Press release

How the Risk Analytics Market is Transforming Decision-Making Worldwide

Market OverviewThe global risk analytics market is witnessing accelerated growth as businesses across sectors increasingly seek robust tools to manage operational, financial, and compliance-related risks. With digital transformation sweeping across industries, organizations are recognizing the strategic importance of real-time and predictive risk analytics. As of 2024, the global risk analytics market is valued at approximately USD 38.7 billion, and it is projected to reach USD 97.6 billion by 2032, growing at a CAGR of 12.3% during the forecast period.

Key drivers of this growth include the increasing prevalence of fraud, the demand for compliance with complex regulatory frameworks, and technological advancements like AI and machine learning integration. Among the market segments, fraud detection and prevention remains dominant due to rising cybersecurity threats. North America holds the largest market share, driven by advanced IT infrastructure, early adoption of analytics solutions, and strong regulatory mandates across the financial sector.

Elevate your business strategy with comprehensive market data. Request a sample report now: https://www.persistencemarketresearch.com/samples/4801

➤ Key Highlights from the Report

➤ The risk analytics market is expected to surpass USD 97.6 billion by 2032.

➤ Real-time analytics tools are becoming a critical component for financial institutions.

➤ Fraud detection and prevention solutions lead the application segment.

➤ North America dominates the market, followed by rapid growth in the Asia-Pacific region.

➤ On-demand risk analytics services are gaining traction among SMEs.

➤ Regulatory compliance continues to be a significant driver for adoption across sectors.

Market Segmentation

The risk analytics market is segmented by solutions, services, applications, and industry verticals, each playing a crucial role in shaping the market landscape. In terms of solutions, the market comprises components such as risk calculation engines, scorecard and visualization tools, risk reporting, and governance risk and compliance (GRC) systems. These solutions empower businesses with decision-making tools that assess and mitigate various types of risks in real-time.

On the basis of services, the market is categorized into support and maintenance, consulting, and integration services. Among these, consulting services are in high demand as organizations seek expert guidance in customizing analytics solutions. The application-wise segmentation includes credit risk management, liquidity risk analysis, real-time situational awareness, and fraud detection-with the latter being the most widely used due to increasing security threats.

Regional Insights

North America leads the global risk analytics market, primarily due to the high concentration of technology-driven enterprises and stringent financial regulations. Major banks and insurance firms across the U.S. and Canada are continuously investing in advanced risk analytics platforms to remain compliant and mitigate exposure to financial losses.

Meanwhile, Asia Pacific is emerging as a high-growth region, driven by increasing digitalization across India, China, and Southeast Asia. Government initiatives promoting data security and the growth of fintech sectors in these countries are expected to propel the regional market forward during the forecast period.

Market Drivers

A primary driver of the global risk analytics market is the increased need for fraud detection and prevention. With organizations dealing with large volumes of digital transactions, the potential for fraud has risen. Risk analytics platforms help monitor transactional data, user behavior, and historical patterns to predict and neutralize fraudulent activities before they escalate.

Additionally, regulatory compliance requirements are forcing organizations, especially in the BFSI sector, to invest in robust analytics tools. These tools support internal audits, transparency, and reporting mechanisms that comply with evolving international and regional regulations, including Basel III, GDPR, and Dodd-Frank.

Market Restraints

Despite its potential, the risk analytics market faces several challenges. One of the most significant is the low awareness and limited expertise in using advanced analytics tools. Especially among small and mid-sized enterprises, the lack of in-house expertise and the complexity of implementation deter adoption.

Moreover, regulatory complexities act as a double-edged sword. While they drive demand, they also restrict innovation and delay product launches, especially when solutions must adhere to multiple and frequently changing compliance standards across different regions.

Market Opportunities

Opportunities in the market are expanding due to the emergence of cloud-based and on-demand risk analytics services. These offerings reduce the entry barrier for SMEs by eliminating the need for extensive hardware or infrastructure investment. Cloud solutions also allow real-time data access and remote risk monitoring, making them highly desirable in today's hybrid work environments.

Additionally, the integration of artificial intelligence (AI) and machine learning (ML) into risk analytics platforms opens new avenues for growth. These technologies allow predictive modeling and adaptive learning, enabling companies to make more accurate and timely decisions regarding risk management.

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/4801

📌 Frequently Asked Questions (FAQs)

➤ How Big is the Risk Analytics Market in 2024?

➤ Who are the Key Players in the Global Risk Analytics Market?

➤ What is the Projected Growth Rate of the Risk Analytics Market?

➤ What is the Market Forecast for Risk Analytics through 2032?

➤ Which Region is Estimated to Dominate the Risk Analytics Industry through the Forecast Period?

✦ Company Insights

Prominent players shaping the global risk analytics market include:

✦ Oracle India Pvt. Ltd.

✦ International Business Machines Corporation (IBM)

✦ SAS Institute Inc.

✦ Microsoft Corporation

✦ SAP A.G.

✦ Cisco Systems, Inc.

✦ Teradata Corporation

✦ TIBCO Software Inc.

■ Teradata Corporation recently launched a cloud-native platform enabling real-time fraud detection using integrated AI models.

■ IBM announced a partnership with a major European bank to deploy predictive risk analytics for credit risk and compliance monitoring.

Conclusion

The global risk analytics market stands at the intersection of technology, compliance, and strategic decision-making. As enterprises increasingly prioritize risk-aware cultures, the integration of risk analytics into business operations is no longer optional-it is essential. With growing cyber threats, fluctuating economies, and ever-changing regulations, risk analytics solutions offer a lifeline by providing actionable insights in real-time.

While challenges such as regulatory hurdles and low awareness persist, the market's trajectory is unmistakably upward. Innovations like AI-driven analytics, cloud deployment, and on-demand services are transforming the landscape, making risk management more predictive, agile, and data-driven. For organizations ready to embrace the future, risk analytics is not just a tool-it's a competitive advantage.

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How the Risk Analytics Market is Transforming Decision-Making Worldwide here

News-ID: 4060756 • Views: …

More Releases from Persistence Market Research

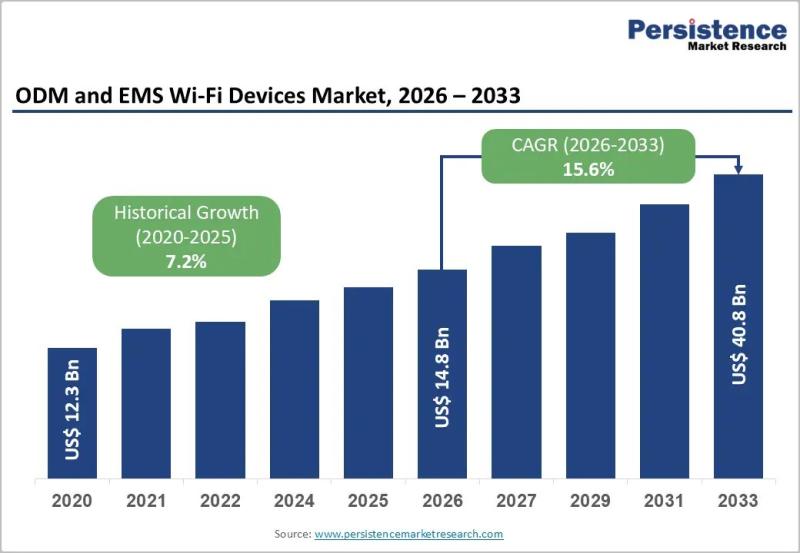

ODM and EMS Wi-Fi Devices Market to Reach US$ 40.8 Billion by 2033 at 15.6% CAGR

The global ODM and EMS Wi-Fi devices market is projected to be valued at US$ 14.8 billion in 2026 and is forecast to surge to US$ 40.8 billion by 2033, registering a robust CAGR of 15.6% between 2026 and 2033. This rapid growth reflects the accelerating demand for advanced wireless connectivity solutions across residential, enterprise, and industrial environments. The expansion of 5G infrastructure, enterprise digital transformation strategies, and large-scale IoT…

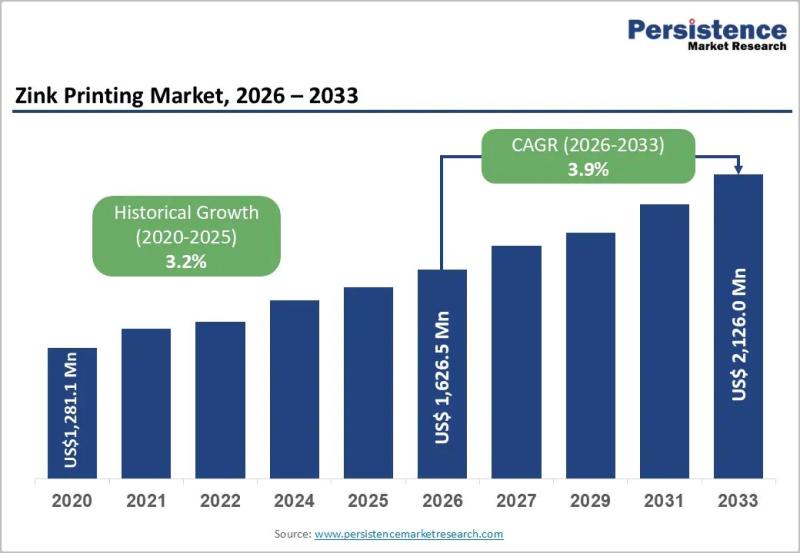

Zink Printing Market to Reach US$ 2,126.0 Million by 2033 at 3.9% CAGR

Zink Printing Market Size and Trends Analysis

The global Zink printing market is projected to be valued at US$ 1,626.5 million in 2026 and is expected to reach US$ 2,126.0 million by 2033, expanding at a CAGR of 3.9% between 2026 and 2033. Zink (Zero Ink) printing technology eliminates the need for ink cartridges by using heat-activated color crystals embedded within specialized paper. This innovation has positioned Zink printers as a…

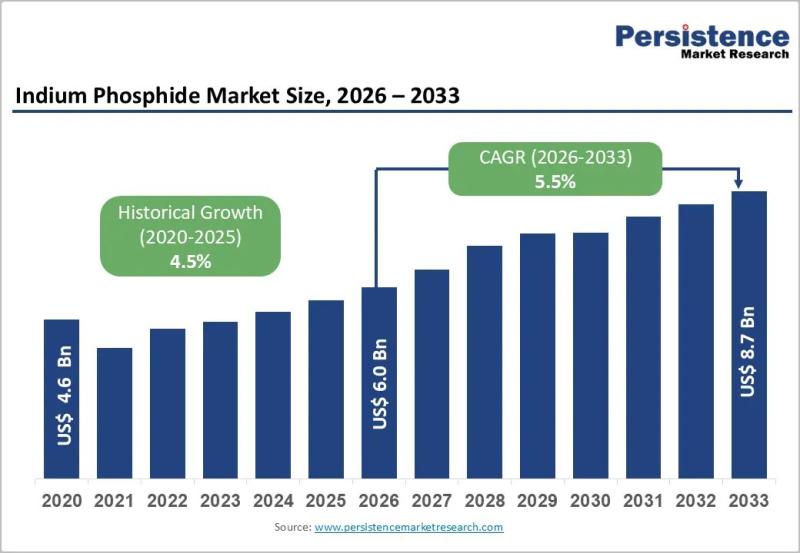

Indium Phosphide Market to Reach US$ 8.7 Billion by 2033 at 5.5% CAGR

The global Indium Phosphide (InP) market is poised for steady expansion, with its valuation expected to reach US$ 6.0 billion by 2026 and further grow to US$ 8.7 billion by 2033, registering a CAGR of 5.5% between 2026 and 2033. Indium phosphide, a high-performance compound semiconductor material, is widely used in optoelectronics, high-frequency electronics, and photonic integrated circuits (PICs). The market growth is largely fueled by the accelerating deployment of…

Roasted Corn Market to Reach $5.5B by 2033 Driven by Rising Snack Demand

The global roasted corn market is poised for steady expansion, driven by rising consumer preference for convenient, ready-to-eat snacks and increasing awareness of healthier alternatives to traditional fried snack options. Current market estimates indicate that the roasted corn market is valued at approximately US$ 3.8 billion in 2026 and is projected to reach US$ 5.5 billion by 2033, reflecting a compound annual growth rate (CAGR) of 5.4% between 2026 and…

More Releases for Risk

The Risk Side of Crypto Trading: Safety Tips + Risk Management

The Risk Side of Crypto Trading: Safety Tips + Risk Management

Cryptocurrency trading can be exciting, fast-moving, and potentially profitable. But it also carries serious risks that many beginners underestimate.

From dramatic price swings in Bitcoin to rapid market shifts in Ethereum, crypto markets are among the most volatile financial environments in the world.

If you're entering crypto trading - especially short-term or automated trading - understanding the risk side is not optional.

In…

SMARTER RISK LAUNCHES REVOLUTIONARY AUTOMATED RISK CONTROL SOLUTION

Winston-Salem, N.C. - Smarter Risk, a risk control solutions provider, is proud to announce the launch of its newest product, Automated Risk Control (ARC) - a first-of-its-kind scalable risk control platform designed for the insurance industry.

ARC delivers unmatched speed, efficiency, and cost savings by automating the entire risk assessment process, from data collection to reporting. With assessments taking just 15 minutes and turnaround times of two business days, ARC…

Construction Risk Software Market is Booming Worldwide : Risk Decisions, Sword A …

2020-2025 Global Construction Risk Software Market Report - Production and Consumption Professional Analysis (Impact of COVID-19) is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global Construction Risk Software Market. Some of the key players…

Future Growth In Risk Analytics Market - Segmented By Material Type (Software An …

The global risk analytics market was valued at, and is expected to reach a 2023 at a CAGR of +13%, during the forecast period (2018-2023). The market is segmented by type of offering, applications, end-user vertical, and geography. This report focuses on adoption of these solutions for various applications various regions. The study also emphasizes on latest trends, industry activities, and vendor market activities. Approximately 73% of the banks are…

Risk Analysis and Risk Management for Public Private Partnerships

Practical Seminar, 21st – 22nd March 2013, Berlin

For many public institutions that plan new projects in the sectors of public buildings, infrastructure or energy and waste, Public Private Partnerships are an attractive alternative to traditional tender and delivery strategies. However, risks in PPPs have to be identified, analysed and allocated to the right partner before embarking on a project.

• What is risk

• What types of risks exist for which type of…

Online Risk Check Analyzes Weighing Risk in Minutes

Mettler Toledo, the leading manufacturer of precision instruments, developed the Risk Check: An online tool to analyze the weighing risk of balances from all kinds of manufacturers. The Risk Check defines the weighing risk to optimize the performance and quality of a balance. It is based on the international weighing guideline Good Weighing Practice (GWP), which is appropriate for persons in charge of quality management in the pharmaceutical, chemical and…