Press release

AI in Fintech Market Size to Worth USD 97.70 Billion by 2033 | With a 19.90% CAGR

Market Overview:The AI in fintech market is experiencing rapid growth, driven by enhanced fraud detection and risk management, personalized financial services, and operational efficiency and cost reduction. According to IMARC Group's latest research publication, "AI in Fintech Market Size, Share, Trends and Forecast by Type, Deployment Model, Application, and Region, 2025-2033", The global AI in fintech market size was valued at USD 17.64 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 97.70 Billion by 2033, exhibiting a CAGR of 19.90% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/ai-in-fintech-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends And Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Industry Trends and Drivers:

● Enhanced fraud detection and risk management:

Artificial intelligence (AI) can analyze transactions, user behavior, and financial activity on an unbelievably large scale in real time, discovering fraudulent patterns more readily than traditional methods. AI systems constantly learn and improve, growing even more effective at detecting new, adapting types of fraud, such as synthetic identities and advanced forms of phishing. By quickly and accurately processing vast amounts of data, it reduces false positives, allowing financial institutions to focus on real threats without unnecessary disruption of service. AI also allows institutions to enhance the forecasting of possible risks by analyzing underlying factors -for example, economic trends and market volatility- resulting in the overall improvement of the financial risk management framework.

● Personalized financial services:

AI is revolutionizing the way that personalized financial services are delivered. As a result, financial services can offer their clients more relevant and customized products and experiences. Fintech companies, for example, are using machine learning algorithms to analyze a large set of user data (spending habits, transaction history, social media behaviors, etc.) to allow users the opportunity to build more customized savings plans, credit options, and investment options. This personalization exceeds expectations of traditional financial institutions - AI can accurately predict clients needs and tendencies. AI also allows for the use of chatbots and personalized virtual assistants which are AI-powered to engage with users instantly for customized solutions to a financial inquiry. individual satisfaction increases as the service is personalized. Customers are demanding more personalized financial services and AI is the answer to their needs.

● Operational efficiency and cost reduction:

AI enables financial organizations to automate repetitive tasks like processing transactions, compliance checks and customer service -- which helps reduce manual labor involved in a task. AI-powered chatbots can offer customer inquiries day and night, and immediately answers for common questions, allowing human staff to focus on more complicated issues. Machine learning (ML) models are also being used to automate back-end tasks such as loan approvals, fraud detection, risk assessments, etc., so organizations can work faster and be more efficient and accurate in making decisions. AI can also speed up data management through processing and analyzing vast quantities of information more accurately and efficiently -- thereby reduce human error and complicating the reporting process for accountants. These efficiencies lead to lower operational costs and allow fintech companies to scale their services.

Buy Full Report: https://www.imarcgroup.com/checkout?id=4483&method=1670

Leading Companies Operating in the Global AI in Fintech Industry:

● Amazon Web Services Inc. (Amazon.com Inc)

● Google LLC (Alphabet Inc.)

● Inbenta Technologies Inc.

● Intel Corporation

● International Business Machines Corporation

● Microsoft Corporation

● Salesforce.com Inc.

● Samsung Electronics Co. Ltd.

● TIBCO Software Inc.

● Trifacta

● Verint Systems Inc.

AI in Fintech Market Report Segmentation:

Breakup By Type:

● Solutions

● Services

Solutions exhibit a clear dominance in the market attributed to the increasing adoption of AI-driven software and platforms that enhance the efficiency and effectiveness of financial services.

Breakup By Deployment Mode:

● Cloud-based

● On-premises

Cloud-based represents the largest segment owing to its scalability, flexibility, and lower costs.

Breakup By Application:

● Virtual Assistant (Chatbots)

● Credit Scoring

● Quantitative and Asset Management

● Fraud Detection

● Others

Based on the application, the market has been divided into virtual assistant (chatbots), credit scoring, quantitative and asset management, fraud detection, and others.

Breakup By Region:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

North America dominates the market due to its advanced technological infrastructure, rising investments in AI innovation, and the presence of major fintech companies.

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=4483&flag=C

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release AI in Fintech Market Size to Worth USD 97.70 Billion by 2033 | With a 19.90% CAGR here

News-ID: 4051204 • Views: …

More Releases from IMARC Group

Biosimilar Market Size, Share, Industry Trends and Forecast 2026-2034

IMARC Group, a leading market research company, has recently released a report titled "Biosimilar Market Size, Share, Trends and Forecast by Molecule, Indication, Manufacturing Type, and Region, 2026-2034." The study provides a detailed analysis of the industry, including the global biosimilar market size, trends, share and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Biosimilar Market Key Highlights:

• The Biosimilar Market is…

Cost of Setting Up a PET Bottle Manufacturing Plant & DPR 2026

The global PET bottle industry is experiencing sustained growth propelled by rising packaged beverage consumption, pharmaceutical packaging expansion, increasing demand for ready-to-drink products, and the lightweight, recyclable advantages of PET packaging. As urbanization accelerates, consumer lifestyles shift toward convenience packaging, and regulatory frameworks increasingly mandate recyclable materials, establishing a PET bottle manufacturing plant positions investors in one of the most stable and essential segments of the consumer packaging value chain.

IMARC…

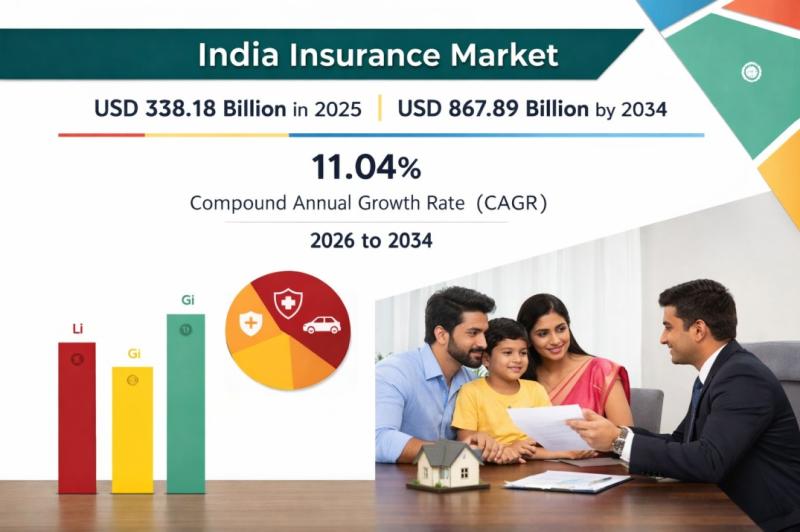

India Insurance Market Forecast 2026: Industry Size, Expansion & Future Scope 20 …

India Insurance Market Overview 2026-2034

According to IMARC Group's report titled India Insurance Market Size, Share, Trends and Forecast by Type of Product, Distribution Channel, End User, and Region, 2026-2034 the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

The India insurance market size was valued at USD 338.18 Billion in 2025 and is projected to reach USD 867.89 Billion by 2034, growing at…

Global Diammonium Phosphate (DAP) Prices January 2026: Asia Gains, Europe Steady …

What is Diammonium Phosphate (DAP)?

Diammonium Phosphate (DAP) is a widely used phosphorus-based fertilizer crucial for global agriculture. Monitoring Diammonium Phosphate (DAP) prices helps manufacturers, distributors, and buyers make informed procurement decisions and manage costs amid fluctuating demand and supply conditions.

Global Price Overview

The global Diammonium Phosphate (DAP) market shows moderate stability with regional supply differences affecting prices. The Diammonium Phosphate (DAP) price trend has remained mixed, while the price index and…

More Releases for Fintech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…