Press release

Tax Advisory Services Market Grows Amid Rising Global Compliance Demands - Strategic Outlook to 2031 by Type & Vertical

According to the report published by Allied Market Research, the global tax advisory services market generated $34.6 billion in 2021, and is projected to reach $97.1 billion by 2031, growing at a CAGR of 11.2% from 2022 to 2031.➡️Request Research Report Sample & TOC : https://www.alliedmarketresearch.com/request-sample/31953

As a global leader in active investing, the company will provide business tax advisory solutions at scale to meet the clients' evolving needs across all areas of the asset management landscape driving the growth for tax advisory services market.

The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities, competitive landscape and regional landscape. The report is a useful source of information for new entrants, shareholders, frontrunners and shareholders in introducing necessary strategies for the future and taking essential steps to significantly strengthen and heighten their position in the market.

COVID-19 Scenario:

The outbreak of COVID-19 has had a negative impact on the growth of the global tax advisory services market, owing to the prevalence of economic recession in both developing and developed countries across the globe.

Thus, there was a drop in demand for these services, which severely impacted market growth.

Apart from that, instability in the financial sector and decreased overall investment further aggravated the impact on the market. However, tax advisory services providers have taken numerous steps to position themselves for the post-COVID future as they begin their recovery.

Moreover, the COVID-19 pandemic increased the importance of digital transformation systems in tax advisory services. Technology-driven tax advisory services start-ups are increasingly offering clients digitized and long-term tax filing services through robo-advisors.

The report offers detailed segmentation of the global tax advisory services market based on type, organization size, industry vertical, and region. The report provides a comprehensive analysis of every segment and their respective sub-segment with the help of graphical and tabular representation. This analysis can essentially help market players, investors, and new entrants in determining and devising strategies based on fastest growing segments and highest revenue generation that is mentioned in the report.

Based on type, the direct tax advisory segment held the largest market share in 2021, holding more than two-thirds of the global market, and is expected to maintain its leadership status during the forecast period. The indirect tax advisory segment, on the other hand, is expected to cite the fastest CAGR of 13.2% during the forecast period.

Based on organization size, the large enterprises segment held the major market share in 2021, holding nearly three-fourths of the global market share, and is expected to maintain its leadership status during the forecast period. The small and medium-sized enterprises segment, on the other hand, is expected to cite the fastest CAGR of 14.0% during the forecast period.

Based on industry vertical, the BFSI segment held the largest market share in 2021, holding more than one-fourth of the global market share, and is expected to maintain its leadership status during the forecast period. The healthcare segment, on the other hand, is expected to cite the fastest CAGR of 16.8% during the forecast period.

➡️Request Customization We offer a customized report as per your requirement https://www.alliedmarketresearch.com/request-for-customization/A31503

Based on region, the market across North America held the largest market share in 2021, holding nearly two-fifths of the global market, and is expected to maintain its leadership status during the forecast period. The Asia-Pacific region, on the other hand, is expected to cite the fastest CAGR of 14.5% during the forecast period.

The key players analysed in the global tax advisory services market report include Aon PLC., Bank of America Corporation, Citigroup Inc., CGI, Inc., Cognizant, CSC consulting services, CREDIT SUISSE GROUP AG, Deloitte, Goldman Sachs, JPMorgan Chase & Co., Morgan Stanley, Northern Trust Corporation, PWC, Wells Fargo & Company, Tax Scouts, and Taxfyle.

The report analyzes these key players in the global tax advisory services market. These market players have made effective use of strategies such as joint ventures, collaborations, expansion, new product launches, partnerships, and others to maximize their foothold and prowess in the industry. The report is helpful in analyzing recent developments, product portfolio, business performance and operating segments by prominent players in the market.

KEY BENEFITS FOR STAKEHOLDERS

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the tax advisory services market forecast from 2021 to 2031 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities of tax advisory services market overview.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the tax advisory services market segmentation assists in determining the prevailing tax advisory services market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as global tax advisory services market trends, key players, market segments, application areas, and market growth strategies.

➡️Buy Complete Report at Discounted Price @ https://www.alliedmarketresearch.com/checkout-final/6d9de9e7f78c98675459302166efee06

Key Market Segments

Organization Size

Large Enterprises

Small and Medium-Sized Enterprises

Type

Direct Tax Advisory

Direct Tax Advisory

Income Tax

Corporate Tax

Property Tax

Capital Gains tax

Others

Indirect Tax Advisory

Industry Vertical

IT and Telecom

Manufacturing

Retail and E-Commerce

Public Sector

BFSI

Healthcare

Others

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Italy, Spain, Netherlands, Rest Of Europe)

Asia-Pacific (China, Japan, India, Australia, South Korea, Singapore, Rest Of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

Trending Reports:

Digital Remittance Market https://www.alliedmarketresearch.com/digital-remittance-market

Banking as a Service Market https://www.alliedmarketresearch.com/banking-as-a-service-market-A14258

Starter Credit Cards Market https://www.alliedmarketresearch.com/starter-credit-cards-market-A315471

Cryptocurrency Market https://www.alliedmarketresearch.com/crypto-currency-market

Revenue-Based Financing Market https://www.alliedmarketresearch.com/revenue-based-financing-market-A07537

Embedded Finance Market https://www.alliedmarketresearch.com/embedded-finance-market-A110805

Contact Us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

https://medium.com/@kokate.mayuri1991

https://www.scoop.it/u/monika-718

https://bfsibloghub.blogspot.com/

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Advisory Services Market Grows Amid Rising Global Compliance Demands - Strategic Outlook to 2031 by Type & Vertical here

News-ID: 4057842 • Views: …

More Releases from Allied Market Research

Faucet Market Forecast 2035: Reaching USD 118.4 billion by 2035

According to a new report published by Allied Market Research, titled, "Faucet Market," The faucet market size was valued at $48.9 billion in 2023, and is estimated to reach $118.4 billion by 2035, growing at a CAGR of 7.6% from 2023 to 2035.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/2448

Faucet is a plumbing fixture used to control the flow of water in various settings such as kitchens,…

Vinyl Wallpaper Market Size Forecasted to Grow at 3.3% CAGR, Reaching USD 1.3 bi …

The Vinyl Wallpaper Market Size was valued at $943.30 million in 2021, and is estimated to reach $1.3 billion by 2031, growing at a CAGR of 3.3% from 2022 to 2031.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/16970

Vinyl wallpaper consists of a carrier layer (recycled paper or non-woven wallpaper base) and a decorative layer made of polyvinyl chloride. A synthetic foam layer provides three-dimensional structures to…

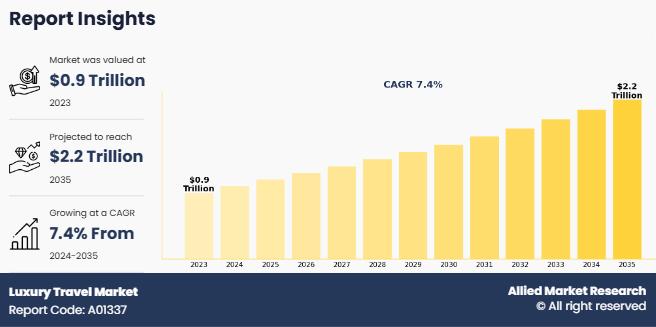

Luxury Travel Market Set to Achieve a Valuation of US$ 2149.7 billion, Riding on …

According to a new report published by Allied Market Research, titled, "Luxury Travel Market," The luxury travel market size was valued at $890.8 billion in 2023, and is estimated to reach $2149.7 billion by 2035, growing at a CAGR of 7.4% from 2024 to 2035.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/1662

Luxury travel refers to travel experiences that offer exceptional comfort, exclusivity, and personalized services, typically catering to…

Men Personal Care Market to Grow at a CAGR of 8.6% and will Reach USD 276.9 bill …

According to a new report published by Allied Market Research, titled, "Men Personal Care Market by Type, Age Group, Price Point, and Distribution Channel: Global Opportunity Analysis and Industry Forecast, 2021-2030," the men personal care market size is expected to reach $276.9 billion by 2030 at a CAGR of 8.6% from 2021 to 2030.

Request The Sample PDF of This Report: @ https://www.alliedmarketresearch.com/request-sample/1701

Men personal care products are non-medicinal…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…