Press release

Lung Cancer Prevalence Driving The Lung Cancer Drugs Market: An Emerging Driver Transforming The Lung Cancer Drugs Market Landscape

The Lending And Payments Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Projected Growth of the Lending And Payments Market?

The lending and payments market has experienced strong growth in recent years. It is set to rise from $12,326.44 billion in 2024 to $13,296.7 billion in 2025, with a CAGR of 7.9%. This growth can be attributed to economic expansion, the increase of banking and financial institutions, consumer demand, and evolving regulatory environments.

The lending and payments market is projected to experience strong growth in the coming years. It will reach $17,569.09 billion in 2029, with a compound annual growth rate (CAGR) of 7.2%. This growth is driven by digital transformation, fintech disruption, financial inclusion, blockchain and cryptocurrency, data analytics, and AI. Key trends include peer-to-peer lending, contactless and mobile payments, open banking, embedded finance, and sustainable finance.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=1886

What Are the Different Lending And Payments Market Segments?

The lending and payments market covered in this report is segmented -

1) By Type: Lending, Cards, Payments

2) By Lending Channel: Offline, Online

3) By End User: B2B, B2C

Subsegments:

1) By Lending: Personal Loans, Mortgages, Auto Loans, Student Loans, Business Loans, Peer-to-Peer (P2P) Lending

2) By Cards: Credit Cards, Debit Cards, Prepaid Cards, Charge Cards

3) By Payments: Digital Payments, Mobile Payments, E-wallets, Bank Transfers, Point Of Sale (POS) Payments, Online Payment Gateways

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=1886&type=smp

What Are the Primary Drivers Shaping the Lending And Payments Market?

The lending and payments market is projected to experience significant growth in the coming years. By 2029, it is expected to reach a size of $17,569.09 billion, with a compound annual growth rate (CAGR) of 7.2%. This growth can be driven by factors such as digital transformation, fintech innovation, financial inclusion, blockchain and cryptocurrency adoption, as well as the use of data analytics and artificial intelligence.

Which Companies Are Leading in the Lending And Payments Market?

Major companies operating in the lending and payments market include China Construction Bank, Agricultural Bank Of China, JPMorgan Chase & Co., Bank of China, Industrial and Commercial Bank of China, Bank of America Corporation, Banco Santander, Citi Group, Wells Fargo & Company, State Bank of India, Klarna Inc., Funding Circle, Advanced Financial Services Private Limited, Visa Payments Limited, Mastercard Inc., Tencent Holdings Limited, Ant Financial Service Group Co. Ltd., PayPal Payments Pvt Ltd., Square Capital LLC., Coinbase Global Inc., Social Finance Inc., Coinbase Global Inc., Robinhood Markets Inc., Venmo, Affirm Inc., Afterpay Australia Pty Ltd., LendingClub Bank., Camden Town Technologies Pvt Ltd., Kabbage Inc., On Deck Capital Inc., Avant LLC., Upstart Network Inc., Lendio.

What Trends Are Expected to Dominate the Lending And Payments Market in the Next 5 Years?

The alternative lending market is growing as it provides loans to individuals and small businesses that traditional banks often consider unprofitable. These lenders use technologies like big data to streamline the process and generate profits. Companies such as Lending Club and OnDeck exemplify this shift by offering fast and accessible lending options.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/lending-and-payments-global-market-report

What Are the Top Revenue-Generating Geographies in the Lending And Payments Market?

Western Europe was the largest region in the lending and payments market in 2023. Asia-Pacific was the second largest region in the lending and payments market. The regions covered in the lending and payments market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Lending And Payments Market?

2. What is the CAGR expected in the Lending And Payments Market?

3. What Are the Key Innovations Transforming the Lending And Payments Industry?

4. Which Region Is Leading the Lending And Payments Market?

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Lung Cancer Prevalence Driving The Lung Cancer Drugs Market: An Emerging Driver Transforming The Lung Cancer Drugs Market Landscape here

News-ID: 4053713 • Views: …

More Releases from The Business Research Company

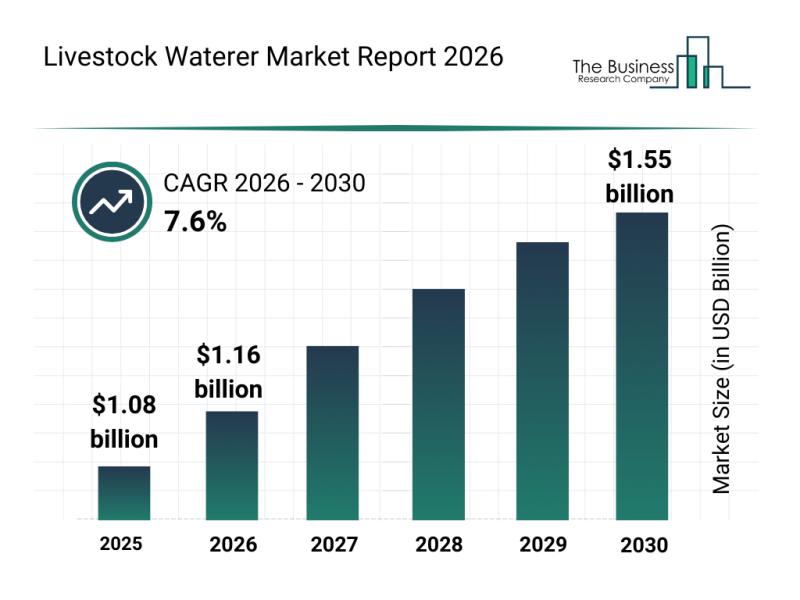

Livestock Waterer Market Overview, Key Trends, and Insights on Top Players

The livestock waterer industry is on track for notable expansion as the demand for efficient and innovative hydration solutions for animals grows. With advancements in technology and a rising focus on animal welfare and sustainability, this sector is becoming increasingly important in modern livestock management. Let's dive into the current market outlook, key players, emerging trends, and major segments shaping the livestock waterer market.

Projected Market Value and Growth Trajectory of…

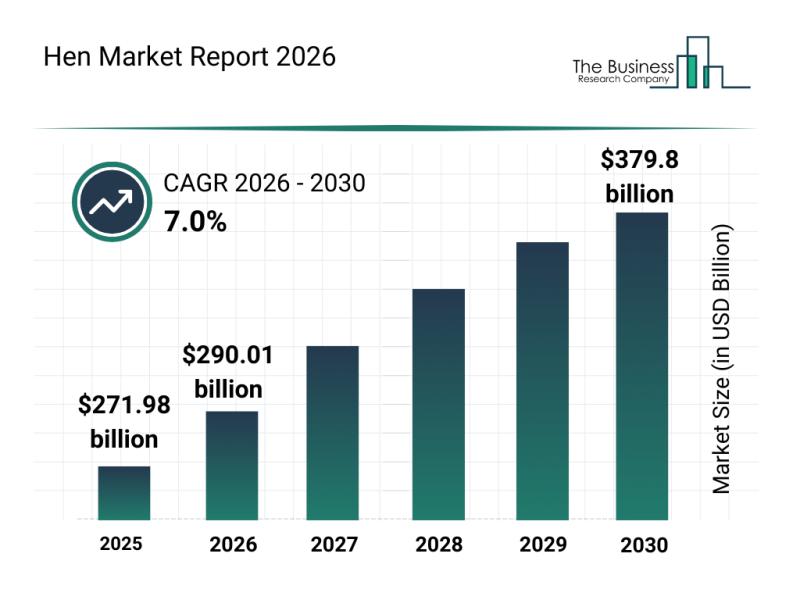

Market Trend Analysis: The Impact of Recent Innovations on the Hen Market

The hen market is on track for substantial expansion over the coming years, driven by evolving consumer preferences and increasing demand for quality poultry products. This overview explores the anticipated growth, key players, prevailing trends, and market segmentation shaping the industry's future.

Strong Growth Outlook for the Hen Market Size Through 2030

The hen market is projected to experience significant growth, reaching a value of $379.8 billion by 2030. This expansion…

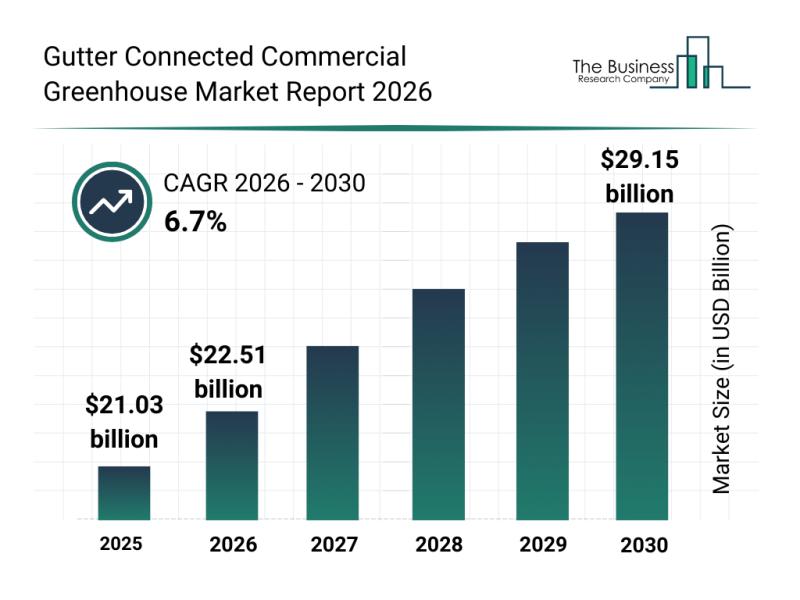

Growth Patterns, Segment Analysis, and Competitive Strategies Influencing the Gu …

The commercial greenhouse sector is evolving rapidly, driven by technological advancements and changing agricultural needs. Among these, gutter connected commercial greenhouses are gaining particular attention for their efficiency and scalability. This overview explores the market's anticipated growth, key players, emerging trends, and segmentation within this promising industry.

Projected Market Value and Expansion of the Gutter Connected Commercial Greenhouse Market

The gutter connected commercial greenhouse market is poised for substantial growth in…

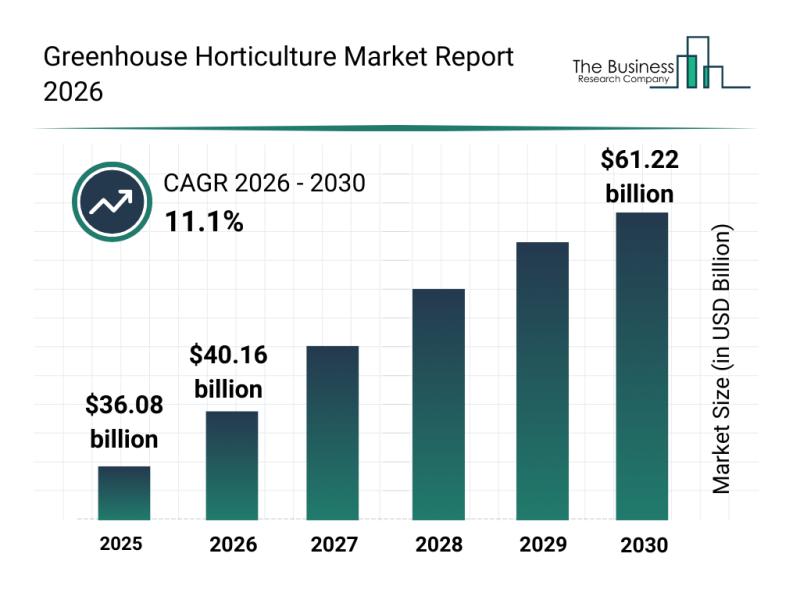

Analysis of Key Market Segments Driving the Greenhouse Horticulture Market

The greenhouse horticulture sector is gaining significant traction as it adapts to the evolving demands of modern agriculture. With increasing emphasis on sustainable food production and advanced farming technologies, this market is set to experience substantial growth. Below is an in-depth overview of the market size, leading players, key trends, and segmentation details shaping the future of greenhouse horticulture.

Expanding Market Size and Growth Outlook for Greenhouse Horticulture

The greenhouse horticulture…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…