Press release

Future Scope of Personal Loans Market Expects to See Significant Growth During 2025-2032

Introduction:The Personal Loans Market is experiencing a period of unprecedented growth, driven by a confluence of factors that are reshaping the financial landscape globally. Increased accessibility to credit, fueled by technological advancements in fintech and online lending platforms, is a primary catalyst. These platforms are streamlining the loan application process, making it faster, more convenient, and more accessible to a broader range of consumers. The demand for personal loans is also escalating due to evolving consumer needs and preferences. Individuals are increasingly utilizing personal loans for various purposes, including education, home renovation, wedding expenses, medical emergencies, and consolidating existing debt. Furthermore, the market plays a crucial role in addressing global challenges by providing financial support for individuals and families, enabling them to invest in their future, improve their living conditions, and overcome unexpected financial difficulties. Government initiatives aimed at promoting financial inclusion and supporting small and medium-sized enterprises (SMEs) further contribute to market expansion. The Personal Loans Market is not just about lending money; it's about empowering individuals and businesses to achieve their goals and contribute to economic growth. The market's ability to adapt to changing economic conditions and embrace technological innovation will be critical for sustained growth and continued relevance in the years to come.

Get the full PDF sample copy of the report: (TOC, Tables and figures, and Graphs) https://www.consegicbusinessintelligence.com/request-sample/1397

Market Size:

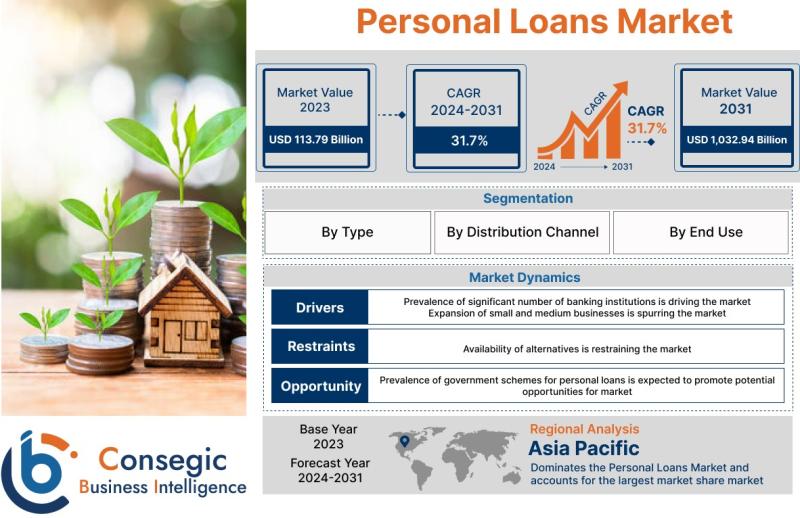

The Personal Loans Market is estimated to reach over USD 1,032.94 Billion by 2031, growing from a value of USD 113.79 Billion in 2023. This signifies a Compound Annual Growth Rate (CAGR) of 31.7% from 2024 to 2031.

Definition of Market:

The Personal Loans Market encompasses the provision of unsecured loans to individuals for various personal uses, distinct from secured loans like mortgages or auto loans. These loans are typically repaid in fixed installments over a specified period, with interest rates varying based on factors like credit score, loan amount, and repayment term. Key components include:

Loan Products: These include various types of personal loans tailored to specific needs, such as education loans, home renovation loans, wedding loans, medical emergency loans, and general-purpose loans.

Lending Institutions: Banks, credit unions, online lenders, and other financial institutions that originate and service personal loans.

Borrowers: Individuals who seek personal loans to finance various personal expenses.

Loan Servicing: The process of managing loan repayments, including billing, collections, and customer service.

Key terms related to this market include:

APR (Annual Percentage Rate): The total cost of the loan, including interest and fees, expressed as an annual rate.

Credit Score: A numerical representation of an individual's creditworthiness, used by lenders to assess risk.

Debt-to-Income Ratio (DTI): The percentage of a borrower's gross monthly income that goes towards debt payments.

Unsecured Loan: A loan that is not backed by collateral, meaning the lender has no specific asset to seize if the borrower defaults.

Fintech: Technology-driven financial services, which are playing an increasingly important role in the personal loans market by streamlining the application process and expanding access to credit.

Get Discount On Report @ https://www.consegicbusinessintelligence.com/request-discount/1397

Market Scope and Overview:

The scope of the Personal Loans Market is broad, encompassing a wide range of technologies, applications, and industries. From a technological perspective, the market is increasingly driven by digital platforms, mobile banking, and automated underwriting processes. Fintech companies are leveraging data analytics and artificial intelligence to improve risk assessment, personalize loan offers, and enhance the customer experience. The applications of personal loans are diverse, ranging from financing education and home improvements to covering medical expenses and consolidating debt. These loans serve individuals across various demographics and socioeconomic backgrounds, providing them with access to funds for essential needs and discretionary spending.

The Personal Loans Market plays a vital role in the larger context of global trends. It contributes to economic growth by enabling individuals to invest in their education, start businesses, and improve their homes. It also supports consumer spending, which is a key driver of economic activity. Furthermore, the market promotes financial inclusion by providing access to credit for individuals who may not qualify for traditional loans. As the global economy continues to evolve, the Personal Loans Market will remain an important source of funding for individuals and families, playing a critical role in supporting economic stability and improving living standards. The increasing demand for personal loans also reflects changing consumer behavior, with individuals becoming more comfortable using credit to finance their goals and aspirations.

Market Segmentation:

The Personal Loans Market can be segmented based on several factors:

By Type:

Education Loan: Used to finance tuition, fees, and other educational expenses.

Home Renovation Loan: Used to finance home improvements and repairs.

Wedding Loan: Used to finance wedding expenses.

Medical Emergency Loan: Used to cover unexpected medical bills.

Others: Includes loans for debt consolidation, travel, and other personal expenses.

By Distribution Channel:

Banks: Traditional financial institutions that offer personal loans to their customers.

Credit Union: Member-owned financial cooperatives that offer personal loans at competitive rates.

Others: Includes online lenders, peer-to-peer lending platforms, and other alternative lending sources.

By End Use:

Individuals: Personal loans taken by individuals for various personal expenses.

Small and Medium Businesses: Personal loans taken by business owners to finance their businesses.

Others: Includes loans to non-profit organizations and other entities.

Each segment contributes to market growth by catering to specific needs and preferences. For example, education loans drive market growth by enabling students to pursue higher education, while home renovation loans stimulate the housing market.

Market Drivers:

Technological Advancements: The rise of fintech and online lending platforms is making personal loans more accessible and convenient.

Increasing Demand for Credit: Growing consumer demand for personal loans is fueled by various factors, including rising living costs and the desire to finance discretionary spending.

Market Key Trends:

Digitalization: The increasing adoption of digital channels for loan applications and approvals is transforming the market.

Personalization: Lenders are increasingly offering personalized loan products and services to meet the specific needs of individual borrowers.

Market Opportunities:

Untapped Markets: There are significant opportunities to expand access to personal loans in underserved communities and emerging markets.

Product Innovation: Developing new and innovative loan products that cater to specific needs, such as green loans and sustainable loans, can drive market growth.

Market Restraints:

Credit Risk: The risk of borrower default is a major concern for lenders.

Regulatory Uncertainty: Evolving regulations surrounding personal lending can create uncertainty and increase compliance costs.

Market Challenges:

The Personal Loans Market, while showing remarkable growth potential, is not without its inherent challenges. One of the most significant challenges revolves around managing and mitigating credit risk. As the market expands and lenders seek to broaden their customer base, there is a growing risk of extending credit to individuals with lower credit scores or unstable financial histories. This necessitates the implementation of robust risk assessment models and stringent underwriting standards to minimize the potential for loan defaults, which can adversely affect the profitability and stability of lending institutions. Striking a balance between expanding access to credit and maintaining responsible lending practices is a crucial challenge that requires ongoing attention.

Another major challenge is navigating the complex and evolving regulatory landscape. The personal loans market is subject to various regulations at the national, regional, and local levels, which can vary significantly and create compliance challenges for lenders. These regulations often address issues such as interest rate caps, disclosure requirements, and consumer protection measures. Keeping abreast of these regulations and adapting business practices accordingly is essential for lenders to avoid legal and financial penalties. Furthermore, the emergence of new technologies and lending models, such as peer-to-peer lending and online lending platforms, may necessitate the development of new regulatory frameworks to ensure consumer protection and market stability. Adapting to these evolving regulatory demands requires significant investment in compliance infrastructure and expertise.

The increasing competition in the personal loans market also presents a significant challenge for lenders. As more financial institutions and fintech companies enter the market, competition for borrowers intensifies, putting pressure on interest rates and profit margins. To remain competitive, lenders must differentiate themselves by offering innovative loan products, superior customer service, and personalized loan experiences. This requires ongoing investment in technology, marketing, and customer relationship management. Furthermore, lenders must develop effective strategies for acquiring and retaining customers in a crowded marketplace. Building brand loyalty and establishing a strong reputation for reliability and trustworthiness are crucial for success in the long term.

Finally, the Personal Loans Market faces challenges related to economic uncertainty and macroeconomic factors. Economic downturns, rising unemployment rates, and inflationary pressures can all negatively impact the ability of borrowers to repay their loans, leading to increased default rates and losses for lenders. To mitigate these risks, lenders must closely monitor economic conditions and adjust their lending practices accordingly. This may involve tightening underwriting standards, reducing loan amounts, or increasing interest rates. Furthermore, lenders must have robust collections and recovery processes in place to minimize losses in the event of borrower defaults. The ability to adapt to changing economic conditions and manage macroeconomic risks is essential for the long-term sustainability of the personal loans market.

Market Regional Analysis:

The Personal Loans Market exhibits diverse dynamics across different regions, influenced by varying economic conditions, regulatory environments, and consumer behaviors. For example, North America and Europe tend to have well-established markets with high levels of financial literacy and access to credit. These regions are characterized by sophisticated lending practices, a wide range of loan products, and a strong regulatory framework. However, these regions also face challenges such as increasing competition and the need to adapt to evolving consumer preferences for digital lending solutions. In contrast, emerging markets in Asia-Pacific and Latin America are experiencing rapid growth in the personal loans market, driven by rising disposable incomes, increasing urbanization, and greater access to technology. These regions offer significant opportunities for lenders to expand their market presence, but also face challenges such as lower levels of financial literacy, less developed regulatory frameworks, and higher credit risk.

Each region presents unique factors influencing its market dynamics. Asia-Pacific, for example, is seeing a surge in demand for personal loans driven by the growth of the middle class and increasing consumer spending. This region also benefits from a large and tech-savvy population, which is driving the adoption of digital lending platforms. In Latin America, the personal loans market is growing rapidly due to increasing financial inclusion and the availability of microfinance loans. However, this region also faces challenges such as high levels of income inequality and political instability. Understanding these regional nuances is critical for lenders seeking to succeed in the global personal loans market. Tailoring products and services to meet the specific needs and preferences of consumers in each region, and adapting to local regulatory requirements, are essential for achieving sustainable growth.

Frequently Asked Questions:

What are the growth projections for the Personal Loans Market?

The Personal Loans Market is projected to grow at a CAGR of 31.7% from 2024 to 2031, reaching over USD 1,032.94 Billion by 2031.

What are the key trends in the Personal Loans Market?

Key trends include digitalization of loan applications and approvals, and personalization of loan products and services.

What are the most popular Personal Loan types?

Popular personal loan types include education loans, home renovation loans, wedding loans, and medical emergency loans.

https://www.linkedin.com/company/insights-nexus-research/

https://www.linkedin.com/company/indepth-consumer-insights/

https://www.linkedin.com/company/technology-redefined/

https://www.linkedin.com/company/the-digital-shifts/

https://www.linkedin.com/company/learning-for-growth-research/

https://www.linkedin.com/company/autonomous-wheels/

https://www.linkedin.com/company/smart-tech-journal/

https://www.linkedin.com/company/innovation-in-moton/

https://www.linkedin.com/company/trend-realm/

https://www.linkedin.com/company/digital-dynamics-update/

https://www.linkedin.com/company/tech-innovators-lounge/"

Contact Us:

Consegic Business intelligence Pvt Ltd

Baner Road, Baner, Pune, Maharashtra - 411045

(US) (505) 715-4344

info@consegicbusinessintelligence.com

sales@consegicbusinessintelligence.com

Web - https://www.consegicbusinessintelligence.com/

About Us:

Consegic Business Intelligence is a data measurement and analytics service provider that gives the most exhaustive and reliable analysis available of global consumers and markets. Our research and competitive landscape allow organizations to record competing evolutions and apply strategies accordingly to set up a rewarding benchmark in the market. We are an intellectual team of experts working together with the winning inspirations to create and validate actionable insights that ensure business growth and profitable outcomes.

We provide an exact data interpretation and sources to help clients around the world understand current market scenarios and how to best act on these learnings. Our team provides on-the-ground data analysis, Portfolio Expansion, Quantitative and qualitative analysis, Telephone Surveys, Online Surveys, and Ethnographic studies. Moreover, our research reports provide market entry plans, market feasibility and opportunities, economic models, analysis, and an advanced plan of action with consulting solutions. Our consumerization gives all-inclusive end-to-end customer insights for agile, smarter, and better decisions to help business expansion.

Connect with us on:

LinkedIn - https://www.linkedin.com/company/consegic-business-intelligence/

YouTube - https://www.youtube.com/@ConsegicBusinessIntelligence22

Facebook - https://www.facebook.com/profile.php?id=61575657487319

X - https://x.com/Consegic_BI

Instagram - https://www.instagram.com/cbi._insights/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Future Scope of Personal Loans Market Expects to See Significant Growth During 2025-2032 here

News-ID: 4047266 • Views: …

More Releases from Consegic Business Intelligence Pvt. Ltd

Europe Pharmaceutical Manufacturing Equipment Market 2025 Industry Updates, Futu …

Introduction:

The Pharmaceutical Manufacturing Equipment Market is experiencing robust growth, driven by a confluence of factors reshaping the landscape of pharmaceutical production. Increasing global demand for pharmaceuticals, fueled by an aging population and the rise of chronic diseases, necessitates advanced and efficient manufacturing processes. Technological advancements, such as continuous manufacturing, automation, and digitalization, are revolutionizing traditional methods, improving production efficiency, reducing costs, and enhancing product quality. Stringent regulatory requirements and the…

Europe Vibration Damping Materials Market Size 2025 Overview, Manufacturers, Typ …

Introduction:

The Vibration Damping Materials market is experiencing significant growth, driven by the increasing demand for noise and vibration reduction across various industries. Key drivers include stringent environmental regulations, the growing automotive industry, particularly the electric vehicle (EV) sector, and the need for enhanced comfort and safety in residential and commercial buildings. Technological advancements in materials science are also playing a pivotal role, with the development of more efficient and durable…

Europe Lightweight Aggregates Market Size 2025 Emerging Technologies, Opportunit …

Introduction:

The Lightweight Aggregates Market is experiencing substantial growth driven by several key factors. Primarily, the increasing demand for sustainable and eco-friendly construction materials is fueling the adoption of lightweight aggregates. These materials offer superior insulation properties, reduced transportation costs, and contribute to the overall reduction of the carbon footprint of construction projects. Technological advancements in the production and application of lightweight aggregates are also playing a crucial role, enhancing their…

Europe Visible Light Communication Market Share, Growth, Size, Industry Trends, …

Introduction:

The Visible Light Communication (VLC) market is experiencing significant growth, driven by the increasing demand for faster, more secure, and energy-efficient communication technologies. VLC leverages light waves for data transmission, offering a complementary solution to traditional radio frequency (RF) based wireless communication. Key drivers include the proliferation of LED lighting, growing concerns about RF spectrum congestion, and the need for secure communication in sensitive environments. Technological advancements, such as improved…

More Releases for Loan

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

New Jersey Loan Modification Lawyer Daniel Straffi Releases Insightful Article o …

New Jersey loan modification lawyer Daniel Straffi (https://www.straffilaw.com/loan-modifications) of Straffi & Straffi Attorneys at Law has recently published an informative article addressing the complexities and solutions surrounding loan modifications in New Jersey. The piece, aimed at helping homeowners understand their options to prevent foreclosure, sheds light on the legal avenues available to modify loan terms effectively.

In the article, the New Jersey loan modification lawyer explores various scenarios that may lead…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…