Press release

Global Real Estate Loan Market Analysis 2025-2030: Growth Drivers, Challenges, And Opportunities

The Real Estate Loan Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].How Big Is the Real Estate Loan Market Size Expected to Be by 2034?

The real estate loan market has grown rapidly in recent years. It will increase from $11,059.09 billion in 2024 to $12,440.21 billion in 2025, reflecting a CAGR of 12.5%. The growth in the historical period is attributed to economic cycles, regulatory changes, interest rate fluctuations, housing market trends, demographic shifts, technological advancements, and the impacts of global financial crises.

The real estate loan market is expected to grow rapidly, reaching $19,659 billion by 2029 with a CAGR of 12.1%. This growth is attributed to changing consumer preferences, sustainability initiatives, digital transformation in banking, geopolitical stability, infrastructure investments, and pandemic recovery strategies. Key trends include a rising demand for sustainable financing, the adoption of digital mortgage processes, increased remote and flexible work influencing property preferences, and innovations in property technology.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18708

What Are the Emerging Segments Within the Real Estate Loan Market?

The real estate loan market covered in this report is segmented -

1) By Property Type: Hotels, Retails, Industrial, Office, Residential, Other Property Types

2) By Provider: Banks, Non-Banking Financial Institutions, Other Providers

3) By End-User: Business, Individuals

Subsegments:

1) By Hotels: Luxury Hotels, Boutique Hotels, Budget Hotels, Resorts

2) By Retail: Shopping Malls, Standalone Stores, Retail Chains

3) By Industrial: Warehouses, Manufacturing Facilities, Distribution Centers

4) By Office: Commercial Office Spaces, Co-Working Spaces, High-Rise Office Buildings

5) By Residential: Single-Family Homes, Multi-Family Units, Condominiums, Townhouses

6) By Other Property Types: Mixed-Use Developments, Healthcare Facilities, Educational Institutions

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18708&type=smp

What Long-Term Drivers Are Shaping Real Estate Loan Market Trends?

Increased foreign investment in property is predicted to accelerate the real estate loan market. Investors are attracted by strong returns, favorable market trends, and portfolio diversification opportunities. Real estate loans play a critical role in enabling these purchases. For instance, in July 2022, the National Association of Realtors stated that foreign buyers spent $59 billion on U.S. homes from April 2021 to March 2022, an 8.5% increase over the previous year. Thus, foreign real estate investment is stimulating the real estate loan market.

Who Are the Top Competitors in Key Real Estate Loan Market Segments?

Major companies operating in the real estate loan market are JPMorgan Chase & Co., Bank of America Corporation, Citigroup Inc., U.S. Bank, The PNC Financial Services Group Inc., Fairway Independent Mortgage Corporation, HomeBridge Financial Services, Caliber Home Loans Inc., New American Funding LLC, Navy Federal Credit Union, loanDepot.com LLC, Guild Mortgage Company, Flagstar Bank N.A., Movement Mortgage, Carrington Mortgage Services LLC, Embrace Home Loans Inc., Northpointe Bank, Sierra Pacific Mortgage Company Inc., PrimeLending, Regions Bank, Rocket Mortgage

What Real Estate Loan Market Trends Are Gaining Traction Across Different Segments?

Companies in the real estate loan market are creating digital financing platforms to enhance and simplify loan applications. These platforms streamline financial services, improving efficiency and user experience. For example, in May 2024, L&T Finance Ltd. launched The Complete Home Loan in India, targeting new home buyers and offering features like paperless processing, attractive interest rates, and flexible financing for home furnishings and décor, with a repayment period of up to 10 years.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/real-estate-loan-global-market-report

Which Regions Are Becoming Hubs for Real Estate Loan Market Innovation?

North America was the largest region in the real estate loan market in 2024. The regions covered in the real estate loan market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Real Estate Loan Market?

2. What is the CAGR expected in the Real Estate Loan Market?

3. What Are the Key Innovations Transforming the Real Estate Loan Industry?

4. Which Region Is Leading the Real Estate Loan Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Real Estate Loan Market Analysis 2025-2030: Growth Drivers, Challenges, And Opportunities here

News-ID: 4043820 • Views: …

More Releases from The Business Research Company

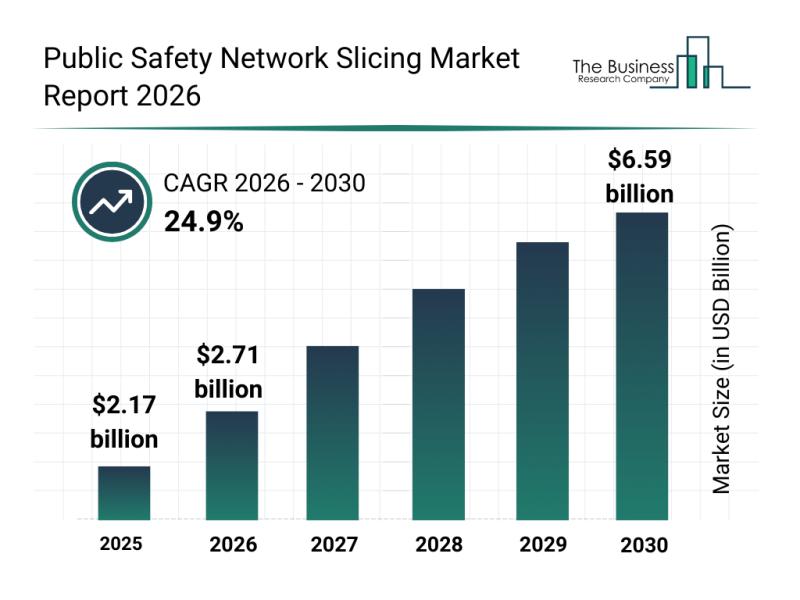

Public Safety Network Slicing Market Overview, Current Trends, and Key Player An …

The public safety network slicing market is on track for remarkable expansion in the coming years, driven by technological advancements and increasing demand for efficient emergency communications. This growing sector is poised to play a critical role in enhancing the capabilities of public safety agencies through dedicated, secure network solutions tailored to their specific needs.

Projected Market Size and Growth Trajectory of the Public Safety Network Slicing Market

The public…

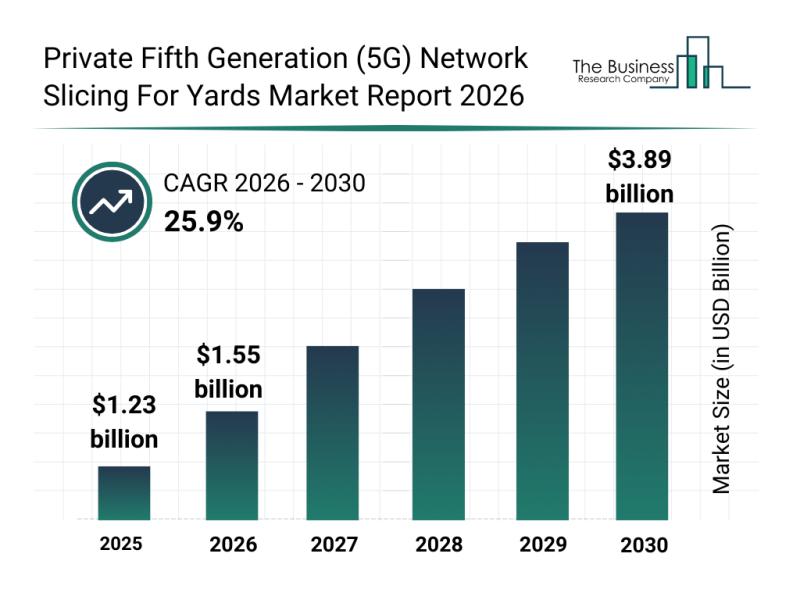

Competitive Analysis: Key Market Leaders and Emerging Participants in the Privat …

The private fifth generation (5G) network slicing market for yards is positioned for remarkable expansion as industries increasingly adopt advanced connectivity solutions tailored for complex operational environments. With rising demand for customized, secure, and low-latency communications, this sector is set to transform logistics, manufacturing, and related fields over the coming years.

Projected Market Value and Growth Trajectory for Private 5G Network Slicing for Yards

The private 5G network slicing market…

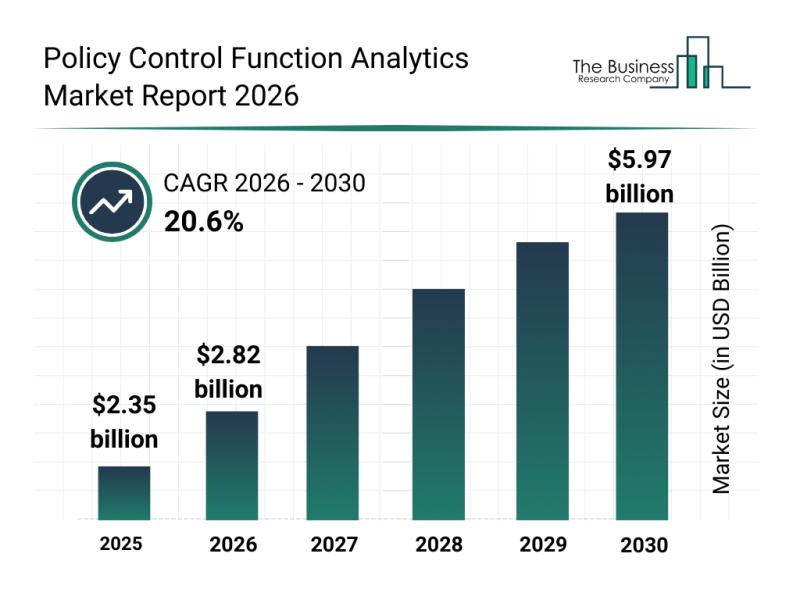

Segmentation, Major Trends, and Competitive Overview of the Policy Control Funct …

The policy control function analytics sector is emerging as a rapidly expanding market, driven by technological advancements and increasing network demands. With the ongoing evolution of communication networks and complex data environments, this industry is poised for significant growth and innovation. Let's explore the market size projections, leading companies, industry trends, and segment breakdown to understand the future landscape of this dynamic field.

Forecasted Market Size and Growth Trajectory of the…

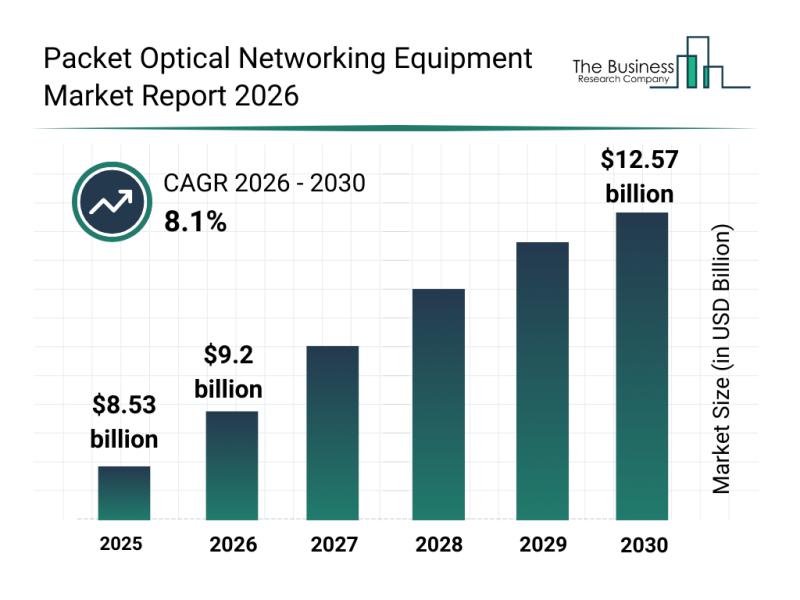

Market Trend Analysis: The Impact of Recent Innovations on the Packet Optical Ne …

The packet optical networking equipment market is poised for significant expansion in the coming years as technological advancements and increasing data demands reshape the telecommunications landscape. This sector's growth is driven by evolving network architectures and the need for more efficient, high-capacity optical transport solutions. Let's explore the market's size projections, key players, influential trends, and segmentation details shaping its future.

Future Market Size Expectations for Packet Optical Networking Equipment …

More Releases for Loan

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

New Jersey Loan Modification Lawyer Daniel Straffi Releases Insightful Article o …

New Jersey loan modification lawyer Daniel Straffi (https://www.straffilaw.com/loan-modifications) of Straffi & Straffi Attorneys at Law has recently published an informative article addressing the complexities and solutions surrounding loan modifications in New Jersey. The piece, aimed at helping homeowners understand their options to prevent foreclosure, sheds light on the legal avenues available to modify loan terms effectively.

In the article, the New Jersey loan modification lawyer explores various scenarios that may lead…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…