to protect payment data.

Market Key Trends:

AI-Powered Fraud Detection: The use of artificial intelligence and machine learning to detect and prevent fraudulent activities is becoming increasingly prevalent.

Tokenization Adoption: Tokenization is gaining traction as a more secure alternative to traditional encryption methods.

Cloud-Based Payment Security Solutions: The adoption of cloud-based payment security solutions is increasing due to their scalability, cost-effectiveness, and ease of deployment.

Biometric Authentication: The use of biometric authentication methods, such as fingerprint scanning and facial recognition, is becoming more common in payment systems.

Increased Focus on Real-Time Fraud Prevention: Businesses are increasingly prioritizing real-time fraud prevention to minimize losses and protect customer data.

Market Opportunities:

Emerging Markets: Untapped potential in developing regions with increasing adoption of digital payment methods.

IoT Payment Security: Securing payment transactions in the expanding Internet of Things (IoT) ecosystem.

Mobile Payment Security: Addressing the unique security challenges associated with mobile payment technologies.

Advanced Threat Detection: Developing innovative solutions to detect and prevent sophisticated cyber threats.

Integration of Security Solutions: Integrating payment security solutions with other security systems to provide comprehensive protection.

Market Restraints:

High Initial Costs: The cost of implementing and maintaining advanced payment security solutions can be a barrier for some organizations, particularly SMEs.

Complexity of Implementation: Integrating payment security solutions with existing systems can be complex and time-consuming.

Shortage of Skilled Professionals: The lack of skilled professionals with expertise in payment security can hinder the adoption of advanced solutions.

Evolving Threat Landscape: The constantly evolving nature of cyber threats requires continuous innovation and adaptation, which can be challenging.

Lack of Awareness: Some businesses, particularly SMEs, may not fully understand the importance of payment security or the risks they face.

Market Challenges:

The Payment Security Market faces a multitude of challenges stemming from the ever-evolving threat landscape, technological complexities, and the inherent difficulties in balancing security with user experience. One of the most significant challenges is the relentless innovation of cybercriminals, who constantly devise new methods to exploit vulnerabilities in payment systems. These threats range from sophisticated malware and phishing attacks to more complex schemes such as account takeovers and point-of-sale (POS) intrusions. The need to stay ahead of these evolving threats requires continuous investment in research and development, as well as a proactive approach to threat intelligence and vulnerability management.

Another significant challenge is the complexity of integrating payment security solutions with legacy systems and emerging technologies. Many organizations operate with outdated infrastructure that is not easily compatible with modern security measures, making it difficult to implement robust protection without significant disruption. Furthermore, the proliferation of new payment channels, such as mobile wallets and cryptocurrency transactions, introduces additional layers of complexity and requires tailored security solutions that can address the unique risks associated with each channel. Maintaining compliance with increasingly stringent regulatory requirements, such as PCI DSS and GDPR, also poses a significant challenge for businesses. These regulations mandate specific security controls and data protection measures, which can be costly and time-consuming to implement and maintain.

Balancing security with user experience is another critical challenge. While robust security measures are essential for protecting payment data, they must not impede the user experience or create unnecessary friction for customers. Complex authentication procedures, cumbersome transaction processes, and frequent security checks can frustrate customers and lead to abandonment of transactions. Therefore, payment security solutions must be designed to be seamless and transparent, providing a high level of protection without compromising usability. Additionally, addressing the shortage of skilled cybersecurity professionals is a major hurdle for the industry. The demand for experts in payment security far exceeds the supply, making it difficult for organizations to recruit and retain the talent needed to effectively manage their security posture. Investing in training and education programs, as well as fostering collaboration between industry, academia, and government, is crucial for building a skilled workforce that can meet the challenges of the payment security landscape. Finally, addressing the global nature of cybercrime requires international cooperation and information sharing. Cybercriminals often operate across borders, making it difficult to track them down and bring them to justice. Enhancing collaboration between law enforcement agencies, governments, and private sector organizations is essential for disrupting cybercrime networks and protecting payment systems worldwide.

Market Regional Analysis:

The Payment Security Market exhibits varying dynamics across different regions, influenced by factors such as regulatory environments, technological adoption rates, and the prevalence of cyber threats. North America is a major market, driven by stringent regulatory requirements, high adoption of e-commerce, and a mature cybersecurity landscape. Europe follows closely, with strong emphasis on data protection regulations like GDPR. The Asia-Pacific region is experiencing rapid growth, fueled by the increasing adoption of digital payment methods, particularly in countries like China and India. However, the region also faces challenges related to cybersecurity infrastructure and awareness. Latin America is another emerging market, with growing adoption of digital payments but also facing significant security challenges. The Middle East and Africa are also showing increasing interest in payment security solutions, driven by the growth of e-commerce and mobile payments. Each region's market dynamics are shaped by unique combinations of these factors, influencing the demand for specific types of payment security solutions and services.

Frequently Asked Questions:

What is the projected growth of the Payment Security Market?

The Payment Security Market is projected to grow at a CAGR of 15.6% from 2025 to 2032.

What are the key trends in the Payment Security Market?

Key trends include AI-powered fraud detection, increased tokenization adoption, cloud-based solutions, and biometric authentication.

What are the most popular market types in Payment Security?

Popular market types include Fraud Detection & Prevention solutions, Encryption and Tokenization solutions, and large Enterprise solutions.

Follow us on:

https://www.linkedin.com/company/nextwave-inovations/

https://www.linkedin.com/company/digital-frontier-digestt/

https://www.linkedin.com/company/market-tech-radar/

https://www.linkedin.com/company/tech-analysis-trends/

https://www.linkedin.com/company/trendwise-tech/"

Contact Us:

Consegic Business intelligence Pvt Ltd

Baner Road, Baner, Pune, Maharashtra - 411045

(US) (505) 715-4344

info@consegicbusinessintelligence.com

sales@consegicbusinessintelligence.com

Web - https://www.consegicbusinessintelligence.com/

About Us:

Consegic Business Intelligence is a data measurement and analytics service provider that gives the most exhaustive and reliable analysis available of global consumers and markets. Our research and competitive landscape allow organizations to record competing evolutions and apply strategies accordingly to set up a rewarding benchmark in the market. We are an intellectual team of experts working together with the winning inspirations to create and validate actionable insights that ensure business growth and profitable outcomes.

We provide an exact data interpretation and sources to help clients around the world understand current market scenarios and how to best act on these learnings. Our team provides on-the-ground data analysis, Portfolio Expansion, Quantitative and qualitative analysis, Telephone Surveys, Online Surveys, and Ethnographic studies. Moreover, our research reports provide market entry plans, market feasibility and opportunities, economic models, analysis, and an advanced plan of action with consulting solutions. Our consumerization gives all-inclusive end-to-end customer insights for agile, smarter, and better decisions to help business expansion.

Connect with us on:

LinkedIn - https://www.linkedin.com/company/consegic-business-intelligence/

YouTube - https://www.youtube.com/@ConsegicBusinessIntelligence22

Facebook - https://www.facebook.com/profile.php?id=61575657487319

X - https://x.com/Consegic_BI

Instagram - https://www.instagram.com/cbi._insights/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payment Security Market Trends, Demand Drivers, Competitive Landscape, and Forecast 2025-2032 here

News-ID: 4062158 • Views: …

More Releases from Consegic Business Intelligence Pvt. Ltd

Europe Pharmaceutical Manufacturing Equipment Market 2025 Industry Updates, Futu …

Introduction:

The Pharmaceutical Manufacturing Equipment Market is experiencing robust growth, driven by a confluence of factors reshaping the landscape of pharmaceutical production. Increasing global demand for pharmaceuticals, fueled by an aging population and the rise of chronic diseases, necessitates advanced and efficient manufacturing processes. Technological advancements, such as continuous manufacturing, automation, and digitalization, are revolutionizing traditional methods, improving production efficiency, reducing costs, and enhancing product quality. Stringent regulatory requirements and the…

Europe Vibration Damping Materials Market Size 2025 Overview, Manufacturers, Typ …

Introduction:

The Vibration Damping Materials market is experiencing significant growth, driven by the increasing demand for noise and vibration reduction across various industries. Key drivers include stringent environmental regulations, the growing automotive industry, particularly the electric vehicle (EV) sector, and the need for enhanced comfort and safety in residential and commercial buildings. Technological advancements in materials science are also playing a pivotal role, with the development of more efficient and durable…

Europe Lightweight Aggregates Market Size 2025 Emerging Technologies, Opportunit …

Introduction:

The Lightweight Aggregates Market is experiencing substantial growth driven by several key factors. Primarily, the increasing demand for sustainable and eco-friendly construction materials is fueling the adoption of lightweight aggregates. These materials offer superior insulation properties, reduced transportation costs, and contribute to the overall reduction of the carbon footprint of construction projects. Technological advancements in the production and application of lightweight aggregates are also playing a crucial role, enhancing their…

Europe Visible Light Communication Market Share, Growth, Size, Industry Trends, …

Introduction:

The Visible Light Communication (VLC) market is experiencing significant growth, driven by the increasing demand for faster, more secure, and energy-efficient communication technologies. VLC leverages light waves for data transmission, offering a complementary solution to traditional radio frequency (RF) based wireless communication. Key drivers include the proliferation of LED lighting, growing concerns about RF spectrum congestion, and the need for secure communication in sensitive environments. Technological advancements, such as improved…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…