Press release

Corporate Insolvency Service Market: Major Trends Reshaping the Future of the Industry

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.What Is the Expected CAGR for the Corporate Insolvency Service Market Through 2025?

The market size of the corporate insolvency service has seen significant growth in the past few years. The projected growth from $11.55 billion in 2024 to $12.45 billion in 2025, with a compound annual growth rate (CAGR) of 7.7%, indicates a thriving industry. The historic expansion is linked to a rise in corporate debt, increasing interest rates, a surge in business terminations, enhanced regulatory supervision, and mounting economic unpredictability.

What's the Projected Size of the Global Corporate Insolvency Service Market by 2029?

Over the upcoming years, the corporate insolvency service market is projected to witness significant expansion. The market is anticipated to reach $16.54 billion by 2029, growing at a compound annual growth rate (CAGR) of 7.4%. Factors contributing to the projected growth during the forecast period include a surge in cross-border insolvency instances, escalating demand for restructuring services, heightened focus on safeguarding creditors, increasing financial instability amongst startups, and growing government participation in insolvency procedures. In the same time frame, the market trends are expected to evolve with progress in digital case management tools, innovative strategies in debt restructuring models, emerging AI-powered insolvency analytics, enhanced collaboration platforms for stakeholders, and advancements in forensic investigation technologies.

View the full report here:

https://www.thebusinessresearchcompany.com/report/corporate-insolvency-service-global-market-report

Top Growth Drivers in the Corporate Insolvency Service Industry: What's Accelerating the Market?

The escalating rate of corporate bankruptcy is driving market growth as financial distress among businesses intensifies.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=27595&type=smp

Which Emerging Trends Are Transforming the Corporate Insolvency Service Market in 2025?

Leading companies in the corporate insolvency service market are working towards the creation of innovative products, such as high-tech risk assessment tools, designed to enable businesses to detect and manage financial challenges early on and craft effective remediation measures. Advanced risk assessment tools are either software solutions or methodologies that scrutinize a company's operational and financial data to detect early signs of either insolvency or fiscal stress. For example, PKF Attest Auditores S.L.P., a professional services firm based in Spain, unveiled its Corporate Insolvency Compliance Service in May 2024. This offering has been developed to cater to the increasingly pressing need for proactive financial risk management in corporate entities. The service is aimed to guide company executives and upper management through the intricacies of the new European regulation intended to preclude insolvency events. It includes four crucial steps: starting with an analysis of the initial economic and financial standing to gauge corporate health, followed by a meticulous risk mapping stage to pinpoint possible weaknesses, the creation of tailored protocols for social administrators and top-level executives to follow, and consistent updates to make sure the strategies keep pace with the company's evolving situation.

What Are the Main Segments in the Corporate Insolvency Service Market?

The corporate insolvency service market covered in this report is segmented

1) By Service Type: Administration, Company Voluntary Liquidation, Creditors Voluntary Liquidation (CVL), Compulsory Liquidation, Other Service Types

2) By Technology Solutions: Insolvency Management Software, Data Analytics Tools, Financial Modelling Software, Workflow Automation Tools

3) By Enterprise Size: Small And Medium Enterprises, Large Enterprises

4) By End-User Industry: Banking, Financial Services And Insurance (BFSI), Manufacturing, Retail, Healthcare, Information Technology And Technology

Subsegments:

1) By Administration: Appointment Of Administrator, Administration Process Management, Restructuring Support, Asset Protection

2) By Company Voluntary Liquidation: Members Voluntary Liquidation, Solvent Liquidation, Insolvent Liquidation

3) By Creditors Voluntary Liquidation: Liquidator Appointment, Creditors Meeting, Asset Realization, Debt Settlement

4) By Compulsory Liquidation: Court Order Enforcement, Official Receiver Actions, Liquidator Appointment, Asset Disposal

5) By Other Service Types: Receivership, Bankruptcy Filing, Debt Recovery, Financial Restructuring

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=27595&type=smp

Which Top Companies are Driving Growth in the Corporate Insolvency Service Market?

Major companies operating in the corporate insolvency service market are Deloitte Touche Tohmatsu Limited., PricewaterhouseCoopers International Limited., Ernst And Young Global Limited., Klynveld Peat Marwick Goerdeler (KPMG), RSM International, FTI Consulting Inc., Houlihan Lokey Inc., Alvarez And Marsal LLC., Baker Tilly US LLP., Evelyn Partners, Kroll Inc., Crowe Global, Clifford Chance LLP, AlixPartners LLP, Begbies Traynor Group plc, FRP Advisory LLP, Johnston Carmichael LLP, BDO International Limited., ASC Group, and Grant Thornton International Ltd.

Which Regions Will Dominate the Corporate Insolvency Service Market Through 2029?

North America was the largest region in the corporate insolvency service market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in corporate insolvency service report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=27595

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Saumya Sahey

Europe: +44 7882 955267,

Asia: +44 7882 955267 & +91 8897263534,

Americas: +1 310-496-7795

Email: saumyas@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Corporate Insolvency Service Market: Major Trends Reshaping the Future of the Industry here

News-ID: 4193857 • Views: …

More Releases from The Business Research Company

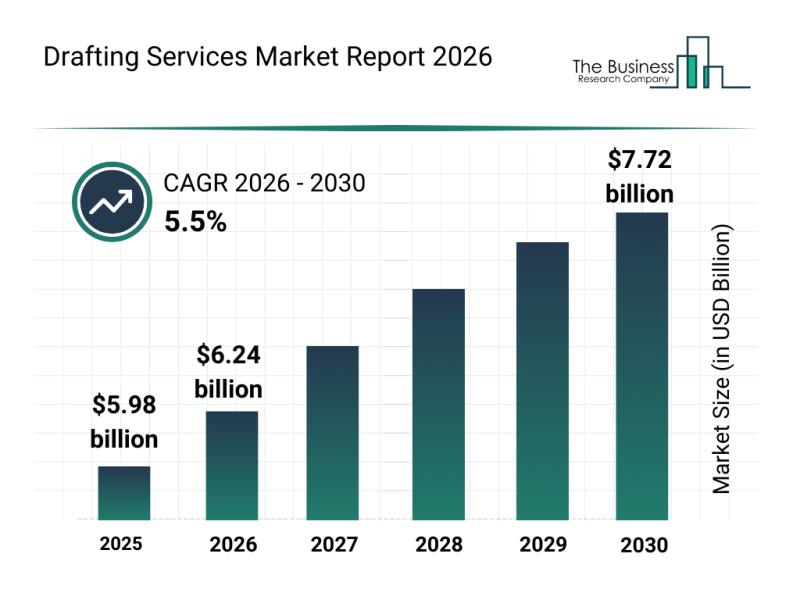

Future Perspective: Key Trends Shaping the Drafting Services Market Until 2030

The drafting services industry is poised for considerable expansion in the coming years as technological advancements and evolving construction needs drive demand. With a wide range of applications across sectors, this market is set to experience steady growth fueled by innovation and increasing adoption of digital tools. Let's explore the current market size, influential factors, key players, emerging trends, and segmentation in this dynamic field.

Projected Growth and Market Size of…

Emerging Sub-Segments Transforming the Digital Rights Management Market Landscap …

The digital rights management (DRM) market is positioned for remarkable expansion in the coming years, driven by technological advancements and increasing concerns over content security. As digital media consumption grows and new platforms emerge, DRM solutions are becoming essential to protect intellectual property and ensure the authorized use of digital assets. Let's explore the current market size, key players, prevailing trends, and the main segments shaping the future of this…

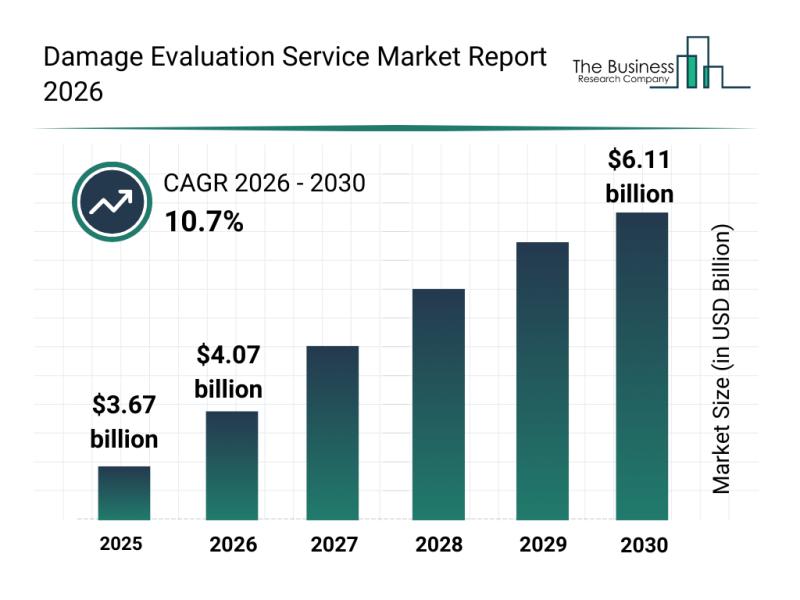

Market Trend Insights: The Impact of Recent Advances on the Damage Evaluation Se …

The damage evaluation service market is on the brink of substantial growth as advancements in technology and increasing demand for efficient damage assessment methods gain momentum. This sector is evolving rapidly with the integration of innovative tools and techniques that enhance accuracy and speed in evaluating damages across various industries.

Forecasted Market Size and Growth Trajectory of the Damage Evaluation Service Market

The damage evaluation service market is projected to…

Corporate Training Market: Segmentation Analysis, Market Trends, and Competitive …

The corporate training sector is on a path of significant growth as organizations increasingly recognize the importance of continuous employee development. With rapid technological advances and shifting workforce needs, this market is expected to expand steadily, driven by innovative solutions and evolving learning preferences. Below, we explore the market's size projections, key players, emerging trends, and segmentation insights to provide a comprehensive overview of the corporate training landscape.

Projected Growth and…

More Releases for Insolvency

Macmillan Lawyers and Advisors Launch Insolvency Support Services for Brisbane B …

Australia, 24th Oct 2025 - Macmillan Lawyers and Advisors, a respected Brisbane law firm, has introduced a dedicated insolvency support service designed to assist local businesses experiencing financial distress. The initiative enhances the firm's existing range of commercial and legal advisory services, ensuring that organisations receive professional guidance during financially challenging periods.

The new insolvency support services have been developed in response to growing demand for specialist legal assistance in navigating…

Insolvency Software Market Size, Future Opportunities, Emerging Trends, Top Comp …

Insolvency Software Market by Offering (Solutions, Services), Organization Size (Large Enterprises, & SMEs), Application (Document Management, Financial Transaction Management, Reporting, Compliance, Creditor Management), Vertical - Global Forecast to 2028.

The Insolvency Software market [https://www.marketsandmarkets.com/Market-Reports/insolvency-software-market-217636399.html?utm_campaign=insolvencysoftwaremarket&utm_source=abnewswire.com&utm_medium=paidpr] is expected to grow from USD 1.5 billion in 2023 to USD 2.4 billion by 2028, registering a compound annual growth rate (CAGR) of 10.4% during the forecast period. Government initiatives aimed at promoting digitalization across key…

Leading Growth Driver in the Insolvency Software Market in 2025: The Pivotal Rol …

What market dynamics are playing a key role in accelerating the growth of the insolvency software market?

The insolvency software market is projected to expand due to an increase in corporate bankruptcies. When a business encounters significant financial hardship and is unable to meet its monetary commitments, it often results in legal interventions for debt resolution, also known as corporate bankruptcies. Insolvency software is a tool that helps firms effectively manage…

McJu§tice buys insolvency claims with immediate effect

It is already annoying when you have claims against third parties. It is even worse when the debtor files for insolvency.

This raises the question: should you throw good money after bad?

Insolvency proceedings are complicated and often very lengthy.

Lawyers are expensive and it often takes a long time to process insolvencies due to the high workload. Creditors often only receive their quota after several years.

If you have legal expenses insurance, you…

McJustice - the voice of insolvency creditors

Insolvency law is a complex topic in Germany. Creditors in insolvency are often overwhelmed by the many unanswered questions and complex issues. For this reason, many creditors take their claims to a lawyer.

The lawyer incurs high costs, which are not economically worthwhile, especially for small claims.

Insolvency law in Germany has been modernized since July 2024. It is now possible to submit the claim to the insolvency administrator using an electronic…

DIRECTOR’S COMPETITION BAN IN THE INSOLVENCY OF THE COMPANY

Does the opening of insolvency proceedings of a company not also trigger a director’s contractual competition ban? OLG Rostock decided on a case where the director cancelled his employment but only to experience that the bankruptcy manager later sued him for breaking contractual agreements (re 4 W 4/20).

To find out more on this topic, please visit the website and read the whole article.

Alexander von Engelhardt

Hardenbergstr. 12

10623 Berlin, Germany

phone: +49 30…