Press release

B2B Payments Market Report 2025-2033: Trends, Segmentation, and Growth Insights

________________________________________Market Overview

The global B2B payments market has witnessed significant growth, reaching a valuation of USD 1,189.6 billion in 2024. This expansion is driven by the increasing adoption of digital payment solutions, the rapid growth of e-commerce, and the need for efficient cross-border transactions. With businesses seeking faster, more secure, and cost-effective payment methods, the market is projected to reach USD 2,189.0 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 7% from 2025 to 2033.

________________________________________

Study Assumption Years

• Base Year: 2024

• Historical Years: 2019-2024

• Forecast Years: 2025-2033

________________________________________

B2B Payments Market Key Takeaways

• Market Size and Growth: The B2B payments market was valued at USD 1,189.6 billion in 2024 and is expected to reach USD 2,189.0 billion by 2033, growing at a CAGR of 7% from 2025 to 2033.

• Regional Dominance: Asia-Pacific leads the market, holding a 36.7% share in 2024, driven by rapid digitalization and a burgeoning e-commerce sector.

• Technological Innovations: Advancements in technology, such as blockchain and artificial intelligence, are enhancing transaction security and efficiency, propelling market growth.

• Demand for Real-Time Processing: The growing need for faster, more secure, and cost-effective payment options is driving the adoption of real-time payment processing systems.

• Digital Payment Adoption: Businesses are increasingly adopting electronic invoicing, digital payment platforms, and real-time transaction tracking to enhance efficiency and reduce operational costs.

Request for a sample copy of this report: https://www.imarcgroup.com/b2b-payments-market/requestsample

________________________________________

Market Growth Factors

1. Enhancing Payment Efficiency Through Technological Advancements

The B2B payment scenario is being completely changed by the incorporation of sophisticated technologies including blockchain and artificial intelligence (AI). With safe and unchangeable transaction records, blockchain technology lowers fraud risk and boosts openness. Real-time data analysis made possible by artificial intelligence helps companies spot anomalies and streamline payment systems. Together, these innovations satisfy the rising need for simplified financial processes by means of quicker, more secure, and effective payment solutions.

2. Legal structures supporting the adoption of digital payments

In Europe, regulatory programs like the Payment Services Directive 2 (PSD2) are creating a safe and competitive payment environment. PSD2 improves payment security and promotes innovation in financial services by requiring open banking APIs. Such rules help to standardize across national borders, therefore streamlining cross-border trade and lowering connected costs. Among companies worldwide, this regulatory assistance is crucial in promoting digital payment adoption.

3. Increasing cross-border and real-time payment solutions' demand.

The growing worldwide reach of companies calls for effective cross-border payment systems. Companies looking for real-time payment solutions are driven by the delays and extra expenses usually associated with traditional methods. Digital payment platform acceptance allows immediate transactions, so enhancing operating effectiveness and cash flow control. A major engine of market expansion is this change toward real-time and cross-border payment solutions.

________________________________________

Market Segmentation

Breakup by Payment Type:

• Domestic Payments: Transactions conducted within a single country's borders, often characterized by standardized processes and regulatory frameworks.

• Cross-Border Payments: Transactions between businesses in different countries, requiring currency exchange and compliance with international regulations.

Breakup by Payment Mode:

• Traditional: Conventional payment methods such as checks and bank transfers, typically involving longer processing times.

• Digital: Modern payment solutions including electronic funds transfers, virtual cards, and mobile payment platforms, offering faster and more secure transactions.

Breakup by Enterprise Size:

• Large Enterprises: Organizations with substantial revenue and employee count, often requiring complex payment solutions to manage extensive transactions.

• Small and Medium-sized Enterprises: Businesses with moderate revenue and workforce, seeking cost-effective and scalable payment solutions.

Breakup by Industry Vertical:

• BFSI: Banking, Financial Services, and Insurance sector, requiring secure and compliant payment systems.

• Manufacturing: Industries involved in the production of goods, necessitating efficient payment processes for supply chain management.

• IT and Telecom: Companies providing information technology and telecommunication services, leveraging digital payment solutions for operational efficiency.

• Metals and Mining: Industries engaged in the extraction and processing of metals and minerals, requiring reliable payment systems for international transactions.

• Energy and Utilities: Sectors providing essential services like electricity and water, utilizing streamlined payment processes for billing and collections.

• Others: Includes various other industries adopting B2B payment solutions to enhance financial operations.

Breakup by Region:

• North America: United States, Canada

• Asia Pacific: China, Japan, India, South Korea, Australia, Indonesia, Others

• Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Others

• Latin America: Brazil, Mexico, Others

• Middle East and Africa

________________________________________

Regional Insights

Asia-Pacific dominates the B2B payments market, holding a 36.7% share in 2024. This leadership is attributed to rapid digitalization, a booming e-commerce sector, and widespread adoption of electronic payment methods in countries like China, Japan, and India. The region's focus on technological innovation and supportive regulatory frameworks further bolster its market position.

________________________________________

Recent Developments & News

The B2B payments landscape is undergoing significant transformations driven by technological advancements and strategic partnerships. Companies are increasingly integrating artificial intelligence (AI) and blockchain technologies to enhance transaction security, streamline processes, and reduce operational costs. The adoption of digital payment methods, such as virtual cards, is surging, with projections indicating substantial growth in the coming years. Moreover, financial institutions are forming alliances to expand their payment services, exemplified by Credem's partnership with Worldline to manage merchant payment activities in Italy, aiming to enhance digital payment offerings for retailers.

________________________________________

Key Players

• American Express Company

• Bank of America Corporation

• Capital One

• Citigroup Inc.

• JPMorgan Chase & Co.

• Mastercard Inc.

• Payoneer Inc.

• PayPal Holdings Inc.

• Paystand Inc.

• Stripe Inc.

• Visa Inc.

• Wise Payments Limited

________________________________________

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=5143&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: +1-631-791-1145

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC's offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

________________________________________

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release B2B Payments Market Report 2025-2033: Trends, Segmentation, and Growth Insights here

News-ID: 4059603 • Views: …

More Releases from IMARC Group

United States Air Freight Market Size, Share, Industry Trends, Growth and Foreca …

IMARC Group has recently released a new research study titled "United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Air Freight Market Overview

The United States air freight market size was valued at USD 64.06 Billion in 2025.…

Mexico Medical Tourism Market 2026 : Industry Size to Reach USD 10.6 Billion by …

IMARC Group has recently released a new research study titled "Mexico Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Medical Tourism Market Overview

The Mexico medical tourism market size reached USD 2.1 Billion in 2025. Looking forward, the market is projected…

Saudi Arabia Pilates & Yoga Studios Market Size to Surpass USD 3.6 Billion by 20 …

Saudi Arabia Pilates & Yoga Studios Market Overview

Market Size in 2024: USD 1.6 Billion

Market Forecast in 2033: USD 3.6 Billion

Market Growth Rate 2025-2033: 8.20%

According to IMARC Group's latest research publication, "Saudi Arabia Pilates & Yoga Studios Market Size, Share, Trends and Forecast by Activity Type, Application, and Region, 2025-2033", the Saudi Arabia pilates & yoga studios market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the…

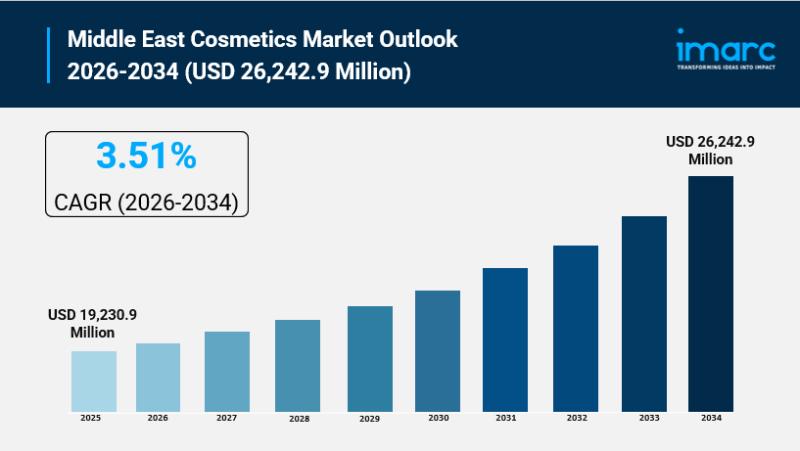

Middle East Cosmetics Market Size to Surpass USD 26,242.9 Million by 2034, at a …

Middle East Cosmetics Market Overview

Market Size in 2025: USD 19,230.9 Million

Market Size in 2034: USD 26,242.9 Million

Market Growth Rate 2026-2034: 3.51%

According to IMARC Group's latest research publication, "Middle East Cosmetics Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", the Middle East cosmetics market size reached USD 19,230.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 26,242.9 Million by 2034, exhibiting a growth rate…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…