Press release

Insolvency Software Market to Grow at 11.9% CAGR, Valued at $4.5 Billion by 2032

The global insolvency software market is experiencing growth due to surge in bankruptcy filings, regulatory compliance, and technological advancements. However, high implementation costs hinder market growth.According to the report, the insolvency software market was valued at $1.6 billion in 2023, and is estimated to reach $4.5 billion by 2032, growing at a CAGR of 11.9% from 2024 to 2032.

Request Sample Report (Get Full Insights in PDF - 200 Pages) at: https://www.alliedmarketresearch.com/request-sample/A324139

Insolvency software is a specialized solution that helps professionals and organizations efficiently manage bankruptcy, liquidation, and restructuring cases. It simplifies tasks such as case management, compliance monitoring, document handling, financial processing, and reporting. By automating complex processes, the software enhances accuracy, boosts efficiency, and ensures adherence to regulatory requirements, enabling practitioners to concentrate on strategic decision-making. Key features like creditor management, communication tools, and integration with financial systems improve workflow and reduce manual errors.

Recent Development:

1. In March 2022, Epiq launched the Epiq Bankruptcy Analytics web technology solution. This solution provides legal and bankruptcy professionals with access to filing information, updated daily across 93 U.S. bankruptcy courts dating back to 2007, which gives users powerful, data-backed insights about the bankruptcy market.

2. In February 2021, Stretto acquired Acumen Recovery Services, LLC, a data-analysis and advisory firm serving attorneys, trustees, and other fiduciaries analyzing, pursuing, or defending preferences or other allegedly avoidable transfers in bankruptcy cases. This acquisition expands Stretto's suite of services designed to support professionals and other stakeholders in streamlining the bankruptcy process.

3. In September 2023, CARET Legal introduced a new feature called Quick Summary, powered by generative artificial intelligence (AI), to revolutionize how attorneys engage with legal documents. This feature is currently in Beta and is accessible to subscribers of CARET Legal & rsquos Enterprise Plus and Enterprise Advance plans. In addition, Quick Summary is designed to enhance the efficiency and effectiveness of legal document handling.

Buy Now & Get Exclusive Report at: https://www.alliedmarketresearch.com/insolvency-software-market/purchase-options

By component, the solution segment held the highest market share in 2023, owing to its comprehensive features, ease of integration, and ability to streamline complex insolvency processes, enhancing operational efficiency for businesses and insolvency practitioners. However, the services segment is projected to attain the fastest growing segment from 2023 to 2032, owing to increasing demand for customization, technical support, and maintenance services that enhance the effectiveness and longevity of insolvency software solutions.

By organization size, the large organization segment held the highest market share in 2023, due to its substantial resources, complex insolvency cases requiring advanced solutions, and a higher propensity to invest in comprehensive software systems for managing extensive financial operations. However, the small and medium-sized enterprises segment is projected to attain the fastest growing segment from 2023 to 2032, owing to increasing adoption of digital solutions, rising bankruptcy rates among SMEs, and the need for cost-effective, efficient insolvency management tools.

By application, the document management segment held the highest market share in 2023, due to its ability to streamline and automate administrative processes associated with insolvency management, enhancing efficiency and accuracy. In addition, this segment is particularly important for managing financial transactions, reporting, compliance, and creditor management, which are critical aspects of insolvency proceedings. However, the financial transaction management segment is projected to attain the fastest growing segment from 2023 to 2032, owing to increasing demand for real-time monitoring capabilities to predict unforeseen financial risks. The segment ability to provide insights into financial health and optimize funds management during insolvency proceedings.

If you have any special requirements, Request customization: https://www.alliedmarketresearch.com/request-for-customization/A324139

By vertical, the BFSI segment held the highest market share in 2023, and is also expected to register the highest CAGR during the forecast period. This is attributed to the increasing frequency of insolvency cases within the BFSI sector, which has heightened the demand for specialized software solutions and increasing importance of digital transformation in modernizing insolvency management practices within the financial services industry.

North America held the highest market share in 2023, owing to advanced technological infrastructure, a high number of insolvency cases, and strong demand for efficient financial management solutions in the region. However, the Asia Pacific is projected to attain the fastest growing region from 2023 to 2032, owing to rapid economic development, increasing bankruptcy cases, and growing adoption of advanced technological solutions in financial management across emerging markets.

Major Industry Players: -

Clio

CARET

Altisource

Aryza

Stretto

Epiq

Kroll

Turnkey IPS

QwikFile

Fastcase

The report provides a detailed analysis of these key players in the global insolvency software market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, acquisition, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to highlight the competitive scenario.

Access the full Report Summary at: https://www.alliedmarketresearch.com/insolvency-software-market-A324139

Contact:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: + 1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060

Fax: +1-800-792-5285

help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP, based in Portland, Oregon. AMR provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domains.

AMR launched its user-based online library of reports and company profiles, Avenue. An e-access library is accessible from any device, anywhere, and at any time for entrepreneurs, stakeholders, researchers, and students at universities. With reports on more than 60,000 niche markets with data comprising 600,000 pages along with company profiles on more than 12,000 firms, Avenue offers access to the entire repository of information through subscriptions. A hassle-free solution to clients' requirements is complemented with analyst support and customization requests.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insolvency Software Market to Grow at 11.9% CAGR, Valued at $4.5 Billion by 2032 here

News-ID: 4039395 • Views: …

More Releases from Allied Market Research

AdTech Market Reach USD 2.9 Trillion by 2031 Growing 14.7% CAGR

Allied Market Research published a new report, titled, "AdTech Market Reach USD 2.9 Trillion by 2031 Growing 14.7% CAGR ." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segment, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain thorough understanding of the industry and determine steps to be…

USD 531.5+ Billion Private Security Market Value Cross by 2032 | Top Players suc …

Allied Market Research published a report, titled, "Private Security Market by Service (Manned Security, Electronic Security, Cash Handling Services, and Others), and End User (Residential, Commercial, Industrial, and Government): Global Opportunity Analysis and Industry Forecast, 2023-2032". According to the report, the global private security market size was valued at $241.4 billion in 2022, and is projected to reach $531.5 billion by 2032, growing at a CAGR of 7.8% from 2023…

Gesture Recognition Market Reach USD 88.2 Billion by 2031 Growing at 20.6% CAGR

According to a new report published by Allied Market Research, titled, "Gesture Recognition Market Reach USD 88.2 Billion by 2031 Growing at 20.6% CAGR ′′ The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segment, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain thorough understanding of the industry…

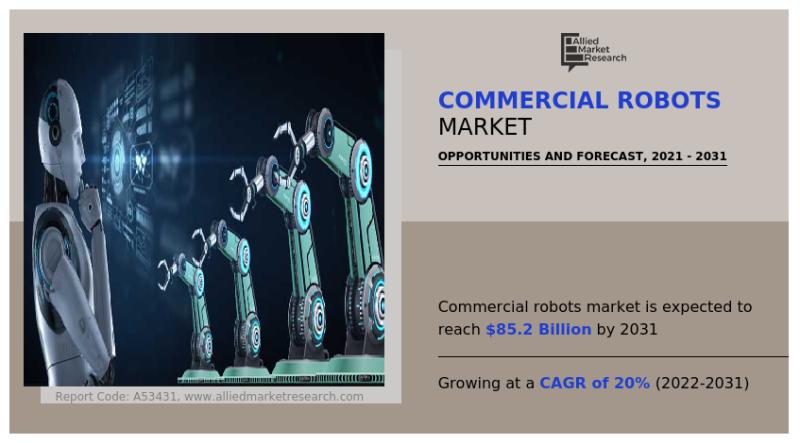

Commercial Robots Market Reach USD 85.2 Billion by 2031 Growing at 20% CAGR

According to the report published by Allied Market Research, Commercial Robots Market Reach USD 85.2 Billion by 2031 Growing at 20% CAGR . The report provides an extensive analysis of changing market dynamics, major segments, value chain, competitive scenario, and regional landscape. This research offers valuable able guidance to leading players, investors, shareholders, and startups in devising strategies for sustainable growth and gaining a competitive edge in the market.

Driving Factors…

More Releases for Insolvency

Macmillan Lawyers and Advisors Launch Insolvency Support Services for Brisbane B …

Australia, 24th Oct 2025 - Macmillan Lawyers and Advisors, a respected Brisbane law firm, has introduced a dedicated insolvency support service designed to assist local businesses experiencing financial distress. The initiative enhances the firm's existing range of commercial and legal advisory services, ensuring that organisations receive professional guidance during financially challenging periods.

The new insolvency support services have been developed in response to growing demand for specialist legal assistance in navigating…

Corporate Insolvency Service Market: Major Trends Reshaping the Future of the In …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Is the Expected CAGR for the Corporate Insolvency Service Market Through 2025?

The market size of the corporate insolvency service has seen significant growth in the past few years. The projected growth from $11.55 billion in 2024 to $12.45 billion in 2025, with a compound annual growth rate…

Insolvency Software Market Size, Future Opportunities, Emerging Trends, Top Comp …

Insolvency Software Market by Offering (Solutions, Services), Organization Size (Large Enterprises, & SMEs), Application (Document Management, Financial Transaction Management, Reporting, Compliance, Creditor Management), Vertical - Global Forecast to 2028.

The Insolvency Software market [https://www.marketsandmarkets.com/Market-Reports/insolvency-software-market-217636399.html?utm_campaign=insolvencysoftwaremarket&utm_source=abnewswire.com&utm_medium=paidpr] is expected to grow from USD 1.5 billion in 2023 to USD 2.4 billion by 2028, registering a compound annual growth rate (CAGR) of 10.4% during the forecast period. Government initiatives aimed at promoting digitalization across key…

Leading Growth Driver in the Insolvency Software Market in 2025: The Pivotal Rol …

What market dynamics are playing a key role in accelerating the growth of the insolvency software market?

The insolvency software market is projected to expand due to an increase in corporate bankruptcies. When a business encounters significant financial hardship and is unable to meet its monetary commitments, it often results in legal interventions for debt resolution, also known as corporate bankruptcies. Insolvency software is a tool that helps firms effectively manage…

McJu§tice buys insolvency claims with immediate effect

It is already annoying when you have claims against third parties. It is even worse when the debtor files for insolvency.

This raises the question: should you throw good money after bad?

Insolvency proceedings are complicated and often very lengthy.

Lawyers are expensive and it often takes a long time to process insolvencies due to the high workload. Creditors often only receive their quota after several years.

If you have legal expenses insurance, you…

McJustice - the voice of insolvency creditors

Insolvency law is a complex topic in Germany. Creditors in insolvency are often overwhelmed by the many unanswered questions and complex issues. For this reason, many creditors take their claims to a lawyer.

The lawyer incurs high costs, which are not economically worthwhile, especially for small claims.

Insolvency law in Germany has been modernized since July 2024. It is now possible to submit the claim to the insolvency administrator using an electronic…