Press release

Oil and Gas Market is Expected to Reach USD 72.6 Billion by 2033 | CAGR 15.21% During 2025-2033

IMARC Group, a leading market research company, has recently released a report titled "Oil and Gas Market Size, Share, Trends and Forecast by Type, Application, and Region 2025-2033". The study provides a detailed analysis of the industry, including the global oil and gas market trends, share, size, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.How Big Is the Oil and Gas Market?

The global oil and gas market size was valued at USD 20.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 72.6 Billion by 2033, exhibiting a CAGR of 15.21% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 36.8% in 2024. The oil and gas market share is growing due to the increasing global energy demand, industrialization, extraction technologies, exploration investments, geopolitical influences, cleaner fuel shifts, and economic recovery that supports the demand in the natural gas and LNG sectors.

Buy Now: https://www.imarcgroup.com/checkout?id=12642&method=1670

Global Oil and Gas Market Trends:

The oil and gas market is expected to navigate a complex landscape shaped by the dual pressures of transitioning to renewable energy sources and responding to geopolitical influences. As the world increasingly prioritizes sustainability and climate change mitigation, traditional oil and gas companies are likely to enhance their investments in renewable energy projects and technologies. This shift will not only help mitigate their carbon footprints but also allow them to diversify their portfolios and remain competitive in an evolving energy market. However, the demand for oil and gas is expected to persist, particularly in emerging economies where energy needs continue to grow. Geopolitical factors will remain a significant influence, with ongoing tensions in key oil-producing regions potentially leading to supply disruptions and price volatility. Companies will need to adopt agile strategies to manage these risks while ensuring energy security. Additionally, technological advancements will play a crucial role in shaping the market, as firms leverage digital tools to optimize operations, enhance safety, and improve environmental performance. The integration of advanced technologies will also facilitate the transition towards cleaner energy solutions, allowing oil and gas companies to adapt to changing consumer preferences and regulatory pressures.

Factors Affecting the Growth of the Oil and Gas Industry:

Transition to Renewable Energy Sources:

The oil and gas market is undergoing a significant transformation as the global energy landscape shifts towards renewable energy sources, driven by increasing environmental awareness and government policies aimed at reducing carbon emissions. As countries commit to achieving net-zero emissions by mid-century, there is a growing emphasis on transitioning from fossil fuels to cleaner energy alternatives such as wind, solar, and hydrogen. This transition poses both challenges and opportunities for the oil and gas industry. While demand for traditional oil and gas products may decline in the long term, the sector is also adapting by investing in renewable energy projects and diversifying its portfolios. Major oil companies are increasingly allocating capital toward renewable energy initiatives, including biofuels, electric vehicle charging infrastructure, and carbon capture and storage technologies. This strategic pivot allows them to remain relevant in an evolving energy market while addressing climate change concerns.

Geopolitical Influences and Supply Chain Disruptions:

Geopolitical tensions and supply chain disruptions are profoundly impacting the oil and gas market, shaping production levels, pricing, and investment strategies. Events such as conflicts in oil-rich regions, trade disputes, and sanctions can lead to significant fluctuations in oil supply, causing prices to rise or fall dramatically. For instance, tensions in the Middle East, which has historically been a critical region for oil production, can create uncertainty in global markets, leading to volatility that affects both producers and consumers. Additionally, the COVID-19 pandemic highlighted vulnerabilities in the supply chain, prompting companies to reassess their strategies regarding sourcing, logistics, and inventory management. As a result, many oil and gas firms are investing in technology to enhance supply chain resilience, such as implementing advanced analytics and digital tools to optimize operations and mitigate risks. Furthermore, the growing importance of energy security is prompting countries to diversify their energy sources and suppliers, leading to increased investments in domestic production and alternative energy projects.

Technological Advancements and Digital Transformation:

Technological advancements and digital transformation are revolutionizing the oil and gas market, enhancing operational efficiency, safety, and sustainability. The adoption of advanced technologies such as artificial intelligence, machine learning, and the Internet of Things (IoT) is enabling companies to optimize exploration, production, and distribution processes. For example, AI-driven analytics can improve reservoir management by predicting production outcomes and identifying potential drilling locations with greater accuracy. Additionally, IoT sensors can monitor equipment performance in real-time, allowing for predictive maintenance that reduces downtime and operational costs. The integration of digital technologies is also enhancing safety protocols, as companies can leverage data analytics to identify hazards and implement proactive measures to protect workers and the environment. Furthermore, the move towards automation in drilling and production processes is streamlining operations and reducing the reliance on manual labor, which can improve productivity and safety outcomes.

Request to Get the Sample Report: https://www.imarcgroup.com/oil-gas-market/requestsample

Oil and Gas Market Report Segmentation:

By Type:

• Upstream

• Midstream

• Downstream

Upstream represented the largest segment due to the extensive exploration and production activities focused on meeting the global energy demand.

By Application:

• Offshore

• Onshore

On the basis of application, the market has been bifurcated into offshore and onshore.

Regional Insights:

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East and Africa

Asia Pacific's dominance in the oil and gas market is attributed to rapid economic growth, increasing energy consumption, and substantial investments in oil and gas infrastructure.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=12642&flag=C

Competitive Landscape:

The competitive landscape of the market has been studied in the report with the detailed profiles of the key players operating in the market.

• BP p.l.c.

• Chevron Corporation

• ConocoPhillips Company

• Equinor ASA

• Exxon Mobil Corporation

• PetroChina Company Limited

• PJSC Lukoil Oil Company

• PJSC Rosneft Oil Company

• Saudi Arabian Oil Co.

• Shell plc

• TotalEnergies SE

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Oil and Gas Market is Expected to Reach USD 72.6 Billion by 2033 | CAGR 15.21% During 2025-2033 here

News-ID: 4055997 • Views: …

More Releases from IMARC Group

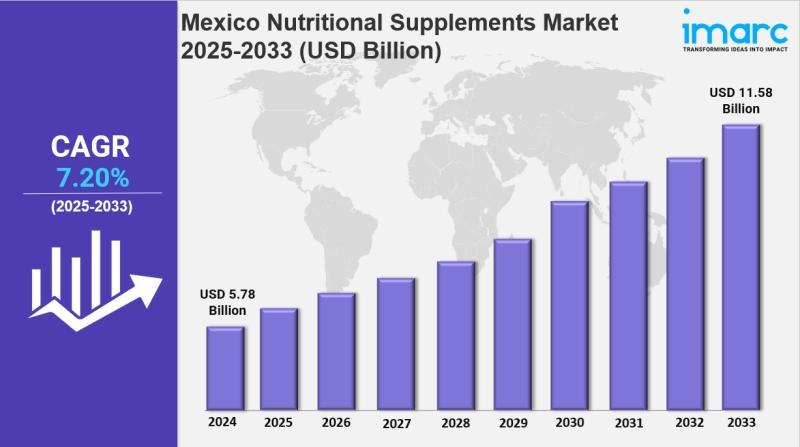

Mexico Nutritional Supplements Market Size, Growth, Latest Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Mexico Nutritional Supplements Market Size, Share, Trends and Forecast by Product Type, Form, Distribution Channel, Consumer Group, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico nutritional supplements market size was valued at USD 5.78 Billion in 2024. It is…

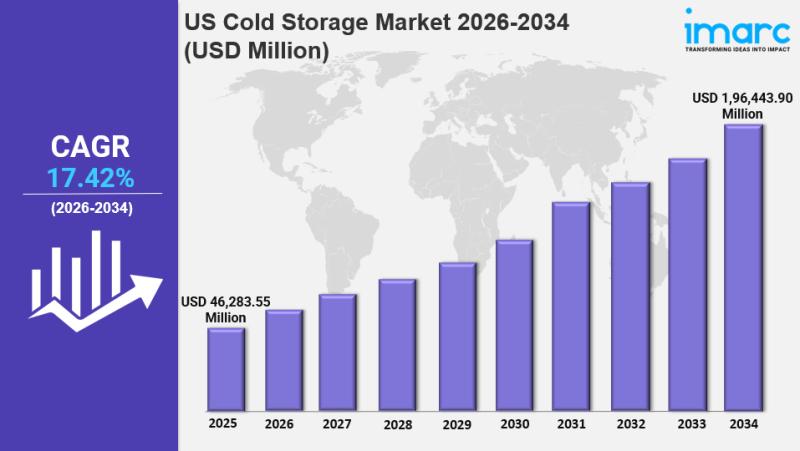

US Cold Storage Market Size, Trends, Growth and Forecast 2026-2034

IMARC Group has recently released a new research study titled "US Cold Storage Market Size, Share, Trends and Forecast by Warehouse Type, Construction Type, Temperature Type, Application, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The US cold storage market size reached USD 46,283.55 Million in 2025 and is projected to grow…

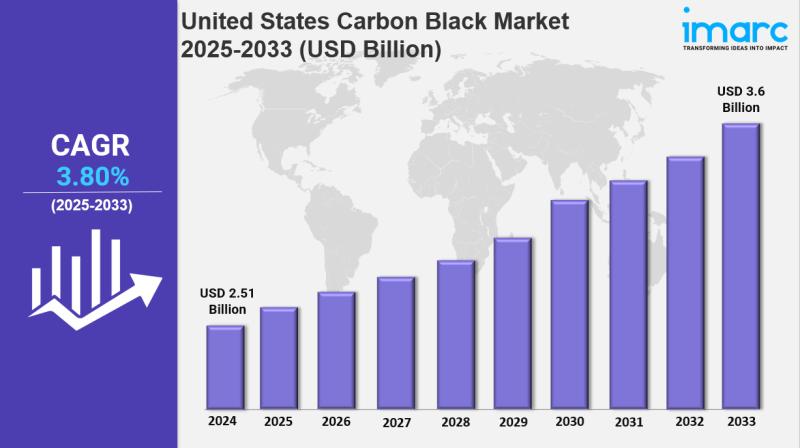

United States Carbon Black Market Size, Trends, Growth and Forecast 2025-2033

IMARC Group has recently released a new research study titled "United States Carbon Black Market Size, Share, Trends and Forecast by Type, Grade, Application, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States carbon black market size was valued at USD 2.51 Billion in 2024 and is projected to…

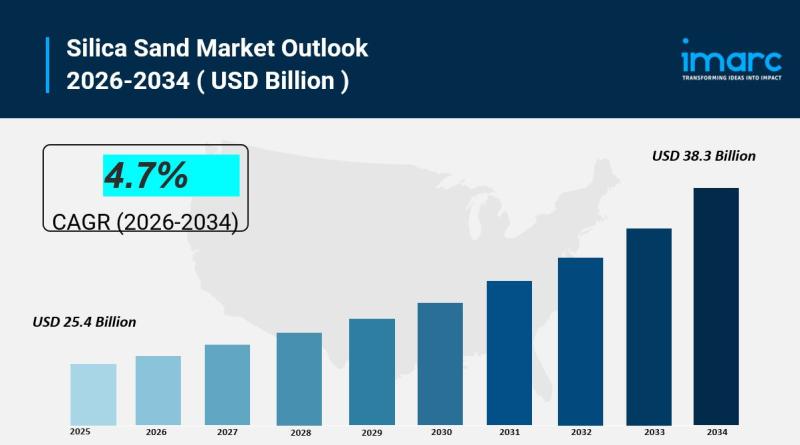

Silica Sand Market is Projected to Reach USD 38.3 Billion by 2034 | At CAGR 4.7%

Silica Sand Market Overview:

The global Silica Sand Market was valued at USD 25.4 Billion in 2025 and is forecast to reach USD 38.3 Billion by 2034, growing at a CAGR of 4.7% during 2026-2034. This growth is driven by increasing demand from the construction and glass manufacturing industries, continual advancements in hydraulic fracturing technology in oil and gas extraction, and rapid changes in environmental and regulatory landscapes.

The silica sand market…

More Releases for Oil

Hydraulic Oil Market,By Base Oil (Mineral Oil, Synthetic Oil, Semi-Synthetic Oil …

In recent years, the production capacity for hydraulic oil has increased significantly across the globe. Moreover, the Group II and III base oils are primarily gaining popularity for utilization in lubricant formulations for automatic transmission engines, heavy-duty trucks, and passenger automobiles. Therefore, these determinants are expected to for drive the development of the global hydraulic oil market in the anticipated period.

Global Hydraulic Oil Market was valued at USD 10.47 billion in 2021…

Cosmetic Oil Market Future Outlook 2023-2029, Industry Demand, Trends, Size, New …

This Cosmetic Oil Market research report is one of the best and wide-ranging, which provides market insights by considering numerous factors. Therefore, businesses can get important market insights cost-effectively with the help of the Cosmetic Oil Market research report. Such a persuasive report is the best to gain a competitive advantage in this quickly transforming marketplace. In addition, the report also provides market segmentation based on type and end-user. The…

Transformer Oil Market, Transformer Oil Market Size, Transformer Oil Market Shar …

The Transformer Oil Market research report consists of a detailed study of the market and the market dynamics that are related to the same. The in-depth data on the development of the market is presented in the Research report. Not only this but also the detailed data on the performance of the market for the forecast period are presented in the Transformer Oil Market research report. The performance analysis is…

Growing demand for corn oil as cooking oil is fuelling the Corn Oil Market

The research report "Corn Oil Market: by Product Type (High Oleic, Middle Oleic, Low Oleic), By Application (Biodiesel, Soap Making, Food Services, Pharmaceutical, Others) and Geography- Global/Region/Country Forecast to 2028." The global corn oil market size was valued at USD 4.2 Bn in the year 2021, growing at a CAGR rate of 7.2% during the evaluation time span 2022-2028.

Glance our 200 slides market research and competitive intelligence research report,…

Apricot Oil, Apricot Kernel Oil Supplier, Co2 Apricot Oil Manufacturer

The seed inside every apricot contains thin oil, which is extracted from the kernel of the seed after eating the delectable fruit. Apricot oil is also known as apricot kernel oil. This oil has been the interest of many experts for research purposes due to its infinite health benefits. It has been found that the oil could cure some serious health conditions (like cancer). Apricot oil has a profound nutty…

Global Sustainable Palm Oil Market analysis report- with Leading players, Applic …

Sustainable Palm Oil Market

The most widely used vegetable oil there is, palm oil is found in everything from snacks to household cleaners to cosmetics. Palm oil is used in many of the products on supermarket shelves, from margarine and chocolate to ice cream, soaps, cosmetics, and fuel for cars and power plants. The report presents a comprehensive overview, market shares, and growth opportunities of Sustainable Palm Oil market by product type,…