Press release

ESG Reporting Software Market to Reach US$ 2.67 Bn by 2031 Amid Rising Focus on Corporate Sustainability

✅Market to Expand at 15.4% CAGR as Demand for Transparent, Regulatory-Compliant ESG Disclosures SurgesAccording to the latest analysis by Persistence Market Research, the global ESG reporting software market is projected to grow significantly from US$ 978.6 Mn in 2024 to US$ 2,667.1 Mn by 2031, expanding at a robust CAGR of 15.4% during the forecast period. This growth is primarily fueled by the global push toward sustainability, increasing regulatory mandates for environmental, social, and governance (ESG) disclosures, and a rising preference for digital tools that streamline ESG data management and reporting processes.

The ESG reporting software market is experiencing rapid growth as organizations worldwide face rising stakeholder expectations and regulatory obligations to disclose ESG metrics. These software solutions help businesses collect, analyze, and report on non-financial performance indicators related to sustainability, ethics, and governance practices. They play a crucial role in enabling transparency, improving stakeholder engagement, and minimizing ESG-related risks. Organizations that adopt ESG software tools benefit from real-time data analytics, standardized reporting formats, and enhanced compliance with evolving ESG frameworks and regulations like the CSRD, SEC climate disclosures, and TCFD guidelines.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.persistencemarketresearch.com/samples/34966

From a market segmentation perspective, Environmental Management Software holds the largest market share, owing to growing climate-related disclosures and carbon footprint tracking requirements. Cloud deployment models are becoming increasingly popular due to their scalability, cost-efficiency, and ease of integration with existing enterprise systems. Regionally, North America leads the market, supported by strong regulatory initiatives, the presence of major ESG software providers, and high corporate adoption of sustainability practices. The United States, in particular, is a major contributor, driven by growing pressure from investors and regulatory bodies to report ESG-related metrics comprehensively and consistently.

✅Key Market Insights

➤ ESG software adoption is being driven by mandatory ESG disclosure laws across North America, Europe, and Asia-Pacific.

➤ Cloud-based ESG software is witnessing rapid uptake due to ease of access, reduced IT overheads, and better scalability.

➤ Environmental management modules lead the market due to increasing climate risk awareness and carbon footprint tracking.

➤ BFSI and energy & utilities sectors are among the most prominent adopters of ESG reporting platforms.

➤ SMEs are emerging as a key user base as ESG standards expand beyond large enterprises into the mid-market segment.

✅What is the role of ESG reporting software in corporate sustainability strategy?

ESG reporting software enables organizations to systematically track, measure, and report their performance across environmental, social, and governance pillars. It supports the collection of accurate and auditable data, facilitates alignment with global ESG frameworks, and helps build investor and stakeholder trust through transparency. By automating reporting and integrating data from multiple sources, it minimizes manual effort and enhances accuracy. Moreover, these tools provide valuable insights that companies can use to identify ESG risks, benchmark against peers, and drive long-term sustainability strategies aligned with global compliance mandates and stakeholder expectations.

✅Market Dynamics

Drivers:

Key drivers of the ESG reporting software market include stringent regulatory frameworks such as the EU CSRD, growing investor demand for ESG transparency, and the reputational benefits of strong ESG performance. Companies are under pressure to respond to climate change, social justice concerns, and governance reform, all of which require comprehensive data collection and reporting capabilities. ESG software provides an efficient platform to manage this growing complexity.

Market Restraining Factor:

One of the major challenges in the market is the lack of standardization in ESG metrics and frameworks. This leads to difficulties in data collection, comparison, and reporting across organizations and industries. Additionally, smaller organizations may find the initial cost of implementation and integration with existing systems to be a barrier.

Key Market Opportunity:

With ESG requirements expanding into mid-sized and small enterprises globally, the SME segment presents a significant growth opportunity. Affordable, modular, and user-friendly ESG software tailored for SMEs can unlock massive untapped demand, especially in developing economies where ESG adoption is still in the early stages.

✅Market Segmentation

The ESG reporting software market is segmented by type, deployment, organization size, and vertical. By type, the market includes Environmental Management Software, Social Management Software, Governance Management Software, and Others. Environmental Management Software dominates the market due to increased carbon disclosure requirements and environmental compliance mandates. Social and governance modules are also gaining traction as businesses address workforce diversity, supply chain ethics, and board-level accountability.

In terms of deployment, the cloud-based segment is growing at the fastest rate due to its scalability, real-time access, and lower upfront infrastructure costs. Many ESG software vendors offer cloud-native platforms with AI-driven dashboards, advanced analytics, and automated reporting features. By organization size, large enterprises currently lead the market due to their well-defined ESG strategies and regulatory exposure. However, SMEs are emerging rapidly, driven by value-chain pressures, ESG rating agencies, and growing stakeholder interest in small business sustainability.

✅Regional Insights

North America holds the largest share of the ESG reporting software market, led by the United States. The region benefits from stringent disclosure regulations, high investor activism, and the presence of key market players offering cutting-edge reporting platforms. Europe is the second-largest region, supported by EU-wide regulations such as the Corporate Sustainability Reporting Directive (CSRD) and strong ESG culture among European corporates. Asia Pacific is emerging as a high-growth market due to increasing ESG awareness in Japan, Australia, and India, along with corporate adoption of climate and sustainability frameworks. Meanwhile, Latin America and the Middle East & Africa are seeing slow but steady growth due to nascent ESG regulations and rising multinational corporate presence.

✅Competitive Landscape

The ESG reporting software landscape is competitive, with a mix of pure-play ESG firms, governance solution providers, and traditional enterprise software vendors expanding into ESG offerings. Strategic partnerships, acquisitions, and platform enhancements are key strategies adopted by these players to enhance their market presence and technological capabilities.

Company Insights

✦ Datamaran

✦ EcoVadis

✦ NAVEX Global, Inc.

✦ OneTrust, LLC

✦ Refinitiv

✦ SAS Institute Inc.

✦ Sustainalytics

✦ TruValue Labs

✦ Verisk 3E

✦ Wolters Kluwer N.V.

✦ Nasdaq

✦ PWC

✦ Diligent

✦ Sphera

✦ Accuvio

For Customized Insights on Segments, Regions, or Competitors, Request Personalized Purchase Options @ https://www.persistencemarketresearch.com/request-customization/34966

✅Key Industry Developments

In recent years, several strategic moves have shaped the ESG reporting software landscape. For instance, Nasdaq enhanced its ESG Insight platform by integrating more customizable frameworks to help listed companies meet various global ESG mandates. Similarly, OneTrust launched its modular ESG platform, offering scalability for both SMEs and global corporations.

Another key development includes the acquisition of ESG rating firms by large software providers to strengthen data analytics and benchmarking capabilities. Datamaran and EcoVadis have entered into strategic partnerships with major consulting firms to provide integrated ESG strategy and software solutions, highlighting the growing importance of end-to-end ESG support.

✅Innovation and Future Trends

The future of the ESG reporting software market lies in AI-driven data intelligence, real-time dashboards, and predictive analytics. Companies are increasingly adopting ESG platforms that offer advanced scenario analysis, automated KPI tracking, and alignment with evolving standards like GRI, SASB, and IFRS Sustainability Standards. These features empower organizations to forecast ESG risks and opportunities more effectively.

Another key trend is the integration of ESG reporting tools into broader enterprise resource planning (ERP) and sustainability platforms, enabling a more holistic approach to business management. Interoperability, API integrations, and machine learning-enhanced data verification are becoming standard features as organizations look to streamline ESG processes while ensuring data accuracy, traceability, and compliance. As stakeholder scrutiny intensifies, the need for seamless, agile, and transparent ESG reporting solutions will only accelerate.

✅Explore the Latest Trending "Exclusive Article" @

• https://medium.com/@apnewsmedia/smart-parcel-locker-market-growth-trends-and-forecast-for-2025-8da78d47bc54

• https://techxpresstoday.wordpress.com/2025/06/10/smart-parcel-locker-market-overview-with-key-insights-for-investors/

• https://webrankmedia.blogspot.com/2025/06/smart-parcel-locker-market-size.html

• https://www.manchesterprofessionals.co.uk/article/information-technology/93785/smart-parcel-locker-market-opportunities-and-challenges-explained

• https://vocal.media/stories/smart-parcel-locker-market-demand-drivers-across-global-regions

✅Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

✅About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release ESG Reporting Software Market to Reach US$ 2.67 Bn by 2031 Amid Rising Focus on Corporate Sustainability here

News-ID: 4060765 • Views: …

More Releases from Persistence Market Research

Bicycle Spokes Market Set for Strong Growth at 5.4% CAGR Through 2032 - Persiste …

The global bicycle spokes market is rapidly gaining traction as bicycles continue to be adopted as preferred choices for commuting, fitness, recreation, and eco‐friendly mobility. The global bicycle spokes market size is likely to be valued at US$2.9 billion in 2025 and is expected to reach US$4.2 billion by 2032, registering a steady CAGR of 5.4 % between 2025 and 2032.

➤ Download Your Free Sample & Explore Key Insights: https://www.persistencemarketresearch.com/samples/30615

Bicycle…

Herbal Toothpaste Market Growth Poised at 6.5% CAGR Through 2033 Amid Rising Hea …

The global oral care industry is undergoing a transformational shift as consumers increasingly prioritize natural, chemical free alternatives. Central to this transformation is the herbal toothpaste market, which is rapidly emerging as a mainstream segment driven by rising health consciousness, sustainability trends, and demand for botanical formulations. The global herbal toothpaste market size is likely to be valued at US$ 2.6 billion in 2026 and is projected to reach US$…

Dead Sea Mud Cosmetics Market Set for Steady Expansion Amid Rising Demand for Na …

The global beauty and personal care industry continues to evolve as consumers shift toward natural, mineral-based, and wellness-oriented skincare solutions. Among these, Dead Sea mud cosmetics have gained strong traction for their mineral content and perceived therapeutic benefits. According to industry estimates, the global dead sea mud cosmetics market is likely to be valued at US$1.5 billion in 2026 and is projected to reach US$2.3 billion by 2033, expanding at…

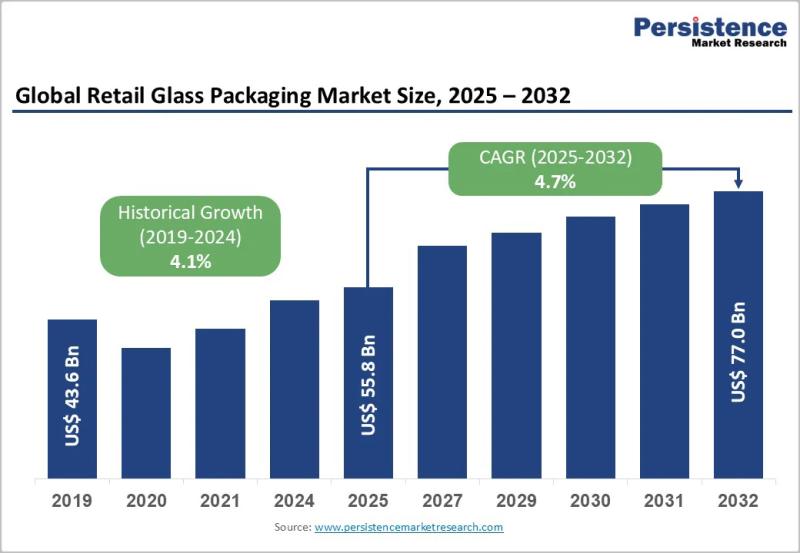

Retail Glass Packaging Market Projected to Reach US$77.0 Billion by 2032 at 5.3% …

The retail glass packaging market continues to play a crucial role in the global packaging ecosystem, particularly across food, beverage, cosmetics, and pharmaceutical retail channels. Glass packaging remains a preferred solution due to its premium appearance, chemical inertness, recyclability, and ability to preserve product integrity. As consumers increasingly prioritize sustainability, safety, and high quality packaging, retail glass packaging has regained strategic importance across both developed and emerging economies. Brands are…

More Releases for ESG

CARE ESG Awards 2025 highlights outstanding achievements in sustainability, clim …

Dubai, UAE, 29th November 2025, ZEX PR WIRE, The CARE ESG Awards by Trescon and ESG Mena recognised the region's most outstanding leaders, changemakers, and industry shapers driving sustainability, clean energy, climate resilience, and responsible growth. Held during the inaugural edition of climate action, renewable energy & sustainability forum, CARE 2025, the awards spotlighted high-impact contributions driving measurable progress across environmental stewardship, renewable energy deployment, resource efficiency, social value creation,…

APAC Investor ESG Software Market Rises at 16.5% CAGR Amid Regional Push for ESG …

The Asia Pacific (APAC) Investor ESG Software market is poised for a decade of robust expansion, projected to grow from US$ 214.91 million in 2024 to an estimated US$ 756.92 million by 2031. This represents a significant Compound Annual Growth Rate (CAGR) of 19.7% during the forecast period of 2024-2031, according to a new market research report published by The Insight Partners.

Download PDF Sample Copy @ https://www.theinsightpartners.com/sample/TIPRE00023473/?utm_source=OpenPR&utm_medium=10813

The report, titled "Asia-Pacific…

Global ESG Reporting Software Market Size by Application, Type, and Geography: F …

USA, New Jersey- According to Market Research Intellect, the global ESG Reporting Software market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The growing need for clear and consistent sustainability disclosures is driving the market for ESG (Environmental, Social, and Governance) reporting software, which is expanding…

ZeeDimension Wins ESG Data Company Award at the 5th World ESG Summit in Riyadh

Riyadh, Saudi Arabia - February 12, 2025 - ZeeDimension, a leading provider of ESG, GRC, and data analytics solutions, has been honored with the prestigious ESG Data Company Award at the 5th World ESG Summit, held on February 10-11, 2025, in Riyadh, Saudi Arabia.

The World ESG Summit is one of the most influential global gatherings for sustainability leaders, investors, and policymakers, dedicated to advancing Environmental, Social, and Governance (ESG) initiatives.…

Transforming the Environmental, Social And Governance (ESG) Investment Analytics …

What Is the Expected Size and Growth Rate of the Environmental, Social And Governance (ESG) Investment Analytics Market?

The market size for investment analytics related to environmental, social, and governance (ESG) has been on a rapid surge over the recent years. The market estimation is to rise from $1.7 billion in 2024 to $2.01 billion in 2025 with a compound annual growth rate (CAGR) of 18.1%. Growth in the past can…

Inrate Unveils New ESG Data Platform for Transparent and Traceable ESG Data Insi …

Zurich, Oct 22, 2024 - Inrate, a leading impact rating and ESG data company, is thrilled to announce the release of CLIF, its new ESG data platform, designed to provide transparent and traceable ESG data to simply investment analysis. With expanded features and seamless functionality, CLIF allows investors to gain enhanced visibility into the sustainability performance of over 10,000 companies and 190 sovereigns worldwide.

Empowering Data-Driven ESG Decisions

The CLIF…