Press release

Tax Tech Market Forecast 2025-2034 Indicates CAGR of 13.4% with Growth Accelerated by SME Digital Transformation and AI Adoption

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the " Tax Tech Market- (By Offering (Solutions (Tax Compliance & Reporting (Corporate tax compliance (direct & indirect taxes), Sales and use tax automation, VAT/GST compliance, E-filing and tax return preparation), Tax Analytics & AI-Driven Solutions (Predictive analytics for tax planning, AI-powered tax audits and risk assessment, Tax data visualization and decision support), Tax Workflow & Document Management (Tax document automation and e-signatures, Tax workflow collaboration platforms, Audit trail and regulatory documentation)), Professional Services (Consulting & Training, Integration & Deployment, Support and Maintenance)), By Deployment Mode (Cloud, On-premises), By Tax Type (Direct Tax (Corporate Income Tax, Capital Gains Tax, Property Tax, Other Direct Taxes), Indirect Tax (Value-Added Tax (VAT) and Goods & Services Tax (GST), Sales & Use Tax, Excise Tax, Customs Duties & Tariffs, Other Indirect Taxes)), By Organization Size (Large Enterprises, SMEs), By Vertical (BFSI, IT & Telecom, Retail & E-commerce, Manufacturing, Energy & Utilities, Healthcare & Life Sciences, Government & Public Sector, Other Verticals)), Trends, Industry Competition Analysis, Revenue and Forecast To 2034."According to the latest research by InsightAce Analytic, the Tax Tech Market is valued at USD 18.3 Bn in 2024 , and it is expected to reach USD 61.9 Bn by the year 2034, with a CAGR of 13.4% during the forecast period of 2025-2034.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/3005

The term "tax tech" describes how sophisticated digital tools, software, and automated solutions are incorporated into tax-related tasks to improve precision, effectiveness, and compliance. It includes a vast range of technologies that assist businesses and tax professionals in streamlining tax procedures like filing, reporting, auditing, and regulatory compliance, such as blockchain, cloud computing, artificial intelligence (AI), machine learning, and data analytics. The need for tax technology solutions is expected to be significantly influenced by the evolving worldwide tax laws and the increasing complexity of international trade. Businesses that expand internationally find it difficult to manage different tax laws, compliance requirements, and reporting requirements. This has led to a pressing need for automated, real-time tax management systems.

List of Prominent Players in the Tax Tech Market:

• Wolters Kluwer

• H&R Block

• Avalara

• Vertex

• Thomson Reuters

• SAP

• ADP

• SOVOS

• Intuit

• Xero

• TaxBit

• Ryan

• TaxAct

• Anrok

• Corvee

• TaxSlayer

• Fonoa

• Token Tax

• Drake Software

• TaxJar

• Picnic Tax

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-04

Market Dynamics:

Drivers-

The expansion of the tax tech market is driven by government regulations, growing cloud adoption, and digital tax reforms. In addition, the growing need for efficient tax technology solutions across a variety of industries, such as retail & e-commerce, financial services, and IT & telecom, is driving the growth of the tax tech market. As tax laws become more intricate and regionally specific, businesses encounter challenges with compliance and reporting. With automation, precision, and real-time updates, the tax tech solution makes it easier for businesses to manage complicated tax laws. As businesses look to streamline tax-related procedures, reduce errors, and ensure acquiescence with changing tax laws, this trend has raised demand for tax technology solutions, ultimately propelling market expansion.

Challenges:

The lack of knowledge about tax technology among businesses in developing nations impedes the tax tech market expansion. Because employees lack digital skills and adopting new technology can be difficult, businesses find it difficult to see the advantages of automation and instead choose the traditional methods of tax processing. Many small and medium enterprises still manage their tax reporting using Excel spreadsheets, paper forms, and accountants, and they still file taxes by hand. Additionally, the market for tax technology is also severely hampered by the frequent changes in tax rules and regulations. Tax systems must be updated frequently when governments modify tax rates, add digital filing requirements, and adopt new regulations in order to remain compliant.

Regional Trends:

The North American Tax Tech market is anticipated to record very large market revenue share because of its highly automated tax system, government-backed e-filing programs, and a strong need for automation driven by artificial intelligence. The area is well-positioned to maintain its leadership position by providing cutting-edge cloud-based, AI-driven, and blockchain-based tax solutions in response to increasingly strict regulatory requirements and companies looking for efficient tax compliance. North America will lead the way in tax technology advancements that will make businesses and taxpayers more accurate, compliant, and efficient through sustained investments in digital tax innovation and security improvements. Besides, over the projection period, Asia Pacific is expected to increase at the fastest rate, driven by the rapid digital transformation and a rise in regulatory requirements. The tax technology market is gaining momentum due to accelerating digital tax reforms, evolving government compliance mandates, and the widespread adoption of cloud-based solutions. Notably, the Asia Pacific region is witnessing rapid growth, fueled by the digital transformation of small and medium-sized enterprises (SMEs) and the enforcement of eInvoicing regulations.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/3005

Recent Development:

• March 2025: Parolla and Xero collaborated to provide Irish users with free VAT3 return and SEPA payment options. With SEPA-compliant files, the Parolla Plugins made it easier to pay suppliers and allowed direct VAT3 filings to Revenue Online Services (ROS).

• December 2024: Avalara expanded its global e-invoicing capabilities by acquiring Oobj Tecnologia da Informação Ltda, a Brazilian software company. Through this acquisition, Avalara's e-invoicing reach is extended to six Latin American nations, and its endpoint connection in Brazil has been improved.

Segmentation of Tax Tech Market-

By Offering-

• Solutions

o Tax Compliance & Reporting

Corporate tax compliance (direct & indirect taxes)

Sales and use tax automation

VAT/GST compliance

E-filing and tax return preparation

o Tax Analytics & AI-Driven Solutions

Predictive analytics for tax planning

Al-powered tax audits and risk assessment

Tax data visualization and decision support

o Tax Workflow & Document Management

Tax document automation and e-signatures

Tax workflow collaboration platforms

Audit trail and regulatory documentation

• Professional Services

o Consulting & Training

o Integration & Deployment

o Support and Maintenance

By Deployment mode-

• Cloud

• On-premises

By Tax type-

• Direct Tax

o Corporate Income Tax

o Capital Gains Tax

o Property Tax

o Other Direct Taxes

• Indirect Tax

o Value-Added Tax (VAT) And Goods & Services Tax (GST)

o Sales & Use Tax

o Excise Tax

o Customs Duties & Tariffs

o Other Indirect Taxes

By Organization Size-

• Large Enterprises

• SMEs

By Vertical-

• BFSI

• IT & Telecom

• Retail & E-commerce

• Manufacturing

• Energy & Utilities

• Healthcare & Life Sciences

• Government & Public Sector

• Other Verticals

By Region-

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of the Middle East and Africa

Read Overview Report- https://www.insightaceanalytic.com/report/tax-tech-market/3005

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: www.insightaceanalytic.com

Tel : +1 607 400-7072

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Tech Market Forecast 2025-2034 Indicates CAGR of 13.4% with Growth Accelerated by SME Digital Transformation and AI Adoption here

News-ID: 4059427 • Views: …

More Releases from Insightace Analytic Pvt Ltd.

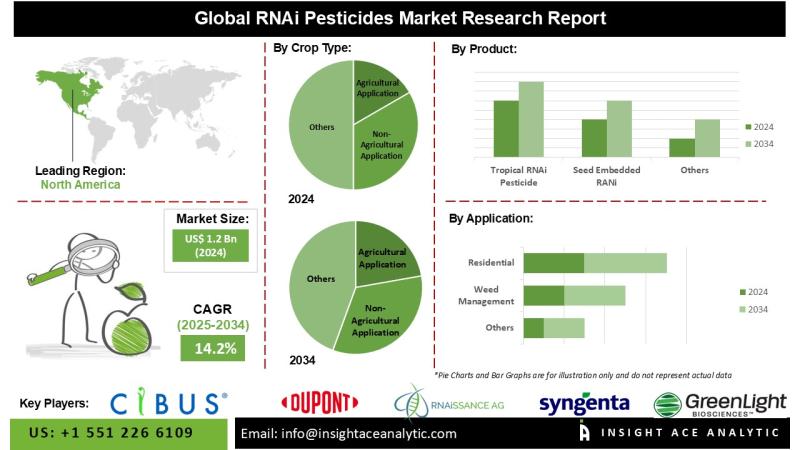

RNAi Pesticides Market Report on the Untapped Growth Opportunities in the Indust …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "RNAi Pesticides Market"-, By Application (Insect Pest Control, Weed Management, Disease Management, Resistance Management), By Crop Type (Agricultural Application, Non-Agricultural Application), By Product (Tropical RNAi Pesticide, Seed Embedded RANi, Transgenic RNAi, Others), By Formulation (Liquid Formulation, Granular Formulation, Powder Formulation, Others), Industry Trends, and Global Forecasts, 2025-2034 And Segment Revenue and Forecast To 2034."

The RNAi…

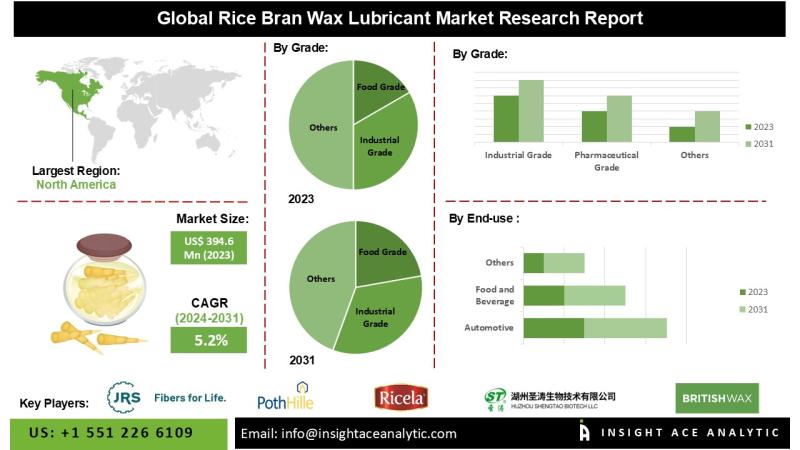

Rice Bran Wax Lubricant Market Know the Scope and Trends

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Rice Bran Wax Lubricant Market - (By Grade (Food Grade, Industrial Grade, Pharmaceutical Grade), End-use (Automotive, Food and Beverage, Cosmetics and Personal Care, Pharmaceuticals, Chemicals, Others)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."

According to the latest research by InsightAce Analytic, the Global Rice Bran Wax Lubricant Market is valued at US$ 394.6 million…

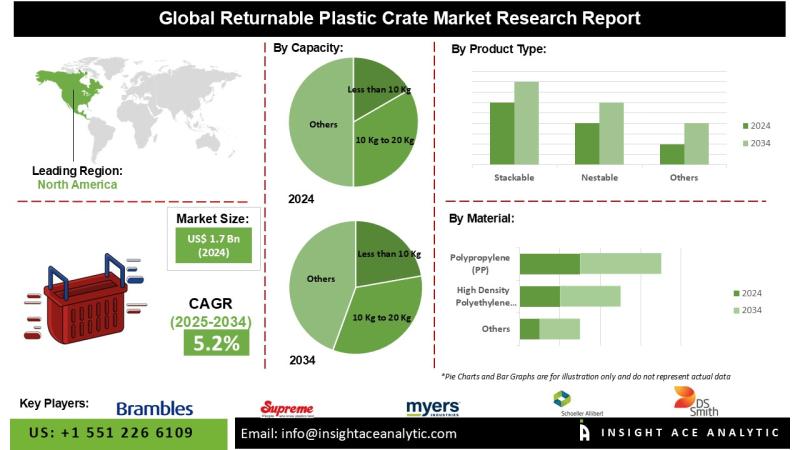

Returnable Plastic Crate Market Exclusive Report with Detailed Study Analysis

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Returnable Plastic Crate Market - (By Capacity (Less than 10 kg, 10 kg to 20 kg, 21 to 35 kg, 36 to 50 kg, Above 50 kg), By Product Type (Stackable, Nestable, Collapsible), By Material (High-Density Polyethylene (HDPE), Polypropylene (P.P.), Others), By Application (Agriculture, Grocery, Dairy, Bakery, Seafood & Meat, Others)), Trends, Industry Competition…

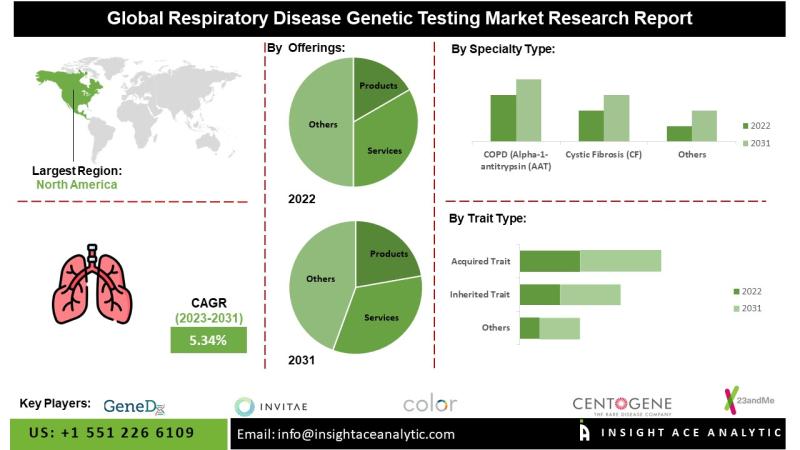

Respiratory Disease Genetic Testing Market Exclusive Report on the Latest Revenu …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Respiratory Disease Genetic Testing Market- (By Offerings (Products (Kits and Consumables), Services, Others), By Disease Type (COPD (Alpha-1-antitrypsin (AAT), Cystic Fibrosis (CF), Diffuse Lung Disease/Surfactant Dysfunction (RHD (Respiratory Distress Syndrome), PPHN (Persistent Pulmonary Hypertension of the Newborn)), Interstitial lung disease, Pulmonary Arterial Hypertension, Pulmonary Hypoplasia, Primary Ciliary Dyskinesia, Other Diseases (BPD)), By Offerings (PCR, NGS…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…